NFTs have evolved far beyond the 2021 boom, and creators entering the space face a very different landscape in 2025. Blockchains have diversified, marketplaces have specialized, and creator tools have become more sophisticated.

The question is no longer “Should I mint an NFT?” but rather “Where should I mint, and which platform gives my work the best chance to succeed?”

Marketplace trends now reflect broader shifts in Web3: lower-cost chains such as Solana and Cardano making minting more accessible, curated Ethereum galleries elevating digital art, and exchange-driven platforms introducing liquidity at a scale not seen before.

At the same time, creators increasingly prioritize contract ownership, flexible minting mechanics, and dependable royalty systems.

This guide helps you navigate those changes by breaking down the leading NFT marketplaces in 2025, what they offer, who they serve, and how to choose the platform that aligns most closely with your creative goals.

- 1. OpenSea

- 2. JPG.Store

- 3. Binance NFT

- 4. Solanart

- 5. Rarible

- 6. SuperRare

- 7. Foundation

- 8. AtomicMarket

- 9. BakerySwap

- 10. KnownOrigin

- 11. Enjin Marketplace

- 12. Portion

- 13. Nifty Gateway

- 14. Decentraland

- 15. Axie Infinity

- Which NFT Marketplace Should You Go With?

- Finding the Right Marketplace to Power Your NFT Journey

- Frequently Asked Questions

Best For: Creators and collectors looking for the largest, most established, multi-chain NFT marketplace with a broad reach. Supported Blockchain: Ethereum, Polygon, Arbitrum, Optimism, Avalanche, Solana, Base, Blast, Zora, Flow, and many more (22+ chains total). Service Fees: NFT Types: General marketplace; supports digital art, collectibles, virtual goods, music, video, domain names, gaming assets, virtual real estate and more. Minting & Upload Options: OpenSea offers “lazy-minting” on supported lower-cost chains (e.g., Polygon), meaning you can upload metadata and create a listing without paying gas upfront. On high-cost chains (like Ethereum), you’ll need to pay gas for minting. If you are a creator or influencer exploring the NFT space in 2025, OpenSea remains the most recognized and widely used marketplace. Founded in 2017, it has grown from a peer-to-peer NFT bazaar into a massive multi-chain marketplace and crypto aggregator that supports NFTs across more than 20 blockchains. Its scale and diversity give you one of the highest chances of finding buyers, whether you produce digital art, music files, gaming items, or virtual real estate. Because OpenSea now embraces many chains, you have flexibility: if gas fees are too high on Ethereum, you can mint and list on a cheaper chain like Polygon and still tap into a global collector base. For emerging creators or those testing a first drop, that flexibility reduces upfront cost and risk. On top of that, the platform remains broadly accepted, and many collectors and traders expect to see new projects there. OpenSea’s multi-chain support is arguably its greatest strength. By 2025, it supports over 22 blockchains, from major networks like Ethereum and Solana to newer alternatives like Base or Blast. That means as a creator you can choose the blockchain that fits your budget and audience; cheaper minting on Polygon or fast trade-ready tokens on Solana, without sacrificing marketplace reach. Because OpenSea has been around since 2017 and survived the NFT boom and bust, it remains the largest marketplace by listings and user base. Millions of tradable items, and a wide variety of asset types (art, collectibles, gaming items, music, virtual real estate, etc.) make it more likely that your work will be discovered. With only a 1.0 % platform fee for sales and the option to enable royalties per collection, OpenSea gives you a competitive economic structure. Combined with the ability to mint via lazy-minting on low-fee chains, this keeps your upfront and ongoing costs lean and lets you maximize net revenue. The world’s largest digital marketplace for crypto collectibles and non-fungible tokens (NFTs), including ERC721 and ERC1155 assets. Buy, sell, and discover exclusive digital assets like Axies, ENS names, CryptoKitties, Decentraland, and more. Best For: Creators, artists, and NFT-project builders working on Cardano-native NFTs, especially those targeting low-gas minting, affordable entry, and a community of Cardano collectors. Supported Blockchain: Cardano (ADA-backed) Service Fees: NFT Types: General Cardano-native NFTs — digital art, collectibles, avatars or gaming-style assets, utility or community NFTs, and other Cardano-compatible formats. Minting & Upload Options: Native Cardano NFT support with smart-contract infrastructure; you can create single NFTs or collections (via “Policy ID”), and mint directly on Cardano using JPG Store’s minting tools. Wallet-based minting; no lazy-minting model but low mint costs (Cardano gas is typically low compared to Ethereum). JPG Store stands out as the largest and most widely used NFT marketplace on Cardano, tailored for creators and collectors operating within Cardano’s ecosystem. It offers a smooth on-ramp to minting, listing, and selling NFTs in ADA, which keeps cost and complexity relatively low. Because minting costs are modest (2 ADA + network fees), JPG Store lowers the barrier to entry compared to high-gas chains. For creators experimenting with small collections, community-driven art drops, or utility-oriented NFTs (games, avatars, metaverse-style items), JPG Store presents a practical and purpose-built option. Also, JPG Store has evolved beyond basic marketplace functions. It supports collection launches, verification workflows, and a suite of creator tools, including a launchpad for new projects, and offers lending/borrowing features using NFTs as collateral. For Cardano-native artists or projects whose audience lives on Cardano — or who want to tap into a less saturated NFT ecosystem compared with Ethereum — JPG Store can serve as a credible primary marketplace. Because JPG Store operates on Cardano rather than Ethereum, you benefit from lower fees, a growing community of Cardano-native users, and a different supply-demand dynamic than on saturated Ethereum marketplaces. With a fixed 2 ADA mint fee and relatively low Cardano blockchain fees, you can mint NFTs affordably. This makes JPG Store suitable for creators testing collections