Influencer Marketing Hub, in partnership with NeoReach, brings you this in‑depth 2025 Creator Earnings Report—uncovering how today’s creators are building income, impact, and influence.

Since 2020, the global influencer market has surged. What began as a rising trend is now a $250 billion industry, up from $210 billion in 2024.

Yet behind these headlines and growth of the creator economy, one critical question remains:

Are creators actually earning more?

In today’s economy, creators are the thought leaders building audiences, setting cultural agendas, and rewriting the rules of engagement.

This report dives into the state of the Creator Economy, backed directly by input from creators themselves. NeoReach is a longtime catalyst of innovation and creation in the influencer space. We’re here to uncover the latest trends, analyze, and amplify the unfiltered opinions of the very people shaping the future of marketing: The creators themselves.

Let’s get into it.

Methodology

NeoReach conducted a time-sensitive survey exploring everything from monetization trends, the TikTok ban, creator economics, creator values, and how creators truly feel about generating income in today’s digital landscape.

1.1B+ Total Followers

Survey Reach

We heard from over 3,000 creators, spanning every corner of the internet. Whether it’s part-time content makers just starting their journey or full-time veterans who’ve turned their platforms into businesses, we heard from them all. While this report doesn’t capture every monetization method out there, it reflects a wide range of real creator experiences across niches, follower counts, and income levels.

Why It Matters

As the creator economy continues to evolve at rapid speeds, our goal is to better understand how creators are navigating this shifting terrain, and more importantly, how they’re getting paid doing it.

Real Voices, Real Data

You’ll see quotes throughout the report pulled directly from anonymous creators who generously shared their unfiltered thoughts and lived experiences. Their voices offer something data alone can’t: perspective.

A huge thank-you to the incredible creators who took part in this survey. Your insights are shaping the future

At a Glance

Before we dive in, let's highlight some statistics that will be covered deeper in the report.

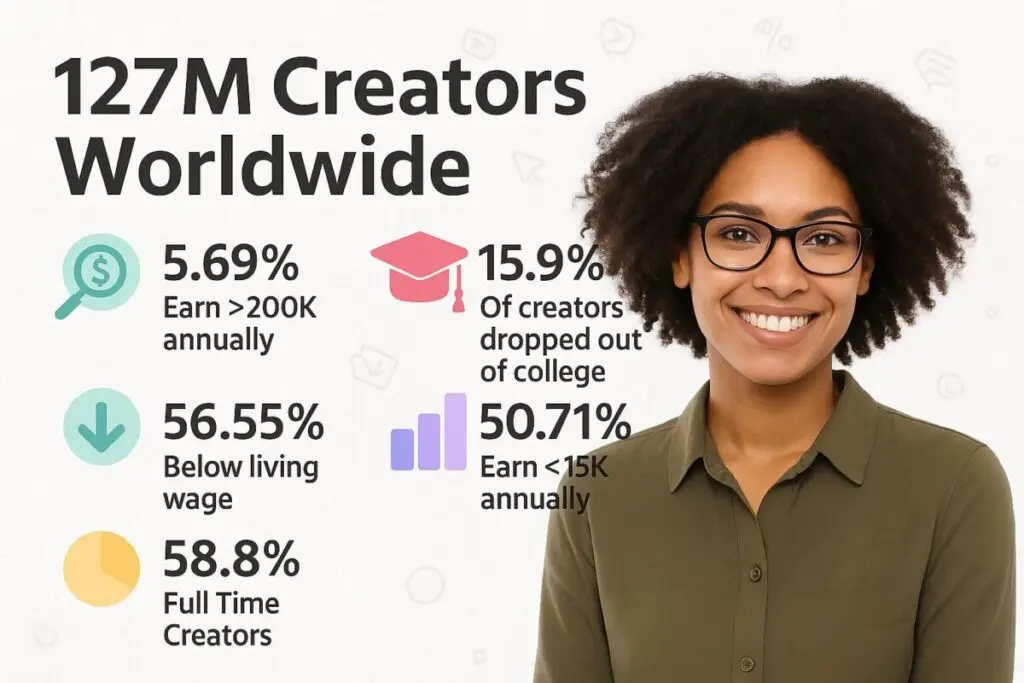

The creator economy has grown by 19.05% since 2024.

