- Short-form video posts grew 71% year-over-year, confirming its dominance across platforms.

- TikTok engagement rose 35%, but reach fell nearly 50% as competition intensified.

- Instagram favors small accounts, but larger creators face steep declines in views and reach.

- Facebook short-form video reach surged 72%, driven mainly by established accounts.

- YouTube Shorts grew in volume but saw engagement collapse by 36%, limiting its standalone potential.

The data underscores shifting dynamics in how audiences consume short-form content.

Short-form video has become the engine of social media, shaping how creators, brands, and audiences connect. Metricool's "The State of Short-Form Video in 2025" report offers one of the most comprehensive analyses yet, drawing on 5.7 million videos and nearly 600,000 accounts worldwide.

The findings confirm the dominance of video across platforms but also reveal sharp divergences in performance between TikTok, Instagram, Facebook, and YouTube Shorts.

The topline numbers are striking: short-form video posts grew by 71% year-over-year, while the number of accounts using the format rose 51%. But more video doesn’t always equal more success. Engagement, reach, and growth opportunities vary sharply depending on the platform, making strategy increasingly complex for marketers.

TikTok: Stronger Engagement, Shrinking Visibility

TikTok is still the cultural driver of short-form, but the Metricool report shows the platform entering a more competitive phase. Accounts publishing content rose 129%, and videos published jumped 156%, far outpacing other networks. Yet this surge in supply has diluted visibility: reach fell by 47%, views dropped by 25%, and average watch time shrank to 3.75 seconds, down 20% from last year.

Despite these declines, TikTok posted the largest engagement growth of any platform (+35%), proving that while fewer users may see individual videos, those who do are more invested.

TikTok also remains the fastest platform for growth, with 24% of accounts leveling up to a higher follower tier in 2025.

For brands, the takeaway is clear: TikTok is still the place to build loyal, engaged audiences, but success depends on capturing attention within the first three seconds.

Instagram: Growth for Small Creators, Decline for Everyone Else

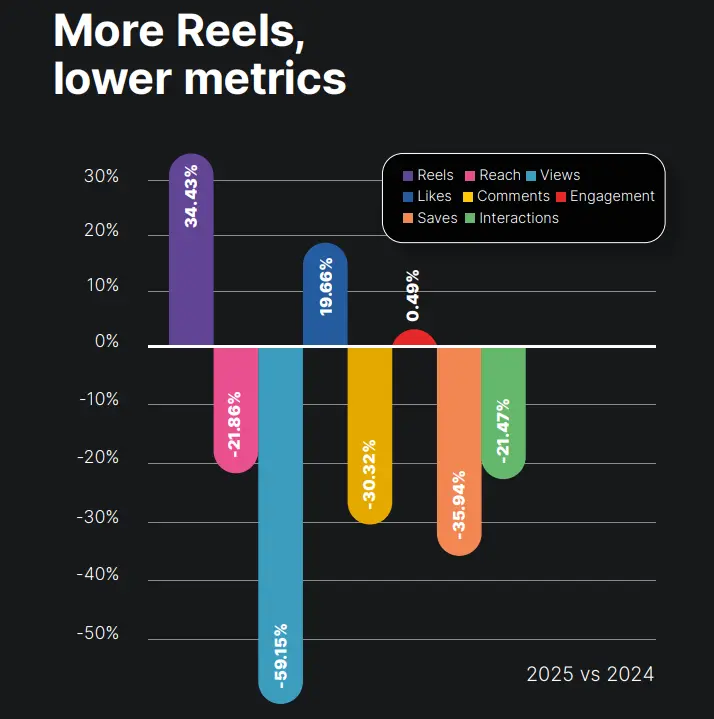

Instagram Reels continues to be a volume leader, with video posts up 34% and accounts posting up 26%. However, performance metrics reveal a troubling pattern: reach fell 22%, views collapsed 59%, and engagement dropped 30% year-over-year.

The platform is increasingly stratified. Small accounts (<10,000 followers) managed to grow likes (+29%), interactions (+22%), and engagement (+30%), suggesting Instagram’s algorithm is giving them more breathing room. Medium, big, and huge accounts, however, saw declines across nearly every metric, confirming that scaling on Instagram has become harder and costlier.

