It should come as no surprise that marketers love statistics. We have even found that some of the most popular posts on the Influencer Marketing Hub highlight marketing facts and figures.

Researchers collect a considerable quantity of data about different aspects of marketing on the internet. They use this data to ensure that they know the latest internet usage trends, and marketers have to adapt accordingly.

We wrote the first version of this post in 2018, based on 2017 and 2018 data. With details from the Interactive Advertising Bureau's (IAB) 2021 Internet Advertising Revenue and Datareportal’s Digital 2022: Global Overview Report, we can paint a more detailed and accurate picture of internet advertising as it stands today. We have also updated the statistics in this post to include more recent data. In this article, we'll highlight the interesting internet advertising trends of the past couple of years, as well as how mobile and ad blocking are impacting the different advertising sectors.

Summary: Quick Jump Menu

- 1. Global Digital Ad Spend Amounts to Over $600 Billion in 2022

- 2. Video Ad Spend Reached Almost $50 billion in 2022

- 3. Stats Show Digital Channels Gain More Than Others

- 4. Mobile Advertising Will Significantly Outpace Desktop Advertising

- 5. 586M People Use Mobile Browsers That Block Ads by Default

- 6. Ad Blocking Is Declining But Is Still Expected to Cost Publishers Revenue Loss

- 7. Search Remains the Top Advertising Format

- 8. Total Search Revenues Amounted to $78.3 Billion in 2021

- 9. Mobile Digital Advertising Revenue Grew by 37.4% in 2021

- 10. Banner-Related Digital Advertising Amounted to Over $140 Billion

- 11. Digital Video Revenues Increased by 50.8% Over 2021

- 12. Digital Audio Revenues Grew by 57.9% in 2021

- 13. Revenue Generated from Social Media Grew by 39.3% in 2021

- 14. Consumers Are More Open to Acceptable Ads

- Final Thoughts

- Frequently Asked Questions

1. Global Digital Ad Spend Amounts to Over $600 Billion in 2022

While a Statista report shows that digital ad spending reached a value of over $600 billion in 2021, the spending for the end of 2022 is at over 600 billion dollars. Note that this covers all forms of advertising: above-the-line as well as below-the-line campaigns (such as display advertising and video ads). However, it is the internet that is seeing a rapid rise in ad content spending, as digital advertising is projected to grow exponentially to over $870 billion by 2026.

2. Video Ad Spend Reached Almost $50 billion in 2022

The ad spend for video has increased. Connected TV (CTV) increased video ad spend to more than $15 billion in 2021, which increased to $50 billion in 2022. What this means is that ads on digital video platforms will be even more prevalent and pervasive than before. In the US, adults spend an average of 7 hours and 50 minutes every day consuming digital media. This impacts advertising heavily as the ad space shifts from print and television to digital video platforms.

3. Stats Show Digital Channels Gain More Than Others

As per the Internet Advertising Revenue Report 2021, revenue from internet advertising across all major channels increased significantly. This is especially true for digital video (which includes OTT and CTV), social media, internet audio, and search. In fact, a survey from Statista shows social media ads accounted for roughly one-third of total digital spending in 2021, exceeding $150 billion globally.

Digital video revenue increased by 50.8% in 2021, which generated generating $39.5 billion in revenue overall. This makes it one of the fastest-growing media channels. Similarly, a growth rate of 57.9% was recorded for digital audio in terms of growth year-over-year. In addition, there were millions of consumers engaging with Meta platforms, as well as Snapchat, TikTok, and Twitter, as social media advertising increased by 39.3% to $57.7 billion. Moreover, it is significant to note that although search revenue increased significantly at 32.8% in 2021, its growth was not as remarkable as the other ones mentioned.

At the beginning of 2022, the number of internet users was at 4.95 billion, with internet penetration standing at 62.5%. With the exception of the first quarter of 2022, social media advertising spending worldwide rose in all but one quarter between the fourth quarter of 2021 and the third quarter of 2022. The third quarter of 2022 saw a 12% increase. With that said, digital channels continue to dominate overall internet advertising revenue. It should be noted, however, that as social media platforms become more intrusive with annoying ads and ad-blocking software grows in popularity, digital ad revenues may experience downward pressure in the years to come. However, there is still significant potential for growth on a global scale as long as marketers continue finding new ways to reach consumers through internet ads and other publisher sites.

4. Mobile Advertising Will Significantly Outpace Desktop Advertising

Mobile advertising is nothing new, but it has been increasing in prominence in recent years. This is largely due to the fact that people are spending more time on their mobile devices than ever before. While desktop advertising is still growing, it is mobile advertising that is seeing the most significant increase—that is, both on mobile websites and mobile apps.

