Just a few years ago, the DTC market faced immense challenges that include broken logistics chains from both the supply and demand side, marketing shifts due to new privacy and data regulations, and economic disruptions brought about by socio-political issues. Smaller brands with low operating margins were hit the hardest, and had to recalibrate expectations, change up strategies, and ensure that they had sufficient resiliency built in.

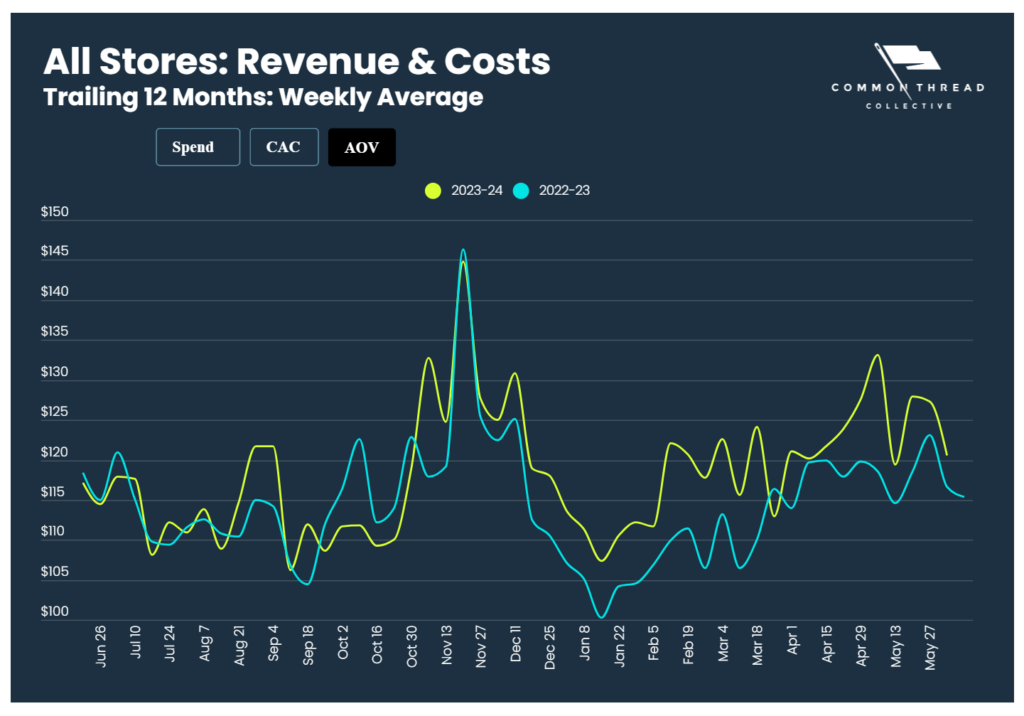

Fortunately new marketing channels and technologies enabled DTC brands to gain traction anew. As most consumers bounce back from financial setbacks, we also see a marked growth in the DTC sector—with the average amount of money spent by customers per transaction consistently higher than the previous year.

Not only did the average consumer spend increase, but the customer acquisition cost and ad spend have also decreased. Ad revenues are still higher despite the lower ad spend, indicating optimized marketing strategies and a generally good outlook for brands and marketers in the DTC sector.

To sustain robust growth in 2024, here are 20 strategies that DTC brands can explore.

- What is Direct-to-Consumer (DTC) marketing?

- What’s the difference between DTC and B2C marketing?

- What are the pros and cons of DTC marketing?

- 20 DTC Strategies That Will Help Brands Survive (and Thrive ) In 2024:

- Direct-To-Consumer Marketing Trends

- Steps to Create Your Own Direct-to-Consumer (DTC) Strategy

- Conclusion

- Frequently Asked Questions

What is Direct-to-Consumer (DTC) marketing?

As the name implies, direct-to-consumer marketing involves manufacturers selling their products directly to the end consumers. Also known as DTC and D2C, this approach bypasses traditional middlemen like wholesalers, distributors, and retailers. Instead, manufacturers leverage ecommerce platforms or online marketplaces to bring their products to consumers. By diverting away from traditional distribution methods, DTC brands have full control over customer experiences and are able to build close relationships with their audience.

What’s the difference between DTC and B2C marketing?

In DTC, brands sell directly to consumers and have closer interactions with them. On the other hand, B2C often involves intermediaries that deal with end consumers more closely than the brand itself. This, in essence, creates differences in how marketing is best approached for each one.

