Consumer research has always been at the core of every successful company.

We vividly recall those days when researchers, armed with clipboards and pencils, would interrupt us on street corners. Later, we became overwhelmed by endless email surveys, constantly probing us for feedback.

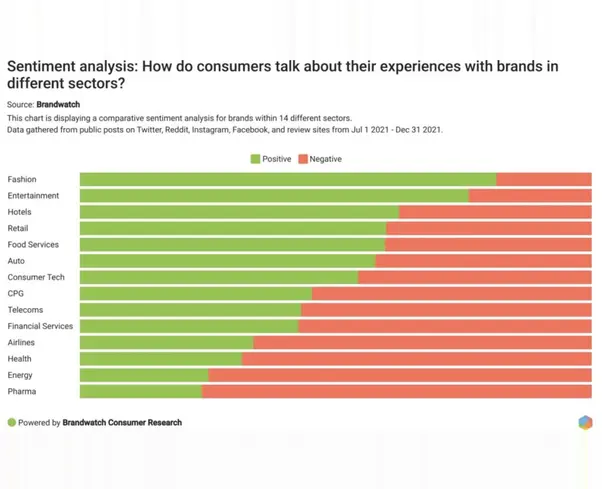

- Brandwatch - Sentiment analysis

But times have changed, dramatically.

Today, consumers voluntarily spend their lives online, freely sharing their experiences, opinions, emotions, frustrations, and desires.

Let's call it consumer research, from the streets to the screens.

Why Brands today Need to Integrate Social Media Listening

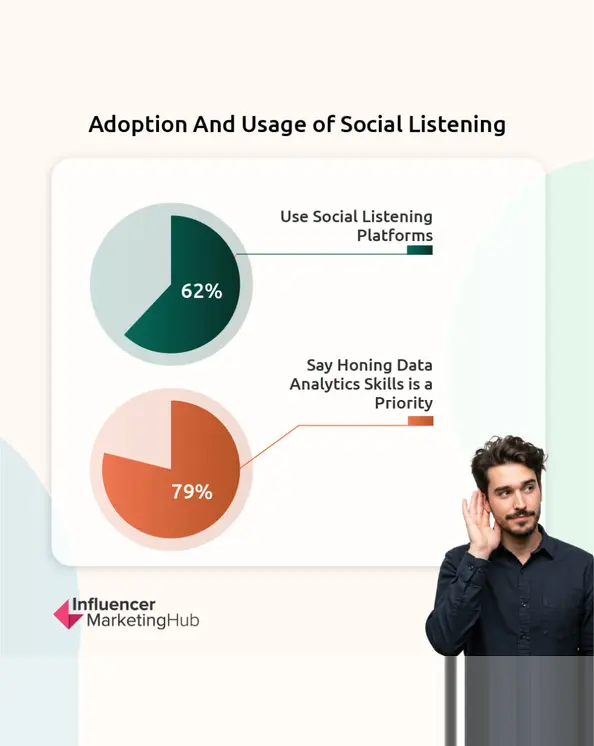

- 62% of marketers consider social media listening a core data source.

- 79% of marketers believe data analytics skills, including social listening, are critical for success in 2025 .

- Companies using social listening effectively achieve up to 10% faster revenue growth compared to their peers.

- Social listening can detect emerging crises in real-time, reducing reputation damage by up to 70%.

- Brandwatch analyzed 719 million online mentions in a single study, highlighting the sheer volume of actionable insights available.

Listen to Your Market - Try BRANDWATCH Today!

Market dynamics and technology makes 2025 the year of Social Listening

- AI and Automation Improvements: Advanced AI capabilities in listening platforms provide deeper insights more efficiently.

- Shifting Consumer Expectations: Consumers expect immediate brand responsiveness. Companies that leverage listening tools become leaders in customer experience and brand loyalty.

- Strategic Advantage for Businesses: Social listening represents an affordable competitive equalizer, enabling especially SMBs to outmaneuver larger, slower-moving competitors by being more responsive and agile.

We no longer have to interrupt their lives to understand them; we simply need to listen. Through social media listening, we're decoding authentic patterns of consumer behavior without intruding or burdening them. In doing so, we're capturing insights in their purest form, unfiltered, unsolicited, and profoundly honest.

This shift isn't just technological; it's philosophical. It's an evolution from interrupting people to truly understanding them, on their own terms. In this new reality, brands that actively listen will form deeper connections, anticipate customer needs, and build strategies rooted in truth rather than assumptions.

Social Media Listening Market is expected to reach $18.43 billion by 2030

Social listening’s importance is surging, evidenced by rapid market growth. The global social media listening market is projected to grow from $9.61 billion in 2025 to $18.43 billion by 2030, nearly doubling in size (13.9% CAGR). This expansion reflects how central social listening has become for modern marketing and PR.

- Key Trends in Social Media Listening (2025)

- Insights from Marketer Survey 2025: Strategies, Tools, and ROI in Social Media Management

- Market Data & Metrics on Social Listening

- AI-Driven Technology Developments in Social Listening

- Transforming Market Research: From Insights to Action

- Why Social Listening is Crucial in 2025

- Strategic Model for Implementation: SLIM Framework

Key Trends in Social Media Listening (2025)

Key trends include the integration of AI and predictive analytics for deeper sentiment analysis and trend forecasting, a greater focus on real-time insights for agile marketing and crisis management, and the expansion of listening to new channels (e.g. forums, podcasts, videos) beyond text-based posts.

- Key Trends in Social Media Listening

Case studies from industries like retail, technology, and aviation demonstrate that companies using social listening see improved campaign ROI, faster product innovation, better customer service, and stronger brand loyalty. Advances in AI, especially NLP that understands sarcasm and context to predictive models – are transforming how marketers extract and act on consumer insights. In 2025, several clear trends have emerged in how organizations use social listening:

AI-Powered, Personalized Listening:

Artificial intelligence is now at the heart of social listening platforms. AI-driven assistants can sift through millions of social mentions in seconds to pinpoint what matters, categorizing conversations by topic, sentiment, and even cultural context. This makes it possible to surface hyper-relevant insights (for example, a skincare brand instantly finding that many customers seek “lightweight SPF for oily skin”) and respond with precision. Machine learning has vastly improved sentiment accuracy and context understanding, even recognizing sarcasm, humor, and slang. The result is faster, more personalized insights that let brands “truly get” their customers’ needs and mood in real time.

Samsung exemplifies the practical use of AI-powered listening. Their social insights team leverages advanced social listening tools to analyze billions of daily conversations across multiple global markets.

Samsung’s insights team monitors conversations across 43 markets in Europe, feeding insights to various business units. They have dashboards for each country so local teams can self-serve insights, drastically reducing the time it takes to find relevant data.

This setup proved its worth when a quirky trend emerged: Samsung’s washing machine jingle went viral on TikTok with users dancing to the tune.

@cost_n_mayor Replying to @nathanonwheels ♬ original sound - Cost n’ Mayor

By spotting this viral hashtag early via Brandwatch, Samsung’s team quickly mobilized a response – creating timely content and partnerships to ride the wave. According to Samsung’s Social & Digital Insights Lead, Prashant Mistry, social data helped them confirm the trend’s momentum and “determine if we’ve stumbled across a trend that’s engaging online communities” before investing in a campaign. The result was a fun, on-brand engagement with a user-generated trend – a clear win from social listening.

As Samsung’s Prashant explained, they have “evolved the practice from generic social listening into social intelligence” – digging into the qualitative drivers behind conversations about their brand and products. This trend means not just tracking mentions, but understanding context, sentiment, and drivers of consumer dialogue. It aligns with marketers’ focus on data skills: 79% say data analysis and interpretation are critical skills for 2025. To support this, teams are tackling challenges like data quality (cited by 56% of marketers) and fragmented data sources (46%) by integrating multiple channels into unified listening programs. The goal is a holistic view of the consumer across social networks, forums, and online communities.

Human Expertise for Deeper Insights:

Paradoxically, as automation grows, so does recognition of the value of human analysts. Companies don’t want generic auto-generated charts – they want nuanced reports with industry context and expert interpretation. In 2025, leading organizations blend AI analytics with human insight to get niche metrics and qualitative context algorithms might miss. This trend underscores that social listening isn’t fully “set and forget.” Human-guided listening helps ensure insights are accurate, relevant, and actionable for strategy.

Duolingo’s social strategy is renowned for its clever, culturally relevant content. Behind this witty presence is a highly skilled team of human analysts who continuously monitor social conversations, identifying emerging cultural stories, memes, and celebrity references.