This explosive growth has brought millions of new creators into the space, making it one of the most dynamic and culturally influential industries in the world. But with that growth comes increased competition, and income hasn’t kept pace. While the number of creators has skyrocketed, more than half still earn under $15,000 a year, highlighting the widening gap between top earners and those trying to break through. Later in this report, we’ll dig into the reasons behind this shift, from income distribution and platform trends to full-time creator growth.

Creator Earnings Analysis

What’s Up Next

Understanding which age groups are most active, and where they spend their time to empower marketers to craft sharper strategies, more relevant content, and stronger collaborations that truly resonate. Our 2025 survey offers a clear lens into the evolving creator economy, helping the industry better understand, support, and elevate today’s creators.

The upcoming sections dive deep into the rich data collected from our expansive survey of creators. Our aim? To provide a granular understanding of the multifaceted aspects of creator earnings.

Here's what you can expect:

Content Creator Demographics

Who are the creators shaping the creator economy in 2025? We explore demographic insights such as gender, platform, education, and creator values to shed light on the factors influencing financial outcomes.

Earnings Analysis

Each demographic detail is paired with corresponding earnings data to help illustrate how identity, background, and platform choice impact income levels within the creator landscape.

Economic Viability

Can creators earn a livable wage in 2025? This section addresses the financial sustainability of content creation as a profession and whether the economics support full-time careers.

The Monetization Barrier

After years of surveying and analyzing the creator economy, we propose a new theory: many creators are hitting a monetization ceiling. Here, we explore the structural and behavioral factors that may prevent creators from breaking through key income thresholds.

Creator Earnings

When it comes to earnings, there’s no one-size-fits-all formula.

A creator’s income is shaped by a mix of variables: everything from their niche and gender, to how many hours they pour into content creation, what platforms they prioritize, and which revenue streams they tap into.

In the pages ahead, we’ll break down the platforms that are putting the most money in creators’ pockets, and where that money’s coming from.

We’ll also highlight key stats that help us spot what’s next for the industry. Whether you’re a brand, a creator, or somewhere in between, these insights are your roadmap to understanding (and thriving in) the future of the creator economy.

Annual Income

What’s Driving This Trend?

Despite most of our creators being content creation veterans with years of experience, more creators are generating less than $15,000 annually than in previous years.

The number of creators making less than $15,000 annually has grown by 2% more than in 2023, in which 48% of creators had been making less than $15,000 annually. A surprising figure due to the amount of veteran creators (4+ years of content creation) surveyed.

What are the causes behind this income distribution? There’s a multitude of reasons reflecting these averages, such as the monetizability of different content platforms, more representation from lower-earning niches, as well as part-time vs full-time creators.

Distribution by Follower Count

To ensure a fair and unbiased survey, we distributed our outreach to many various sizings of creators. Here’s who we heard from.

For the creators who participated in our survey, 43.8% had under 100K followers across their accounts.

While we received solid responses from all follower tiers, response rates naturally declined as follower count increased, a common trend when surveying larger creators.

Still, the dataset offers a strong cross-sectional snapshot of the creator economy at varying levels of reach.

We’ll take a look into income by follower count further into the report.

The Monetization Barrier

Analyzing years of creator income data has led us to identify a consistent pattern we call “The Monetization Barrier.” This threshold, set at approximately $15,000 in annual revenue, separates creators struggling to monetize from those positioned to scale successfully.

The Monetization Barrier - Once annual earnings exceed $15,000, creators exhibit an acceleration in income growth. Crossing this threshold indicates a turning point for creators with increased access to brand partnerships, enhanced platform visibility, and rapid audience expansion. Creators who fail to surpass this benchmark often struggle to scale their income and will plateau around that point. Not from a lack of talent or reach, but because they likely aren’t structured for monetization. Without a strategy for converting influence into income, their revenue stays disconnected from their growth, effectively capping their potential under $15k annually.

Several factors contribute to this barrier:

Platform Monetization Limits

Some creators produce high-quality content that doesn’t align with monetization programs, either due to content category, brand safety guidelines, video length, or platform preferences

Format Constraints:

For instance, creators making short, sub-15-second TikToks may not qualify for programs like the TikTok Creativity Program Beta, which has driven a shift toward longer-form content as a pathway to revenue.

Strategically aligning content with monetization systems is often what separates top earners from the rest.

