What does it take to stand out when millions of shoppers, ads, and algorithms collide in the same six-day window? And how has Walmart—once synonymous with doorbusters and crowded aisles—become a data-driven powerhouse shaping how brands plan Black Friday and Cyber Monday?

The 2025 holiday season marks a turning point in retail strategy. Walmart’s shift toward multi-wave deal launches, member-first access, and retail-media integration signals a future where success depends on timing, not chance.

Consumer behavior is fracturing across channels, yet Walmart continues to concentrate intent through one of the most advanced performance ecosystems in commerce.

This playbook explores how marketers can master that ecosystem—aligning promotions, logistics, and media with surgical precision to win the moments that matter. Because on Walmart’s stage, every discount, delivery tag, and ad placement is either orchestrated—or overlooked.

- Walmart’s Black Friday & Cyber Monday Landscape & Trends

- What Makes Walmart Unique (vs. Amazon & DTC)

- Pre-BFCM Planning Checklist for Brands & Marketers

- Designing Walmart-Specific Promotional Strategies

- Advertising Execution & Optimization During BFCM

- The Walmart Playbook: Where Precision Meets Peak-Season Profit

- Frequently Asked Questions

Walmart’s Black Friday & Cyber Monday Landscape & Trends

Walmart’s Black Friday/Cyber Monday (BFCM) strategy has evolved from single-day doorbusters into a multi-phase, membership-driven campaign powered by early access, content-led advertising, and data-optimized pricing.

For marketers, agencies, and brands, understanding these shifts is essential to timing campaigns, aligning discounts, and predicting consumer behavior during Q4’s most competitive stretch.

From Big-Day Blitzes to Multi-Wave Campaigns

In 2024, Walmart formalized a multi-wave BFCM structure built around Walmart+ Early Access. Members received a five-hour online head start on Nov. 25 ahead of the public drop, with in-store activations on Nov. 29 and Cyber Monday exclusives on Dec. 1. This sequencing was confirmed by PYMNTS, which noted Walmart’s pivot to tiered access as a long-term engagement strategy rather than a one-off test.

For marketers, this means campaign calendars should now include two visibility peaks — one for members, one for the public — to sync with Walmart’s staged rollouts and maximize impressions before algorithmic ranking stabilizes.

Scaling Reach With Entertainment-Driven Creative

Walmart’s “Deals of Desire” campaign in 2024 marked a major creative shift. The 10-episode “advertainment” series spoofed classic film genres and featured celebrity cameos tied to live product drops. Each episode doubled as a storytelling ad unit and conversion moment, blending entertainment with commerce.

@iansomerhalder Sink your teeth into Walmart #BlackFriday Deal 🧛♂️ Shop Nov. 25-Dec. 1! #WalmartDealsofDesire #WalmartPartner

The takeaway for brands: BFCM success on Walmart is increasingly tied to content performance, not just discount depth. Marketers should align creative assets to high-engagement formats (short-form video, episodic storytelling, or social tie-ins) that mirror Walmart’s own campaign tone.

