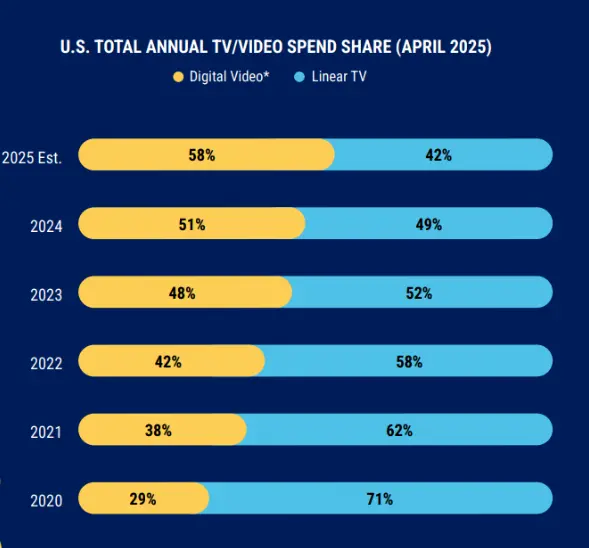

- Digital video spend hits $72.4 billion (58% share) in 2025.

- 2020–2025 CAGR outpaces total media by 2×–3×.

- Precision targeting & real‑time optimization power digital’s appeal.

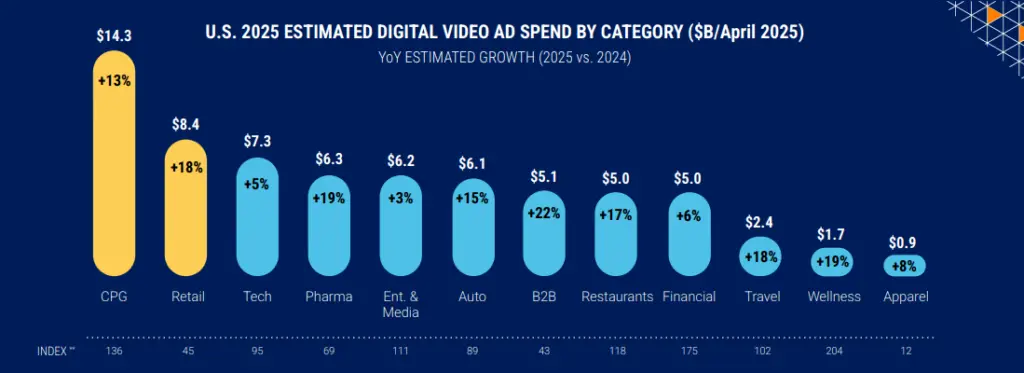

- CPG, retail, pharma lead category growth.

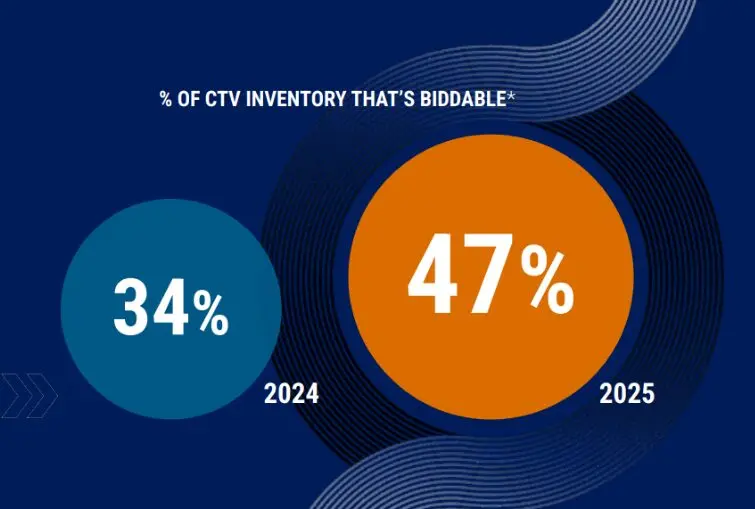

- 47% of CTV inventory now biddable—programmatic expertise required.

