How do creators turn a 15-second clip into a reliable revenue stream? And what patterns separate casual affiliate dabblers from those building six-figure pipelines? These are the questions shaping YouTube’s push to make Shorts a shoppable engine in 2025.

The platform’s Shopping Affiliate program has grown quickly. Once a limited beta, it now integrates directly with Shopify, bringing thousands of retailers into the fold. Commission structures are clearer, with brands setting default rates and attribution windows stretching 30 days — long enough to capture delayed conversions.

For creators, the challenge is no longer access but execution: knowing how to tag products, how to design creative that sparks taps, and how to balance Shorts against long-form for higher-value purchases. For agencies, this shift signals scale.

This article serves as a guide for turning culture-driven videos into measurable commerce.

Program Setup & Eligibility

YouTube’s Shopping Affiliate program has quickly evolved from a limited pilot into a major revenue lever for creators, particularly those leaning into Shorts. As of 2025, the program is more structured, with defined eligibility thresholds, broader retailer coverage through Shopify’s integration, and clearer brand-side defaults.

Understanding how to qualify — and what setup steps are non-negotiable — is the foundation for turning Shorts into a commissionable channel.

Who Can Access the Program

To join, creators must be part of the YouTube Partner Program (YPP). That requires at least 10,000 subscribers, three valid public uploads in the last 90 days, and either 3,000 watch hours or 3 million Shorts views in the past 12 months. This expansion (rolled out in mid-2023) opened the door for smaller creators who specialize in Shorts to monetize earlier.

@moneywhileyousleep YouTube is going to be the place I focus the majority of my attention this year and at the end of last year I got into YouTube shopping program. I am doing my best to figure it all out, and I will let you know what I learn along the way. Please let me know if you have any questions. #youtubeshopping #affiliatemarketing

For creators, being YPP-eligible is just the first step. They must also enable the Shopping affiliate feature in YouTube Studio, connect to the affiliate product catalog, and verify account compliance. Agencies managing talent often help streamline this process by ensuring every client has properly linked accounts and access to a consistent catalog of products.

Regional Availability and Rollout

Initially confined to the U.S., India, and Brazil, YouTube Shopping affiliate access expanded rapidly in 2024 to most of Europe and Southeast Asia. With Shopify now acting as a backbone, creators in regions like the U.K., Canada, and Australia have seen access to a broader range of retailers.

This matters because eligibility isn’t only about subscriber count; it’s about geography and catalog availability. A beauty creator in France can now tag Sephora products in Shorts, while a gaming creator in Japan can tag PlayStation peripherals directly through YouTube’s interface.

Agencies that operate globally are increasingly vetting which creator geographies overlap with retailer availability before committing to affiliate-heavy campaigns.

Brand & Agency Access

From the brand perspective, setup has become more hands-off. In 2025, YouTube introduced default commission settings for retailers. This allows brands to set a standard affiliate rate that applies across the creator network, rather than negotiating individually with each influencer. Agencies managing brand accounts can still offer boosted commission tiers for strategic partners, but the baseline is automated.

For example, Shopify retailers connecting through YouTube can set a flat 10% commission, which then applies to every creator tagging their products. Agencies can later decide to layer incentives, such as a 15% rate for creators driving high-volume conversions.

This balance between automation and flexibility lowers the barrier for brands while still rewarding high-performing talent.

Why Setup Matters

Eligibility isn’t simply a technical gate. It sets the stage for whether creators can access the 30–50 day attribution windows that make affiliate marketing viable. Without being part of the program, creators default back to non-trackable external links in descriptions — a far less compelling model in an environment where TikTok, Instagram, and even Pinterest are aggressively promoting in-app affiliate features.

For creators, the message is simple: program setup is no longer optional if you want Shorts to function as a revenue driver. For agencies, the calculus is about scale — making sure every talent on the roster is eligible, activated, and aligned with brand catalogs.

Commission Structures & Attribution Windows

The economics of YouTube Shopping affiliate in 2025 are no longer experimental — they’re standardized enough for creators to forecast revenue and for agencies to benchmark performance.

Understanding how commission rates are set, how attribution windows function, and how brands deploy default settings is crucial for making Shorts monetization sustainable.

Typical Commission Ranges by Category

Affiliate commissions on YouTube vary by vertical, but most fall within 5% to 20%, aligning with broader industry norms. The vast majority of median rates are around 15%. Consumer electronics and gaming peripherals typically sit at the lower end (5–8%), while beauty, fashion, and home goods often hit 12–20%. This mirrors patterns long observed in Amazon Associates and TikTok Shop affiliate networks.

For instance, creators signed up to Sephora’s affiliate program can earn around 10% commission per sale on all products. Meanwhile, brands like Logitech or Razer often opt for single-digit commissions, betting that volume and product desirability will balance the lower cut.

Agencies use these baselines to advise clients. A gaming creator can’t expect beauty-tier payouts, but they can scale through higher ticket sizes (e.g., $200 headphones vs. $20 mascara).