The Monetization Barrier

Closing the Gap

With the monetization barrier clearly defined, the data shows a stark reality: many creators will not earn more than $15K annually from content creation if they maintain their current strategy. But what does this mean for those looking into the creator economy from the outside?

This under-monetized middle tier of creators represents a blind spot in the ecosystem. The creators are influential to be ignored, yet, they fall between the cracks of how other creators are monetizing, whether its owning a brand or getting brand deals.

A Moment for Intervention

This gap presents an inflection point. For platforms, it's a chance to build smarter monetization tools. For brands and agencies, it's an opportunity to rethink how they discover and support scalable talent. For creators, it’s a call to explore new revenue strategies.

At NeoReach, we believe the next chapter of the creator economy will be shaped by the solutions that rise to meet this moment. That’s why we’re introducing Influencers.com, a creator-first platform built to help creators turn influence into income, backed by the tools, systems, and the support they need to scale.

Learn more about creator-focused tools at Influencers.com.

Economic Viability

The annual “living wage” in the United States is $44,000.

Yet, nearly 57% of surveyed full-time creators earn less than the living wage from content creation alone.

This includes not only beginners, but also a surprising share of seasoned full-time creators who have been active for multiple years.

In the sections ahead, we examine the structural and platform-based challenges that make financial sustainability difficult. from inconsistent brand deals and monetization restrictions to the difficulty of scaling a solo operation.

Understanding why so many creators remain below this threshold is essential to addressing long-term sustainability in the creator economy.

Content Creator Demographics

The majority of surveyed creators are between 18 and 34, with Millennials and Gen Z accounting for over 90% of responses. As content creation continues to evolve, we expect a significant rise of Gen Alpha survey respondents in coming years.

Annual Income

By Gender

When breaking down earnings by gender, much of the higher average among men comes from a smaller group of outliers reporting earnings in the millions. While many factors influence income, this trend suggests that the highest-earning creators in our survey were predominantly male, which continues a larger pattern seen across the digital and entertainment industries, as well as our past surveys.

What Best Describes Your Niche?

When it comes to the entertainment industry, it’s no shocker that lifestyle and entertainment make up the most popular niches in the creator economy.

Creators selected which niche best represented themselves, and nearly 30% of them identified with lifestyle and entertainment.

Lifestyle and entertainment offer umbrella-style categories for fashion, beauty, family, travel, gaming, and are continuously intertwined with one another.

When excluding lifestyle and entertainment, the top identified niches are gaming and fashion.

Now that we’ve compared the growth directly to last year’s report structure, let’s look into the data with a wider lens, allowing us to view a wider range of data.

Primary Social Channels Used by Creators

(2023 VS 2025)

How does our roster of surveyed creators line up with 2023's creators? This year, we had a significant decrease in responses from creators on Instagram, making up 62.68% of last year's respondents. Only 27.55% of creators reported TikTok as their main platform, with the remaining 9.59% being on YouTube. This year, they’ve flipped the script, with a significant increase in responses from the creators on TikTok and YouTube.

Instagram currently leads in average annual income, bolstered by a handful of top-earning creators that significantly elevate the platform’s earnings. TikTok, despite its large respondent base, has the heaviest concentration of lower income brackets, highlighting ongoing monetization challenges for a sizable portion of its creator base.

Our data also reveals higher-earning creators are more prominent and responsive on YouTube and Instagram, whereas TikTok responses are skewed toward smaller creators, indicating it may serve as a more accessible entry point into the creator economy and starting content creation.

Content Creator Demographics

The majority of creators surveyed are not newcomers.

Nearly all have been creating content for more than a year, with most falling into the 1 to 4-year range. This gives us a snapshot that the economic data we’ve collected is substantially from creators who’ve already weathered the initial learning curve and have learned the ins and outs.

More than half of these creators treat content creation as their full-time job, while the rest balance it with other responsibilities and not as their sole source of income.

Notably, only 1 in 4 creators reported being under formal management. The remaining three-quarters operate independently, suggesting that even among seasoned creators, many are still navigating brand deals, negotiations, and strategy on their own.

These distinctions between full-time and part-time creators, as well as managed and independent ones, influence not only how creators work but also their earnings, growth, and long-term sustainability. We’ll explore these dynamics in the sections ahead.

