Overview

The American tax system is a mess. This isn’t some kind of political rant, it’s just a statement of fact: tax codes are a complex labyrinth of rules and regulations, loopholes and exemptions. For something that is the responsibility of every citizen and business in the country, the architects of these laws did not spend a lot of time making sure any of it was easy to understand. And that’s just at the federal level. Each state has its own additional laws, and this is the level at which sales tax is determined. Except when each county, city, and town in each state has the power to slap more sales taxes on top of the state.

All told, there are more than 11,000 tax jurisdictions in the United States. There was a time when this number was irrelevant. You set up shop somewhere, you learned the laws of that specific somewhere, paying tax accordingly. If you were successful, you might have opened up a second shop somewhere else, and that shop would have to abide by the rules of that place’s laws. All of this became only more confusing with a ruling handed down by the US Supreme Court in 2018, which held that businesses must pay sales tax based on where the consumer bought it, not where the business was located. If we were to type the one word that could accurately describe the system as a whole, we might be fired from this writing gig for objectionable language—so imagine the words that e-commerce business owners everywhere must have screamed when they learned they’d be responsible for knowing the tax code for any possible place where they might make a sale.

TaxJar founders Mark Faggiano and Matt Anderson must have heard those screams. In fact, they heard them way back in 2013 when they founded the company. Even before the Supreme Court ruling, calculating your taxes owed was still complicated, as your rate could change depending on where you were, where your inventory was, or how many employees you had. If you attended a trade show and made sales there, your tax burden changed. If you delivered products using your own trucks, your tax burden changed. Even when it was simple, it was too much.

So, Faggiano and Anderson created a must-have tool for businesses that, in the wake of 2018’s changes, became even more crucial. To date, the company has onboarded more than 24,000 businesses to its platform. Stripe (the payment processor) also viewed TaxJar as a must-have—and now they have it. The purchase was finalized in April of 2021 and, while the financials of the deal haven’t been disclosed, we do know that TaxJar was valued at $179 million when it last raised funds in 2019. There’s no word on where they had to pay the taxes for that sale, but the software could tell you.

Pricing

Interestingly, the software designed to simplify money-related stuff for your business has pricing that’s not entirely clear. At least, it isn’t spelled out clearly on their pricing page. They list three plans, two of which show a monthly price for handling up to 200 orders per month. An order can be a purchase and a return (so if someone returns a product, that’s two orders), as the tax refund has to be calculated and reported. Keep in mind that these plans aren’t capped at 200 orders per month—there’s no actual limit. It’s just a matter of your pricing changing as you grow. You should also note that each plan lists a number of free AutoFiles included (automatic filing of taxes), but these are only available if you pay for a full year upfront. If you’re month to month, you can pay a fee each time you file using TaxJar.

- Starter, $19/month — Up to 200 orders per month, up to 3 e-commerce integrations (this is a data import only from stores that handle all the tax calculations), basic CSV data import, 4 free AutoFiles, reporting by jurisdiction, support for multiple businesses, email support

- Professional, $99/month — Up to 200 orders per month, all of the above, plus: 10 users, API access, API integrations (more than data import, this is for when your e-commerce relies on TaxJar’s calculations for tax), 10 integrations (data import and API), advanced CSV imports, economic nexus dashboard, 10k increased API calls per minute, 12 free AutoFiles, phone support, account management (at 1k orders per month)

- Premium, $Custom/month — All of the above for a customized number of orders, plus: unlimited users, unlimited integrations, 25k increased API calls per minute, unlimited autofiles, white glove support from dedicated account team

The Details

If you only learned about TaxJar through its marketing materials, you’d be forgiven for thinking that it’s a fully automated set-it-and-forget-it situation. It’s not that they’re making false claims—they’re not—and TaxJar will dramatically improve your tax-calculating life. But there is something about the way they describe the software that gives the impression you only need to connect it to your shopping cart and TaxJar becomes your robot accountant, counting tills and paying bills. (Notice to TaxJar: you can license the slogan “counting tills and paying bills” for a modest fee)

Still, what it does is impressive. If you only used TaxJar to figure out whether or not you owe sales tax in any given state is almost worth the price of admission alone. See, it’s not just a geography thing; it’s not as simple as “If a sale happens in a state, charge that state’s sales tax.” There can be many conditions at play that determine whether or not you owe. For example, while some states go by the number of sales, others don’t charge til you reach a certain dollar amount. Some counties add their own sales tax. Some cities add their own to the counties’ addition to the state’s.

Without TaxJar, you’re running reports on your sales by state and then cross-referencing that data with each state’s tax code and trying to decipher. With TaxJar, you’re running the State and Transactions Checker, which will analyze all your sales, identify whether or not you meet the criteria for each state. When it’s identified where you’re on the hook, it shows you a list of each state and provides a link to instructions for registering your business there. If you don’t want to do it, your account team at TaxJar can connect you with a partner CPA who will do it (for their regular fee.

