Black Friday has always been regarded as the biggest annual US shopping event. Happening right after Thanksgiving, shoppers look forward to this day for huge discounts while retailers anticipate huge sales. However, record-high inflation and lingering impacts of the pandemic have caused a shift in consumer behavior, affecting this annual shopping event.

In this article, we’ll take a closer look at consumer behavior surrounding the Black Friday Sale Event and how retailers can cope with it.

Black Friday Consumer Behavior – Understanding the Impact of Behavior Shifts:

The Rise and Fall of Black Friday Deals

Black Friday began as an unwritten rule for stores to start promoting shopping deals after Thanksgiving. It became the day that officially kicked off the US Christmas shopping season. In the early 2000s, Black Friday sales surged as consumers flocked to brick-and-mortar stores to take advantage of limited deals and huge discounts.

By 2005, Cyber Monday was coined as online shopping behavior started to boom the Monday right after a Black Friday event. As crowds turned violent during Black Friday events, customers turned to digital channels to shop for exclusive deals. This shift coincided with the e-commerce boom, and by 2012, Black Friday mentions on social media peaked at 1.5 million.

However, this proved to be the peak of Black Friday mentions as negative sentiment around the event grew due to consumers expressing frustrations over not getting the deals that were advertised. Black Friday started losing steam as consumers began shunning consumerism and became mindful of their spending habits.

Fast forward, Black Friday remains a strong holiday shopping event despite several hiccups in the past years. In 2022, online spending during Black Friday grew by 2.3% versus the previous year and surpassed projections when it reached $9.12 billion.

Retailers expect the same or better performance this year. But if one thing’s certain, the bulk of sales will come from online channels, rather than in-store sales. And despite looming concerns over inflation, millions of shoppers are still expected to shop this year if the record-breaking 196 million customers who shopped last year are to be an indicator of consumer shopping behavior in the face of an economic crisis.

Predictions for 2024 Black Friday Consumer Behavior

With Black Friday just around the corner, let’s look at how consumers are predicted to behave based on the data gathered from the past year.

Consumers will continue to shop online during Black Friday

According to Adobe Analytics, US consumers spent $9.12 billion online during Black Friday 2022, while Salesforce Inc. reported online retail sales reached $17.2 billion. Shopify, meanwhile, reported $3.36 billion in Black Friday 2022 sales.

Shopify, Adobe, and Salesforce are e-commerce platform providers for some of the leading retailers in the US. Their reported 2022 sales figures are 10-17% higher than previous years.

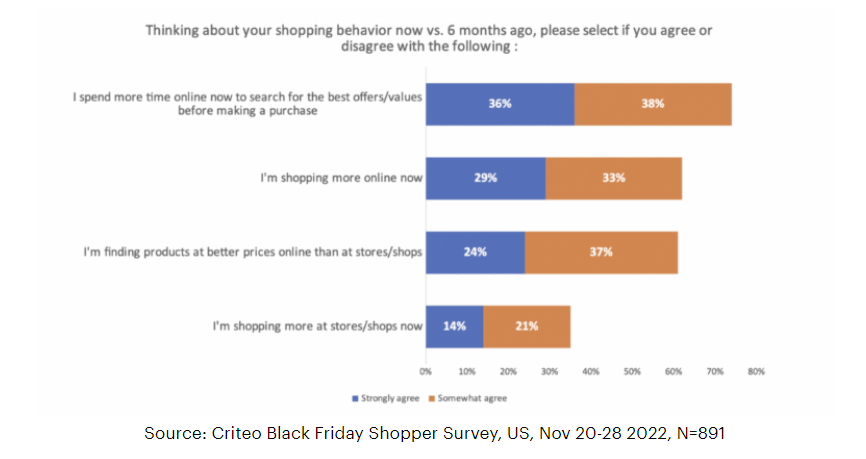

With more consumers shopping online, Black Friday is becoming more like Cyber Monday. A Criteo survey found that US online transactions increased by 13% during the Black Friday weekend with sales skyrocketing by 374% compared to the previous month.

Source: criteo.com

Deloitte confirms that Black Friday and Cyber Money events are becoming channel-agnostic, with the share of online and in-store Black Friday sales being at 16% and 17% respectively. They cite better price transparency as the main reason for consumers to shop on either channel.

As Black Friday approaches, expect the same trend to continue. E-commerce sales will outpace in-store ones, and retailers should be prepared to handle the traffic. Consumers are bargain hunting and shopping online gives them greater freedom to do so.

