While some creative purists may look at money with disdain, the reality is that you can't operate as a creator for long if you can't pay the bills. You might not like to think about financial matters and may even pay an accountant or tax advisor to do much of the work for you. But you can't ignore such issues for too long before someone from the IRS (or whatever name your country calls its tax department) comes knocking.

However, you will be able to give yourself more time to prove you are a good credit risk and can become profitable if you already have a positive net worth. You might even find banks or other financial institutions could consider lending you bridging finance if your Net Worth is sufficiently positive, and your creative plans look viable.

So, what is Net Worth, and how do you work it out?

What Is Your Net Worth? (+ FREE Net Worth Calculator):

The Influencer Marketing Hub Net Worth Calculator

We have created a simple tool for creators to calculate their Net Worth. In fact, virtually any ordinary person will find this tool helpful for understanding their financial position. Simply enter values for your assets and liabilities, and our calculator will automatically work out your Net Worth for you.

If you are a company, registered charity, or another type of organization, or have complex tax or trust funds, we suggest you work with your accountant, banking advisor, or tax advisor to undertake your net worth calculations.

Real estate

Checking accounts

Savings accounts Retirement accounts

Autos/Cars

Other

Mortgages

Consumer debt

Personal loans Student loans Auto/Car loans Other Net worth $0Assets

Enter the current market value of your home and any other real estate you own.

Current market value

The value of other accounts and investments

Liabilities

Balances on credit cards, unsecured personal loans and payday loans

What is Your Net Worth?

We all own some assets, and most of us owe some amount of liabilities. In simple terms, assets are the things we own, and liabilities are the debts we owe.

You may think that only big businesses have assets and liabilities, but in reality, virtually everybody does. Most kids receive their first assets at a young age, and once they manage to talk their mom or dad into loaning them some money, they have booked up their first liability.

While we may have more liabilities than assets at times in our lives, you will hopefully have more assets than liabilities most often. The name we give to the difference between our assets and our liabilities is our Net Worth. Mathematically, we can write this as a simple equation:

Net Worth = Assets – Liabilities

In theory, this sounds extremely simple. However, in practice, it can be complex, and many accountants and tax advisers have earned good incomes from determining the correct values to use in this equation.

Points To Consider When Deciding on the Values of Your Assets and Liabilities

Technically, your Net Worth is the amount left over if you sell your assets and fully pay your liabilities. It is a personal equivalent of a business's Owner's Equity or a club's Accumulated Funds. Therefore, you need to think carefully about what values to place on your assets and liabilities. Of course, some of these can only be estimates, so you can't expect a perfect answer.

It may sometimes be challenging to determine the values for assets and liabilities.

Valuing Your Assets

Technically you will want to show your assets as worth the amount of cash you could turn them into if you had to liquidate (sell) them today. Of course, this won't be the same value as what you paid for them, and in some cases will be considerably less.

The most straightforward asset to value, apart from any cash you may have in hand, is the value of your bank accounts. You should be able to find the current balances of your accounts from your bank. You might even be able to view these from your banking app on your phone. Likewise, ask your other financial providers for the current values of your investments and retirement accounts. Remember, it is the amount that you could cash them in for today that is relevant. Technically, you might have to pay a break fee if you cancel an investment early, but you probably won't need to go into this level of detail in these calculations.

Include the value of your retirement assets in your calculations. In the case of US citizens, that means the current value of your 401(k)s, IRAs, and taxable savings accounts. Technically, including these could be problematic if you can't cash them out until retirement, but the general consensus is to include these amounts anyway.

Don't overestimate the current value of your vehicles. Cars depreciate, i.e., reduce in value, quickly after they leave the lot. Therefore, you will want to record them at the amount you would get if you sold them today. One way you can find this figure is to look at a car auction to see what prices people are paying for similar vehicles to yours. Depending on the type of insurance you have, you may already have a recent valuation from your insurance company.

Be careful when including your other assets. Many of the things we purchase and use have little resale value. You could look at a pawn broker's website in your area for an estimation of what you could get for personal items, such as electronics or furniture if you had to sell them. However, you certainly can't include most of these types of assets in your calculations for the amount you paid for them.

If you have used an asset for a secured loan, you can still include it amongst the assets in these calculations but ensure that you record the corresponding debt in your liabilities.

If you own real estate, you have a major asset you can include in this calculation. Remember, unless you are freehold, you probably still have mortgage repayments to make, and you should include the remaining amount of debt in your liabilities. If you live in an area that has seen rising house prices over the last few years, the value of your house may be considerably more than what you paid for your property, particularly if it was more than a few years ago. Depending on where you live, you may discover the current market value of your house or other property from a local real estate office or possibly your council.

