NeoReach returns with its Social Intelligence Insights Report for a 2021 Year In Review analysis, this time in collaboration with Tensor Social. Bringing to Influencer Marketing Hub an extensive report filled with thoughtful research, industry insights and groundbreaking analysis to dive deep into the state of influencer marketing and how it has evolved over the past 12 months.

The report analyzes data from over 28,000 YouTube videos. The data set of qualifying videos all were required to adhere to the following guidelines. (1) The video indicated brand partnership or sponsorship in line with FTC regulations. (2) The YouTube video received over 10,000 views. (3) The video was sponsored by a United States or Canadian brand. (4) The video was published within the period of January-December 2021.

The results of the data analysis are visible in the following report to deliver industry-leading insights into influencer marketing through the behavior of the top spending brands on YouTube through sponsored influencer campaigns.

Included with the results of this research, we incorporated additional statistics relevant to influencer marketing across all industries. The data and conclusions presented in this report are thanks to our partner NeoReach, an influencer marketing agency and data insights provider for the world’s leading brands. NeoReach’s data is collected using their best-in-class software, Social Intelligence API, which is available for free and paid subscription access for brands and marketers. The platform provides data to guide campaign strategy and influencer selection, capable of building effective campaigns at scale for a desired campaign objective.

Despite the downfalls from COVID-19 that permeated beyond 2020 and into 2021, sponsored YouTube videos and influencer-brand partnerships continued to drive results and revenue for creators and brands with their ability to capture highly targeted, engaged audiences.

This article covers the detailed results from NeoReach’s 2021 Year In Review: Social Intelligence Insights Report along with the downloadable report. It includes a thorough analysis of the data accompanied by a range of statistics and findings on the state of the influencer marketing industry as it pertains to YouTube spending.

YouTube Influencer Marketing Report:

- Key Insights

- Research Methodology

- Top Industries on YouTube

- Top 18 Industries Metric Breakdown

- Top Industries on YouTube: Closer Look

- Campaign Objectives

- Calls to Action

- Content Types

- Top Brands Highlight

- Top Spenders on YouTube

- Top Spenders on YouTube: Closer Look

- Ad Lengths for Top 5 Spenders

- Breakout Creators

- Brands to Watch in 2022

- Top Sponsored Video of 2021

- CPV Campaign Feature

- Best Brand Sentiment

- Industry Winner

- Brands’ Social Media Growth

- Monthly Top Spenders

- Year in Review

- Quarter Over Quarter Comparison

- Tech Industry Overview

- Top 5 Tech Spenders on YouTube

- Tech: Compare Q1 – Q4

- Top Tech Spender Spotlight

- Top Influencers: Tech Industry

- Gaming Industry Overview

- Top 5 Gaming Spenders on YouTube

- Gaming: Compare Q1 – Q4

- Top Gaming Spender Spotlight

- Top Influencers: Gaming Industry

- Food & Drink Industry Overview

- Top 5 Food & Drink Spenders on YouTube

- Food & Drink: Compare Q1 – Q4

- Top Food & Drink Spender Spotlight

- Top Influencers: Food & Drink Industry

Key Insights

The purpose of this report is to give insight into the growth of the Influencer Marketing Industry in 2021. Here are some insights into what you will find in this report:

- Brands spent $603.9 million on YouTube Influencer Marketing last year.

- Honey, Express VPN, and GFuel were Influencer Marketing’s Top 3 Spenders of 2021.

- The most recognizable YouTube channel of 2021 is @H3Podcast. The channel produced on IMV of $18.6 million, reaching 234 million with their sponsored videos.

- Tech, Gaming, and Food & Drink remain The Top 5 Industries Investing in YouTube. Influencer Marketing with a combined IMV of $349.5 million.

- Honey continues its reign as the Top YouTube Influencer Marketing Spender, investing nearly $30 million in 2021. The brand amassed over 18 million views and reached 42.2 million users on the platform.

- Top Spenders invested up to $7.5 million per month on YouTube Influencer Marketing.

- Top Influencer Marketing Spenders reached over 14 billion users on YouTube in 2021.

- 3,387 brands in the U.S. and Canada activated influencer campaigns on YouTube in 2021.

- $21,632 was the average IMV of 2021.