For example, when a news story went viral about actor Cillian Murphy trying to learn Dutch, Duolingo’s team saw an opportunity.

when a sexy actor does it, he gets an Oscar. when i do it i’m annoying. double standards smh

— Duolingo (@duolingo) July 26, 2023

They quickly responded on social media with a humorous quip tying the story to their brand. The result was a viral tweet that put Duolingo in the spotlight without any direct advertising. This tactic, known as newsjacking, relies on listening to the online zeitgeist – catching a moment when your brand can chime into a popular conversation in a relevant way. Duolingo’s quick draw on social trends (often led by their feisty owl mascot character) has massively boosted their engagement. It underscores that real-time listening enables brands to ride cultural waves and humanize their image.

From Monitoring to Active Engagement & Community Building:

Social listening has evolved from passive monitoring to an active strategy for digital engagement. Marketers are using insights to join conversations and build communities rather than just chasing virality. In fact, 62% of marketers now use social listening tools to track audience preferences and competitor activity, making it their second-highest social media priority (after direct audience engagement). Brands are listening to learn what content resonates, then creating more entertaining, informative social content (over 60% of content for many brands) instead of pure promotion. By tapping into what people care about, companies foster genuine connections. For example, micro-communities and “micro-viral” moments are valued over mass appeal – social listening helps identify niche cultural trends that a brand can authentically engage with.

Enhanced Competitive Intelligence:

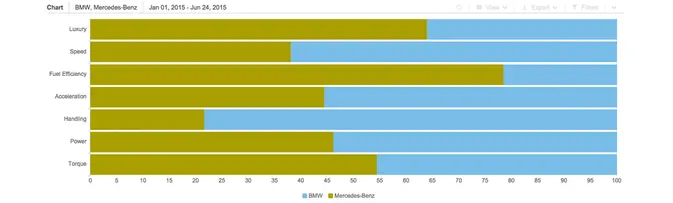

In 2025, social listening isn’t just about your brand – it’s also a powerful lens on competitors. Modern tools can track competitors’ social profiles and mentions as easily as your own, enabling side-by-side comparisons of content strategies, audience sentiment, and growth. Competitive intelligence is critical in social media marketing, where new platforms and trends emerge rapidly.

By analyzing public sentiment around competitors, brands can spot weaknesses or unmet customer needs to exploit. Social media is like having a window into your competitors’ focus groups: customers publicly share pain points and feature requests that savvy brands can use to differentiate. For instance, if consumers complain en masse about a rival product lacking a feature, your team can proactively offer it – seizing a market gap.

Predictive Analytics & Trend Spotting:

A major 2025 trend is using social listening data not only to react, but to predict. By applying predictive analytics to historical and real-time social data, brands try to anticipate “the next big thing” before it hits. This might mean detecting an uptick in conversations about a nascent topic or lifestyle (e.g. a sudden spike in “sustainable living” chatter) and aligning product plans accordingly. It also means forecasting audience reactions – using past campaign data to model how a new campaign might perform. Crucially, predictive listening can serve as an early-warning system for crisis prevention: unusual growth in negative sentiment can flag an issue with a product or policy, giving the brand a chance to fix it before it explodes publicly. Brands in 2025 want to be proactive, not just reactive, and trendspotting through social listening offers that strategic edge.

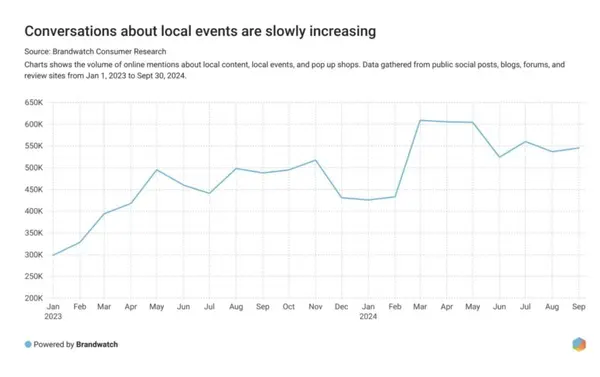

Trends on social media now “appear and disappear in the blink of an eye,” making real-time listening more important than ever. Brands are using social listening to spot emerging conversations early. For instance, Brandwatch recorded 5.24 million mentions around localized events content in one recent year – a signal that hyper-local and experiential marketing was trending. With the right tools, marketers can immediately detect spikes in discussion and gauge if a trend is gaining traction. This agility is crucial in 2025’s landscape; companies that swiftly identify and act on viral moments or consumer concerns can capitalize on opportunities (or avert crises) faster than competitors. Social data is increasingly being used as an “early warning system” for both positive trends and potential issues.

- Discussions about local events are growing

Multimedia and Omni-Channel Listening:

Social conversation is no longer confined to text posts – consumers are talking via images, videos, live streams, and audio (podcasts, Twitter Spaces, etc.). Thus, audio and video listening is on the rise. Advanced platforms now incorporate image recognition and voice analysis to capture these non-text mentions. For example, tools can “listen” to a TikTok video for a brand mention or analyze the sentiment in a podcast discussion about a company. This broadens social listening beyond X (Twitter) and Facebook to channels like YouTube, TikTok, Instagram Stories, Reddit threads, Discord communities, and more.

McDonalds excels at multi-platform social listening to tap into pop culture. A vivid example is the 2023 “Grimace Shake” TikTok trend. McDonald’s social team noticed an explosion of user-generated videos and memes on TikTok, Instagram, and YouTube related to a purple milkshake launched for Grimace’s birthday.

I have received so many questions about the Grimace Trend and how McDonald's handled it.

I shared on LinkedIn but here is an insider view from the social media team of what happened :

- if you think we planted the grimace shake trend, thank you. So much. But you think way too… pic.twitter.com/dMjxSu9jkD— Guillaume Huin (@HuinGuillaume) July 12, 2023

Through listening, they realized this organic craze had huge engagement. McDonald’s quickly jumped in, reposting fan-created content and even crafting their own playful responses (like tweeting a tongue-in-cheek meme pretending not to notice the trend). This agile response – only possible because social listening alerted them to the trend early – amplified the buzz and turned a limited product into a viral sensation. It showed how cross-platform listening and quick creativity can dramatically boost brand visibility and customer interaction

Niche and emerging platforms are part of this omni-channel approach – brands are paying attention to conversations on Reddit, Discord, TikTok, forums, review sites and others, not just the big networks. In fact, 70% of social listening professionals consider Reddit and forums essential data sources. Capturing the full conversation means meeting consumers wherever they express themselves online.

Integration with Customer Care:

Social listening and customer service have converged. In 2025, many companies pipe social listening insights directly to their customer support teams. By flagging customer questions, complaints, or needs in real time, brands can respond almost instantly – often within minutes or hours – on the same platform. This trend is exemplified by companies like Delta Airlines, which maintain teams dedicated to watching social mentions and addressing customer issues on Twitter as they arise, yielding faster response times and higher satisfaction.

As we saw in the beginning, the airline industry is amongst those with the highest level of negative sentiments. Delta was an early adopter of Twitter for customer service. They have a dedicated social listening team that monitors tweets and messages for any mention of flight issues, complaints, or praise. By responding to customer inquiries and grievances in real time on social channels, Delta resolves problems faster than via call centers.

Hi! This is Selena in the Delta Baggage Service Center. Our claims department is not in messaging nor on the phones. I am sorry I am not in the claims department and no one in baggage cannot override anything your claims manager decides.

— Delta (@Delta) March 1, 2025

American Airlines established an "always-on" social command center powered by Brandwatch's Vizia platform, enabling real-time insights and actionable intelligence throughout the entire organization—from customer service to operational management and executive leadership. This innovative approach proved crucial during high-stakes crises, such as the devastating hurricanes of 2017, when timely and precise communication directly impacted customer experience and brand reputation.

- Brandwatch American Airlines case study

American Airlines' proactive use of visual alerts, real-time trend tracking, and rapid distribution of insights across all business units not only allowed them to swiftly manage potential PR crises but also consistently kept their teams informed and responsive. This contrasts notably with competitors who relied on slower, less integrated systems—resulting in comparatively weaker sentiment performance.

- Brandwatch American Airlines case study

This commitment to cutting-edge social listening infrastructure has empowered American Airlines to dominate conversations, earn positive consumer sentiment, and swiftly address customer concerns. Their success underscores a critical insight: the brands investing strategically in advanced, integrated social listening capabilities today are those that truly own the customer conversation tomorrow.

Social listening has essentially become an extension of CRM, ensuring no customer voice goes unheard.

Beyond reactive support, it’s used for relationship building – thanking users for praise, surprising loyal fans, and showing that the brand is “always listening.” By integrating listening with CRM data, responses can be personalized and prioritized by influence or urgency. Every mention becomes an opportunity to engage and turn a customer into a brand advocate.