For marketers, Instagram is shifting into a retention platform—valuable for maintaining presence, but less reliable as a discovery engine unless you’re an emerging creator.

Facebook: The Unexpected Resurgence

Perhaps the biggest surprise in Metricool’s 2025 report is Facebook’s short-form revival. Once written off as a declining space for younger audiences, the platform showed strong results: reach grew 72%, views rose 24%, and interactions climbed 22%.

Yet, as with Instagram, the benefits are uneven. Big and huge accounts drove the bulk of the gains, while small and medium profiles saw declines in reach and engagement. For large brands and established publishers, Facebook Reels has become a reliable mass-distribution tool. For smaller creators, however, it remains difficult to break through.

YouTube Shorts: Activity Without Engagement

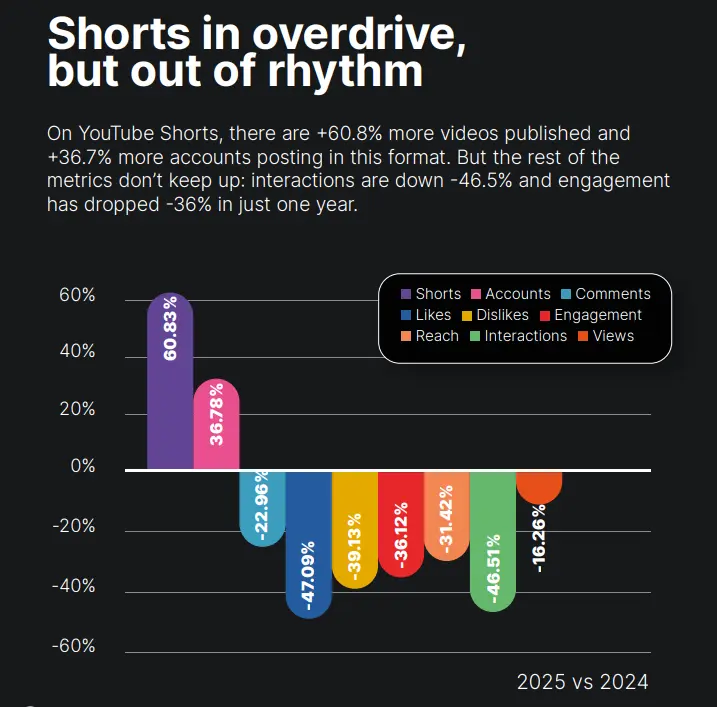

YouTube Shorts posted the highest volume growth after TikTok, with 61% more videos published and 37% more accounts posting. But here the good news ends. Shorts recorded a 31% drop in reach, a 46% decline in interactions, and a 36% decrease in engagement.

Metricool’s analysis suggests that Shorts functions less as a standalone engagement driver and more as a funnel to long-form YouTube content. In other words, Shorts may be effective for discovery and subscriber conversion, but they are not where brands or creators should expect deep audience connection.

Growth Opportunities Across Platforms

Metricool’s year-over-year analysis makes the differences stark:

- TikTok remains the fastest track for creator growth, with 24% of accounts moving into a higher tier.

- Facebook is the hardest platform to grow on organically, despite gains for large accounts.

- Instagram favors small creators, but scalability remains elusive.

- YouTube Shorts adds visibility but lacks staying power in terms of engagement.

These dynamics reinforce the idea that short-form video is not a one-size-fits-all strategy. Each platform serves a distinct role in the funnel, and marketers must balance engagement, reach, and growth potential when allocating resources.

The Big Picture: Short-Form Is Here to Stay, But Fragmenting

The Metricool report confirms that short-form video is no longer the “future” of social—it is the standard. Yet fragmentation is deepening.

- TikTok remains the leader in engagement and growth

- Instagram is tightening competition

- Facebook has staged a comeback

- YouTube Shorts is struggling to align scale with interaction

For brands, the implication is clear: short-form is non-negotiable, but platform strategy matters more than ever. Engagement rates, watch times, and audience behaviors differ too widely to rely on duplication alone.

The marketers who win in 2025 will be those who treat each platform’s short-form ecosystem as distinct, tailoring creative, cadence, and expectations accordingly.