What You Can Do:

- Introduce great deals that outperform the competition

- Ensure your website can handle the influx of traffic

- Keep inventory levels updated to prevent the dreaded out-of-stock item

Buy Now Pay Later deals will drive conversion

Shoppers are under immense economic pressure with 67% of Americans worried that inflation will make it more difficult to buy the things they want. However, 21% of Americans surveyed are still most excited to shop on Black Friday, indicating that with an extra nudge, retailers can still capture these shoppers.

Flexible payment options, like Buy Now Pay Later (BNPL) schemes, have proven to be a huge motivation with BNPL orders during Black Friday 2022 increasing by 78% compared to their figures the previous week.

These figures supported a Deloitte survey that revealed 37% of shoppers are planning to use BNPL services. This remains a lower number, though, compared to 48% of shoppers planning to use credit cards.

With inflation rates continuing to rise in the US, it’s expected that consumers will look for more ways to extend those dollars, and BNPL deals may very well be at the top of their list. Shoppers are refusing to let inflationary pressures dampen the holiday spirit and will count on credit to stretch their holiday budgets.

What You Can Do:

- Offer BNPL options during checkout but don’t neglect other traditional payment methods like credit cards

Shoppers will still go to physical stores but stay out of long lines

Black Friday used to be characterized by long lines of consumers waiting outside for stores to open. There are even reports of dangerous stampedes as shoppers rushed through doors to grab the on-sale items. Those days are long gone as shoppers now opt to purchase online rather than in-store. However, don’t be quick to dismiss in-store sales.

In 2022, in-store traffic during Black Friday increased by 2.9% compared to 2021. While retail stores offered curbside pickup, only 13% of shoppers opted for it as the majority opted to venture inside stores.

This behavior could have contributed to the rise of the use of the BOPIS (Buy Online, Pick Up In Store) service option, which was 20% higher during Black Friday compared to other days of the season.

Interestingly, millennials and Gen Z were more likely to shop in-store while Gen X and boomers were more likely to shop online during Black Friday. This seeming reversal in consumer behavior is a testament that consumers have already accepted that Black Friday deals are the same, regardless if they shop online or in-store.

What You Can Do:

- Create a seamless in-store and website shopping experience that reinforces the belief that consumers can get the best deals whether they shop in-store or online

Consumers will continue to shop early as retailers offer better pre-Black Friday deals

One of the common customer woes during Black Friday is the massive out-of-stock items that greet them the moment they’re ready to check out their purchases. Most retailers start offering early Black Friday deals, and consumers who are mindful of their purchases start their Christmas shopping early.

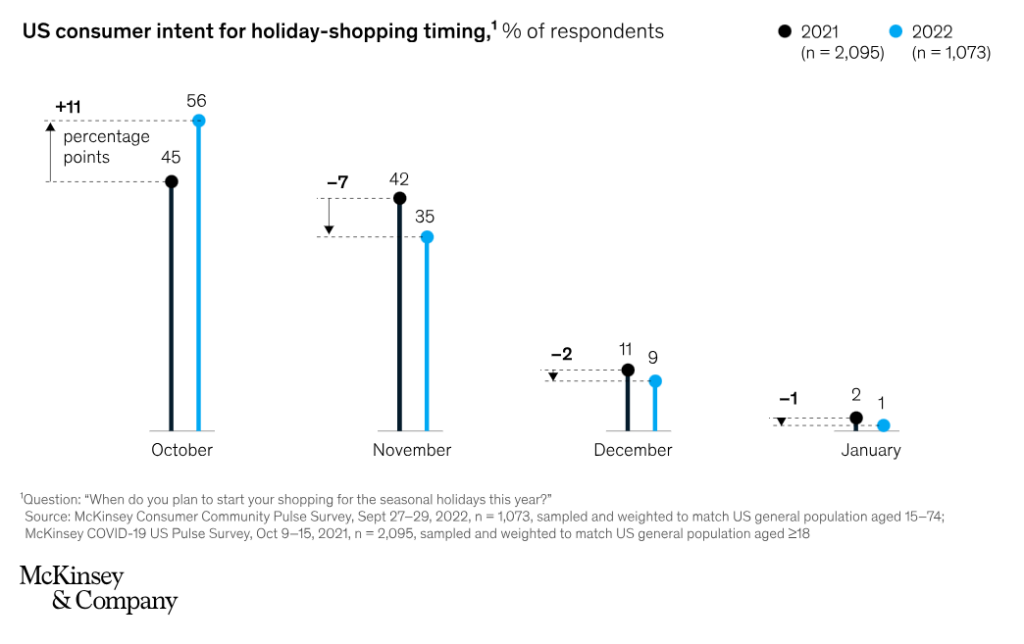

A McKinsey 2022 study discovered that 56% of surveyed consumers are cautiously optimistic and opted to start shopping by October. Early shopping gives them the opportunity to compare prices and find the best deals without the pressure of a major holiday shopping event.