DTC Marketing | B2C Marketing | |

Data Collection | Direct access to customer data | Limited by intermediaries May rely mostly on third-party data |

Customer Relationship | Direct, personalized communication | Varies, but often less direct as consumers interact mostly with retailers |

Marketing Control | High control over branding and customer experience | Less control due to intermediaries |

What are the pros and cons of DTC marketing?

With brands directly interacting with consumers, DTC marketing allows for more personalized experiences. It also enables brands to offer their products at lower costs. However, it also comes with challenges. Before shifting to DTC marketing, weigh the pros and cons first.

Pros | Cons |

Low upfront costs due to the accessibility of ecommerce platforms | Intense competition in crowded online marketplaces |

Potential for higher margins as costs related to intermediaries are removed | Limited reach compared to traditional retail distribution |

Better control over branding and marketing strategies | Increased responsibility for marketing and data security |

Access to customer data and insights allows marketing optimization and product innovation | Requires robust logistics, fulfillment, and customer service infrastructure |

20 DTC Strategies That Will Help Brands Survive (and Thrive ) In 2024:

1. Omnichannel, here it comes again

Omnichannel is definitely not a new concept. Pre-2021 it was a nice thing to have on your strategy deck. But now, depending on a single channel for customer acquisition is more fatal than ever for the health of the business, and all DTC brands need to devote time to thinking through omnichannel strategies.

Providing a seamless switch between channels and devices will be the norm in 2024. To enhance engagement, DTC brands and marketers must make experiences across multiple touchpoints as cohesive as possible. This means maintaining a consistent brand image and customer experience in their physical stores, websites, apps, and social media channels.

The latest "A Guide to CPG Retail in 2024" from @cpgdxyz is fantastic.

The market is now aligning with our bet @CrstlTech from a few years ago -- that old will be new again -- DTC brands will look to go omnichannel, and established omnichannel brands will look to refresh their… pic.twitter.com/6tqnY0MeGL

— Dipti Desai (@diptidesaisf) February 29, 2024

What would that look like? In most cases, it is a combination of online and physical retail, but the combinations vary- fully owned, shop-within-a-shop, phygital (browse at the shop, buy online), etc.

2. Start investing in marketplaces also instead of only Shopify

For a number of brands, having a standalone Shopify store can become a single point of failure, given that the average GMV of a Shopify merchant is only $4000 in sales per month.

For brands who don’t want to sacrifice the customer experience they have carefully built by going on Amazon, there are other marketplaces that can give them the best of both worlds- a happy combination of their own storefront that has much larger traffic than their single website can hope to pull in.

3. Build (or acquire) media brands for DTC growth

A century ago, Michelin got into the restaurant review business because they wanted to highlight good restaurants that people would want to drive to, on their tires.

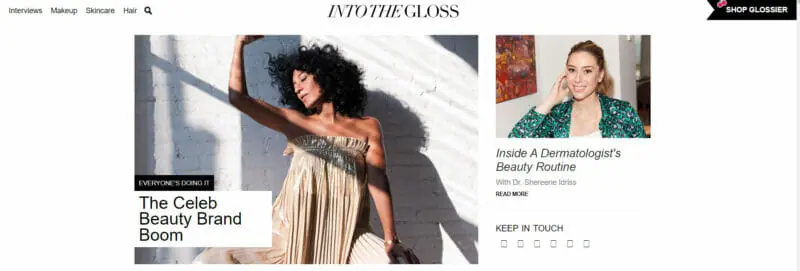

Many modern DTC brands have actually built themselves around owned media- think Barstool Sports or Glossier (Into the Gloss). Then there are the likes of Peloton whose entire business model is based around high-quality content.

However, it's also true that there have been spectacular failures and owned media missteps too, and DTC companies will have to figure out how to get their content game right (check this post for examples and detailed strategy).

4. Explore web3, the metaverse and NFTs

The metaverse and the web 3 is no longer a niche experiment as far as eCommerce is concerned.