or producing multiple works without high upfront costs. The platform offers collection creation via “Policy ID”, verification options, and a launchpad for new projects — enabling creators to manage drops, metadata, and community-ready launches without needing deep technical expertise. Best For: Creators and brands looking for high liquidity, access to a large existing crypto-user base, and a streamlined NFT experience integrated with a major exchange. Supported Blockchain: Binance Smart Chain (BSC) and Ethereum. Service Fees: NFT Types: General marketplace — digital art, collectibles, gaming items, mystery-box NFTs, entertainment and sports-related drops, utility-style NFTs. Minting & Upload Options: Minting is possible, but by default only approved/authorized creators can create NFTs on Binance NFT. Gas or network fees apply depending on chain (BSC or Ethereum). Binance NFT is the non-fungible token marketplace operated by Binance, one of the largest global crypto exchanges. Launched in 2021, the marketplace leverages Binance’s massive user base, exchange liquidity, and security infrastructure to offer a straightforward entry point into NFTs. Because Binance NFTs work across BSC and Ethereum, the platform caters to both users who prefer lower-fee, faster transactions (via BSC) and those who want compatibility with the broader Ethereum ecosystem. For a creator or brand, this dual-chain support gives flexibility: you can choose BSC for cost-efficient drops or Ethereum for broader visibility among traditional NFT collectors. Binance integrates NFT trading with its broader exchange ecosystem — meaning you can use the same account, wallet, and crypto balances you already hold on Binance to mint, buy or sell NFTs. Because of its scale, Binance NFT tends to offer high liquidity and visibility. Drops from major brands, gaming projects or entertainment-linked NFTs can reach a big audience quickly. For creators who prioritize reach, volume, and ease of use, Binance represents one of the more pragmatic NFT marketplaces in 2025. With support for both BSC and Ethereum, Binance NFT lets you pick the chain that fits your project’s economics and target audience. Lower-cost BSC for volume drops, or Ethereum for reach among traditional crypto art collectors. Binance’s massive ecosystem, exchange users, wallets, liquidity, offers built-in potential buyers and exposure. For creators, this means easier onboarding for collectors who already use Binance, reducing friction in discovery and purchase. With a flat 1% service fee on sales, no listing fees, and configurable creator royalties on secondary sales, Binance NFT presents a cost-effective alternative to many high-fee marketplaces. Best For: Digital artists, PFP collectors, gaming-asset creators and anyone working with Solana-native NFTs who want a straightforward, low-fee marketplace on a fast, high-throughput blockchain. Supported Blockchain: Solana Service Fees: NFT Types: Solana-based digital art, profile-picture (PFP) collections, collectibles, gaming/metaverse assets and general Solana NFT categories. Minting & Upload Options: Creators mint NFTs using Solana — listing and selling require standard chain transaction (SOL) fees. There is no widely advertised lazy-minting or gasless-mint option. Solanart is among the original and most established NFT marketplaces built on Solana, recognized for offering creators and collectors access to many of the chain’s notable NFT collections. Its infrastructure leverages Solana’s strengths — fast confirmations, high throughput, and low transaction costs — enabling comparatively inexpensive minting and trading compared with high-gas chains. The platform’s community and track record include hundreds of thousands of trades to date, making it a trusted environment for Solana-native NFTs. As a creator, this means your work is exposed to a base of users already active in Solana’s NFT ecosystem, and you benefit from a marketplace optimized for speed and cost-efficiency. For projects oriented around PFP collections, collectibles, gaming assets, or general digital art, especially those aiming for Solana users, Solanart offers a solid foundation: relatively low fees, native-chain compatibility, and access to an established Solana-NFT audience. Solanart runs purely on Solana, which allows it to benefit from the blockchain’s high throughput and low fees. That makes minting, listing and trading more cost-efficient for creators and collectors compared with high-fee chains. Many prominent Solana collections and PFP/collectible projects list via Solanart. If your work aligns with these formats — rather than fine art or highly curated galleries — Solanart provides ready demand and community familiarity. With a flat ~3% marketplace fee and minimal or no listing fees (depending on sale type), the economics are clear and predictable, helping creators plan pricing without complex fee surprises. Best For: Creators who want flexibility across many blockchains and a community-driven environment with low-barrier minting. Supported Blockchain: Ethereum, Polygon, Immutable X, Base, zkSync Era, RARI Chain, Celo, Moonbeam, Palm, Aptos and several others. Service Fees: NFT Types: Digital art, collectibles, gaming items, metaverse assets and other general NFT categories. Minting & Upload Options: Lazy minting available on supported chains, enabling creators to list NFTs without upfront gas fees. Rarible has evolved into one of the most flexible multi-chain NFT marketplaces in 2025, structured around broad accessibility and community influence. Its defining characteristic is its reach across a large number of blockchains, which positions it as a versatile option for creators who want choice in how they mint and sell their work. By supporting both high-traffic ecosystems such as Ethereum and lower-cost or emerging networks like Immutable X, Base or Aptos, the platform allows creators to adapt their strategy to their budget, audience and technical needs. Another notable aspect of Rarible is its fee structure. Unlike flat-fee marketplaces, Rarible uses a sliding model that becomes more favorable as the item price increases. This can make the platform especially appealing to creators producing mid-tier or premium pieces. In addition, lazy minting remains a practical option for those who prefer to avoid upfront blockchain costs, making the onboarding