Deeper Discounts by Category

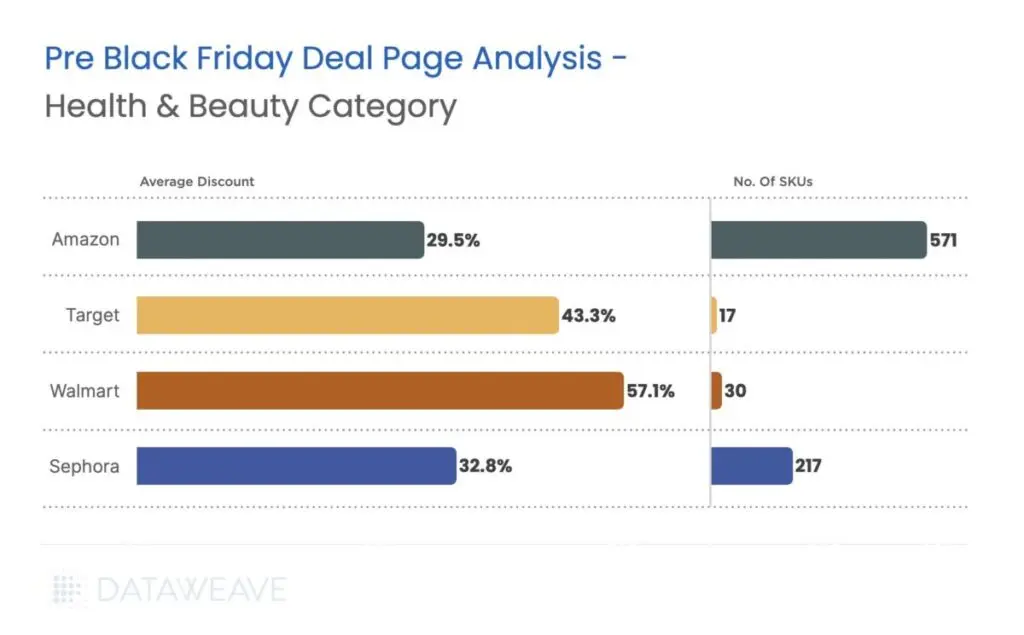

Analysts have verified that Walmart continues to lead competitors in category-specific markdowns. DataWeave’s 2024 Black Friday pricing report found that Walmart’s health & beauty discounts averaged 57.1%, the steepest among top U.S. retailers. In activewear, the average markdown reached 41%, signaling deeper and more targeted price plays year over year.

These data points highlight the importance of category benchmarking before setting ad bids or discount thresholds. Generic “30% off” strategies risk under-competing in Walmart’s most price-sensitive verticals.

Marketplace Growth and Conversion Records

Walmart Marketplace reported its highest-ever sales day and set a single-day conversion rate record during the 2024 BFCM period (Nov. 25–Dec. 2).

Walmart’s FY25 wrap-up states that its U.S. Marketplace grew 34% in the last quarter, and highlights that this included “achieving our highest ever sales day and setting a record for the highest single day conversion rate during the Holiday.” In concurrent coverage, Walmart noted that marketplace sales growth during the holiday week outpaced overall eCommerce growth—Marketplace was up 43% year-over-year in its most recent quarter, while total eCommerce grew 22%.

Because of this, for brands selling via Walmart Marketplace, the platform is not just a support channel but a primary conversion driver during peak windows. That means brands must align inventory, bid pacing, and deal timing to fully capture surging demand between Thanksgiving and Cyber Monday, rather than spreading spend shallowly across December.

Speed as a Visibility Lever (WFS and 2-Day Tags)

Operational factors heavily influence conversion. At Walmart’s 2024 Seller Summit, the company reported that items fulfilled through Walmart Fulfillment Services with the “2-Day Delivery” badge experienced an average 50% GMV lift versus non-tagged SKUs.

For marketers overseeing Walmart storefronts, speed tags are now performance multipliers—driving both visibility in search and consumer trust at the point of purchase.

Macro Forces Shaping BFCM 2025

Adobe projects $253.4 billion in U.S. online holiday sales for November–December 2025 — a 5.3% year-over-year increase — with Cyber Week (Thanksgiving through Cyber Monday) expected to generate $43.7 billion, or roughly 17.2% of the season’s total. Cyber Monday alone is forecast to reach $14.2 billion in spending, maintaining its position as the largest single shopping day of the year.