Annual Income (Part Time vs. Full Time)

Impact of sponsored posts, Income by time as a creator, and by video content

We asked creators to share two key details about their content workflow, the percentage of their content that is video-based, and the number of hours they dedicate each week to content creation.

These insights give us a clearer view into the time and effort behind each post especially as video content, which often requires more editing, planning, and production, has become the dominant format across platforms.

The number of hours spent creating each week also offers a window into the difference between hobbyists and career-focused creators.

When analyzing earnings, a clear trend emerges. Those who utilize a mixture of video and static content were the highest earners. Utilizing both forms means that the creator is spread across multiple platforms such as Instagram and TikTok and isn’t siloed into one spot.

Revenue Source

Over 49% of surveyed creators earn most of their revenue from brand deals.

This is a 10% decrease from last year with a notable shift towards ad revenue and self-owned businesses.

The decrease in brand deals being the top earning portion of revenue for creators may be a result from brand deal saturation, a lack of brand deals, as well as other revenue sources becoming more viable over the past few years.Interestingly, when asked what creators would prefer to make the most revenue from, over 64% want to make the majority of their revenue from brand deals, indicating brand deals may have become less valuable or less accessible for creators than they previously were. If brand deals become scarce, secondary measures such as ad revenue and building their own brand takes priority.

Creator Owned Brands - Branding Is Everything

One of the most important aspects for creators is their ability to brand themselves. Many creators have begun taking this to the next level by building their own brands as well. The results are an astounding yes, in which nearly 45% of creators own some form of business or brand in addition to their standard content creation.

Creators Are Becoming Entrepreneurs

Annual Income by Business Ownership

Nearly 45% of full-time creators own a brand, and they earn close to $100K annually by doing so.

Owning a brand is one clearest markers for financial success in the creator economy.

Creators that are ready to earn a brand make more money than those who do not presently own one, indicating that owning a brand or being position to have one is a key aspect of breaking past the monetization barrier.

Those who don’t have a brand or aren’t looking to have one, likely don’t earn enough to start one or have the type of content that a brand can be revolved around. As the Creator Economy continues to shift, we can expect more creators to adapt to having a brand in the future.

What Inspired You To Become a Creator?

Why do creators start creating? We asked this to uncover the driving force behind today’s most influential voices. Most respondents say they’re motivated by passion or a desire for creative expression. The least cited reason? Creating purely for financial gain.

Annual Income (by Creator Approach)

Creators who prioritize making money earn more than twice as much as their peers.

Our data shows a significant divide in earnings based on creator intent. Among all motivations surveyed, financial gain was the least commonly chosen reason for becoming a creator, yet it yielded the highest income by a significant margin.

Creators who selected “Making Money From My Content” reported an average annual income of over $132k, more than double that of those focused on creating quality content, connecting with their audience, or building a personal brand. This data is likely skewed from the few who selected this as their option being significant earning makers in the creator economy.

While passion and audience-building remain key drivers for creators, those who actively treat their content like a business are positioned for long-term success.

Sponsored Posts

In 2025, over 53% of surveyed creators created between 0 and 10 sponsored posts, while 23.9% created 10-20, and 10.7% created 20-30 sponsored posts.

Compared to our data from last year, the average max pay of a sponsored post has risen by $1,150, while the average median pay of a sponsored post has risen by $1,000. This indicates that the rates for creator content have significantly risen and will likely continue to do so as both inflation and the value of influencer content increases.

Annual Income (by Sponsored Posts)

The amount of sponsored posts is directly correlated to the amount of sponsored posts.

Our data shows a significant divide in earnings based on creator intent. Among all motivations surveyed, financial gain was the least commonly chosen reason for becoming a creator, yet it yielded the highest income by a significant margin.

Creators who selected “Making Money From My Content” reported an average annual income of over $132k, more than double that of those focused on creating quality content, connecting with their audience, or building a personal brand. This data is likely skewed from the few who selected this as their option being significant earning makers in the creator economy.

While passion and audience-building remain key drivers for creators, those who actively treat their content like a business are positioned for long-term success.

The Impact of Higher Education on Content Creation

Over 77% of the creators surveyed attended higher education, the majority of whom pursued a 4-year degree.

Most creators financed their education through either working, their family’s support, or taking on student loans. Only a fraction of creators have dropped out to pursue content creation instead of higher education.