experience smoother across chains that support this feature. Rarible’s marketplace activity is influenced heavily by community participation, and its decentralized ethos still shapes how features roll out and evolve. For creators who value experimentation and cross-chain reach, Rarible offers a low-friction way to publish work while maintaining control over pricing, royalties and distribution strategy. Rarible’s architecture emphasizes chain diversity. With support for more than twenty networks, creators can choose environments that balance cost, liquidity and audience alignment without switching platforms. The sliding fee system becomes more advantageous as sale prices increase. This benefits creators with higher-value work and creates a pricing environment that aligns revenue potential with platform costs. Lazy minting offers a practical approach to publishing NFTs without incurring blockchain fees upfront. This is particularly useful in multi-chain ecosystems where gas conditions vary widely. Best For: Artists who create one-of-a-kind digital art and want exposure within a curated, high-quality NFT art gallery environment. Supported Blockchain: Ethereum Service Fees: NFT Types: Curated digital art (1/1 unique pieces), including images, animations, 3D art and other original digital artworks. Minting & Upload Options: Minting occurs via ETH on Ethereum. There is no public “lazy-minting” option; artists must pay gas fees to mint their work. SuperRare stands out as a premium, invitation-based NFT marketplace that positions itself as a digital art gallery more than a general NFT bazaar. Since launching in 2018, it has specialized in single-edition (1/1) digital artworks, giving collectors access to unique, limited-edition pieces. The platform operates exclusively on Ethereum. All transactions, from minting, listing, bidding, and purchases, are denominated in ETH. Because of its curated nature, SuperRare tends to attract serious collectors who value rarity, provenance, and aesthetic quality, rather than users browsing for mass-market or utility NFTs. SuperRare is best suited for artists with strong portfolios and a commitment to digital art as a medium. If your art fits that profile and you aim for premium positioning, SuperRare can serve as a gallery-like platform that signals quality and scarcity. SuperRare preserves a high standard by curating which artists can list. By maintaining an exclusive artist roster, the platform builds a high-end brand reputation in digital art. Collectors expecting polished, rare, one-of-a-kind pieces tend to browse here, which can elevate perceived value for listed works. Every NFT on SuperRare is a 1/1 — truly one-of-a-kind. That means if you list on SuperRare and your work sells, it will not be diluted by editions or reprints. For serious art collectors and artists building digital-art careers, this provenance and scarcity can significantly enhance long-term value and collectability. Secondary-sale royalties (10%) give creators a stream of income beyond the first sale. In addition, the platform is governed by a community via token-based governance (holders of the platform’s native token participate in decisions and curation), which gives artists and collectors a stake in how the marketplace evolves. SuperRare may not be the easiest entry point due to its exclusivity and higher costs, but for creators focused on high-quality, collectible digital art, it remains one of the most respected marketplaces in Web3. Best For: Digital artists and creators focused on high-quality, art-centric NFTs and curated auctions. Supported Blockchain: Ethereum (with optional drop/mint support on L2 chain Base since 2024) Service Fees: NFT Types: Curated digital art, 1-of-1 artworks, drops and editions, galleries or curated collections Minting & Upload Options: Creators deploy their own smart-contract Collections. Minting requires gas; there is no “gasless lazy-minting” option. For Drops or Editions, you pay the per-mint fee (0.0008 ETH) plus gas. Foundation remains one of the most respected curated NFT marketplaces in 2025, known for its focus on high-quality digital art and a community-led, invitation-based onboarding model. Originally launched in 2021, the platform’s mission centers on putting artists first by ensuring that works listed are serious art pieces rather than mass-minted disposable items. The marketplace leans heavily into auction-driven sales and curated editions or drops. That structure tends to attract collectors who value scarcity, provenance, and artistic merit. Because you mint using your own smart-contract collection, you retain control over your contract and artwork ownership, an appealing setup for creators wanting long-term control over how their work is managed and resold In 2024, the platform added support for the Ethereum L2 chain Base. That gives creators optional flexibility to mint or sell on a lower-fee chain when appropriate, though Ethereum remains the backbone. Foundation uses a selective, invitation-based approach rather than open minting. This keeps overall marketplace quality high and ensures works remain art-focused rather than flood-driven. As a creator, this means your art appears in a context where collectors expect refinement and worth. On Foundation, you deploy your own smart-contract Collection, meaning you own and control your contract and future releases. That gives you long-term control over how your art is managed, updated, or evolved. Foundation accommodates traditional 1-of-1 auctions but also supports drops and editions, giving you flexibility in how you release your work depending on strategy and audience. Best For: Creators, game-asset developers, and collectors who want low-cost NFTs on a blockchain built for digital collectibles and gaming, seeking shared liquidity and efficient marketplaces. Supported Blockchain: WAX (via the AtomicAssets standard on EOSIO-related chains). Service Fees: NFT Types: Digital collectibles, gaming and metaverse items, virtual goods, in-game assets, and other AtomicAssets-compatible NFTs (art, utility, game items). Minting & Upload Options: Creators mint via the WAX blockchain using AtomicAssets. There is no typical “lazy-minting” setup like L2 lazy-mint platforms; minting and listing require creation under the AtomicAssets standard. AtomicMarket acts as a decentralized smart-contract marketplace on