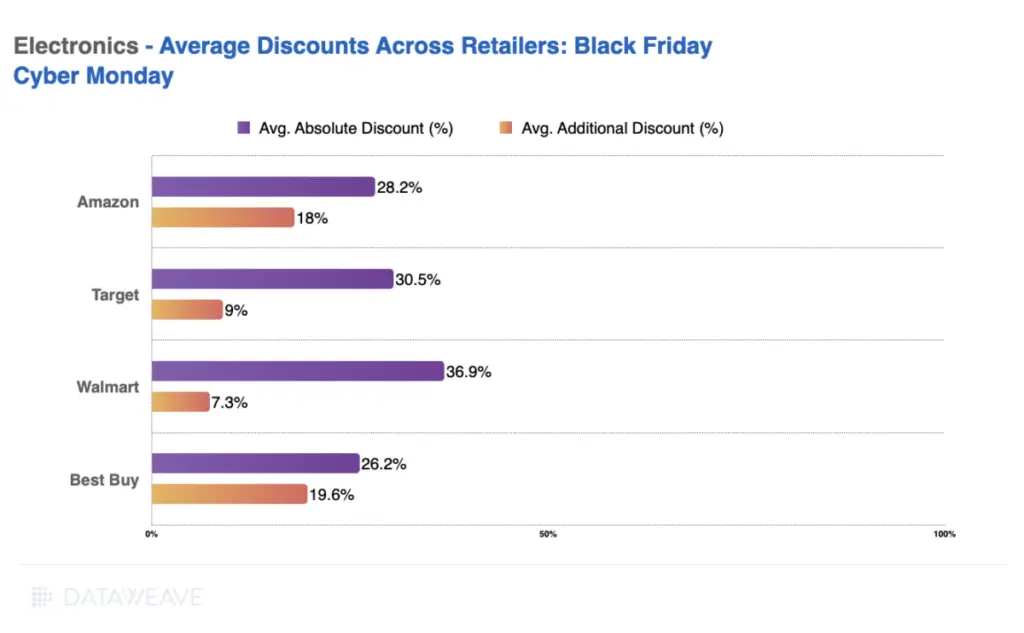

Discounting intensity remains high: Adobe expects electronics markdowns to peak near 28%, consistent with 2024’s levels, as retailers compete to attract price-sensitive consumers.

Implications for Walmart Strategies:

- Focus budgets and creative rotations on the Thanksgiving–Cyber Monday window, when consumer intent peaks.

- Model margins assuming deeper discount floors, especially in electronics and high-ticket categories.

- Structure messaging and ad pacing around two surges of demand — Black Friday and Cyber Monday — rather than a single burst.

Key Takeaways for Marketers and Brands:

- Build dual-phase campaigns around Walmart+ early access and public drop windows.

- Match Walmart’s “advertainment” tone with high-engagement creative formats.

- Use real category benchmarks to avoid under-discounting.

- Prioritize WFS or 2-Day tags on top SKUs to secure ranking and conversion boosts.

- Anticipate continued 2025 discount intensity and plan margin models accordingly.

What Makes Walmart Unique (vs. Amazon & DTC)

Walmart’s Black Friday and Cyber Monday operations are governed by a distinct blend of retail discipline, marketplace control, and omnichannel integration. Unlike Amazon’s auction-style agility or DTC’s pricing freedom, Walmart’s ecosystem runs on predictability, compliance, and consumer trust — all anchored by its Everyday Low Price (EDLP) philosophy.

Pricing Discipline and Promotional Boundaries

Walmart’s pricing model is designed to preserve consistency year-round. The EDLP policy discourages erratic discount spikes that undermine price trust, even during BFCM. Sellers using Walmart Marketplace must comply with strict pricing parity rules — for example, Walmart can suppress listings that are cheaper on competing sites or marketplaces.

During Black Friday, this translates into fewer “race-to-zero” scenarios than Amazon, where algorithmic repricing dominates.