Moreover, Adobe found out that while Black Friday and Cyber Monday spending fell short of the previous year, the combined consumer spending throughout the holiday season was higher than in previous years. Shoppers are evenly spending their holiday cash, reducing the impact of dedicated shopping holidays.

According to the National Retail Federation, 56% of shoppers took advantage of early holiday promotions to start their holiday shopping. Although on average, they are only 47% done by the time Black Friday rolls around. This still left plenty of room for additional purchases for the remainder of the coming weeks.

Deloitte confirms the same trend as their surveys revealed that 23% of shoppers are nearly done with their holiday budgets by the end of October.

Black Friday also remained the most popular day for online shopping, even eclipsing Cyber Monday. In 2022, 72 million in-store shoppers and 87 million online shoppers purchased during Black Friday as opposed to 22 million in-store shoppers and 77 million online shoppers during Cyber Monday.

What You Can Do:

- Offer promotions early in the shopping season, but be careful of creating deal fatigue among shoppers

- Create better deals during Cyber Week that are genuinely good offers that will help consumers save money

More shoppers will use their mobile phones to make purchases

Mobile shopping is something that consumers can do discreetly and casually, even while still at their Thanksgiving gatherings. Consumers also want the freedom to shop from anywhere, especially as they stay on top of the latest deals.

Mobile shopping during Thanksgiving 2022 accounted for 55% of online retail sales, higher by 8.3% from the previous year. Black Friday 2022 mobile sales also peaked at 48% vs 2021.

These figures reflect the growing trust shoppers have in smartphone transactions, including mobile payments and better mobile online experiences.

What You Can Do:

- Create a better mobile shopping experience using a responsive, intuitive website design

- Optimize your website to have fast loading times, simple navigation, and mobile payment options

Customers who shop during Black Friday will expect bigger discounts

In 2022, a PwC Holiday Outlook survey revealed that only 20% of respondents planned to shop during Black Friday. However, people’s habits are sticky and Black Friday is the time of the year when they make more purchases than usual and spend more than they should.

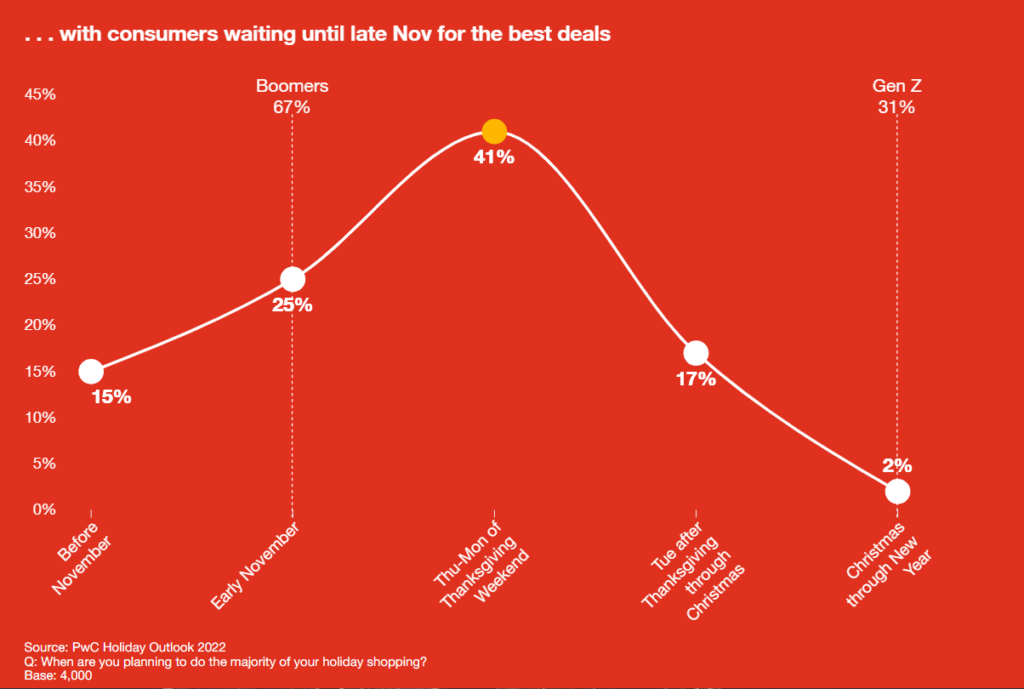

For those consumers who opt to reserve their holiday shopping during Black Friday and the days after it, they will expect bigger discounts than those offered during the regular sale season. The same survey revealed that 41% of respondents are waiting for discounts offered between Thursday and Monday of Thanksgiving weekend.