WAX (EOSIO) built around the AtomicAssets standard. Because of the shared-liquidity model, any NFT listed through AtomicMarket becomes visible across all front-ends that use its contract, increasing exposure without requiring multiple listings. As a creator or game-asset developer, this shared liquidity and cross-platform visibility mean a single listing can reach a broader ecosystem of collectors, gamers, and traders. The platform’s design lets you list and auction multiple NFTs or bundles (as long as they belong to the same collection) under a unified contract. Because ownership is held in the smart-contract until sale, sellers maintain control until a buyer accepts the offer, preserving security and reducing nthe eed for repeated transfers or approvals. For creators working in gaming assets, tradable virtual items, or collectibles, this gives efficient distribution and resale capabilities. Given WAX’s orientation toward NFTs and gaming items, often with lower barriers to entry and lower transaction friction compared with major chains, AtomicMarket provides a practical, cost-effective alternative for creators who prioritize affordability and liquidity over the speculative art-market pricing found on Ethereum-based marketplaces. AtomicMarket’s core smart contract aggregates inventory across all marketplaces using it. That means when you list an NFT or bundle the sale becomes available to all front-ends — maximizing visibility without duplication. NFTs are not transferred to escrow at listing. Instead, an “offer” is created. Ownership remains with you until a buyer purchases, minimizing unnecessary gas or transfer overhead and reducing risk and complexity for creators. Base marketplace fee is 1% maker + 1% taker. Moreover, developers of collections can set their own market fee up to 15%, giving flexibility to monetize their collection governance or community directly. This makes AtomicMarket more flexible than rigid-fee platforms. Best For: Creators, artists and NFT-project builders who prefer low-cost minting and trading on BSC and want a combined DeFi + NFT environment. Supported Blockchain: BNB Smart Chain (BSC) Service Fees: NFT Types: General NFTs — digital collectibles, gaming or metaverse-style items, NFT “combos”, and marketplace art/collectible listings. Minting & Upload Options: You mint NFTs through smart contracts on BSC; BakerySwap does not offer ETH-style “lazy-minting.” Gas and BSC transaction fees apply for creation and transfers BakerySwap combines decentralized finance (DeFi) and NFTs under one roof, built on the BNB Smart Chain. Originally launched in 2020, it became recognized as the first NFT-ready automated market maker (AMM) on BSC. The platform’s dual nature, a DEX plus an NFT marketplace, allows creators not only to mint and sell NFTs but also to engage with DeFi features such as liquidity pools, staking, or yield farming. That gives it a unique positioning: if you are working on NFTs but interested in tokenomics and DeFi-native audiences, BakerySwap offers an integrated ecosystem. Because it runs on BSC, transaction and gas fees tend to be far lower than on chains like Ethereum. That can make it a pragmatic choice for artists or projects experimenting with budget-conscious drops, frequent editions or gaming/metaverse-style assets rather than high-end digital art. The “cost-efficiency + flexibility” formula makes BakerySwap especially interesting for creators aiming for volume, affordable entry or utility-oriented NFTs rather than 1-of-1 gallery-type pieces. BakerySwap blends a Uniswap-like AMM DEX with a functioning NFT marketplace. That means, besides selling your NFTs, you could use liquidity pools, yield farming or staking to engage with crypto users. This dual model gives creators more flexibility in monetization and exposure compared to NFT-only platforms. Since BakerySwap runs on BSC, network fees and gas costs are significantly lower than on typical Ethereum-based NFT platforms. For creators planning frequent mints, multiple editions, or lower-price drops, this reduces entry barriers and risk. BakerySwap supports NFTs beyond pure art: gaming assets, “combo” NFTs tied to staking or token rewards, collectible items, and other utility-style NFTs. That flexibility broadens your potential project types beyond traditional digital art and opens doors to community or game-oriented NFT builds. Best For: Digital artists focused on curated, high-quality art and collectors seeking exclusive Ethereum-native digital artworks Supported Blockchain: Ethereum only Service Fees: NFT Types: Curated digital art (1-of-1 art, limited editions, crypto-art, images / GIFs / multimedia) Minting & Upload Options: Minting requires paying Ethereum gas fees. There is no public lazy-minting or alternative chain support. Editions are mint-on-demand but still require on-chain gas. KnownOrigin is one of the oldest and most tightly curated NFT art marketplaces. Since its launch in 2018, it has built a reputation as a gallery-style platform specializing exclusively in digital art rather than gaming assets, collectibles, or utility NFTs. By focusing on Ethereum and the ERC-721 standard, KnownOrigin ensures full provenance tracking and compatibility with standard Web3 wallets. The platform’s curated onboarding process means not every artist can list — this helps maintain high quality and reduces spam, but also limits access for many creators. Because of that curation, KnownOrigin tends to attract serious digital-art buyers who value uniqueness and scarcity. For creators whose work aligns with fine-digital-art sensibilities — graphic or generative art, limited-edition pieces, visually distinct NFTs — KnownOrigin provides a higher prestige context than broader NFT marketplaces. KnownOrigin’s strict selection criteria keep the marketplace focused on serious digital art. That means as a creator accepted there, your work sits among curated peers — which can enhance perceived value, credibility, and appeal to discerning collectors. With 10% royalties on resales plus a 2.5% marketplace cut, KnownOrigin ensures creators benefit from ongoing resale value. This royalty setup is more favorable than many mass-market platforms for art-centric creators. Because KnownOrigin uses Ethereum and ERC-721, every token has clear, immutable provenance. Editions are mint-on-demand, giving creators flexibility in supply