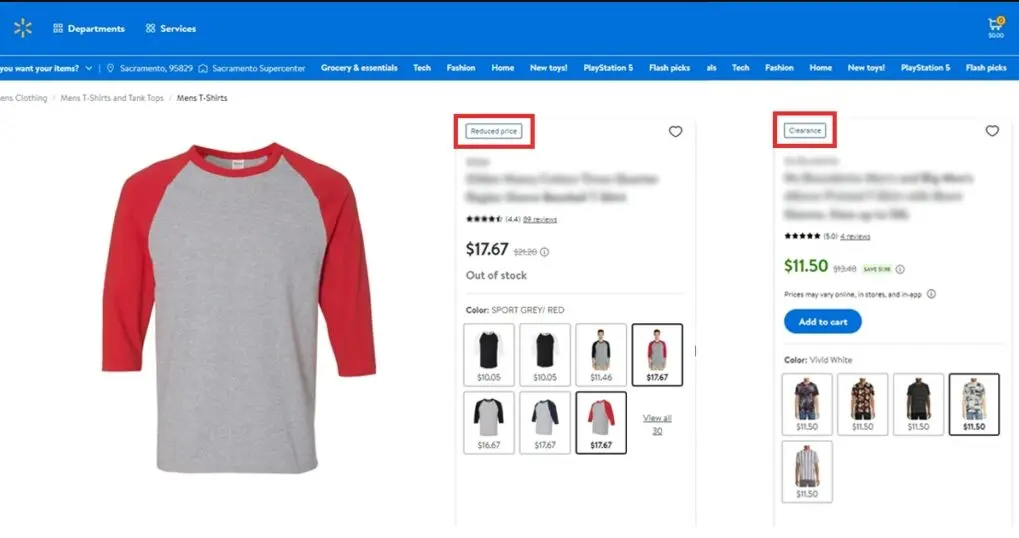

Instead of “Lightning Deals” or “Today Only” banners, Walmart deploys rollback and reduced-price badges tied to verified promotional start and end times. Each promotion must be uploaded via the Seller Center’s Promotional Pricing tool and approved by Walmart before going live. This ensures every deal meets Walmart’s margin, compliance, and timing standards.

Advertising and Visibility Mechanics

Walmart Connect — the company’s first-party advertising platform — integrates sponsored search, display, and in-store screens into one closed-loop system. Unlike Amazon Ads, Walmart Connect can tie media exposure directly to both online and in-store sales, thanks to first-party shopper data from over 145 million weekly customers.

During BFCM 2024, brands like Procter & Gamble and Samsung leveraged Walmart Connect’s omnichannel placements to reinforce discount messaging across TV walls, app search, and physical endcaps — a synergy few DTC platforms can match.

Fulfillment and Ranking Power

Visibility on Walmart also depends on operational excellence. As mentioned previously, listings fulfilled through Walmart Fulfillment Services (WFS) with “2-Day Delivery” tags enjoy, on average, a 50% higher GMV lift.

This logistics advantage mirrors Amazon’s FBA benefits but with stricter oversight — and unlike most DTC brands, Walmart sellers can lean on WFS’s integrated inventory placement to maintain conversion and ranking stability during Cyber Week.

For marketers, the takeaway is clear: Walmart’s BFCM edge isn’t speed or depth of discount — it’s predictability and cross-channel control. Success depends on mastering compliance, leveraging Walmart Connect’s ad data, and securing fulfillment tags that keep hero SKUs visible when traffic peaks.

Pre-BFCM Planning Checklist for Brands & Marketers

For Walmart sellers and advertisers, the 60–90 days before Black Friday and Cyber Monday define the success of the season. The brand teams that finalize inventory, pricing, and ad structure early gain priority visibility once Walmart’s deal waves open.

1. Segment SKUs & Set Offer Ladders

Group items into: Hero SKUs (door-opener discounts + ad budget), Margin Protectors (modest promos), and Opportunistic SKUs (bundles/clearance).

Use Walmart’s Promotional Pricing tools to pre-stage “Reduced Price” or “Clearance” with defined start/end dates; approvals and timing controls happen inside Seller Center or via API. You can’t edit a promotion within 30 minutes of start time, so finalize rules early.

2. Inventory, Eligibility & Speed Signals

Ensure inventory is in place before early November so your top SKUs are eligible for fast-delivery tags via Walmart Fulfillment Services (WFS). Walmart’s official guides make clear that fulfillment configuration, in-stock status, and service-level eligibility directly affect search/placement and Buy Box stability—critical when traffic spikes compress into a few days. (Avoid over-promising; align inbound dates to actual capacity.)

3. Creative & Content That Clears Compliance

Refresh titles, bullets, and hero images to Walmart standards; keep price/benefit messaging legible at thumbnail size, and prep variants for Sponsored Search and on-site placements. Walmart Connect’s Holiday Retail Insights outlines seasonal planning considerations and approved creative patterns you can mirror across formats (search tiles, browse banners, brand modules) without risking disapproval.

4. Timeline You Can Execute

- T-60 to T-45: Lock SKU tiers, submit promotional pricing drafts, and start content QA.

- T-45 to T-30: Finalize promotions in Seller Center; remember the edit lockout window before go-live.

- T-21 to Event: Stage ad groups and budgets around the two peak surges (Black Friday and Cyber Monday), guided by Walmart’s 2024 peak-week records and your category’s discount norms.