The Role of Attribution Windows

The second pillar of earnings is attribution — how long a viewer’s click remains commission-eligible. In 2025, YouTube Shopping affiliates operate on 30-day windows, depending on retailer participation. Shopify-powered integrations have made 30 days the default, while larger retailers like Target and Best Buy push toward 45–50 days to remain competitive with Amazon.

This matters for Shorts because of the consumption pattern. A viral clip may generate an initial spike of traffic within 48 hours, but the long-tail conversions often trickle in weeks later. With a 30-day attribution period, creators capture that extended buyer intent — something TikTok’s shorter cookie windows (often 7 days) struggle to support.

Default Commission Settings for Brands

One of the biggest changes in 2025 is YouTube’s default commission framework for brands. Previously, every commission tier required negotiation or agency oversight. Now, when a brand integrates through Shopify or directly into YouTube Shopping, they set a default percentage that applies platform-wide.

For creators, this means predictability — you no longer have to negotiate with every brand. For agencies, it simplifies scaling campaigns: a roster of 20 beauty creators can all immediately monetize Sephora’s catalog without bespoke contracts.

However, brands can still offer boosted rates for select creators or campaigns. For example, a fitness apparel brand might set a 10% baseline but offer 20% for top creators during a New Year’s resolution push. Agencies are increasingly using this lever to incentivize higher output from proven partners.

Tagging Products in Shorts vs. Long-Form

The mechanics of tagging products on YouTube look simple on the surface, but execution differs dramatically between Shorts and long-form uploads. These differences shape how audiences engage with shoppable content and directly impact conversion rates.

Creators and agencies that understand the nuances of product placement, visibility, and behavior in each format can extract far more value from the affiliate program.

Tagging Workflow in Shorts

In Shorts, creators can add shopping tags directly during upload in YouTube Studio. The tagged products appear as tappable overlays within the vertical player, typically positioned below the video near the description toggle. Because Shorts are consumed in feed mode, these tags behave more like native commerce CTAs, encouraging immediate browsing without requiring viewers to open a new window.

The best practice is to keep the tagging flow aligned with the narrative beat.

Creators should note that YouTube caps the number of visible products per Short (currently up to 30 items per upload, though best practice is 1–3). Over-tagging clutters the UI and dilutes focus, so agencies managing multiple creators often build standardized SKU lists to avoid repetition and maintain consistency.

How Long-Form Tagging Differs

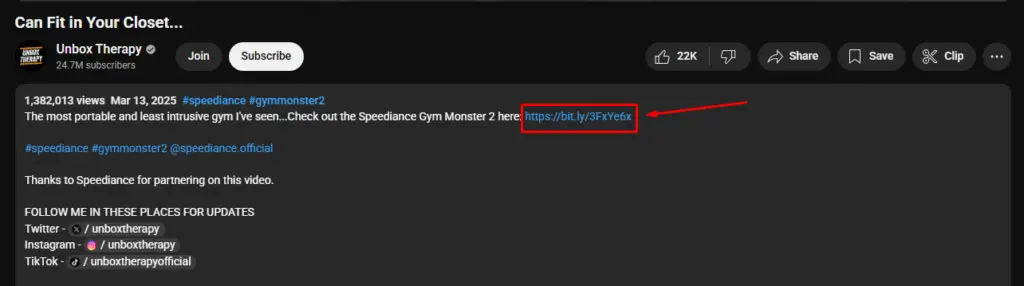

In long-form videos, tagged products appear in a dedicated shopping shelf beneath the video player and sometimes in cards within the playback window. While still clickable, the placement is less immediate compared to Shorts. Long-form tagging leans more on descriptions, pinned comments, and deep-dive reviews to drive conversions.

For example, Unbox Therapy often integrates tagged products in his 10–15 minute tech reviews. Viewers who watch these videos are already in research mode, so they’re more likely to click through after hearing detailed specs and opinions. The affiliate tags here act less like impulse triggers and more like final-step nudges in the purchase funnel.

Agencies typically use a dual-format approach: Shorts create awareness and generate quick affiliate clicks, while long-form videos provide credibility and deeper product exploration. Together, they reinforce one another, often capturing both the impulse buyer and the considered shopper.

Engagement and Conversion Patterns

The placement difference drives conversion patterns. Shorts tend to generate higher click-through rates because tags surface seamlessly in the feed, but conversions skew toward lower-ticket, impulse-friendly categories like beauty, apparel, and small accessories.

Long-form, meanwhile, produces higher average order values (AOV). A viewer watching a 20-minute laptop review is further down the funnel, so even if CTR is lower, the resulting sales are more lucrative.

Agency Standardization

For agencies, the challenge is scale. When managing dozens of creators, inconsistent tagging practices can undermine campaign measurement. Standard operating procedures (SOPs) now include tagging hierarchies:

- Primary products aligned with campaign objectives (tagged in Shorts).

- Secondary SKUs supporting AOV growth (featured in long-form).

- Seasonal or trend-based add-ons rotated in monthly.