while preserving token fungibility and ownership transparency. Best For: Creators building gaming assets, metaverse or utility-oriented NFTs who want a blockchain environment purpose-built for games and digital assets. Supported Blockchain: Enjin Blockchain (native), with NFTs backed by Enjin Coin (ENJ) and integrated into the broader Enjin ecosystem. Service Fees: NFT Types: Gaming items, virtual goods, utility NFTs, metaverse assets, in-game assets, blockchain-native collectibles, digital assets built with Enjin’s tooling. Minting & Upload Options: NFTs are minted using Enjin’s tooling, requiring ENJ to back creations; metadata and blockchain storage follow Enjin’s standards. There is no widely-advertised “lazy-minting” or gas-free minting option. Enjin Marketplace, often referenced under the name NFT.io, is part of a broader Web3 ecosystem designed specifically for gaming, digital assets, and utility NFTs. For creators who are building game items, virtual goods, or metaverse assets rather than purely collectible art pieces, this can offer a more aligned environment than typical art-centric or generalist NFT platforms. The marketplace is closely integrated with the Enjin Blockchain and uses the ENJ token as the backbone for minting and trading. Because the platform’s architecture and tooling are tailored to game-ready NFTs and utility/collectible assets, creators working on game integrations, in-game economies, or interoperable digital goods benefit from out-of-the-box blockchain compatibility, asset backing, and ecosystem support. The emphasis is not on art-gallery style listings but on assets with potential utility, functionality, or in-game utility, which aligns with many modern Web3 game or metaverse creators’ needs. When you mint an NFT via Enjin, it is backed by ENJ and easily integrated with Enjin Wallet and ecosystem tools, facilitating trading, transfers, and game interoperability. For creators interested in utility NFTs or in-game items rather than speculative art drops, Enjin Marketplace may present a lower-friction, more purpose-driven environment compared to Ethereum-centric art marketplaces. Enjin’s core design centers on game assets, virtual goods, and utility NFTs rather than fine art. If you build NFTs intended for games, metaverse, or utility, Enjin’s tooling, ENJ-backed assets and blockchain are designed to support such use cases efficiently. With a full stack, blockchain, native token (ENJ), wallet, and marketplace, Enjin offers a unified infrastructure. That reduces fragmentation for creators building across games and assets, simplifying minting, ownership, and trading workflows. Because Enjin has a history in gaming and game-asset communities, listing on Enjin Marketplace gives access to audiences specifically interested in game NFTs, digital goods, and blockchain-native collectible ecosystems rather than general NFT art buyers. Best For: Artists and collectors interested in digital or physical art and collectibles, especially those who value transparent provenance, optional physical-asset backing, and a marketplace that bridges crypto-native NFTs with traditional art/collectible sensibilities. Supported Blockchain: Ethereum (uses ETH + smart contracts) Service Fees: NFT Types: Digital art, physical-art backed NFTs, art collectibles, mixed digital/physical collectibles, luxury art tied to provenance certificates. Minting & Upload Options: Tokenization of both digital and physical artwork via a drag-and-drop interface; minting happens on Ethereum, with art metadata stored via decentralized storage (IPFS). Portion positions itself as more than “just another NFT marketplace.” It aims to merge digital-native NFT technology with traditional art and collectible markets. That means you can tokenize purely digital art — or tie a token to a physical artwork or collectible, complete with provenance records and optional real-world storage or delivery. Launched originally in 2018 and relaunched in version 2.0 around 2020, Portion sought to democratize access to the art and collectibles marketplace by removing intermediaries like galleries and auction houses. On Portion, creators keep full control of proceeds from primary sales, while the platform enforces an 11% royalty for secondary sales. This model can appeal strongly if you want to retain maximum upside from first sales and also benefit from resale activity. Portion’s offer isn’t limited to digital-only assets. The infrastructure supports tokenization of physical art and collectibles, enabling fractional ownership or full ownership via blockchain-backed provenance certificates. Given this positioning, Portion is especially relevant for creators who straddle both traditional art/collectible markets and the crypto-native NFT world — or those who envision hybrid physical-digital releases. Portion blends Ethereum-based NFT minting with real-world art market features: provenance certificates, optional physical delivery or storage, and support for both digital and physical collectibles. That makes it ideal for creators building for an audience beyond crypto-native collectors. Creators receive 100% of proceeds from their first sale, a rare feature among NFT marketplaces — which maximizes upfront revenue potential. With 11% royalties on resales, Portion offers ongoing earnings for artists as NFTs/certificates change hands — a long-term value path typical of art and collectibles markets. Best For: Artists and creators aiming for curated, high-end digital art drops or limited-edition NFT releases, especially if you value curated positioning, fiat payment options, and streamlined UX. Supported Blockchain: Ethereum (NFTs on Nifty Gateway are backed by ETH). Service Fees: NFT Types: Curated digital art and limited-edition drops. Minting & Upload Options: Minting happens on Ethereum. For NFTs minted and stored in Nifty Gateway’s custodial Omnibus wallet, buyers and creators may avoid paying gas fees at time of purchase. Nifty Gateway remains one of the most visible and curated Ethereum-based NFT marketplaces. The platform differentiates itself by focusing on high-quality, limited-edition digital art and works with established artists and brands to launch curated NFT drops. Because it is backed by the established crypto-exchange Gemini, Nifty Gateway combines crypto-native NFT capabilities with a more user-friendly, fiat-accessible interface — enabling artists to reach collectors who are comfortable with card payments or fiat balances rather than requiring prior crypto-ownership. The marketplace is curated, meaning not everyone can list. Many high-profile NFTs and celebrity-artist drops have originated on Nifty Gateway, which reinforces its positioning as a premium storefront rather than an open-listing bazaar. At the same time, Nifty Gateway’s combination of curated art, NFT-native blockchain underpinnings, and more traditional payment methods gives you a hybrid access path: you get the benefits of blockchain authenticity and provenance while offering accessibility to a broader collector base, including those who may not use crypto regularly. Nifty Gateway’s curated-drop model ensures that listed NFTs come with selectivity. That means works tend to carry more perceived value, and collectors browsing Nifty expect higher-caliber art. As a creator, being featured can elevate your positioning and align your brand with premium NFT art. Because Nifty uses a custodial omnibus wallet system, buyers can use credit/debit cards, fiat, or ETH, lowering friction for collectors who are not crypto-native. This also means gas fees can be avoided or deferred for many transactions, easing the buying process for a wider audience. Nifty blends blockchain-native ownership and provenance with a smooth, consumer-friendly purchase experience. For creators, that balance can open doors to both legacy-style art buyers and crypto-aware collectors — expanding potential reach beyond strictly crypto-native audiences. Best For: Creators and developers who build virtual-world assets, 3D environments, wearable NFTs, and interactive digital real estate. Supported Blockchain: Ethereum (ownership of LAND, wearables, and other NFTs is recorded on Ethereum via smart contracts) Service Fees: NFT Types: Virtual land parcels (LAND), 3D real-estate, avatar wearables and accessories, virtual fashion items, metaverse-ready items, interactive content, in-world assets. Minting & Upload Options: Minting or purchasing LAND and wearables happens on Ethereum. Decentraland blends the concept of a virtual world with blockchain ownership. Rather than being a traditional NFT marketplace for digital art, it is a fully-fledged metaverse where digital land and 3D parcels are tokenized as NFTs. Creators, developers, and designers can buy or build parcels of virtual land (LAND), design environments, avatar wearables, virtual fashion items, interactive installations, and virtual real-estate — then trade, rent, or monetize them in ways that mimic real-world digital property or experiences. Because Decentraland uses Ethereum to register ownership through smart contracts, all assets, land, wearables, and user-generated 3D content are verifiable, transferable, and subject to blockchain standards. The platform’s scope extends beyond static NFTs. Instead of one-off image or video NFT drops, your creations become part of a shared, persistent 3D world. That makes Decentraland especially interesting if you envision your NFT not as a standalone asset but as part of an immersive world. Unlike art-focused NFT marketplaces, Decentraland is about land, 3D space, and wearable/virtual goods that have utility within the metaverse. If you build environments or assets meant to be walked through, worn by avatars, or interacted with — rather than displayed — Decentraland gives a framework to monetize them. Every parcel of land, wearable, or in-world asset uses Ethereum smart contracts for provenance and ownership. That brings transparency, transferability, and permanence — critical for property-like virtual assets where proof of ownership matters. Assets on Decentraland are embedded in a communal, social 3D world. Users can explore, interact, wear NFT clothes, attend events, use wearables — turning NFTs into experiences rather than just collectibles. This creates potential for ongoing engagement and repeat value beyond a one-time NFT sale. Best For: Creators, players and developers who want to mint, sell, or trade in-game NFTs (Axies, land, items) inside a well-established Web3 gaming ecosystem. Supported Blockchain: Assets are hosted on the game’s own sidechain, Ronin Network (Ethereum-linked), which underpins the marketplace and reduces reliance on main-chain gas. Service Fees: NFT Types: Game-native items: digital pets (Axies), in-game items, virtual land parcels, in-game assets, breeding-offspring NFTs, other Lunacia metaverse assets. Minting & Upload Options: There’s no traditional “open-art” minting — NFTs are generated via in-game mechanisms (e.g. breeding) or via official game asset creation; you cannot simply upload arbitrary art. Axie Infinity operates a fully integrated NFT marketplace designed specifically for its gaming universe rather than as a general art marketplace. Every asset, from creature NFTs (Axies) to land parcels and in-game items, is native to its ecosystem and tied to game mechanics: breeding, battling, owning land, or participating in the broader metaverse. Because the marketplace runs on the Ronin sidechain, it affords lower friction compared with main-chain Ethereum marketplaces: transfer and transaction overhead tend to be more optimized for gaming use. When you list an asset, whether an Axie, land parcel, or in-game item, you can choose between a fixed-price sale or auction. Auctions follow a “clock auction” format: you set a starting price, an ending price, and a schedule. This system gives flexibility for sellers to target both price-sensitive and premium buyers, depending on how they structure their sale. Because all NFTs on Axie Infinity have in-game utility — pets, land, resources — the marketplace supports real functional demand rather than speculative art-market demand. That makes it more stable for creators/developers focused on gaming, utility, and engagement rather than pure aesthetics. Axie Infinity remains one of the most recognized blockchain games. Its active users and the fact that NFTs double as playable assets increase the likelihood of resale, trading, or demand — especially among players seeking new Axies, land, or resources. The marketplace supports both fixed-price and auction-style listings. Auctions allow sellers to set initial and final price over a duration, giving flexibility in pricing strategy depending on demand, rarity, or supply.1. OpenSea