Bottom line: build your plan around real category floors, pre-approved promos, and eligibility that won’t break under load. The data shows Walmart’s Marketplace concentrates extraordinary intent into Cyber Week—be ready before it hits.

Designing Walmart-Specific Promotional Strategies

When running promotions on Walmart during BF/CM, brands must align not just with discount tactics but with Walmart’s proprietary promotion types, timing rules, and display logic. Here’s how to build a promotions playbook rooted in Walmart’s system.

Promotional Pricing Options & Rules

Walmart Marketplace enables sellers to run temporary price reductions through its Promotional Pricing tools. These discounts can run for up to 180 days, but must be set with explicit start and end times to qualify as valid promotions. Sellers typically choose between “Reduced Price” or “Clearance” labels, which cause the listing to display as strikethrough pricing (e.g. “Was $X, Now $Y”).

One key rule: To show a strikethrough comparison price, the promotional price must be at least 10% lower than the published “Was Price” or list price.This enforces a minimum bound on discounting, helping Walmart preserve its everyday low-price (EDLP) positioning.

Additionally, Walmart enforces a minimum lead time: a promotion must begin at least four hours after creation, and editing a promotion after submission often requires an exact start/end match to delete. These controls limit last-minute changes and encourage rigorous preplanning.

Timing & Layering Promotions Across Waves

To mirror Walmart’s multi-wave BF/CM cadence, brands should layer multiple promotional windows. For example:

- Teaser/Early-Access Deals: Run light but meaningful discounts during Walmart+ early-access windows to gain algorithmic visibility.

- Main Drop: Use core hero SKUs with aggressive “Reduced Price” or “Clearance” tags once the broader consumer drop starts.

- Flash / Hourly Intensifiers: Use time-limited promos within those windows on underperforming SKUs to ramp urgency.

Because promotional edits close before start time, you must lock in your waves 24–48 hours in advance. Walmart’s Promotional Pricing dashboard differentiates draft, scheduled, active, and expired promotions to help sellers manage them properly.

Discount Benchmarks by Category (Validated Data)

Using real price intelligence from holiday 2024, DataWeave observed notable discount behaviors in electronics: Across 22,383 SKUs, Walmart’s promotions often matched or outpaced rivals in competitive categories.

In Health & Beauty, Walmart offered average discounts of 35.2% on Black Friday 2024, trailing places like Ulta but still aggressive for a mass retail channel.

These benchmarks can act as guardrails when you define your discount ladders (e.g. hero SKUs might go deeper, while margin-preserving SKUs stay shallower).

Integration with Advertising & Discovery

Promotions on Walmart aren’t isolated—they are amplified when tied to Walmart Connect ad placements and merchandising surfaces. As brands layer promotions, they should simultaneously boost ad spend behind those SKUs to ensure they land in recommendation slots, search results, or featured deals modules.

Further, use Walmart’s Pricing Insights dashboard (built into Seller Center) to monitor how promo SKUs are performing relative to baseline catalog items and adjust your ladder logic ahead of subsequent waves.

Advertising Execution & Optimization During BFCM

For marketers and brands, Walmart Connect is the single biggest visibility lever during Black Friday and Cyber Monday. Its closed-loop ad ecosystem—spanning sponsored search, on-site display, in-store screens, and connected TV—ties exposure directly to both online and offline sales.

According to Walmart’s Q4 FY25 earnings release, U.S. Walmart Connect advertising sales grew 24% year-over-year, underscoring the platform’s accelerating relevance for brands seeking measurable retail impact.

Understanding Walmart Connect’s Ad Ecosystem

Walmart Connect integrates four key ad products:

- Sponsored Search (keyword-based placements across search and browse results)

- On-Site Display (homepage, category banners, and PDP placements)

- In-Store Digital Media (self-checkout screens, TV walls, and endcap video)

- Offsite and Connected TV (CTV) ads through Walmart’s DSP and partner network

The power of this ecosystem is its reach. Walmart’s physical and digital properties now touch 145 million weekly shoppers across stores, the Walmart app, and Walmart.com. This omnichannel footprint enables marketers to sequence creative and budget pacing to reach the same customer through multiple touchpoints over Cyber Week.