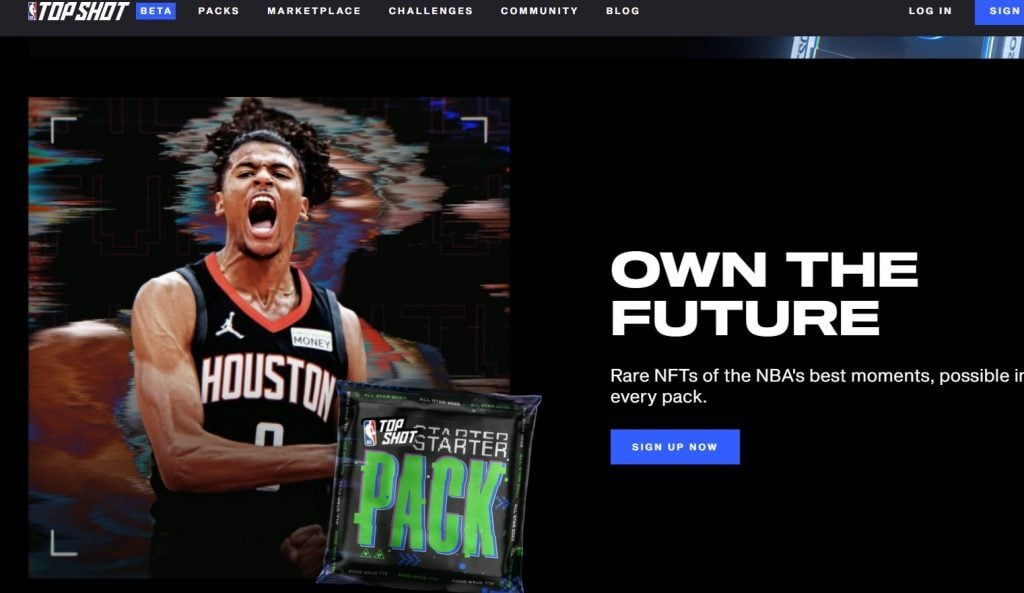

Almost all major big brands have virtual stores in the metaverse, and from Disney to Adidas to Nike and NBA, everyone has some kind of NFT project, as this updated list published by AdAge shows.

NBA Top Shot was one of the first mainstream NFT projects to draw mainstream attention.

However, we are just scratching the surface of what could be possible when the physical world interacts with the blockchain. Innovative DTC brands will be able to establish themselves with an entirely different and passionate segment of the population.

5. Build supply chain muscle (where possible)

In the last quarter of 2023, even after reeling back from the impact of the pandemic, shipping and fulfillment are still among the top factors that affect business growth. In fact, 50 percent of DTC marketers mention it as being among the areas of greatest opportunity.

Major DTC brands will live or die based on how well they have been able to reduce supply chain disruptions. They might do this by moving production to onshore factories, working with local suppliers, building warehouses and containers, or building redundancy into their supply chain.

If they have teething supply chain and logistics issues, they will also need to evaluate their 3PL arrangements, pick a better partner or bring fulfillment in-house.

6. Invest in owned brick and mortar stores

This strategy isn’t just for big brands who are going back to brick and mortar retail as pandemic lockdowns ease and cities open up.

Smaller brands like Savage X Fenty, Aurtate, Knix and more have dusted off their 2020 retail plans that were waylaid thanks to the pandemic.

Rihanna just announced the upcoming opening of Savage X Fenty "brick-and-mortar" retail stores ! Launching in 5 cities : Las Vegas, Los Angeles, Houston, Philadelphia and Washington DC. ?? pic.twitter.com/VrW5Gnu7CG

— Fenty Headlines (@FentyHeadlines) January 7, 2022

When executed well, brick-and-mortar isn’t just a new customer acquisition channel.

Its brand building, retention boosting and experiential marketing plays all rolled into one that can yield a significant chunk of revenue.

Lots of great customer data in the @WarbyParker S-1. A few interesting tidbits:

--Blended CAC of $25 is pretty low, but then again, 2/3rds of their sales came through physical stores pre-COVID (=> lower CAC but more store-related overhead).https://t.co/yXFWlT9zEk pic.twitter.com/3US7J0kJZm— Daniel McCarthy (@d_mccar) August 24, 2021

Digitally native brands Warby Parker and Wayfair are seeing good returns on their investments into physical stores. Warby Parker saw higher revenues in the first quarter of 2024 with a year-on-year increase of 16.3%.

Wayfair is also optimistic as it opens its first large-format store this year. Although its first-quarter sales fell by one percent, its sales have fared much better compared to the average 8.4% drop in sales across the furniture industry.

These successes indicate a potential for growth for DTC brands venturing into physical retail and delivering omnichannel experiences to their customers.

7. Establish relationships with retailers

If digital native brands don’t have the financial resources to set up their own store, there are other options. They can tie up with existing wholesalers and retailers.

According to research by BMO Capital Markets, wholesalers who have been branded as profit-sucking middlemen for brands were actually contributing to business growth in ways that a digital channel could not just do.

So, as soon as DTC brands reach a growth plateau, they can pay to invest in relationships with retailers.

60% of DTC brands sell through retail partnerships today.