- The top sponsored video of 2021 was sponsored by Honey with an IMV of $3.1 million and a reach of 42.2 million users.

- Over the year, the top spending brands experienced an increase in their social media following. Skillshare gained the most followers, with a growth of 58.4% on Instagram in 2021.

Research Methodology

The data presented in this report was collected from all sponsored YouTube videos posted during 2021. All of the YouTube influencer data that is contained in this report was captured by the NeoReach Social Intelligence API. Videos were required to comply with proper FTC disclosure regulations. Our analysis included sponsored YouTube videos posted between the months January through December 2021. We further refined this data to target YouTube videos of influencers located in North America, solely in the United States and Canada.

Of the selection of YouTube videos which met these criteria, this report showcases only those brands and companies that activated campaigns with sponsored content achieving at least 10,000 views on YouTube. The resulting data set consisted of over nearly 28,000 YouTube videos.

Therefore, the following report does not include all sponsored content on YouTube during the 2021 calendar year. However, it does include the top spending brands and industries for influencer marketing on YouTube for the entirety of 2021.

Top Industries on YouTube

3,387 qualifying brands activated sponsored videos on YouTube in 2021. Brands included in this data were confirmed to use proper FTC disclosure of advertisement in their sponsored influencer marketing videos. NeoReach has compiled all four quarters of 2021 into a holistic year-end review report for in-depth insights from the influencer marketing data on YouTube. This report analyzes the highest spending industries. Below are the top 18 industries in YouTube influencer marketing.

Top 18 Industries Metric Breakdown

In 2021, the qualifying brands in the top 18 industries spent a combined total of over $603.9 Million. Amassing over 4 Billion views and reaching over 44.2 Billion users, these top spending industries have certainly made their mark on the platform.

If you read our 2020 Industry Report, you may have noticed that the top 3 spending industries remain Tech, Gaming, and Food & Drink. These three industries continue spending the most on influencer marketing on YouTube.

Out of the 3,387 brands and the 27,917 sponsored videos that qualified for analysis in this data set, engagements were over 244.3 Million.

Top Industries on YouTube: Closer Look

Isolating the top 5 industry spenders – Tech, Gaming, Food & Drink, Beauty, and Fashion – Tech, once again, is responsible for just short of half with 44% of the total IMV this year. Tech spent nearly twice as much as the #2 spot, Gaming. Altogether, these top 5 industries spent $442 Million on YouTube sponsored videos and amassed over 3 Billion views.

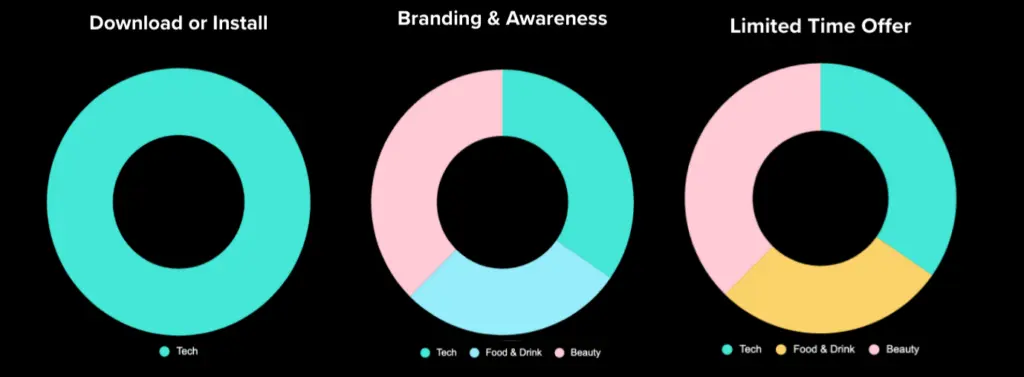

Campaign Objectives

To better analyze influencer marketing campaigns on YouTube, we identified each sponsored video as one of four campaign objectives – (1) Branding and Awareness, (2) Contest/Giveaway, (3) Download or Install, and (4) Limited Time Offer. The data included was from the top 10 brands overall. The majority of campaigns were Limited Time Offer and only one video, less than 1% of the total campaigns, were promoting a contest or giveaway.