- Cross‑platform measurement is critical to ROI and budget efficiency.

Digital video’s rise to prominence in U.S. ad budgets represents a tectonic shift in how marketers allocate precious dollars, and nowhere is this more evident than in the Interactive Advertising Bureau’s (IAB) July 2025 Digital Video Ad Spend & Strategy report.

Below is an expanded, data‑rich news‑style article exploring how and why digital video now commands 58% of all TV/video ad spend, and what senior social media and influencer marketing professionals need to know.

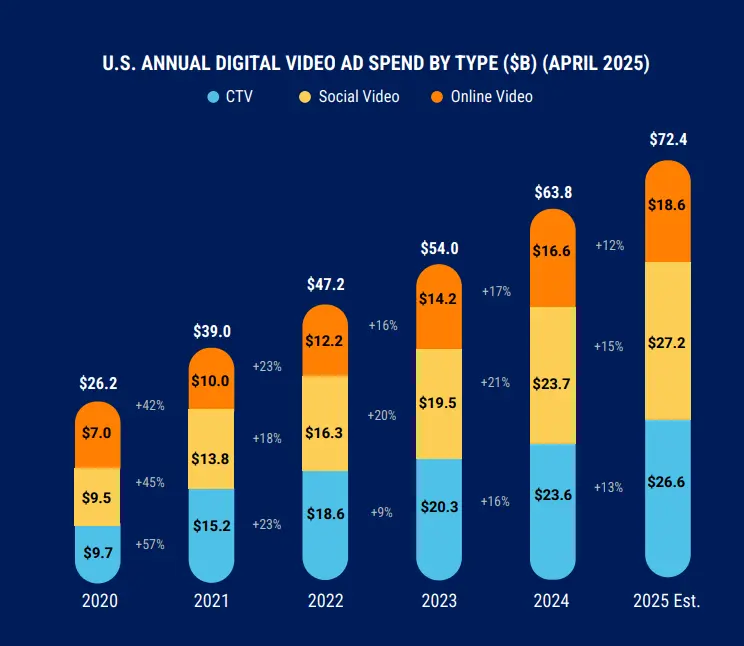

From $26 B to $72 B: A Half‑Decade of Exponential Growth

- 2020: Digital video spend stood at $26.2 billion (29% share).

- 2021–2024: Annual spending climbed from $39 billion (+49% YoY) in 2021 to $63.8 billion (+18% YoY) in 2024.

- 2025 Projections: A further 14% increase will push spend to $72.4 billion—two to three times faster growth than total media markets.

This trajectory illustrates not only accelerating demand but also the maturity of digital video as a channel. In contrast, traditional linear TV has seen its share erode continuously, dipping below half of total video ad spend in 2024 amid subscriber losses of 6.3 million households.

Why Marketers Are Flocking to Digital Video

IAB's report outlines three main reasons for how advertisers plan, buy, and optimize video campaigns. Those are:

1. Programmatic Precision Across Channels

Programmatic buying has become foundational for streaming strategies. The IAB report finds that 47% of CTV inventory will be available via real‑time bidding in 2025—up from 34% in 2024—bringing the same data‑driven targeting and dynamic budget adjustments that advertisers have long used in display and social channels to the CTV ecosystem.

Beyond mere availability, this shift enables marketers to optimize creative, audience segments, and bid parameters mid‑flight, ensuring ads reach high‑value viewers precisely when they are most likely to engage.

Source: IAB

Agencies and in‑house teams alike are building out programmatic specialists who can leverage machine‑learning algorithms for predictive forecasting, audience look‑alike modeling, and fraud detection within streaming environments. These capabilities not only enhance ROI but also reduce manual trafficking work, freeing up creative and strategy resources to focus on campaign innovation.