Step into the world of wholesale and learn:

➡️ How to select your ideal retail partner

➡️ What it takes to get started

➡️ Exactly how wholesale distribution worksRead the guide here: https://t.co/feQ1bzjcPB

— Airhouse (@AirhouseHQ) December 20, 2023

In 2024, these DTC-retail partnerships can help small brands grow and gain visibility offline even with limited capital. Retail stores, on the other hand, gain an increase in market base as new product offerings attract new buyers.

DTC brands can work with retailers in setting up dedicated kiosks or interactive displays in store. These partnerships work best for brands with complementary products and similar core values.

8. Innovate on partnership marketing

The idea of partnership marketing is simple: two non-competing brands with the same customer base pooling together their resources to offer an improved shopping experience.

For instance, Petco, a pet products company tied up with Lowe, a home improvement company. Feather, an outdoor furniture rental brand tied up with subscription meal startup Daily Harvest. Brightland, which sells olive oils, has run joint offers with Lettuce Grow, an indoor garden supplies startup.

There are scores of such cases, and as acquisition costs increase, more brands will need to think through how their product can pair up with another brand.

9. Refine influencer marketing

Aside from partnerships with retail brands, DTC brands must learn to leverage the clout of influencers. Solid influencer partnerships can expand their reach and build consumer trust.

Influencer partnerships play a crucial role in building DTC brands by expanding your reach, building trust, generating UGC, and providing a cost-effective marketing strategy.

When executed strategically, influencer partnerships can help you grow your brand.

(7/9)

— SellerApp (@SellerApp_Inc) May 13, 2024

Influencer marketing is not a new strategy, but traditional, pay-to-play influencer marketing has plenty of issues. Brands can no longer recruit scores of influencers through an agency, ask them to do promoted posts, and expect sales to flow in automatically.

Instead, brands need to do the extra legwork of building relationships with nano and micro-influencers who are passionate about the product, and who will talk about it just because they truly enjoy it.

This Twitter thread has more details.

99% of DTC fashion brands fail at influencer marketing.

??️ They fail to find the right influencers for them ? Partner with influencers for short-term campaigns

The 1% that succeeds, follow a 5-step process that doesn't need bottomless pockets or a huge teamHere it is ↓ ? pic.twitter.com/IAF1cJoPOf

— SARAL - The Influencer OS (@getsaral) June 12, 2024

The statistics are likely to be the same beyond the fashion industry. A DTC-influencer partnership would only be effective when a DTC brand finds influencers who truly love their products, share their values, and commit to helping achieve their vision.

10. Leverage the virality of TikTok

TikTok might be that one platform that could somewhat fill the Facebook-sized hole in customer acquisition playbooks: in 2024 it is expected to reach $17.2 billion in revenue.

Because the platform still is in its early stages, it's relatively easier to rack up organic views on videos, and many brands have reported respectable ROAS numbers for TikTok ads.

Also, because TikTok works so well with influencer content, having a good TikTok marketing strategy will automatically support a brand’s influencer marketing efforts.

Awesome journey for a DTC brand started last year using $FB ads, $SHOP and TikTok.

Influencers were key addition to the process.

Good questions on LTV. https://t.co/jSm1Tfgnxp

— David Eborall (@davideborall) August 10, 2021

Is TikTok still relevant in 2024? Absolutely. With the launch of TikTok Shop in 2023, TikTok is making people buy stuff. Also, because TikTok works so well with influencer content, having a good TikTok marketing strategy will automatically support a brand’s influencer marketing efforts.

Some brands are wary of the platform as talks of a ban remains. Nonetheless, it remains an exciting platform to be in. Aside from being able to organically grow your following, the returns are high even with lower ad costs.

An advertising study shows that TikTok ads yield an 11x return on ad spend while its cost-per-click is 30% lower than that of Meta’s.

11. Don’t sleep on email marketing and SMS

Old is gold, and email marketing is still as impactful now as it was in the late 1990s.

DTC brands with good email marketing will drive up to 20-30% of their revenue through the channel, and at a much higher ROI ($38 revenue for $1 spend) than paid channels like Facebook ads.

How can brands improve these numbers? Simple, by pairing up email with SMS and building out funnels that will inform, educate and build an emotional connection with their audience.

When it comes to email marketing, traditional methods of hard-selling won’t cut it today. Consumers want to get value and feel valued in brand interactions.

DTC brands with email marketing often struggle:

1. Overselling products; don't forget to provide value.

2. Ignoring personalization; customers love to feel special.

3. Neglecting to keep their audience engaged; consistency is key.Time to rethink your methods.

— mark mei (@markdmei) June 17, 2024

12. Adjust to new trends in brand discovery

Today’s consumers rarely discover new brands through ads, especially in the post iOS14 scenario where targeting is way out of whack.