Optimizing BFCM Ad Spend

Marketers should adopt a tiered pacing model during the 10 days surrounding Thanksgiving:

- T-5 to T-1: Increase bids by 20-25% to capture pre-event research traffic.

- Black Friday weekend: Prioritize Sponsored Search on hero SKUs with inventory certainty.

- Cyber Monday: Allocate 30-35% of budget; Walmart’s historical data shows ROAS peaks on Cyber Monday when shoppers convert high-consideration categories like electronics and appliances.

Use the Performance Dashboard to apply hourly pacing adjustments and redirect spend to top-performing SKUs in real time.

Leveraging First-Party Data & Closed-Loop Attribution

Walmart Connect’s biggest strategic advantage during BFCM is its closed-loop measurement system, which links ad exposure to verified sales across Walmart’s website, mobile app, and physical stores.

According to Walmart Connect’s official measurement overview, the platform enables advertisers to “measure what matters most” — including online, in-app, and in-store conversion impact across campaigns.

In 2024, Walmart expanded this framework with in-store attribution for Sponsored Search and display placements, allowing brands to see how digital impressions or clicks translate into brick-and-mortar sales.

This first-party data depth gives brands a major advantage compared to Meta, TikTok, or open-exchange programmatic media, where attribution often relies on modeled conversions. Walmart’s reporting environment ties real purchase receipts to ad exposure, giving advertisers a complete view of campaign performance across both digital and physical commerce.

Key takeaway: Walmart Connect’s closed-loop measurement—now enhanced with in-store attribution—provides marketers with one of the most transparent and accountable retail media systems available. For BF/CM, this means campaigns can be optimized based on verified revenue outcomes, not assumptions, helping teams allocate budget toward what demonstrably drives sales.

The Walmart Playbook: Where Precision Meets Peak-Season Profit

Walmart’s Black Friday and Cyber Monday evolution tells a bigger story about modern retail: scale alone no longer guarantees success—strategy does. The brands that win here don’t just slash prices; they synchronize pricing, fulfillment, and retail media to hit the exact moments when intent spikes.

From tiered early-access deals to closed-loop ad attribution, Walmart has turned BFCM into a controlled performance machine. Its balance of everyday low price discipline and media sophistication gives marketers what Amazon can’t: transparency, reach, and measurable offline impact.

For brands and agencies, this isn’t a one-week sprint; it’s a masterclass in retail orchestration. Success comes from aligning logistics with storytelling, inventory with insight, and spend with proof. In short, Walmart’s BFCM isn’t just where consumers shop—it’s where the smartest marketers compete.

Frequently Asked Questions

How can brands improve inventory accuracy during Walmart’s BF/CM surge?

Using Walmart inventory management software helps brands forecast demand, sync real-time stock levels, and prevent out-of-stock penalties during high-velocity sales windows.

What advertising options do Walmart sellers have during BF/CM?

Walmart Connect offers multiple advertising platforms, including Sponsored Search, on-site display, and in-store placements, giving brands visibility across every shopper touchpoint.

Why is Walmart’s pricing model crucial for BF/CM success?

Mastering Walmart’s pricing strategies ensures that discounts stay compliant with its Everyday Low Price policy while remaining competitive against Amazon and Target.

How can advertisers maximize ROI from Walmart Connect campaigns?

Brands can boost efficiency through Walmart advertising optimization tactics like bid adjustments, keyword segmentation, and performance pacing across peak hours.

What should marketers budget for the full holiday season?

Following proven holiday budgeting frameworks allows teams to balance early BF/CM spend with sustained December conversion lift.

How do Walmart’s BF/CM campaigns differ from other retailers?

Unlike generic promotions, Walmart’s Black Friday campaigns rely on multi-wave scheduling, member-exclusive drops, and omnichannel media support.

What role does video commerce play in Walmart’s strategy?

Video formats—especially shoppable integrations similar to YouTube Shopping affiliate models—are increasingly used by Walmart brands to bridge discovery and conversion.

How should advertisers track cross-channel performance during Cyber Week?

Running consistent creative and bid strategies when advertising on Walmart ensures accurate attribution between on-site, in-store, and off-site media during the peak season.