Valuing Your Liabilities

Your liabilities will be easier to measure in most cases. They are the bills that you have at the date on which you make your calculations, i.e., the sum of money that you expect to have to repay in the future. These figures will often include the agreed interest you will have to pay. Before you begin to worry about having to calculate interest rates on future debt, like your mortgage interest for the next 25 years, you can generally get away with simply using the information you know now. For example, if you currently have to pay $1,000 per month off your mortgage, and have ten years left to go, then at the moment, the value of your mortgage debt will be $1,000 x 12 (months) x 10 (years) = $120,000. If these numbers change later, then you can recalculate your Net Worth at that point.

Similarly, for something like your credit card, simply record the amount you owe on it the day you make your calculations. You don't need to worry about any potential future purchases.

If you went to university or college and still have student loans to repay, check with your provider for an up-to-date record of how much you still owe. Remember to include all the debts that you currently owe, from every source, in your calculations.

Producing a Statement of Affairs

A Statement of Affairs shows a person's Assets, Liabilities, and Net Worth at a moment in time. It is an individual's equivalent to a business's Balance Sheet. In most cases, a Statement of Affairs is relatively simple.

The layout of a Statement of Affairs will depend on where you live, although it is not a formal account, so you won't have to get too worried about any correct formatting. A simple Statement of Affairs could look like this:

Why Should Creators Calculate Their Net Worth?

Your Net Worth is just one of a series of metrics you should know so you can understand your financial health. Others include your current Net Income, your credit score, and the amount you have saved for retirement.

Ideally, you should gradually build up your Net Worth over your lifetime. Of course, you might temporarily decrease it at times, but the medium to long-term trend should be upwards.

Banks and other financial institutions look closely at your Net Worth when they consider whether to advance you funding. They want to ensure that if things don't work out, you can at least afford to repay their loans by selling some assets.

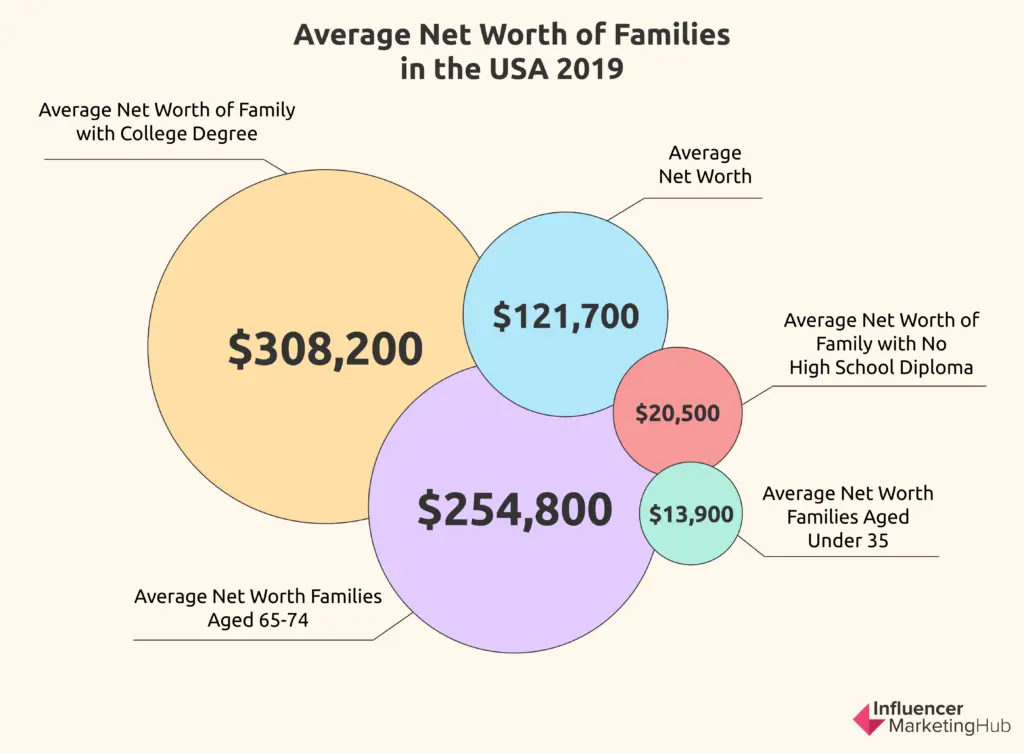

According to the Federal Reserve 2019 Survey of Consumer Finances, in the United States, the average Net Worth for families in 2019 was $121,700. However, figures differed dramatically depending on the age of the families. For example, families aged under 35 only averaged a net worth of $13,900. Those aged 65-74, however, had an average Net Worth of $254,800.

Another notable area of difference in Net Worth calculations is the level of education. The average Net Worth for a family with no high school diploma is $20,500. However, the average for those with a college degree was $308,200.

![Instagram Money Calculator [Influencer Engagement & Earnings Estimator]](https://s.influencermarketinghub.com/imaginary/resize?width=400&height=200&type=webp&url=https://influencermarketinghub.com/wp-content/uploads/2017/03/Instagram-Influencer-Sponsored-Post-Money-Calculator.png)