DTC brands have to be savvy about platforms like vertical marketplaces, podcasts and influencer YouTubers (90% of consumers said they learned about new brands on YouTube) where consumers congregate, and figure out how to drive traffic from them.

This might be a challenge for smaller DTC brands that don’t have the resources to figure out and manage multiple channels.

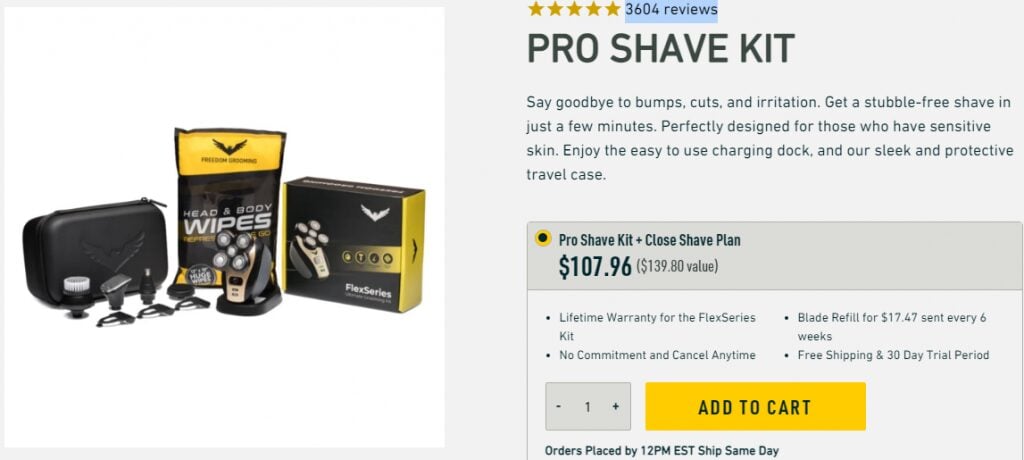

13. Make upsells, cross sells and bundlings

Many DTC brands are content to just get a single sale off a single customer visit when they could have gotten two or more through upsells, cross sells or bundles.

To pull this off, DTC brands need to have enough complementary SKUs in their inventory, and data on which products pair well together.

When offering upsells or one-time offers, DTC brands should think more about customer requirements and less about maximizing their average order value numbers.

It’s easier to get more out of your current customers than acquire new ones.

Include this in your post-purchase flow:

— Thank you for your order

— Ask for a review

— Refer a friend/affiliate program

— Cross-sell/bundle upsell

— Subscription upsell

— 10% off your next order— Andreas | DTC Mailman ? (@lilstass_) June 16, 2024

14. Ramp up on delivery and be more competitive in pricing.

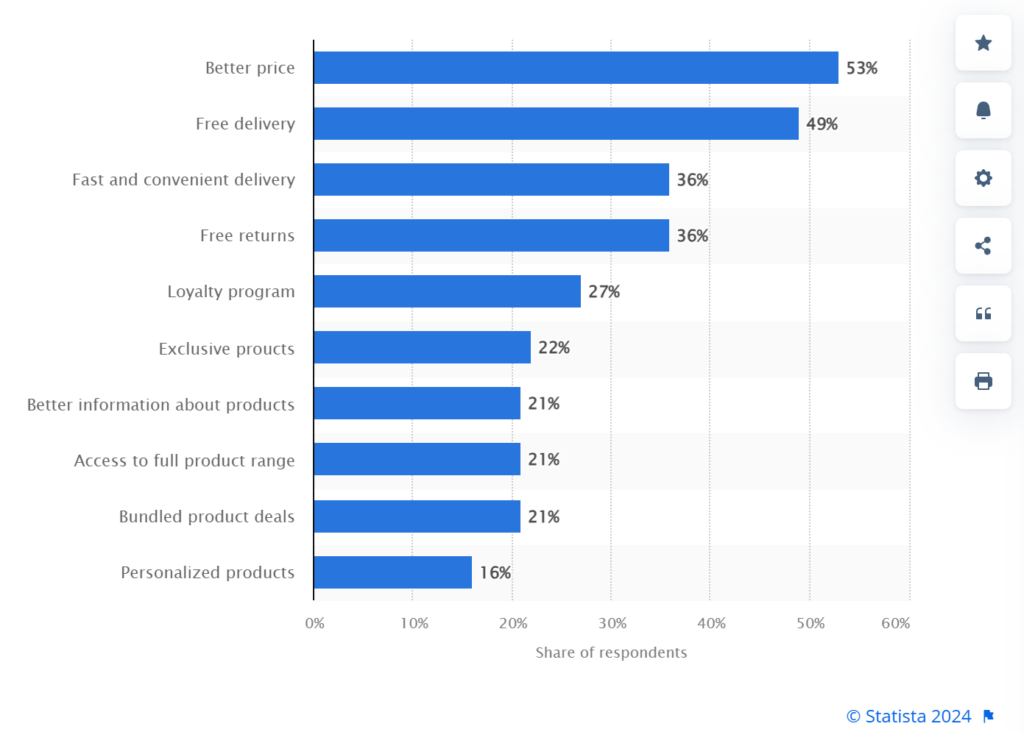

Better prices and free delivery top the list of factors that motivate consumers to buy directly from brands. Statista insights show that 53 percent of consumers would buy directly from a brand if it offered a better price. To win the favor of most consumers, DTC brands must also look into offering free, fast, and convenient delivery options.

15. Maintain product innovation and R&D

Last but not least, DTC brands need to spend heavily on product innovation if they want to stay competitive.

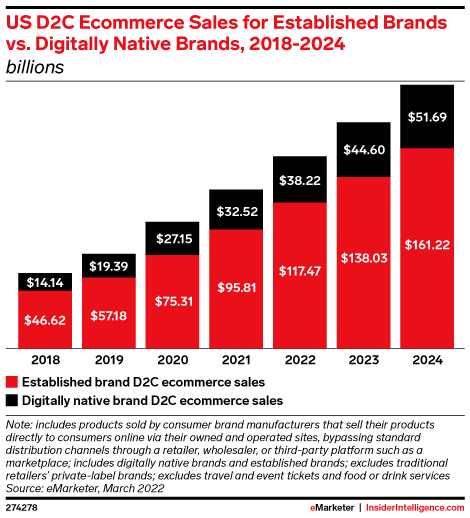

Compared with established brands, digitally native DTC brands trail behind in ecommerce sales. Perhaps this is because a consumer, when choosing between two products, would likely choose the one from a known brand.

By innovating and offering products exclusive to their own brands, they create a new market in which there is little competition. However, for product innovation to yield the best results, timelines have to be short.

For instance, DTC fashion brands like Shein will need just 20-30 hours to spin up completely new apparel designs, often taking advantage of social media trends, to launch 2000 SKUs every day!

Ideally, brands need to be thinking about supporting top-selling SKUs, like how Dollar Shave Club started selling personal grooming products after making it big with razors.

Instead of lowering prices to compete with other brands, focus on innovating and developing new products.

I think most brands in DTC are overcomplicating the discount narrative and it's stopping them from focusing on product innovation and the customer experience.

Firstly, we can all agree that discounts suck for the brand.

They give us less margin to play with in an era when… pic.twitter.com/nWVJjKo4Do

— Adam Kitchen (@AdamKitchen_co) January 22, 2024

Direct-To-Consumer Marketing Trends

Aside from the recommended strategies above, here are DTC trends worth monitoring. We’ve also included actionable steps you can take to leverage the trends.

1. Ad platforms are on the upswing.

A couple of years ago, Facebook ROAS was falling, and a new kid was taking up space. Surprise surprise, it’s Apple. Apple released a slew of different ad products for native apps, collaboration with third-party publishers, and home/lock screen ads.

In 2024, advertising platforms appear to have rebounded, and the outlook is generally positive. Right now, Amazon is also rapidly growing its ad business. Its ad revenue has reached $31bn in 2021, and it wants to reach a 13% US market share by 2024 (current share is 10.3%).

2. Live commerce continues to rise in popularity.

For those who came in late, live commerce can be considered to be QVC on steroids, where live audience participation, entertainment, and interaction make for a whole new experience.

A few years ago, live commerce in the US was still at a very premature stage and was only expected to fetch $35bn by 2024. However, live streaming commerce sales in the country reached 50 billion dollars in 2023. This shows the burgeoning popularity of shopping via online streams on TikTok, Facebook, and other social platforms.

E-Commerce D2C sales are expected to grow from 2$bn to 20$bn in 2030, revealing the explosive growth in the online platform. Social Commerce, QCommerce and Live Commerce are also expected to grow multiple folds. ???#DTC #ecommercetrends #MarketTrends pic.twitter.com/hddrJC3BRD

— Alme (@Almeapp) March 29, 2024

So we can say that this is no longer virgin territory. With a 36 percent growth expected in live online shopping sales by 2026, savvy brands must team up with influencers using platforms like TikTok to get out in front of consumers. If you want to accelerate DTC growth, embrace live commerce.