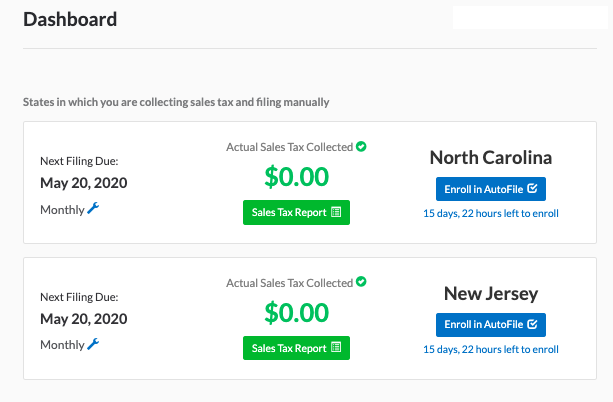

Once you’ve determined which states you need to file with, you can add that state to your TaxJar dashboard, where you’ll see a state-by-state breakdown of what you’ve collected as compared to what the software calculated you owe. Each state shows the aggregate of all your connected shopping carts and marketplaces. If you have a Shopify store, but also sell on eBay and Amazon, TaxJar will keep real-time tabs on each of them, pull all the transaction data and sort it into the appropriate state. Running a report on each state gives you the breakdown of every transaction—the order total, tax rate charged, the amount of tax collected, and even the individual tax jurisdiction that applies to each sale.

TaxJar does not collect any tax for you—it’s meant to act as a centralized reporting and compliance tool—but for some of the e-commerce platforms it supports it can set the rate for each transaction. With BigCommerce, for instance, when it comes time to charge tax, it will make an API call to TaxJar to get the rate. If the laws ever change, affecting what you have to charge, you won’t need to know about it: TaxJar is cloud software and so always up to date. If you’re using Spotify or Amazon, or any other platform that does its own tax calculations, your integration with these services will strictly pull data down so that it can report it to you. And file, of course.

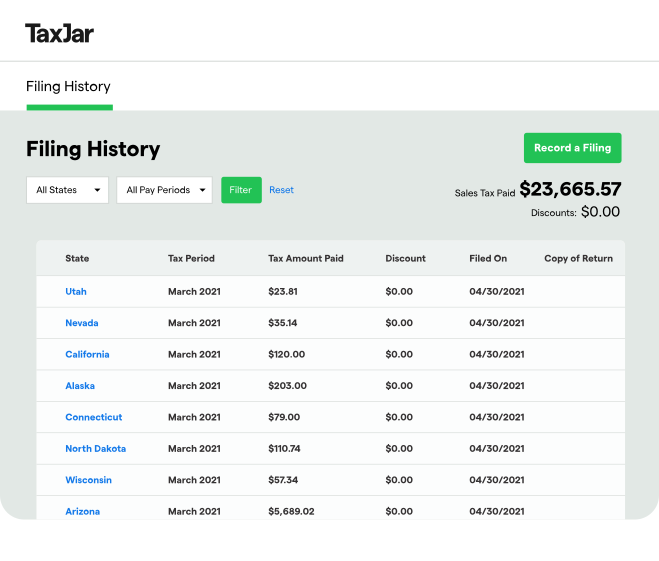

This is another huge timesaver from TaxJar. It goes beyond simply centralizing your payments onto a single platform. Everything in your state reports is there not just for you to see, but for the filing—and payment!—of the returns, as well. When you enroll in AutoFile, TaxJar will begin processing your return on the first of the month that it’s due. If you need to pay by April 15, the process starts on April 1. You’ll get an email notification detailing which states are getting paid that month, and you have some time to make sure there’s enough money in your connected banks account (and that all the numbers look good). As long as the return hasn’t yet been filed, you can pause or cancel it any time.

Integrations

There are three main categories for TaxJars integrations.

- E-commerce/Shopping Carts — The major names are covered here. BigCommerce, Ecwid, Magento, PayPal, Shopify, Square, Squarespace, Stripe, and WooCommerce. If yours isn’t listed here, you could always import data via CSV.

- Marketplaces — Amazon, eBay, Etsy, and Walmart

- Finance/Operations — Oracle Netsuite, Intuit Quickbooks, Salesforce

Conclusion

TaxJar isn’t perfect, but neither is the tax system itself. While we might be disappointed to realize that it’s not a totally automatic thing, it’s also understandable. How can you automate bureaucracy? For a lot of people, having to calculate and file can suck up hours and hours a month, time that’s better spent marketing or engaging with customers. With TaxJar, you can get most of those hours back, and it’ll pay for itself each month merely in terms of time saved.

There’s that old saying about how nothing in life is certain except death and taxes. And for many of us, we’d jokingly say that we prefer the former to the prospect of having to figure all this out, for multiple states, several times a year. In this way, it’s kind of a life saver.

Rating

-

Features

-

Ease of Use

-

Reporting

-

Integrations