Social Listening in the Era of Community Notes

What happens when the world's largest social media platforms change how they moderate content, shifting responsibility from traditional fact-checkers to community-driven oversight?

A reminder - in the year 2020, Donald Trump rejected the California government’s request for federal disaster relief funds to help the state recover from its devastating wildfires.

He said no.

And the second he’s given the chance, he will do it again.

— Jo (@JoJoFromJerz) January 9, 2025

Platforms like Twitter (X) and Meta are leading this transformation, significantly altering the online landscape for advertisers and brands. The shift away from traditional fact-checking toward tools like Twitter’s Community Notes and Meta’s similar initiatives has far-reaching implications for brand reputation, consumer trust, and advertising strategies.

Impact on Brands and Advertisers

Twitter's Community Notes have already demonstrated significant consequences for brands. Prominent cases, such as Apple and Samsung having their ads publicly flagged and corrected, show how community-driven moderation can directly impact a brand's credibility, visibility, and overall engagement. Reports from sources like Rolling Stone and the Wall Street Journal underline how swiftly Community Notes can influence public perception, turning advertisements into points of scrutiny and potential reputational damage.

Why Social Listening is Critical

In this environment, social listening tools like Brandwatch become vital. They enable brands to proactively assess sentiment, detect controversial or unclear messaging before campaigns launch, and adapt swiftly if issues arise. Through sentiment analysis, brands can pinpoint potential vulnerabilities or misinformation risks within their content, significantly reducing the likelihood of being negatively spotlighted by Community Notes.

Real-World Examples and Insights

For instance, Stake.com's ads on Twitter, flagged by Community Notes, serve as a cautionary tale of what happens when community moderation intersects with advertising. The flagged content not only saw decreased engagement but also faced reputational repercussions. By contrast, brands proactively using social listening tools have navigated such pitfalls more effectively, adjusting their messaging or strategies in real-time based on predictive insights.

Preparing for Meta’s New Approach

Meta’s decision to follow Twitter's example by removing traditional fact-checkers and introducing community-based moderation will amplify these challenges across an even larger audience base. With ambiguity still surrounding whether Community Notes will affect paid ads or just organic content, brands must leverage advanced social listening platforms to stay informed, responsive, and strategic. Tools like Brandwatch provide crucial insights, helping brands to understand evolving conversations, anticipate risks, and safeguard their reputation.

Strategic Recommendations for Brands

- Continuous Monitoring: Leverage social listening tools to track public sentiment around key topics linked to your brand.

- Proactive Adjustments: Identify potential issues early and modify ad and content strategies before public scrutiny occurs.

- Cross-Platform Strategies: Maintain consistent messaging and vigilance across multiple platforms to minimize risk.

- Transparency and Responsiveness: Embrace transparency in communication, openly addressing community-driven feedback to foster trust.

Insights from Marketer Survey 2025: Strategies, Tools, and ROI in Social Media Management

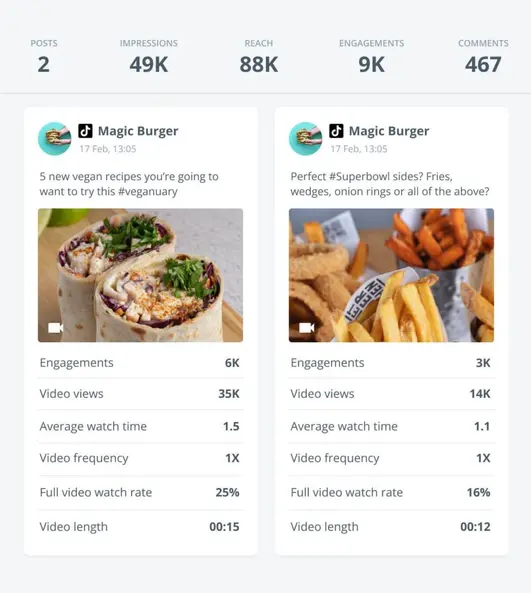

Our recent survey, gathering insights from 183 marketers, sheds significant light on strategies, tools, and performance metrics relevant to the broader context of social media listening and consumer research in 2025. This section bridges the gap between theoretical insights and practical applications, connecting directly to the global trends, AI advances, and the overarching narrative outlined earlier in the report.

Importance of Social Media Listening in 2025

Social media listening has become mission-critical for brands in 2025. A customer-centric marketing strategy relies on tracking consumer opinions in real time – Brandwatch emphasizes that monitoring online conversations with social listening tools is “key to staying ahead of the competition”. Marketers recognize its importance: 62% of marketing professionals now use social listening as a core data source (just behind website analytics at 69% and surveys at 66%). By combining quantitative analytics with qualitative insights from social listening, companies gain a well-rounded understanding of audience sentiment and needs. In fact, social listening, analytics, and social management platforms are seen as critical investments for staying competitive in the fast-paced digital landscape. As one Brandwatch guide put it, a straightforward listening approach can uncover valuable insights to drive decisions in marketing, PR, and even product development – underscoring “just how powerful and invaluable social listening is.”

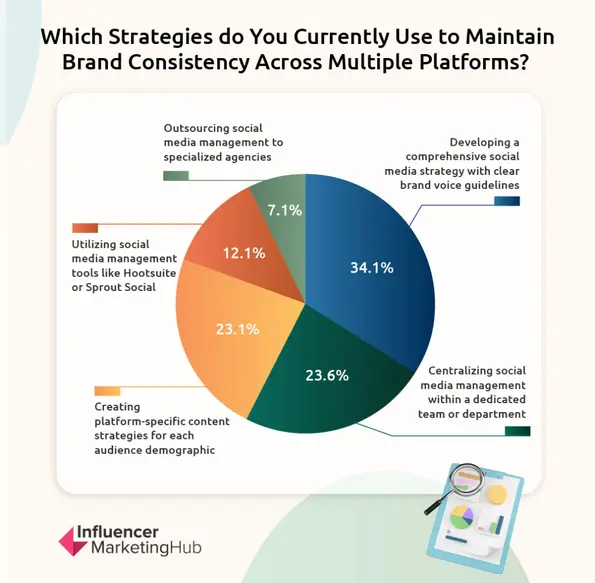

Maintaining Brand Consistency Across Platforms

Brand consistency is crucial for impactful brand communication, and our data emphasizes marketers' strategic shifts. A significant 34.1% of marketers focus on developing comprehensive social media strategies coupled with clear brand voice guidelines. This aligns with the broader global trend, suggesting the importance of clear, uniform communication facilitated through strategic social listening practices.

- Maintaining Brand Consistency Across Platforms

Interestingly, 23.6% centralize their social media management within dedicated teams or departments, reinforcing the notion that cohesive internal structures complement effective social listening. Platform-specific strategies tailored to each demographic (23.1%) underline an understanding of audience fragmentation—highlighted in our earlier discussion around the necessity of real-time listening and response.

Utilizing social media management tools (12.1%) and outsourcing management to specialized agencies (7.1%) were less prevalent, indicating a preference for in-house, strategy-driven approaches that are essential to maintaining brand authenticity and agile responses, consistent with findings emphasizing human expertise alongside AI-driven insights.

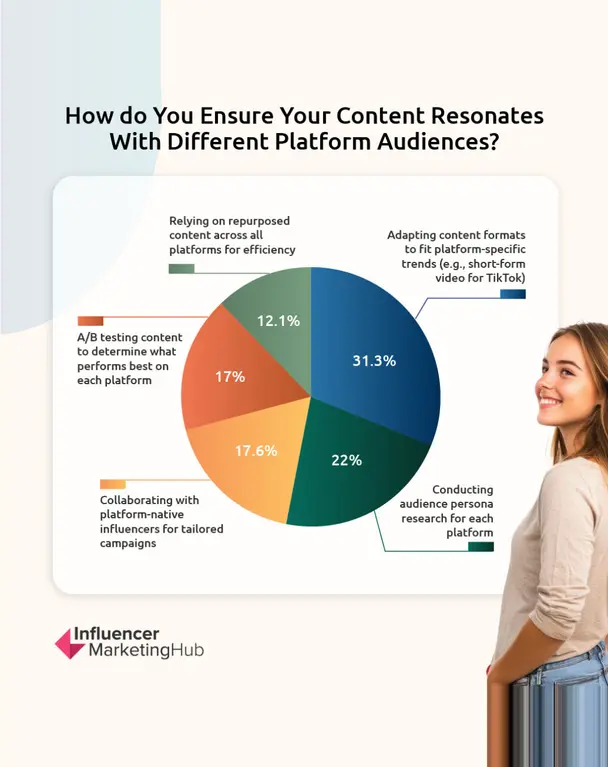

Ensuring Content Resonance with Platform Audiences

To resonate with diverse audiences, marketers prioritize adapting content formats to platform-specific trends (31.3%), reflecting the emphasis on multimedia and omnichannel listening previously discussed. Audience persona research (22%) also figures prominently, indicating marketers understand the need for deeply contextual, data-informed insights, a task social listening tools excel at.