3. Consumers are eager for unique and exciting unboxing experiences.

Type in #unboxing on Instagram, and over 5.5 million posts will come up in search results. The popularity of this hashtag highlights the advantage such experiences provide to brands.

#DTC marketers, let's figure out how to spice up your customer experience! An Automated Handwritten Note Service adds that special something to every unboxing, making it memorable and unique for each of your customers. #Personalization #Ecommerce #DTC pic.twitter.com/8h5yYl00ej

— UnDigital (@GoUnDigital) May 27, 2024

Unboxing has a 100% open rate, and DTC brands should strive to create unique and innovative unboxing experiences for their customers.

I'm a sucker for 2 things.

- great unboxing experiences

- great sleep

And @HushBlankets nails them both.

Sensational product!#review #ecommerce #unboxing pic.twitter.com/Ghc36DUJiB— JJ (mostly Parody) (@julianajaxx) February 15, 2021

When brands combine uniqueness with sustainability practices, they get an even bigger boost from eco-conscious consumers, since 61% of consumers consider packaging recyclability when they make buying decisions.

It's so important for DTC brands to get their packaging and unboxing experience for customers right.

— Pukar (@pukarr_uprety) March 23, 2024

I am an advocate of "Show. Don't tell"

When brands say their unboxing process is great

It's not the same as showing happy customers enjoy seamless unboxing themselves.

Ads are not the place to tell how awesome your product is

It's where you prove it.

— Toby | Ads for 8-Fig DTC Brands (@TobyWalleruk) March 14, 2024

Use unboxing as an advantage. When done well, it can create an indelible impression in the minds of consumers.

4. Brands are leaning more into zero and first-party data.

DTC brands have long relied on third-party data from the likes of Google to build their audiences and drive traffic.

But post privacy changes, third-party data is becoming less and less valuable, as attribution windows collapse to 7 days (vs 30 days) and the Facebook Pixel collects fewer clickstream data.

This makes it critical for brands to collect as much zero and first-party data directly from customers using email, quizzes, SMS, etc, and use tools like customer data platforms to make sense of it all.

First-party data is the key to creating email experiences that resonate with your audience.

By collecting data through:

1. Lead magnets

2. Quizzes

3. SurveysYou gain valuable insights into your subscribers' needs and preferences.

— Jamie Watkins | DTC Email Marketing (@jamiewatkinsdtc) May 14, 2024

5. Younger consumers clamor over limited releases and exclusive drops.

When done well, limited releases have always whipped up excitement, created a FOMO reaction, and drove extra sales, because it combines scarcity with a deadline.

MSCHF, for instance, grew virally just because they executed this strategy over and over again. Other brands like Supreme, Sporty and Rich, and Outer have made their name by creating hype with drops.

In 2022, with looming logistics issues, the limited release made even more sense for DTC brands, especially for those that could deliver on the uniqueness of the products on offer. This year, it continues to make consumers eager to be among those who get to try the limited products.

Bolt Insights for 2024 reveal that limited-edition products generate 2.6 times more revenue compared to regular items. The exclusive and luxurious appeal of limited releases is particularly popular with the GenZ crowd. To ride on this trend, build buzz with limited releases or drops this year.

Steps to Create Your Own Direct-to-Consumer (DTC) Strategy

Ready to dive into the DTC market? Here’s a step-by-step guide to creating a DTC strategy that sets your brand apart and drives growth.

1. Create a strong brand identity.

The competition in the DTC market is fierce. If you want to stand out, you must make your brand recognizable. The first step to doing this is creating a strong brand identity. Start with a visually appealing logo, a cohesive color scheme, and a distinct typography that can be easily associated with your brand. Then craft a brand voice and messaging that reflects what you stand for and resonates with your audience. Make sure to use these consistently across your initiatives.

2. Leverage technology and automation.

One of the advantages of DTC is having full control over the entire customer journey. However, this is two-pronged and brings challenges as well. Aside from ensuring that the manufacturing process is smooth, you’d also need to handle inventory, logistics, shipping, marketing, and other processes.

To streamline all these processes, leverage advanced tools for workflow management and automation. Look for logistics solutions that make order fulfillment smooth and fast. Integrate customer support systems that address customer needs whatever stage in the buyer’s journey they are in.

Automating your workflows end-to-end not only reduces internal errors, but also enhances customer experiences and satisfaction. Consider a unified solution that addresses all business aspects. With 57% of consumer brands looking to consolidate their technology systems, you ought to look into it too.