Education (2023 vs 2025)

Since the 2023 Creator Earnings Report, we’ve discovered that 7.7% more creators did not attend higher education than in 2023. This indicates that content creation has become more accessible, and the number of content creators attending higher education will likely continue to decrease, especially as more youth pick up content creation before they reach college.

More Creators Are Dropping Out for Content

In 2025, 15.9% of content creators dropped out or postponed their higher education for content creation. Nearly twice as many creators have dropped out of college compared to 2023’s 8.6%.This suggests that becoming a creator, especially in a market favoring influencers, has become more viable than the standard 9-5 work schedule.

Surprisingly, creators who had no higher education had higher annual income than those who did. It’s likely that younger full-time creators entered the space early, monetized faster, and forgoed traditional education.

Degree Relevancy to Content Creation

When asked on a scale of 1 to 5 how relevant their degree is to their content creation, they responded with only a 2.66 average.

Only 36% of creators that have degrees find it relevant to their content creation.

Economic Conclusions

The Creator Economy Is Skewed Toward Low-Income Earners

Through our data, we’ve found that the majority of the creator economy is heavily skewed towards low-income earners, with many creators struggling to break the monetization barrier.

What Does This Tell Us?

Most creators in the creator economy aren’t earning substantial income, the majority make less than $15,000 annually. But for those who surpass that threshold, earnings tend to accelerate.

It’s important to note that while many creators struggle with monetization, many earn a great deal. The creator economy is growing and economically viable, but for many, breaking through the $15,000 threshold remains a difficult climb.

Creator Values

How do you measure your success as a creator?

The creators surveyed significantly leaned toward engagement as their metric of personal success.

2023 VS 2025

Through our data, we’ve found that engagement as a measurement of success has stayed nearly identical from 2023. Engagement best encapsulates the value of the content and its ability to connect with their community, allowing them to attract brands, receive sponsorships, and generate income.

We’ve found that creators are now slightly less focused on income and have shifted their focus to follower count. While income as a success measurement continues to reign supreme, there is a noticeable shift towards community growth instead of economic performance as growth leads to increased economic performance.

Biggest Challenges for Creators

Let’s get on a personal level with the creators, we asked them to give us more detail:

Biggest Challenges for Creators

Here’s some other comments from the creators:

Creator Services

The Rise Of CapCut

Helpful and accessible editing programs, such as CapCut, Canva, and Adobe Suite, are some of the heavily preferred tools for creators. These platforms and programs offer the creators photo and video editing capabilities while retaining cost efficiency.

Since 2023, there has been a massive increase in the use of CapCut as it dominates the creator services market, nearly doubling in usage from last year. According to Statista, Capcut had a total of over 410 million downloads in 2024, being the 7th most downloaded app in 2024.

Capcut’s prominence has shown itself both on the creator stage and in our survey. Other notable mentions included a rise in Adobe Suite and Canva’s usage, while a significant decrease occurred for InShot, dropping down to 4.1%.

The TikTok Ban

An Endangered Hub of the Creator Economy

A Platform Creators Rely On

The majority of our surveyed audience are TikTok users (44%), many of which being social media veterans with 4+ years of being a creator.

We Asked Creators: What Happens If It’s Banned?

With the TikTok ban looming, these creators' comfort, audience, and way of living are currently at risk.

We decided to ask them their thoughts and plan if the TikTok ban were to take place.

TikTok - An Endangered Hub of the Creator Economy

Nearly all surveyed TikTok creators have a plan to pivot if TikTok were to become banned in the United States. Most of which have Instagram as a ready backup, which makes sense as TikTok’s short-form video content Integrates most easily to Instagram Reels, and then subsequently YouTube Shorts.

What do you feel will happen to the Creator Economy if the TikTok ban were to take effect?

As expected, creators are heavily against the TikTok ban. But there was a mixture of opinions; some creators were very hopeful, thinking of the TikTok ban as a challenge and opportunity to grow on new platforms and switch things up. But overall, creators are resoundingly against the TikTok ban.

The TikTok Ban

We invited creators to weigh in on the potential TikTok ban. Their responses offer a candid look at how the platform’s future impacts the people who rely on it most.

channels.”

Future Predictions

Quotes across the company on our predictions:

-James Michalak

CEO

-Brendon McNerney

CRO

-Steph Payas

CMO