- Ensuring Content Resonance with Platform Audiences

Collaborations with platform-native influencers (17.6%) and A/B testing content (17%) further underscore the blend of data analytics and qualitative strategy outlined in our global trend analysis. Fewer marketers (12.1%) rely on repurposed content, suggesting growing recognition of the necessity for authentic, platform-specific communication shaped by real-time insights derived from social listening.

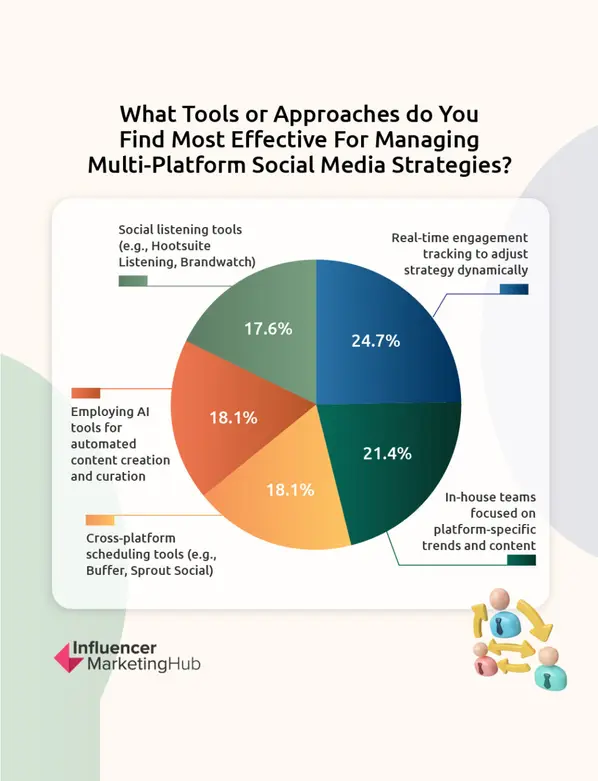

Effective Tools for Multi-Platform Social Media Strategies

Real-time engagement tracking leads as the most effective tool (24.7%), echoing our earlier emphasis on immediacy and agility in marketing responses. This is directly tied to the advanced capabilities of social listening platforms that provide instantaneous insights and alerts.

- Effective Tools for Multi-Platform Social Media Strategies

In-house teams dedicated to platform-specific trends (21.4%) further emphasize a preference for internally managed social intelligence operations, aligning with the broader trend of blending human expertise with AI-supported analytics. Notably, cross-platform scheduling tools and employing AI tools each received equal support at 18.1%, indicating balanced adoption of automation and manual oversight.

Social listening tools specifically were identified by 17.6% of marketers as essential, highlighting their critical role, especially given the expanded multimedia capabilities and AI-driven analytics that have become indispensable for staying competitive in 2025.

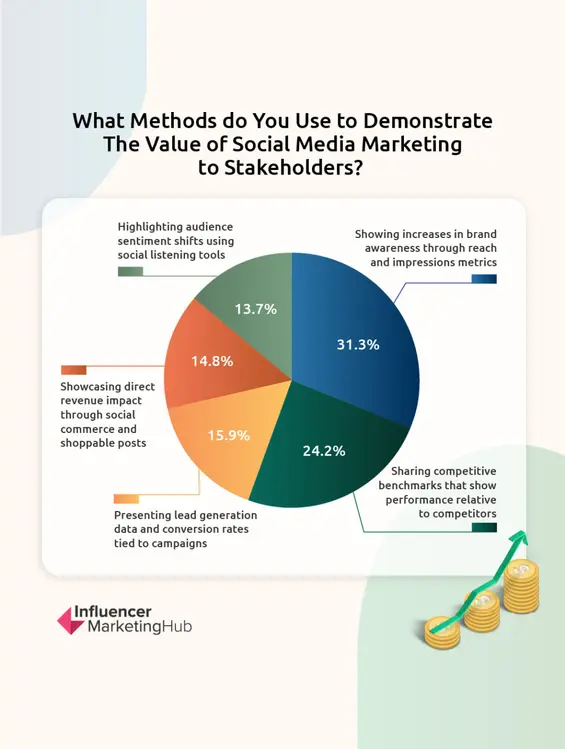

Demonstrating Social Media Marketing Value to Stakeholders

The importance of tangible metrics emerges clearly in demonstrating value. A substantial 31.3% of marketers prefer highlighting brand awareness via reach and impressions, echoing our report's emphasis on upper-funnel metrics. Sharing competitive benchmarks (24.2%) also aligns with enhanced competitive intelligence capabilities enabled by advanced social listening.

- Demonstrating Social Media Marketing Value to Stakeholders

Lead generation and conversion metrics (15.9%), direct revenue impact from social commerce (14.8%), and sentiment analysis (13.7%) were also critical, reflecting the diversified approach marketers now use. Particularly, sentiment analysis underscores the strategic value of nuanced, emotion-focused insights from advanced AI-powered social listening tools.

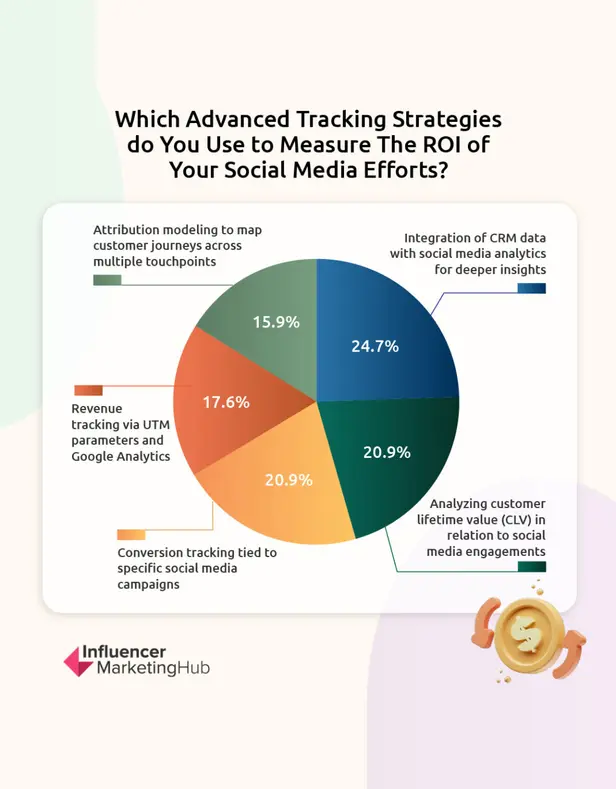

Advanced ROI Tracking Strategies

ROI tracking in 2025 has evolved significantly, with integration of CRM data into social analytics leading at 24.7%, highlighting a shift towards deeper, data-rich integrations that social listening platforms now commonly facilitate.

- Advanced ROI Tracking Strategies

Analyzing customer lifetime value and conversion tracking tied to campaigns both received 20.9% support, demonstrating the move towards granular, sophisticated analytics frameworks. Revenue tracking via UTM parameters (17.6%) and attribution modeling (15.9%) further indicate comprehensive, cross-platform measurement strategies.

These approaches parallel the comprehensive predictive analytics and trend forecasting capabilities discussed earlier, which are becoming standard features of social listening technologies.

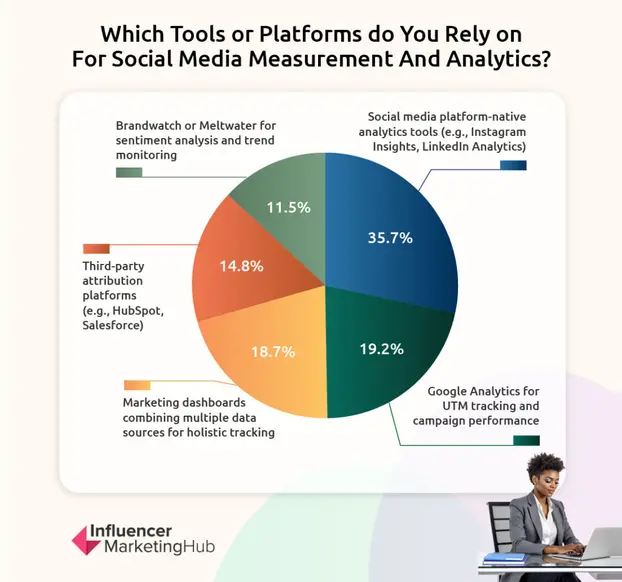

Preferred Measurement and Analytics Platforms

Marketers heavily utilize platform-native analytics tools (35.7%), reflecting trust in direct platform metrics for immediate, actionable insights. Google Analytics remains popular (19.2%), demonstrating continued reliance on robust web-tracking integrations alongside social media insights.