Unmatched Chain Flexibility

Massive Buyer & Collector Network

Low Platform Fees + Optional Royalty Structures

Pros

Cons

OpenSea

2. JPG.Store

Multi-Chain Alternative Inside Cardano Ecosystem

Low Minting & Transaction Costs

Robust Creator Tools & Community Infrastructure

Pros

Cons

3. Binance NFT

Dual-Chain Infrastructure for Flexibility

Large User Base and Exchange Integration

Competitive Fee Structure and Simplified Marketplace Entry

Pros

Cons

4. Solanart

Strong Solana-Native Infrastructure

Focused on Popular Solana Collections & PFP/Collectible-Style Work

Transparent and Simple Fee Structure

Pros

Cons

5. Rarible

Community Driven Multi-Chain Model

Fee Structure That Scales With Value

Minting Designed to Reduce Upfront Cost

Pros

Cons

6. SuperRare

High-End Gallery Positioning

Provenance and True Scarcity for Each Piece

Ongoing Royalties & Marketplace Governance via Token

Pros

Cons

7. Foundation

Signature Curation Model

Direct Contract Ownership and Control

Flexible Formats: Auctions, Drops, Editions

Pros

Cons

8. AtomicMarket

Shared Liquidity via a Single Smart Contract

Control Until Sale via Offer Mechanism

Low Fees and Flexible Collection-Level Settings

Pros

Cons

9. BakerySwap

Signature AMM + NFT Integration

Low-Cost, Fast Transactions on BSC

Accessible to Projects Beyond High-Art — Collectibles, Gaming and Utility NFTs

Pros

Cons

10. KnownOrigin

finder.comCurated Ethereum Art Gallery Environment

High Royalties for Secondary Sales

Transparent Provenance and Edition Controls

Pros

Cons

11. Enjin Marketplace

Gaming & Utility-First Ecosystem

Built-in Ecosystem Integration (Wallet, Token, Blockchain)

Access to Existing Gaming & Collectible Communities

Pros

Cons

12. Portion

Global Art + Blockchain Hybrid Model

Zero Commission on Primary Sales

Secondary Market Royalties + Transparent Resale Infrastructure

Pros

Cons

13. Nifty Gateway

Curated Premium Drops for High-End Collectors

Custodial Wallet + Fiat or Crypto Checkout Simplifies Onboarding

Hybrid Chain-Native Infrastructure with Traditional UX Benefits

Pros

Cons

14. Decentraland

Real-Estate & 3D Asset Marketplace — Not Just Simple NFTs

Ethereum-Backed Ownership with Smart-Contract Certainty

Metaverse & Community Integration

Pros

Cons

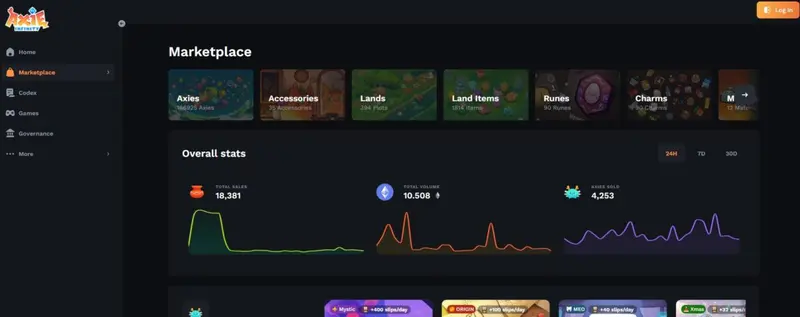

15. Axie Infinity

Utility-Native Game Asset Economy

Built-In Liquidity Pool via Game User Base

Flexible Sales Format: Auctions and Fixed Price Listing

Pros

Cons

Which NFT Marketplace Should You Go With?

Choosing the right NFT marketplace is less about size and more about fit. Different platforms serve different creative goals, technical needs, and audience types.

The scenarios below map common creator goals to the marketplace best designed to support them.

Lowest-cost minting and budget-friendly experimentation -> JPG Store

Maximum reach, chain flexibility, and broadest collector base -> OpenSea

High liquidity for brand, entertainment, and utility-driven NFT releases -> Binance NFT

Fast, low-fee environment for PFPs, collectibles, and gaming assets -> Solanart

Multi-chain publishing with strong creator controls and lazy-mint options -> Rarible