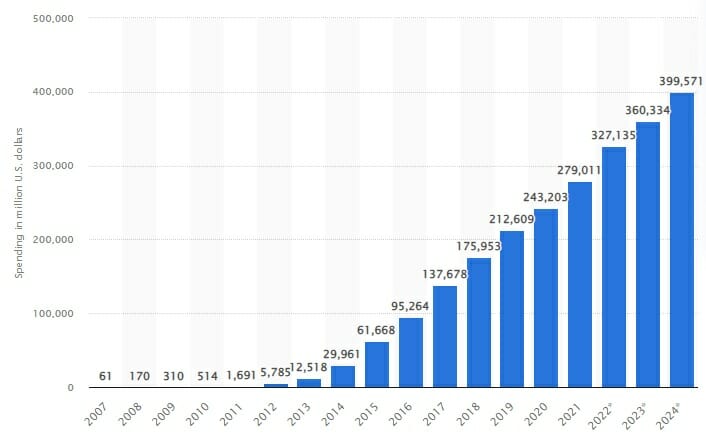

The past couple of years have been about mobility, and this is only set to continue in the future. This can be seen in the trend of people using their smartphones to do everything from ordering food to buying clothes and even booking holidays. Consequently, it is not surprising that mobile ad spending is expected to reach almost $500 billion by 2024, which is quite a notable growth from the $276 billion spent in 2020.

5. 586M People Use Mobile Browsers That Block Ads by Default

The number of mobile ad-blocking software and browsers that are actively used across the globe has been increasing rapidly and is now estimated to be around 586 million. This growing number presents a significant challenge for advertisers, as it means that their ads are being seen by fewer people.

What’s more, research in the US shows that ad blockers are most commonly used by those aged 25-34, which is the key demographic for many brands. This is particularly problematic, as this age group is also among the most elusive when it comes to advertising. Aside from being heavy mobile users, they are in a position to make purchasing decisions. These factors coupled with their use of ad blockers can cost brands a lot of money. In fact, brands and publishers lose billions of dollars every year due to ad blocking.

6. Ad Blocking Is Declining But Is Still Expected to Cost Publishers Revenue Loss

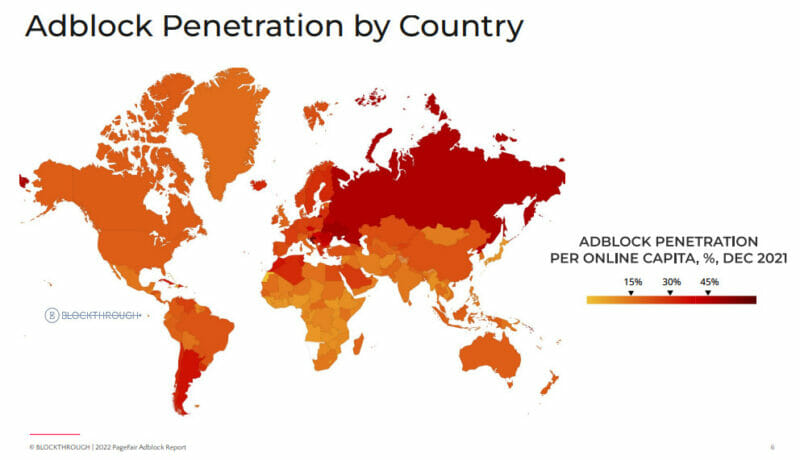

One of the most significant challenges facing the publishing industry is ad blocking. This is because it results in lost revenue, as well as a decline in readership. While the use of ad blockers was shown to have penetrated other parts of the world, such as Asia and Europe, it has been declining in recent years.

Source: PageFair Adblock Report

According to eMarketer, the United States had a slow decline from 2018 to 2021 in terms of ad-blocking penetration and growth, dropping to 3.3% from 7.5%. This is good news for brands and publishers, as it suggests that people are becoming less likely to use ad blockers.

Even with this decline, it does not mean users will stop using ad blockers altogether. In fact, it is still estimated that ad blockers will cost publishers a lot of money in the coming years. In effect, this means that ad blocking will continue to be a significant challenge for the publishing industry.

7. Search Remains the Top Advertising Format

In IAB's 2021 Ad Revenue Report, search remains at the top of all advertising formats and accounts for 41.4% of the total advertising revenue for 2021. Search generates the majority of desktop and mobile revenue. This shows that people are still using search engines to look for the products and services they need. And since advertisers want to be where their target audiences are, it's no wonder that this channel remains one of the most popular.

8. Total Search Revenues Amounted to $78.3 Billion in 2021

There is no doubt that revenue generated through search grew significantly (32.8%) in 2021 and even generated more than $70 billion. But it’s also important to note that out of all advertising channels, it was digital video that took the top spot at 50.8%.

For brands and publishers, what this means is that their audience still resorts to search channels as their primary source of information. This is likely because it's easy to use and provides relevant results. Consequently, publishers need to make sure that their site is optimized for search engines to increase their chances of being found by potential readers.