- Preferred Measurement and Analytics Platforms

Marketing dashboards combining multiple data sources (18.7%) are increasingly favored, aligning with the seamless integration capabilities of modern social listening technologies. Third-party attribution platforms (14.8%) and advanced sentiment analysis tools like Brandwatch or Meltwater (11.5%) underline the growing role of dedicated social listening and analytics platforms to manage complexity across multi-channel landscapes.

Conclusion

Our survey data complements and confirms many of the global trends discussed throughout this report. Marketers today clearly prioritize strategic, data-driven, and platform-specific approaches, reflecting the nuanced, AI-supported social listening capabilities that are critical for success in 2025. The results reinforce the necessity of integrated social listening frameworks to maintain brand consistency, ensure content resonance, demonstrate clear ROI, and ultimately drive competitive advantage in a rapidly evolving digital landscape.

Market Data & Metrics on Social Listening

The sheer scale of conversations happening online is enormous. Brandwatch regularly analyzes hundreds of millions of mentions for its reports – for example, 719 million mentions for The State of Social study and 179 million for a recent food and beverage trends report. Their research provides several data points illustrating the scale and impact of social listening:

Adoption and Usage:

Social listening tools have moved from nice-to-have to must-have. In Brandwatch’s global survey of marketers, 62% reported using social listening platforms as part of their data toolkit. This high adoption places social listening among the top three methods for understanding customers (alongside web analytics and surveys). Additionally, 79% of marketers say honing data analytics skills (which include social data analysis) is a priority, suggesting usage will continue to grow. Many brands also report expanding their listening programs to new networks (e.g. TikTok, Reddit) and integrating more departments (from marketing to product to customer care), indicating a broader organizational reliance on social intelligence.

- Adoption and Usage

Effectiveness & ROI:

While measuring ROI of social media has historically been challenging (40% of marketers in 2024 struggled to attribute social campaigns to tangible outcomes), there is evidence that social listening helps improve those outcomes. By informing more targeted campaigns and timely responses, listening can increase engagement and mitigate risks – leading to cost savings and revenue opportunities that wouldn’t exist otherwise. For instance, when Samsung leveraged a viral trend identified through social listening, it gained additional organic reach and brand affinity that traditional marketing alone may not have achieved.

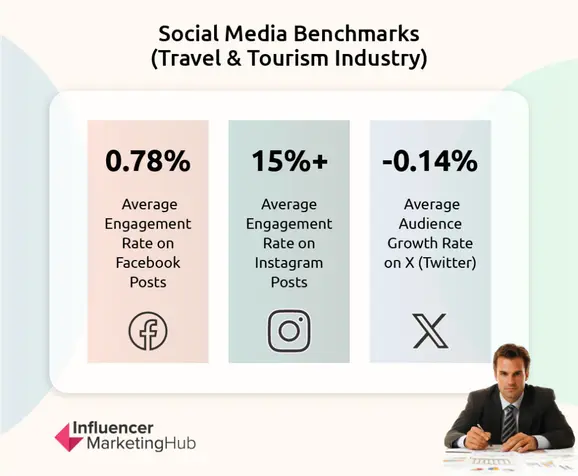

Likewise, Ben & Jerry’s capitalized on an insight from social data to drive new product sales – a direct revenue impact. On a micro level, brands track metrics like sentiment shift, share of voice, response time, and customer satisfaction scores to quantify the impact of their social listening efforts. An example from Brandwatch’s benchmark data: one industry’s average social engagement rate on Instagram is over 15% – if a brand’s listening finds their rate is below that, they know there’s room to improve content strategy. Companies are increasingly tying such metrics to business KPIs, proving the worth of social listening in hard numbers (e.g., faster crisis detection avoiding PR costs, or insights that lead to a successful product launch worth millions).

Cross-Industry Benchmarks:

Brandwatch’s cross-industry social media benchmarks provide useful metrics that set context for performance. They show how different channels stack up in different industries – for example, average posting frequency and engagement rates by platform – which can guide listening focus. A snapshot: Facebook pages in one industry (Travel & Tourism) see 0.78% engagement per post, whereas Instagram posts in that same industry average a much higher 15%+ engagement. Such data points inform where brands might concentrate their listening and content efforts. Another key metric is audience growth rate: the data reveals some networks (like X/Twitter) even have negative growth on average (-0.14%), while others like Instagram see 2.25% growth. These trends, reported by Brandwatch, indicate the shifting landscape of social media and underscore why listening across platforms is necessary – consumer attention is dynamic, and brands need to monitor where conversations are moving.

- Social Media Benchmarks

Social media listening in 2025 is backed by data-driven proof points – from its widespread adoption and billions of data points analyzed, to concrete improvements in marketing outcomes. By using the metrics and insights surfaced through Brandwatch’s reports (like sentiment trends, engagement benchmarks, and share-of-voice figures), organizations can quantitatively assess their social strategy and the effectiveness of listening. The consensus in the latest Brandwatch findings is clear: investing in social listening yields measurable benefits, and those who do it well are setting the pace in customer engagement and market intelligence.

Social Listening as Major Opportunity for Mid-Market

One of the most significant opportunities we've identified with social listening software is the potential for SMBs to leverage this technology to gain a competitive edge.

As more brands adopt a social-first strategy, neglecting social media listening becomes strategically irresponsible. SMBs, in particular, stand to benefit disproportionately from investing in this capability. By harnessing real-time consumer data and predictive insights, smaller brands can significantly outperform their competitors through targeted marketing, agile crisis management, and proactive product innovation.

We are in a hyper-digital, post-attention economy, where consumers are more vocal, information is more decentralized, and brand reputation can skyrocket or collapse within hours. Yet, paradoxically, most small and mid-sized brands are still not investing seriously in social media listening. This is a huge blind spot and a missed opportunity for competitive advantage.

Big brands like Samsung, Ben & Jerry’s, and Amazon are already leveraging real-time consumer insights to predict trends, optimize marketing, and even create new products. But the reality is social media listening is even more powerful for SMBs that need to be agile, cost-effective, and highly targeted. It’s the ultimate asymmetric advantage, giving smaller players the ability to compete by being faster and more in tune with consumer sentiment than larger, slower-moving competitors.

AI-Driven Technology Developments in Social Listening

Technology advances – especially in AI, NLP, and analytics – have supercharged social listening capabilities by 2025. Modern social listening tools are far more sophisticated than those of even a few years ago. Key AI-driven developments include:

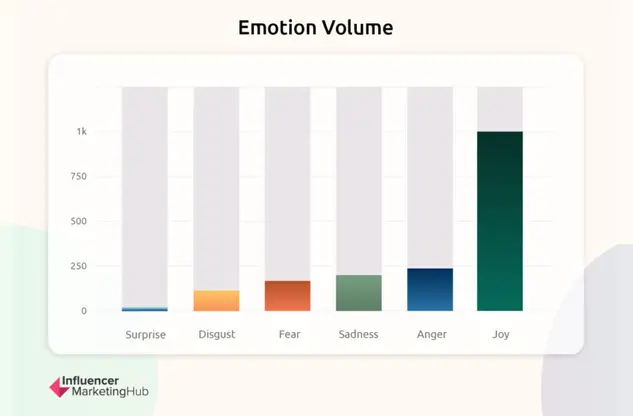

Advanced Sentiment Analysis & Emotion AI

Sentiment analysis has grown from simple positive/negative tagging to nuanced emotion recognition. Natural language processing (NLP) models can interpret context and tone with greater accuracy, distinguishing sarcasm or irony (a sarcastic “Well, that’s just great” won’t be misread as positive).

They also detect specific emotions – joy, frustration, anger, surprise – expressed in social posts. This is achieved through deep learning trained on vast social media datasets and even including emoji/context understanding.

- Emotion volume

Brands benefit by knowing not just if sentiment is negative, but the intensity and emotion driving it. For example, a spike in anger reactions to a product update vs. mild disappointment would warrant different responses. Emotion AI gives deeper insight into customer feelings, enabling more empathetic and targeted engagement. Additionally, multilingual sentiment analysis has improved, allowing global brands to gauge sentiment across languages and regions with NLP models tuned to local slang and idioms.

Real-Time Analytics and Alerts

Speed is a defining feature of 2025’s social listening tech. Platforms now offer real-time dashboards and instant alerts for important spikes or changes. If negative mentions suddenly jump or a particular topic trends, the system pings the team immediately.

- Brandwatch: Real-Time Analytics example

This immediacy lets brands address issues in the moment – turning social listening into a live radar.