With inflation still foremost in their minds, consumers want to save their dollars for Black Friday’s impressive discounts. This will help them stretch their limited funds further. The same survey revealed that 74% of consumers expect bigger discounts during the November shopping holidays.

Adobe Analytics reported that discounts hit record highs in 2022 with an average of 25% off the listed price. Categories like toys saw deeper discounts at 34%, while electronics, which sold the most items, saw average discounts at 25%.

What You Can Do:

- Offer discounts in the 15% to 25% range or higher. Discounts lower than this will not be as impressive.

Young people will spend the most on expensive, high-quality items

Shopify reported that the average order value during Black Friday in 2022 was $102.10—a figure slightly higher than 2021’s AOV of $100.70. Meanwhile, Deloitte projected that Black Friday shoppers would spend an average of $205 in 2022, higher than the $190 average spend in 2021.

Whether this increase was due to inflation or higher purchasing power remains unclear, but a Wunderkind survey revealed that young people remain optimistic about their discretionary spending.

Only 22% of Gen Z respondents stated that they would reduce their discretionary spending compared to 52% of the general US consumer population who planned to cut back spending on non-essentials. However, they are looking at quality over quantity and will prioritize quality products despite their higher price tag.

What You Can Do:

- Create discounts for top-quality items that customers will actually want to buy

Paid advertising remains the primary way to reach consumers but social media comes in a close second

Black Friday deals are advertised through various marketing channels, including emails, paid search, SMS, and social ads. A HubSpot survey found that online ads retained the #1 spot that attracted 32.9% of shoppers to Black Friday deals. However, it only had a 0.9% lead over the 32% of shoppers who cited social media ads as the main revenue driver.

Omnisend also released a report stating that brands sent 68% more SMS during Black Friday, leading to a 57% increase in orders. Promotional emails also increased by 28% compared to 2021 and led to a 13.8% increase in orders.

The best way to engage customers is to use a simple three-click journey. For instance, if you’re using Instagram, consumers can scroll through your feed, tap a product they like, and check out without leaving the platform.

If you’re using tailored SMS, they can click the link to view the item similar to their past purchase, tap to add to cart and apply their Black Friday discount code, then check out to complete the purchase.

Whatever advertising channel you use, consumers want a clear and simple purchase path that makes the shopping experience quick and seamless.

What You Can Do:

- Create a clear path to purchase embedded in your marketing ads

Despite Economic Uncertainties, Black Friday Is Here to Stay

Black Friday remains a significant event in the retail calendar, but it’s evolving in response to changing consumer behaviors, economic pressures, and technological advancements.

Despite economic challenges, consumers are willing to spend, embracing practical shopping strategies like early bargain hunting and the use of flexible payment options like BNPL.

Moreover, Black Friday has surpassed its primarily in-store origins, becoming a channel-agnostic shopping event that blurs the lines between online and offline experiences. Features like BOPIS and curbside pickup, along with comparable deals across both channels, attract shoppers seeking convenience.

In the face of rising inflation, retailers who work with their customers to navigate these challenges will build brand loyalty. By offering compelling deals, convenient payment options, and a seamless online and in-store shopping experience, retailers are poised to meet the expectations of today's shoppers.

Frequently Asked Questions

What are the key consumer behavior trends for Black Friday in 2024?

Some of the key consumer behavior trends for Black Friday in 2024 include the continued rise of online shopping, the prevalent use of Buy Now Pay Later options, and the increase in AOV where customers prioritize quality over quantity.

Mobile shopping is expected to remain popular. Consumers will also continue to seek bigger discounts and start shopping early to hunt for the best deals.

Are consumers still shopping in physical stores on Black Friday?

Yes, some consumers still visit physical stores on Black Friday, as seen by the slight increase in in-store traffic in 2022. However, more shoppers are opting for online purchases, and retailers should focus on creating a seamless shopping experience, both online and in-store.

What advertising strategies are effective for Black Friday promotions?

Paid search advertising remains the primary effective way for consumers to discover Black Friday deals. However, social media ads are also gaining traction. Other effective strategies include email marketing, SMS, and MMS marketing.

Effective ads should have a simple purchase path like three-click journeys where customers check out their desired products in three clicks or less. While this ensures the maximum conversion, it also demands precise ad personalization.

How can out-of-stock items be avoided during Black Friday?

Retailers can start offering early Black Friday deals to encourage early shopping, reducing the likelihood of running out of popular items. Carefully managing inventory levels and monitoring demand trends will also prevent out-of-stock situations.