3. Diversify your marketing channels.

As a DTC brand, you won’t have your intermediaries doing the footwork for you. To reach more consumers, you must make your presence felt in multiple channels. A consumer will be more likely to purchase your products if they’ve seen it several times on different platforms. So craft a DTC marketing strategy that combines email, social media, SEO, content marketing and other marketing methods.

However, more isn’t always better. Focus on the channels where your target audience is and keep your messaging aligned and consistent across the channels you use. What’s important is for your consumers to have a cohesive brand experience in all these channels.

4. Strive to understand the preferences of your customers.

C is essential in DTC. You must apply a customer-centric approach and adapt your marketing efforts according to the preferences and behaviors of your consumers. This is where first-party data becomes extremely useful. Gather insights on their purchasing habits, preferences, pain points, and feedback. Use this information to optimize your DTC marketing strategies.

5. Find influencers and content creators aligned with your brand values.

In our influencer marketing report, over 84.8% of survey respondents believe that influencer marketing is effective. DTC brands may also benefit greatly from this marketing approach. By tapping influencers and content creators who already have an established community of followers, you can widen your reach and connect more closely with your customers.

However, it is vital that you choose influencers who are aligned with your brand values. This not only increases engagement with the right audience but also lends credibility to your brands.

6. Be creative.

The success of digitally native DTC brands has inspired established brands to implement their own DTC strategies. This has further increased the competition in the DTC market. To stand out, you must capture the attention of consumers using innovative and creative campaigns.

You can host live shopping events where potential buyers can see your products in action and ask questions in real-time. Instead of boring product demos, make the experience more engaging through interactive games or immersive activities.

Other creative approaches you can implement are incorporating VR/AR experiences in shopping experiences, hosting virtual workshops that highlight the use of your products, connecting with consumers in physical stores through immersive installations, and using functional branded packaging.

7. Monitor your KPIs.

You won’t know what truly works if you don’t measure. To keep your DTC strategy optimized, you need to track and analyze key performance indicators. Keep a close eye on metrics that matter to your brand.

Conversion rates, site traffic, customer acquisition costs, and such help identify which touchpoints are getting the most interactions. Evaluate how interactions are translating into numbers such as sales and repeat purchases. Make sure to identify where customers abandon their carts or lose interest, as this points to areas that need improvement.

Use these insights to adjust your strategy and achieve better results consistently.

Conclusion

2022 was a big breakout year for many DTC brands as they experienced a jump in sales and replaced closed brick-and-mortar stores.

However, sales volumes have continued to drop since then across the board. Expecting to see plenty of consolidation and bankruptcies, especially as high fuel prices and logistics issues cause income contraction and increase inflation, DTCs were then advised to focus on ten core areas.

The top 10 most valuable functions at a DTC Brand in 2022:

1/ Creatives

2/ Merchandising

3/ Product Development

4/ Supply Chain + Logistics

5/ Planning and Analytics

6/ UX

7/ CX

8/ Finance

9/ Marketing

10/ Technology— Nate Poulin (@digitallynativ) January 8, 2022

In 2024, however, we see a shift in focus as marketers see more opportunities for DTC brands in the following areas:

- Digital advertising expansion/improvement

- Testing/iteration improvement

- Shipping/fulfillment improvement

- Website/UX improvement

- Content creation capacity/quality

- Increased access to emerging tech

- Data/privacy compliance improvement

- Subscription and loyalty program improvement

- Customer support improvement

- In-store/OOG marketing effectiveness

The outlook for the DTC space is positive. However, DTC brands must remain vigilant on market and consumer trends to adapt to sudden shifts.

Frequently Asked Questions

What are the key benefits of the Direct-to-Consumer (DTC) model for businesses?

DTC allows brands to engage directly with customers, gain valuable insights into consumer behavior, and build stronger relationships, ultimately improving customer loyalty and lifetime value.

How does the DTC model revolutionize customer experience?

By bypassing traditional retail channels, DTC brands offer personalized shopping experiences and control over their branding and customer service, enhancing overall satisfaction.

What are some effective strategies for DTC e-commerce fulfillment?

Prioritizing demand forecasting, optimizing inventory management, and ensuring efficient logistics are crucial for balancing stock levels and meeting customer expectations.

What challenges do DTC companies face in scaling their operations?

DTC businesses often encounter challenges in customer acquisition costs, scaling logistics, and maintaining brand differentiation in a competitive market.

How can social commerce boost online sales for DTC brands?

Leveraging social commerce tools can enhance product visibility, engage customers through interactive content, and streamline the purchase process, driving higher conversion rates.