- Brandwatch: social listening live radar

Some tools even integrate with messaging apps or email to push alerts to stakeholders company-wide (so a product manager might get alerted if there’s a surge in complaints about their product).

Real-time sentiment tracking during an event or campaign launch has become common – marketers watch gauges that update by the second to see how an audience is reacting and adjust on the fly if needed. In essence, listening tools have evolved into command centers for live consumer intelligence.

Predictive Analytics & AI Trend Forecasting

As noted in trends, predictive analytics is a game-changer. Technologically, this involves AI models that analyze historical social data and current velocities to forecast future outcomes. For example, machine learning can extrapolate whether a hashtag that’s gaining traction will fizzle out or become a week-long trend, or predict seasonality in conversations (perhaps forecasting that “pumpkin spice” chatter will start earlier each year).

- Brandwatch: social panels over time

Some social listening vendors have introduced trend prediction modules that score emerging topics on their “virality potential.” Businesses use these predictions to stay ahead: a fashion retailer might get early warning that ’90s nostalgia is trending and accelerate a retro-themed line rollout. Predictive models also help in crisis aversion – by recognizing patterns that in the past led to viral backlash, the AI can warn PR teams of a brewing issue. In sum, tools are moving from descriptive analytics (“what are people saying now?”) to forward-looking insights (“what are people likely to talk about next?”).

Visual, Audio, and Video Listening

One of the most exciting developments is the ability to “listen” beyond text. Modern platforms incorporate computer vision and speech-to-text AI to analyze images, videos, and audio clips. For images, AI can identify logos or products in user-posted photos (e.g. spotting your brand’s sneaker in an Instagram post even if you aren’t tagged).

- Brandwatch: Visual, Audio, and Video Listening

For video and audio, speech recognition transcribes spoken content from YouTube, podcasts, Twitch streams, etc., and then analyses that text for sentiment and mentions. This opens a trove of new data – for example, a brand can know if a popular YouTuber casually mentions their product in a review, or if they are being discussed in a Twitter Space or Clubhouse room. Voice sentiment analysis can even detect tonal sentiment from voice (e.g. a customer sounding upset in a recorded review). These advancements mean social listening now covers a 360° view of media types. Given the dominance of visual platforms and the rise of audio chat, this is crucial. Companies that only track text would miss a huge part of the consumer conversation in 2025.

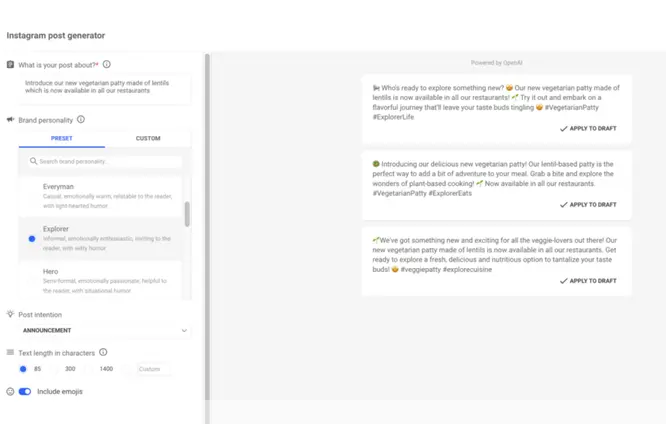

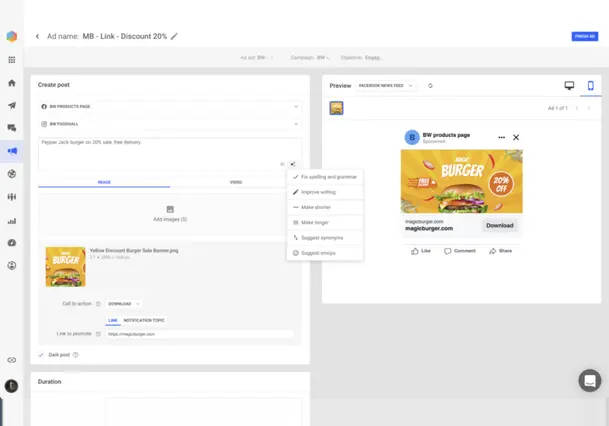

Integration of Generative AI for Insights

A newer trend is embedding generative AI (e.g. GPT-like models) into social listening tools. This allows platforms to not just gather data, but also to summarize and interpret it in natural language. For example, instead of the user manually parsing dozens of charts, they can ask the system, “What are the key takeaways about our brand sentiment this month?” and get a concise AI-generated report. AI can draft summaries of social trends or even create first-draft responses to common customer inquiries flagged via listening (to be reviewed by humans).

- Instagram post generator

Some tools offer AI-written insights such as “Sentiment dipped mid-month due to complaints about our new pricing – customers especially disliked the subscription change.” This helps teams quickly grasp issues and opportunities without deep analytical expertise.

- Brandwatch post generator

While still emerging, generative AI is making social listening outputs more accessible and actionable across organizations, translating raw data into plain-English (or any language) narratives.

Seamless Workflow Integration and APIs

Technological development has also focused on integrating listening data into everyday workflows. Robust APIs and out-of-the-box integrations allow social listening to feed into CRMs, marketing automation systems, and business intelligence dashboards. For instance, a social mention could automatically create a customer service ticket if it’s a complaint, or populate a trend report in a marketer’s Google Slides. This automation of insight sharing ensures listening isn’t siloed with the social media team – product, sales, and strategy teams all get relevant alerts and reports. Advanced platforms support custom analytics and exports, so companies can mash up social listening data with sales figures or web analytics to find correlations (did a spike in negative sentiment correlate with a dip in sign-ups?). In 2025, social listening tech is characterized by this interconnectivity – it’s a core node in the martech and research stack rather than a stand-alone tool.

Overall, the AI-driven developments in sentiment analysis, predictive insight, and multimedia mining have elevated social listening from simple keyword tracking to a sophisticated form of “social intelligence.” Marketers and researchers now wield tools that can analyze tone, predict trends, and capture conversations from virtually any digital medium. These advances allow businesses to derive richer insights and do so faster than ever, keeping pace with the real-time nature of social discourse.

Transforming Market Research: From Insights to Action

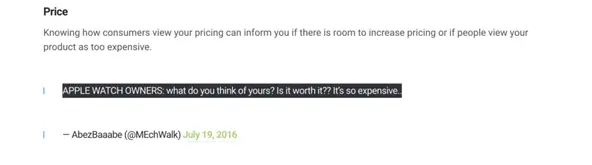

Social media listening is increasingly interwoven with market research methodologies, transforming how companies gather and use consumer insights. Traditional market research – surveys, focus groups, interviews – has been augmented or disrupted by the massive, real-time dataset that social media provides. Here’s how social listening is changing the game in market research and intelligence:

Real-Time Consumer Insights vs. Traditional Research

One of the biggest shifts is speed and timeliness. Traditional research can take weeks or months to design, conduct, and analyze, often delivering insights that are historical by the time they’re reported. In contrast, social listening provides a continuous pulse of consumer opinion in real time. Marketers can gauge reaction to a new product the same day it’s released by listening to social chatter, rather than waiting for a post-launch survey.

This real-time insight means companies can pivot quickly – adjusting messaging, pricing, or features on the fly. It’s like having an always-on focus group that updates every second. Additionally, the volume of data is far larger: millions of unsolicited opinions versus a few hundred survey responses, yielding more robust insight into diverse customer segments. Speed and scale together make social listening a powerful complement to traditional research, which is often slower and smaller in scope.

Unbiased, Unprompted Feedback

Social listening captures consumers’ unprompted conversations in their natural habitat. This contrasts with surveys or focus groups where questions can lead or constrain answers, and participants may give more guarded or artificial responses. With social data, people are freely sharing what they care about, using their own language – which often yields more honest sentiment. For example, a customer tweeting “Ugh, this update is a downgrade” is candid in a way they might not be in a moderated focus group.

The authenticity of social feedback is a huge asset. It reveals topics consumers talk about on their own (which might be issues a company didn’t even realize were important). As one analysis noted, social listening is more natural and not influenced by the research setting. This doesn’t mean traditional methods lack value – rather, listening can surface insights that surveys miss and help inform better survey questions. In practice, many firms now use social listening in early research stages to identify the key issues and vocabulary, then explore them further with targeted surveys or interviews.

Replacing or Informing Focus Groups

Some companies are finding that a savvy analyst with a social listening tool can simulate certain aspects of a focus group or interview study. By probing social data (filtering for specific topics, demographics, or sentiment), researchers can glean how a particular customer segment feels about a product feature or an ad campaign. This can reduce the need for some exploratory focus groups, saving time and cost. For instance, rather than convening a focus group to ask “What do young urban professionals think of our new sneaker line?”, a brand can analyze Twitter and Instagram conversations among that demographic talking about the sneakers.