Premium gallery setting for 1-of-1 digital art -> SuperRare

Art-first platform with creator-owned smart contracts and curated drop formats -> Foundation

|

Marketplace |

Best For | Supported Blockchain | Service Fees | NFT Type | Minting Options |

Use For |

| OpenSea | Creators wanting maximum reach and multi-chain flexibility | 22+ chains including Ethereum, Polygon, Solana, Base, Arbitrum, Optimism, Avalanche, Flow | 1% platform fee; optional royalties | General marketplace: art, collectibles, gaming, domains, music, virtual goods | Lazy-minting on low-fee chains; standard minting on others | Broadest exposure across chains and audiences |

| JPG Store | Cardano-native creators seeking low-cost minting | Cardano | 2.5% sale fee + 2 ADA mint fee | Cardano NFTs: art, collectibles, avatars, utility NFTs | Direct minting; no lazy-minting; very low fees | Budget-conscious creators testing collections |

| Binance NFT | Brands and creators needing high liquidity and exchange-native visibility | BSC + Ethereum | 1% platform fee; royalties vary | General NFTs: art, collectibles, gaming, entertainment | Minting restricted to approved creators; chain fees apply | Accessing a massive built-in crypto user base |

| Solanart | Solana creators building PFPs, collectibles, or gaming-style assets | Solana | ~3% marketplace fee | Solana NFTs: PFPs, art, collectibles, gaming items | Standard Solana minting; no lazy-minting | Fast, low-cost trading for high-volume drops |

| Rarible | Multi-chain creators wanting flexibility and creator-first controls | Ethereum, Polygon, Immutable X, Base, Aptos, more | Sliding 0–7.5% fee per party | General marketplace: art, collectibles, gaming, metaverse items | Lazy-minting on supported chains | Multi-chain publishing with customizable royalties |

| SuperRare | Fine-art creators focused on 1-of-1 art | Ethereum | 15% primary sale fee; 3% buyer fee; 10% royalties | Curated digital art (1/1) | Standard ETH minting; no lazy-minting | Premium gallery placement for serious collectors |

| Foundation | Artists needing curated art context with custom contract ownership | Ethereum + Base | 5% marketplace fee; 0.0008 ETH per mint for drops | Digital art, auctions, editions, curated collections | Smart-contract collections; no lazy-minting | Art-focused auctions and editions with contract control |

| AtomicMarket | Creators of gaming assets and digital collectibles on WAX | WAX (EOSIO) | 1% maker + 1% taker; optional collection-level fee | Digital collectibles, gaming items, virtual goods | AtomicAssets standard; no lazy-minting | Shared liquidity across multiple WAX marketplaces |

| BakerySwap | BSC creators wanting cost-efficient, DeFi-integrated NFT drops | BNB Smart Chain | Variable marketplace fees | General NFTs, gaming items, utility NFTs | Standard BSC minting; gas required | Low-cost drops with DeFi audience crossover |

| KnownOrigin | Artists seeking curated Ethereum-based art exposure | Ethereum | 15% primary sale fee; 2.5% + 10% royalties on secondary | Curated art: 1-of-1, editions, multimedia | Standard ETH minting; no lazy-minting | High-quality curated environment for serious digital art |

Finding the Right Marketplace to Power Your NFT Journey

The NFT landscape can feel overwhelming, but the core decision is simple: choose the platform that aligns with what you create and who you want to reach. Each marketplace operates with its own strengths, from ultra-low-cost minting and multi-chain flexibility to curated art environments and high-liquidity ecosystems.

By exploring how each platform handles fees, supported blockchains, audience size, and creative formats, you can confidently map your work to the marketplace where it will perform best. There is no universal winner here; the “right” choice depends entirely on your artistic goals and the experience you want to deliver.

With a clear understanding of the landscape, you’re now equipped to pick the marketplace that elevates your creative vision and gives your NFTs the strongest chance to thrive.

An NFT is a non-fungible token. It is a unique item that you cannot replace with something else. An example of an NFT is a one-of-a-kind trading card, such as a digital artwork, that you simply cannot replace with any other artwork. Today, the majority of NFTs are digital which makes it very easy for creators to give their supporters something unique and rare. While they are similar to Bitcoins and other cryptocurrencies, they are non-fungible and non-divisible. Creators who want to scale output efficiently often rely on automated tools such as an NFT collection generator, which supports trait layering, rarity setups, and metadata export for streamlined production. Yes, certain platforms focus on athlete IP and fan collectibles, and interest continues to grow around dedicated sport NFT marketplace ecosystems built for leagues, teams, and athlete-driven drops. Artists who stand out often develop a recognisable style and consistent release cadence, drawing on insights from how top NFT creators build long-term collector trust. Creators frequently rely on early-community building, allowlists, and platform-native engagement, supported by structured crypto NFT promotional strategies that improve discovery. Collectors and creators often assess engagement depth, mint participation, and retention across drops — all core NFT campaign metrics that signal real demand. Many algorithmic artists tap niche digital-art communities and collaborate with creators who already reach collectors interested in generative aesthetics, similar to approaches in influencer marketing for generative-art NFTs. Micro-creators often convert better because of focused, high-trust audiences, making how to build NFT campaigns with micro-influencers a valuable strategy for sell-through. Partnerships become useful when projects need coordinated storytelling, launch sequencing, and technical execution typically handled by crypto agencies.Frequently Asked Questions

What is an NFT?

How can creators quickly generate large NFT collections without coding?

Are there NFT marketplaces designed specifically for sports brands and athletes?

What traits set top-performing NFT artists apart from others?

What promotion tactics help new NFT collections gain early traction?

Which metrics matter most when evaluating an NFT campaign’s performance?

How do generative-art creators find the right audience for algorithmic work?

Can micro-influencers help small NFT collections sell out more reliably?

When should a creator or brand partner with a crypto-native agency?