This system ensures campaigns remain focused while allowing experimentation. Brands also benefit because attribution data stays clean, with fewer SKU mismatches muddying performance analysis.

Creative Patterns That Drive Conversions

Monetizing Shorts through YouTube Shopping isn’t just about tagging products. The way creators frame, pace, and present products directly impacts whether viewers tap those affiliate tags.

Conversion-driven creative follows recognizable patterns — some borrowed from TikTok and Instagram Reels, others uniquely adapted to YouTube’s algorithm and user behavior.

Storytelling Beats That Spark Clicks

The highest-performing Shorts follow a show-first, explain-later rhythm. Creators hook viewers with the product in action within the first three seconds, then deliver context or benefits after curiosity has been triggered. This sequencing is particularly effective in categories like beauty, fitness, and food, where visual impact drives impulse interest.

Agencies working with multiple creators are increasingly codifying this as a best practice: “action first, context second.” It’s the opposite of a traditional review structure and mirrors the pace of modern feed consumption.

Leveraging Shorts-Native Trends

YouTube Shorts borrows cultural mechanics from TikTok, and creators who lean into trending audio, challenges, or meme formats see significantly higher engagement. When paired with affiliate tagging, this creates a conversion flywheel: cultural participation draws in views, and shoppable elements monetize them.

Take the 2024 “#CleanTok” trend, which exploded on Shorts. Cleaning influencers tagging products like Scrub Daddy sponges or The Pink Stuff cleaner saw spikes in affiliate revenue because the products were both visually satisfying in demos and low-cost enough for impulse purchases.

Agencies managing retail accounts in home goods often push creators to monitor trending tags weekly, then map catalog SKUs to those creative formats. The rapid sync between trend and product is what turns views into shoppable behavior.

Visual Techniques That Drive Taps

Certain editing choices consistently outperform when paired with affiliate tags:

- Jump cuts keep pacing tight, preventing drop-offs before the tag appears.

- On-screen text overlays reinforce product names or discount codes, creating memory anchors.

- Split-screen comparisons (e.g., old vs. new makeup look) double as product testimonials.

Viewers stay hooked long enough to notice and interact with product tags.

Cross-Format Reinforcement

Finally, conversion rates climb when Shorts are supported by companion formats. A creator might launch a 15-second demo Short tagging a skincare product, then follow it up with a 6-minute review for deeper education. This pairing captures both impulse buyers and considered shoppers.

Shorts as the New Commerce Engine

YouTube is betting big on turning Shorts into a full-fledged shopping channel — and the pieces are falling into place. With lower eligibility thresholds, default commission settings, and attribution windows that outlast rivals, the affiliate program is no longer experimental. For creators, success hinges less on access and more on execution: tagging products seamlessly, crafting high-retention creative, and leaning into formats that spark taps.

For agencies, the opportunity is scale. Standardized tagging protocols, cross-format sequencing, and category-specific commission strategies are how they’ll unlock predictable performance.

The big picture? In 2025, Shorts aren’t just a discovery tool. They’re a conversion engine backed by YouTube’s growing retailer ecosystem and Shopify’s infrastructure. The creators who master the rhythm of affiliate storytelling — and the agencies that can systematize it — will define the next wave of YouTube commerce.

Frequently Asked Questions

What makes affiliate marketing on YouTube different from traditional methods?

Unlike static blog reviews or coupon sites, YouTube leverages high-retention video formats where creators can integrate products into storytelling. This format blends aspects of affiliate marketing websites, which focus on discoverability and niche authority.

How do creators maximize their affiliate income beyond just tagging products?

Successful creators often use layered tactics, combining strong hooks, trend participation, and evergreen content. These align with broader affiliate marketing strategies such as building audience trust and testing multiple formats to increase conversion consistency.

Why are influencers such a strong fit for affiliate models?

Because their audiences are already primed for product recommendations, creators on Shorts mirror the effectiveness of influencers in affiliate marketing across other platforms, where social proof and authenticity shorten the buyer journey.

What role does education play in affiliate adoption?

Many newer creators still struggle with terminology and commission mechanics, making resources like affiliate marketing 101 critical for understanding how tagging translates into revenue opportunities.

How can brands set up their own affiliate opportunities for YouTube creators?

Brands don’t have to rely solely on YouTube’s defaults; they can also create an affiliate marketing program that integrates with Shopify or external platforms to control commission rates and incentive structures.

Are agencies relevant in scaling affiliate campaigns on Shorts?

Yes — agencies streamline cross-creator rollouts by providing SOPs and negotiating boosted rates, much like specialized affiliate marketing agencies do across broader ecosystems.

What niches tend to perform best for affiliate content on Shorts?

High-volume categories like beauty, fitness, and home goods dominate conversions, aligning with the most lucrative affiliate marketing niches where consumer demand naturally fuels repeatable content.

How should a beginner think about entering affiliate monetization on YouTube?

The same way early-stage publishers did: start small, pick one or two products, and focus on learning fundamentals of what affiliate marketing is before scaling into multiple partnerships or advanced tagging strategies.