One retailer described social media as “thousands of tiny focus groups happening every day.” Of course, there’s still value in direct interaction, but listening provides an initial read and can validate whether focus group findings match broader opinion. In fact, social listening often supports traditional research by adding quantitative backing – if a survey says 20% of customers dislike a feature, listening might show that this gripe also appeared in, say, 18% of relevant social mentions, reinforcing the insight.

Competitor Analysis & Industry Trends

Market research isn’t just about customers – it’s also about context. Social listening has become a cornerstone for competitor analysis, as discussed earlier. Researchers analyze competitors’ mentions and campaign reactions to benchmark share of voice and sentiment. They can easily see what competitors’ customers complain about or love, offering clues for market positioning. Traditional competitive intel might involve mystery shopping or competitor product reviews, but social media provides a real-time feed of competitor pros/cons straight from consumers’ mouths.

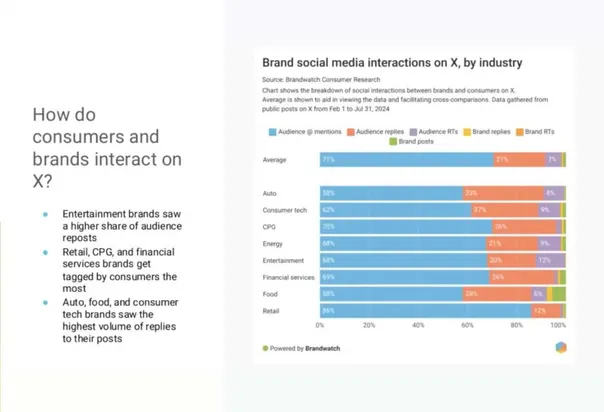

- How do consumers and brands interact on X

Additionally, listening identifies macro-level trends in the industry. It acts as early detection for shifting consumer preferences. For example, a beverage company might use listening to track the rise of non-alcoholic cocktail conversations, signaling a trend toward “mocktails” that could influence product development. According to recent stats, social listening can spot emerging trends 3 times faster than traditional methods, giving companies a head start. Those who actively monitor trends on social media have seen measurable benefits – some report a 10% increase in revenue growth compared to those who don’t, likely by being first to market with new offerings. In sum, the ability to mine social data for trends and competitor intel has made market research more proactive and forward-looking.

Crisis Management & Brand Perception Studies

Social listening has revolutionized how companies manage brand crises and reputation studies. Traditionally, a brand might run periodic reputation surveys or rely on PR agencies to gauge public perception. Now, with listening, brands track reputation in real time and can conduct instant “sentiment audits” after any major event.

When a potential PR crisis hits – for example, a controversial ad or a negative news story – social listening acts as an early warning system. It enables early detection of issues, often before they hit mainstream media. This early detection is critical: one study notes that identifying a brewing issue on social media quickly allows brands to address it before it becomes a full-blown crisis. Companies increasingly have crisis dashboards monitoring volume and sentiment so they know within hours if public opinion is turning against them.

Moreover, by analyzing the content of conversations, they can craft a more effective, targeted response. For example, United Airlines’ infamous 2017 incident (dragging a passenger off a plane) taught brands that a slow or tone-deaf response can be disastrous. In 2025, companies use social listening to avoid such missteps – if something goes wrong, they see the backlash forming in real time and can quickly issue apologies or clarifications that address the specific concerns people voice online.

Global food giant Nestlé uses social listening to track brand mentions and sentiment at scale, across products and regions. They particularly focus on identifying negative mentions or emerging complaints that could harm their brand reputation.

- Nestlé social listening

By catching issues early – for instance, concern about the quality of a new product line – Nestlé’s team can respond with public statements or corrective actions before a situation escalates. This strategy of continuous reputation monitoring has allowed Nestlé to maintain a positive brand image and quickly address customer concerns (such as reformulating a product that isn’t meeting expectations). It exemplifies how active listening is essential for crisis prevention and brand trust.

Post-crisis, social listening also helps measure recovery, seeing if sentiment rebounds after corrective actions, which is more dynamic than waiting for the next quarterly brand survey.

Data-Driven Decision Making & Best Practices

The infusion of social listening into research means decision-makers are not only relying on periodic reports but can tap into a live feed of consumer insight when making choices. This has led to emerging best practices in organizations. Many companies now hold weekly “social insight” meetings where the social listening team presents key findings to cross-functional stakeholders (marketing, product, PR, etc.). Some have instituted war rooms during major campaigns or events, where a multi-disciplinary team watches social data together to guide strategy in real time. Best practices also include combining social data with other business data: for instance, a dip in social sentiment can be correlated with a dip in sales to strengthen the case for action.

Collaboration is key – social insight is no longer confined to a social media manager; it’s shared with product designers, executives, and even finance teams (who might use it for early indicators of quarterly performance). Another best practice is refining listening queries and filters continuously. As businesses learn what conversations matter, they adjust their listening keywords and models to focus on quality over quantity (e.g. filtering spam or irrelevant chatter). Lastly, companies are drafting social listening playbooks – guidelines on how insights should be escalated and used. For example, a playbook might state, “If negative sentiment on a product rises >20% in a week, inform product team and draft a holding statement for PR.” This institutionalizes the use of listening in decision-making processes.

Social media listening has become a cornerstone of modern market research, offering immediacy, authenticity, and depth of insight that traditional methods struggle to match on their own. The best approach many companies have found is a hybrid one: use social listening to continuously gauge the market and generate hypotheses, then use targeted traditional research to probe “why” in depth or to validate findings with representative samples.

What’s clear is that in 2025, ignoring the wealth of consumer voice data on social media would leave a gaping hole in any market research program. For example, Brandwatch’s consumer tech report (261M+ conversations analyzed) found notable shifts like 40% of online chatter advocating less screen time, signaling changing consumer priorities in the digital age. As another study put it, 82% of social media conversations about your brand happen outside your official channels – meaning if you’re not listening broadly, you’re essentially “deaf” to a huge portion of the market. Companies have recognized this and are embedding social listening into how they derive consumer insights, perform competitive analysis, manage their reputation, and ultimately make customer-centric decisions.

Why Social Listening is Crucial in 2025

Several overarching factors in 2025’s business and consumer landscape make social media listening especially critical:

- Social Listening

Empowered Digital Consumers:

Today’s consumers are more vocal and empowered than ever. Over 5.4 billion people use social media worldwide in 2025, which is about 64% of the global population. Platforms like Twitter (now X), Instagram, TikTok, and Reddit have become the go-to venues for consumers to express opinions or seek information. Crucially, the majority of unhappy customers won’t complain to a company directly – they complain publicly on social networks. Studies show 96% of dissatisfied customers vent on social media or review sites but do not contact the business first. This means that if a brand isn’t listening online, it literally doesn’t hear 96% of its unhappy customers. In an era where one viral negative post can dent a brand’s image, being tuned in to these conversations is essential for timely response and damage control. On the flip side, customers also freely advocate and recommend on social – a single tweet praising a product can drive a surge of interest. Brands need to catch and amplify these moments. In essence, consumer behavior has shifted to “always on” communication, and businesses must adapt by always listening.

The Expectation of Responsiveness:

Along with being more vocal, consumers in 2025 expect brands to respond and engage quickly. Patience for a reply is low; a Socialbakers study cited by Palowise found that responding to a complaint within an hour can increase customer satisfaction by 70%. Users now tag brands in posts expecting customer service, or they stir conversations hoping the brand will notice. When a brand actively listens and replies – whether solving an issue or just thanking someone for a shout-out – it signals that the company cares and is accessible. This builds loyalty. Conversely, silence can be interpreted as apathy. Consider how Twitter users often call out companies with “@Company I have a problem…” – those mentions are public. A swift, helpful response not only aids that user but is observed by others (potentially improving brand perception by up to 20% through showcasing responsive service). In short, 2025 customers expect brands to be present in the social dialogue. Social listening is the only way to meet those expectations at scale, by funneling the relevant posts to the teams who can act.