2. Engagement Across Platforms & Formats

Digital video spans long‑form streaming, short social clips, and interactive shoppable ads, meeting consumers wherever they choose to watch. In 2025, social video spend alone reached $27.2 billion, while CTV spend rebounded to $26.6 billion following industry disruptions last year.

Source: IAB

3. Linear TV’s Waning Influence

Linear television has lost its momentum as digital formats solidify their lead. After digital video surpassed linear TV share in 2024—driving linear’s implied share below 50%—the IAB projects this gap will widen in 2025. Without marquee events like elections or the Olympics to spike viewership, linear platforms can no longer justify their premium rates, reinforcing the advertiser shift toward digital video.

Source: IAB

As a result, media planners are increasingly reallocating dollars away from “scatter” and “upfront” linear buys toward digital line items that offer guaranteed impressions, audience guarantees, and performance-based pricing. While linear still holds sway for certain live‑event audiences, brands seeking sustained reach and measurable outcomes are directing their most innovative budgets into streaming, social, and online video ecosystems.

Industry Perspectives

The report’s survey of 368 senior ad‑spend decision‑makers reveals that perceived content quality remains the top criterion when evaluating video channels, yet failure to deliver business outcomes is the leading cause for budget reductions or reallocations.

In practice, this means that while premium inventory and engaging creative are table stakes, the campaigns that consistently scale spend are those demonstrating clear lifts in store visits, e‑commerce conversions, or other bottom‑line metrics.

Several agencies interviewed in the report emphasize the necessity of hybrid measurement frameworks combining deterministic identifiers (like user‑logged‑in data) with probabilistic modeling to reconcile digital video performance with broader brand health and sales metrics. These sophisticated approaches help marketers justify further investment by connecting ad exposures to incremental outcomes.

Category Spotlight: Leading Investors

As digital video becomes mainstream, certain industries are accelerating their adoption even faster. The IAB identifies consumer packaged goods (CPG), retail, tech, and pharmaceutical sectors as the fastest‑growing investors in 2025.

Source: IAB

In CPG, brands leverage addressable CTV to deliver product tutorials and demo-driven storytelling at scale, pairing these placements with limited‑time offers surfaced through dynamic ad insertion.

Retail marketers—particularly those with omnichannel footprints—use geo‑fenced streaming activations to synchronize TV‑style creative with in‑store promotions, driving foot traffic and online order lift. Meanwhile, pharmaceutical advertisers apply strict compliance playbooks to deploy educational video messages across devices, ensuring regulatory adherence while maximizing audience reach.

Strategic Imperatives for Senior Marketers

To capitalize on digital video’s prevailing momentum, senior social media and influencer marketing professionals should:

- Rebalance Media Mix Toward Digital

Rigorously audit existing linear commitments and redirect incremental spend to CTV, social video, and online video placements that offer addressability, performance guarantees, and real‑time optimization.

- Invest in Unified Measurement

Adopt or partner on cross‑platform analytics solutions that harmonize data from digital video and linear sources, delivering a single view of campaign performance against brand and direct‑response KPIs.

- Build Agile Creative Workflows

Establish modular production processes that produce a “master” asset alongside cut‑downs and interactive variants—enabling swift iteration based on performance signals and platform requirements.

- Deepen Programmatic Expertise

Expand in‑house or agency capabilities to leverage growing shares of biddable CTV inventory, employing advanced audience segmentation, look‑alike modeling, and machine‑learning bid optimization to maximize ROI.

Looking Ahead

The IAB forecasts digital video could approach 65% of total TV/video ad spend by 2027, cementing its role as the centerpiece of video strategies within the decade. As media fragmentation intensifies, brands that master the interplay of programmatic precision, cross‑format storytelling, and outcome‑driven measurement will lead the market—transforming video from a cost center into a scalable growth engine.

By aligning budgets, capabilities, and creative to this digital‑first reality, senior marketers can harness video’s full potential and drive sustained business impact.