9. Mobile Digital Advertising Revenue Grew by 37.4% in 2021

While the growth rate has decelerated over the past three years—13.4% growth in 2020, 24% growth in 2019, and 40% growth in 2018—mobile advertising revenue in 2021 rose by 37.4%, generating a sum of more than $130 billion. Given the travel restriction caused by the pandemic, people have been increasingly turning to their mobile devices for entertainment, eCommerce, gaming, information, and communication. This resulted in a significant increase in the amount of time people spend on their phones, which then led to more opportunities for brands to reach them with their ads.

However, this did not mean publishers avoided desktops altogether. As reported by the IAB, desktop ad revenue increased by 58.2% in 2021.

Source: statista.com

10. Banner-Related Digital Advertising Amounted to Over $140 Billion

Advertising products and services through digital banner ads is still a popular way for brands to reach their target audiences. This is because it allows them to be seen by potential customers who are already interested in what they have to offer. In 2021, banner-related digital advertising revenue amounted to over $140 billion. What does this mean for publishers? It simply means that there is still a lot of money to be made from banner ads. Consequently, they need to make sure that their site is able to display these types of ads in order to maximize their earnings. Whether it be desktop, mobile, or both, banner ads should be a part of their ad strategy.

11. Digital Video Revenues Increased by 50.8% Over 2021

According to IAB, digital video revenues increased by 50.8% over the previous year, generating a total of more than $39 billion. This was largely due to the increasing popularity of streaming services, as well as the number of people who are now watching videos on their mobile devices. In fact, it is estimated that by 2022, it could be that more than 80% of all internet traffic will be related to video content.

12. Digital Audio Revenues Grew by 57.9% in 2021

In the same report from IAB, digital audio revenues were at their highest at 57.9% in 2021. This growth can be attributed to the increasing popularity of streaming services such as Spotify. As a result of this trend, brands and publishers are allocating more of their budget to audio advertising. This means audio ads can generate a lot of revenue, so publishers need to make sure that they are maximizing them to the fullest.

13. Revenue Generated from Social Media Grew by 39.3% in 2021

Social media platforms have become one of the most popular places for people to connect with friends and family, as well as to discover new products and services. Consequently, it's no wonder that social media advertising revenue grew by 39.3% in 2021. This growth is only expected to continue because of platforms like Facebook, Instagram, Twitter, and TikTok, so publishers are urged to get involved as soon as possible. When done correctly, social media advertising can be a powerful way to reach your target audience and generate revenue.

14. Consumers Are More Open to Acceptable Ads

In consideration of the user experience of online users, ad-blocking software has become increasingly common. In fact, an Independent Ads Committee was formed to address ad-blocking concerns. Their goal is to create more acceptable ads within a defined set of standards that internet users will be more willing to view without blocking them. In the 2022 report from PageFair, it found that the average opt-in rate for acceptable ads is now over 95% among users of browsers and browser extensions supporting the feature.

Source: PageFair Adblock Report

Final Thoughts

Overall, ad blocking is on the decline as users become more tolerant of acceptable ads. Publishers must pay close attention to user experience and adhere to best practices to ensure that ads are viewed properly. Additionally, social media, eCommerce, and gaming platforms on mobile continue to grow in popularity, which will only increase advertising revenue over the next few years. Whether it’s organic or paid advertisement, online ads will continue to be a major player in the internet economy.

Global digital ad spending has seen significant growth. In 2021, it reached over $600 billion and continued to grow, with projections suggesting it will exceed $870 billion by 2026. This increase encompasses various forms of digital advertising, including display advertising and video ads. Mobile advertising has been outpacing desktop advertising significantly. As more people use their mobile devices for various activities, mobile ad spending is expected to reach almost $500 billion by 2024, up from $276 billion in 2020. Mobile advertising includes ads on mobile websites and apps, reflecting the growing trend of mobile usage. Ad blocking on mobile devices is quite prevalent, with an estimated 586 million people using mobile browsers that block ads by default. This poses a significant challenge for advertisers, as their ads reach fewer people, particularly within the key demographic of 25-34-year-olds, who are heavy mobile users and significant decision-makers. Ad blocking can result in substantial revenue losses for brands and publishers. Video ad spending has increased dramatically, reaching almost $50 billion in 2022. Connected TV (CTV) contributed significantly to this growth. Video ads are crucial because they align with the increasing consumption of digital media. In the US, adults spend an average of 7 hours and 50 minutes daily consuming digital media, making video ads a vital component of modern advertising strategies. Acceptable ads aim to balance the need for advertising revenue with a positive user experience. The Independent Ads Committee has established standards for acceptable ads, which users are more willing to view without blocking. As of 2022, the opt-in rate for acceptable ads is over 95% among users of browsers and browser extensions that support this feature. This indicates a growing tolerance for ads that adhere to user-friendly standards.Frequently Asked Questions

How has global digital ad spending changed in recent years?

What is the impact of mobile advertising compared to desktop advertising?

How prevalent is ad blocking on mobile devices, and what impact does it have on advertisers?

What trends are seen in video ad spending, and why is it important for advertisers?

What role do acceptable ads play in the context of ad blocking?