The AI & Automation Imperative:

Companies themselves are going through digital transformation. AI and automation are being adopted in all business areas to improve efficiency and decision-making. Social listening fits squarely into this, as it leverages AI to handle what no human team realistically could – reading millions of posts in dozens of languages across a fragmented social landscape. The reason social listening is crucial is because it’s a prime example of using AI not to replace humans, but to empower them with superhuman awareness. Still, in Brandwatch’s trends survey, 71% of marketers agreed that leveraging AI without losing the human touch is a major challenge. In 2025, data-driven decision making is a mantra, and social media provides a goldmine of data. It would be a glaring omission for a company that has invested in analytics and AI elsewhere (like sales forecasting or supply chain optimization) to ignore the real-time market intelligence AI social listening can deliver. Moreover, competitors are embracing these tools. By late 2024, 13% of social media leaders had made social listening a top priority with growing budgets, and 82% of marketers consider social listening an essential planning tool. This widespread adoption means that any company not doing it is potentially a step behind in awareness. Social listening is now often baked into marketing automation flows, campaign planning, product roadmaps, etc. – it’s part of the modern, AI-enabled business toolkit. Thus, to keep up with the pace of competitors and the market, leveraging social listening (and the AI that powers it) is no longer optional.

Faster Market Changes & Shorter Attention Spans:

The half-life of trends has never been shorter - what’s viral today might be forgotten next week. Consumer interests are more dynamic, and brand crises can erupt overnight. This volatility in consumer behavior and discourse means static, infrequent research or slow feedback loops are insufficient. Social listening provides the agility required to navigate 2025’s fast-changing environment. It allows companies to detect subtle shifts – perhaps noticing that Gen Z consumers this month are all talking about a new app or meme related to your industry – and capitalize quickly. Brands that can latch onto or address trends in near-real time appear culturally savvy and relevant; those that don’t may seem out of touch. Additionally, in competitive industries, spotting an emerging trend could be the difference between being a leader or a laggard. For example, a beauty brand that listened to rising conversations about skinimalism (simplified skincare routines) could pivot sooner than competitors still operating on last year’s trends. Digital transformation has accelerated the feedback loop between consumer preference and company action. Social listening is the mechanism that closes that loop effectively, by providing instant feedback on whether strategies are hitting the mark or if tastes are evolving. In essence, the cadence of marketing has moved to real-time, and only through listening can brands keep cadence with their audiences.

Holistic Customer Understanding:

2025 strategies emphasize customer-centricity. Social listening uniquely offers a 360-degree view of customers’ lives and interests. You don’t just learn what they think about your product, but what else they care about, what language they use, what problems they face in daily life. This contextual understanding is invaluable for everything from product innovation to messaging. It’s a form of continuous ethnography, observing customers in their natural setting (social media) as they discuss hobbies, values, frustrations, etc. In a year where personalization is key, and brands strive to appear genuinely in tune with their customers, the insights from social listening help paint a rich picture of the target audience. This can inform content marketing (speak their slang), partnership decisions (collaborate with the influencers they mention), even store experience (carry the trends they are into). No survey or quarterly report can provide this depth in an ongoing way. That’s why companies in 2025 see social listening as essential to remain customer-centric and culturally relevant on a continuous basis.

Measurable Impact and ROI:

Finally, social listening has proven its worth in quantifiable terms, solidifying its importance. Companies that excel at social listening have been found to achieve significantly higher customer satisfaction rates (+17%) compared to those that don’t. Many also report gains in innovation speed and marketing ROI. Because social listening is tied to outcomes (campaigns, product tweaks, etc.), it’s easier to demonstrate its impact. For example, a campaign shaped by insights from listening might outperform a previous campaign by 30% in engagement – a clear ROI boost traceable to listening. As tools integrate with analytics, brands can see, say, that social listening insights contributed to a revenue uptick or prevented customer churn (by addressing an issue that would have driven customers away). This tangible value has elevated social listening from experimental to indispensable. In Hootsuite’s global survey, companies using social listening consistently expressed greater confidence in their social ROI. With budgets scrutinized, the fact that listening yields actionable, revenue-affecting insights justifies its place in 2025 strategies.

Social media listening in 2025 is crucial because it aligns with how consumers communicate and how modern businesses operate. It enables brands to be responsive, proactive, and truly customer-centric in a fast-paced digital world. The confluence of widespread consumer use of social media, high expectations for brand engagement, and advanced AI tools makes listening not just possible at scale, but necessary. Companies that embrace social listening are better equipped to nurture their communities, outmaneuver competitors, stave off crises, and innovate in line with customer needs. Those that do not risk falling out of touch and reacting too slowly to the market. In 2025 and beyond, the brands that win hearts and market share will likely be those with their ears closest to the digital ground – constantly listening, learning, and evolving with their consumers.

Strategic Model for Implementation: SLIM Framework

In 2025, the brands that thrive won’t simply speak, they'll truly listen. Social listening is becoming a core strategic capability for business agility, customer loyalty, and sustained competitive advantage and for some companies it has been a way to reduce risk for a decade.

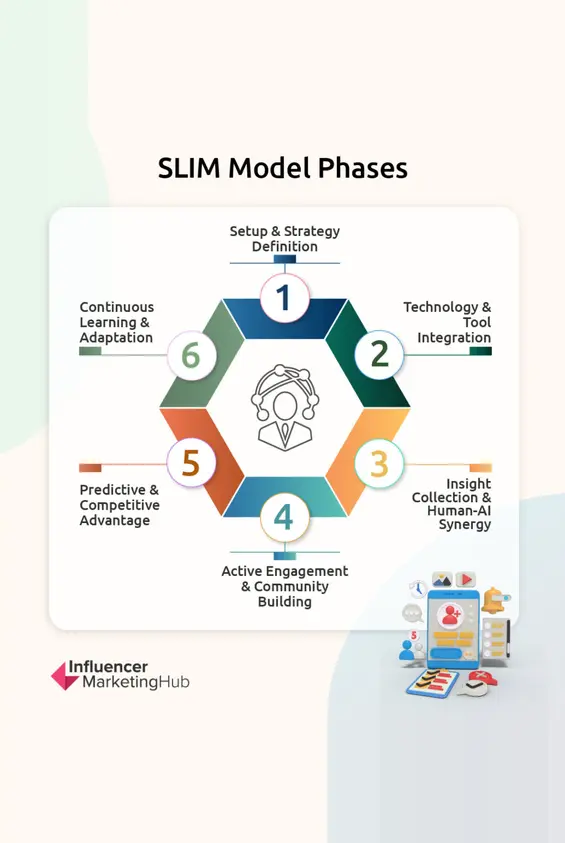

- SLIM Framework

By systematically adopting the SLIM framework, brands position themselves to thrive amidst rapid consumer and market evolution.The SLIM (Social Listening Integration Model) guides brands through a structured process to harness social listening strategically:

Phase 1: Setup & Strategy Definition

- Objectives: Clearly define listening objectives—brand awareness, crisis management, customer care, competitor intelligence, or product innovation.

- Audience Segmentation: Leverage AI tools to define and segment audience personas based on real-time social insights.

- Channel & Scope Identification: Identify key channels (text, audio, video) and niche platforms relevant to your audience.

Phase 2: Technology & Tool Integration

- AI-Driven Platforms: Select comprehensive listening platforms (Brandwatch, Meltwater) equipped with AI capabilities such as predictive analytics, NLP-driven sentiment analysis, and multimedia listening.

- Real-Time Dashboards: Establish real-time dashboards tailored for different internal stakeholders, enabling immediate responsiveness.

Phase 3: Insight Collection & Human-AI Synergy

- Hybrid Analytics: Combine AI-driven analytics with human interpretation to ensure contextual accuracy, especially for nuanced cultural or emotional insights.

- Trend & Crisis Alerts: Create automated real-time alerts for sentiment spikes or emerging trends to swiftly mobilize teams for response or engagement.

Phase 4: Active Engagement & Community Building

- From Passive to Proactive: Shift from monitoring to actively engaging users, addressing concerns instantly, and fostering authentic community interactions.

- Community Management Integration: Direct social listening insights to CRM and customer support teams to drive personalized responses and proactive service.

Phase 5: Predictive & Competitive Advantage

- Predictive Trend-Spotting: Use AI-driven predictive analytics to anticipate consumer behaviors, product demands, and market trends before competitors.

- Competitive Benchmarking: Continuously benchmark sentiment, share of voice, and engagement against competitors, identifying strategic opportunities to differentiate and win market share.

Phase 6: Continuous Learning & Adaptation

- Feedback Loops: Regularly refine listening queries, filters, and scope based on previous insights.

- Stakeholder Engagement: Hold frequent cross-functional "Social Insight" briefings, embedding social insights directly into strategic decision-making processes.

Our Strategic Recommendations (Next Steps for Brands

- Immediate Pilot Program: Launch a focused pilot project targeting high-value listening areas (e.g., crisis alerts or product insights).

- Organizational Buy-In: Educate and align internal stakeholders (marketing, product, customer service) around social listening’s strategic value.

- Technology Investment: Allocate budget towards advanced, AI-powered listening platforms to ensure comprehensive capabilities.

- Continuous Capability Building: Invest in ongoing training for internal analysts, blending AI literacy with strategic insight interpretation.