- Pinterest’s where-to-buy links let shoppers select from multiple retailers, reducing friction in the purchase journey.

- The feature delivers purchase intent data like clicks and value, enabling advertisers to measure impact without losing transparency.

- Partnerships with Pear Commerce and MikMak ensure coverage across thousands of retailers and robust analytics.

- Early results show higher engagement compared to traditional landing pages, strengthening Pinterest’s performance credentials.

- For CPG brands, the update closes the gap between inspiration and measurable lower-funnel outcomes.

The update connects upper-funnel inspiration to lower-funnel conversions with built-in analytics.

For years, consumer packaged goods (CPG) advertisers have faced a structural trade-off. Either send shoppers directly to a retailer, where the path to purchase is smoother but insight is lost, or direct them to brand-owned sites to retain data at the cost of convenience and lower-funnel conversion.

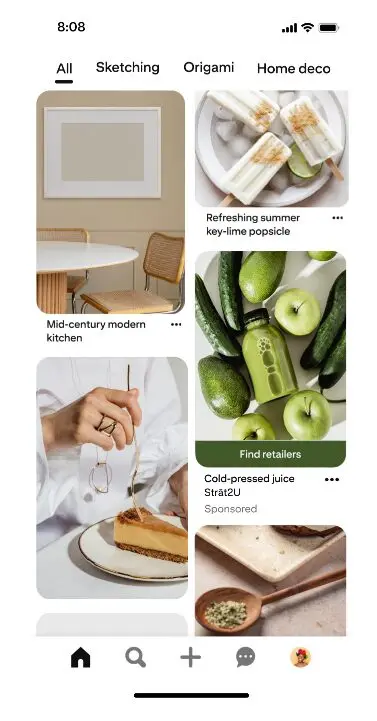

Pinterest’s newly launched where-to-buy links are designed to resolve this tension. By overlaying multiple retailer options within a single ad unit, the platform positions itself as both a source of inspiration and a true engine of purchase-ready action.

How the Feature Works

The feature transforms static image ads into shoppable experiences.

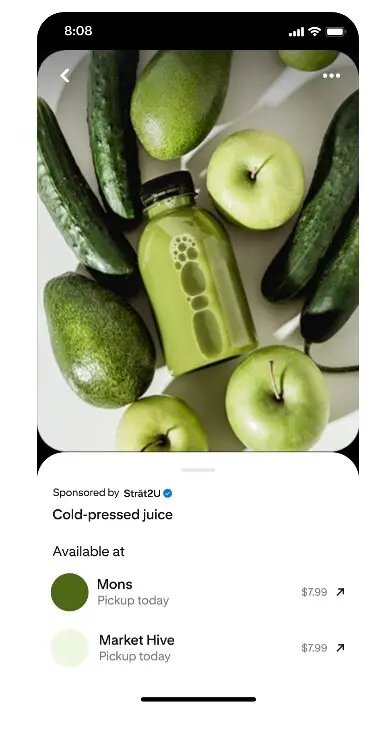

With a single tap, users are shown a curated list of in-stock retailer options, allowing them to add products to their cart from the outlet they trust most.

For consumers, this improves the browsing-to-purchase journey by reducing friction and offering choice. For brands, it strengthens engagement quality by ensuring that those who click are already displaying intent to buy.

Julie Towns, Pinterest’s Vice President of Product Marketing and Operations, framed the update as a breakthrough in resolving the long-standing dilemma:

“With where-to-buy links, we can offer our CPG advertisers the best of both worlds: a seamless shopping experience for consumers and richer, more transparent purchase intent signals for brands.”

Check out the Pinterest Responds to AI Backlash: Introducing Gen AI Labels for Better Content Control

Performance and Measurement Gains

Unlike external landing pages, where data capture is fragmented, Pinterest’s native integration provides clear metrics. Advertisers gain access to Purchase Intent Clicks and Purchase Intent Value, metrics designed to quantify the quality of engagement without requiring tracking on retailer-owned sites. Early testing indicates that campaigns using these links have delivered higher engagement and stronger performance than traditional external redirect models.

This shift marks a deeper evolution of Pinterest’s advertising offering. By aligning with both inspiration at the top of the funnel and measurable outcomes at the bottom, Pinterest strengthens its position as a performance-driven platform rather than simply a discovery tool.

Partnerships That Power the Experience

To bring where-to-buy functionality to market, Pinterest is leaning on established commerce enablers:

- Pear Commerce provides the native, no-fee option available directly through Pinterest Ads Manager. It connects shoppers to more than 3,000 retailers across 165,000 stores, enabling broad coverage without additional cost.

- MikMak, already integrated with many CPG brands, adds advanced analytics and extends reach across 8,000+ retailers and 3 million store locations.

Rachel Tipograph, Founder & CEO of MikMak, highlighted the significance of the collaboration:

“Pinterest now unlocks seamless, native shopping across 8,000+ retailers and more than 3 million store locations with real-time measurement, offering new lower-funnel opportunities that help boost sales for advertisers.”

By embedding these partnerships, Pinterest ensures that advertisers are not locked into a single ecosystem but can instead access a wide network of retail options while retaining measurement transparency.

Why It Matters for CPG Advertising

The implications for CPG brands are substantial. These categories are uniquely dependent on widespread retail distribution, meaning that choice is crucial for consumers. A household brand may be stocked in thousands of outlets, and shopper loyalty often leans more toward the retailer than the manufacturer. By offering multi-retailer visibility within one click, Pinterest helps brands avoid lost sales when a shopper’s preferred retailer isn’t featured.

Moreover, the integration helps advertisers close the loop between inspiration (pin discovery) and conversion (retail checkout). For Pinterest, this positions its ads not only as vehicles of discovery but as tools that can credibly claim credit for sales outcomes—a key demand in an era of ROI-driven marketing budgets.

Industry Context: Commerce Media in Motion

Pinterest’s move reflects a broader industry trend toward commerce-enabled media. Platforms like TikTok, Meta, and Amazon have blurred the line between content and commerce, but Pinterest’s approach is particularly aligned with its “inspiration-first” brand identity. For advertisers, this creates a differentiated opportunity: a platform where aspirational content flows directly into measurable action, without losing transparency on the data side.

With performance accountability now non-negotiable in digital advertising, this combination could give Pinterest an edge in winning budget allocations from CPG advertisers, a sector historically anchored in television and retail trade spend.

A Strategic Win for Both Sides

Where-to-buy links underscore Pinterest’s ambition to evolve from a visual inspiration engine into a full-funnel commerce channel. Shoppers benefit from convenience and flexibility, while brands gain actionable insights and more efficient media spend. As commerce media matures, features like this are likely to become standard—but for now, Pinterest has carved out a first-mover advantage that could shift how CPG advertisers approach platform investment.