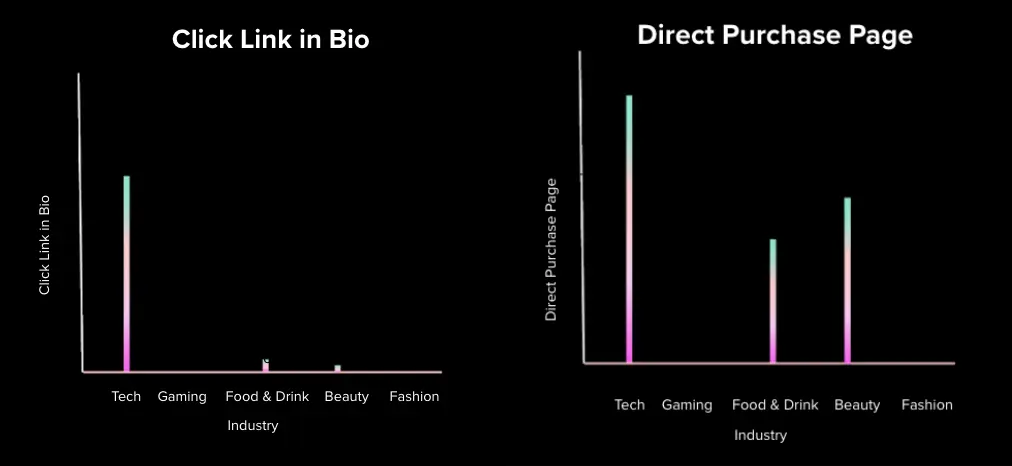

Calls to Action

The data for analyzing campaign calls to action was analyzed in the same way as campaign objectives. 100% of sponsored videos used a call to action of Click Link in Bio or Direct Purchase Page, with the majority preferring a Direct Purchase Page. Inversely, none of the analyzed campaign calls to action involved entering a giveaway or filling out a contact form.

Continuing the trend we have identified in past reports, this data supports that idea that brands favor direct calls to action with the ability to track and measure return on investment of influencer marketing on YouTube.

Content Types

Out of the qualifying videos, integrated content continues its winning streak as the dominant content type, appearing in 45% of videos from the top 10 brands in 2021. Intro cards, which were once less than half as popular as integrated content, now represent over 32% of the total. Similarly, the description only content time has also grown to almost 20% in 2021.

Top Brands Highlight

Ranking in the highest spending category, Supernova, are 16 brands who spent over $10M in influencer marketing on YouTube in 2021. 617 brands spent more than $100K over the course of the year. Each influencer tier contains brands from a variety of industries, proving that influencer marketing is a viable strategy in any economy for everyone.

Top Spenders on YouTube

The highest spending brands displayed here invested a combined $164 Million in YouTube influencer marketing. The top 10 brands reached over 14.3 billion users in 2021. Their sponsored videos amassed over 1 billion views from 1,870 influencers and 5,947 videos.

Top Spenders on YouTube: Closer Look

At the highest spending spot, Honey invested $29.1M in 2021 on influencer marketing on YouTube. With the top 10 brands spending over $164M, these heavy hitters only account for 27% of the total annual spend on YouTube sponsored videos.

If you’ve been keeping up with our content in 2021, you will recognize certain brands on this list who have been consistent high spenders throughout the year. Most of the brands appearing on this chart are from the top 3 spending industries.

The trend continues to support the positive growth influencer marketing plays for brands. With expertly placed sponsorships and highly targeted audiences from proper influencer selection, brands are skyrocketing in their industries.

Ad Lengths for Top 5 Spenders

In 2021, Keeps sponsored videos with the longest ad length for a total of 38,828 seconds in sponsorship content across all of its videos. That makes up almost half of the total ad length of the top 5 spenders of 81,905 seconds. Although Keeps has the longest overall ad length, the average ad length for Honey, Nord VPN, and Keeps all ranged from around 55 to 60 seconds. Express VPN and GFuel, on the other hand, had significantly lower averages.

Breakout Creators

Breakout creators for 2021 participated in multiple YouTube sponsorships with many different brands. They have established a strong name and brand identity among their loyal audiences. These five creators achieved a total of 541M views on 983 videos with a reach of over 8 Billion users. Collectively, the total IMV was $73M.

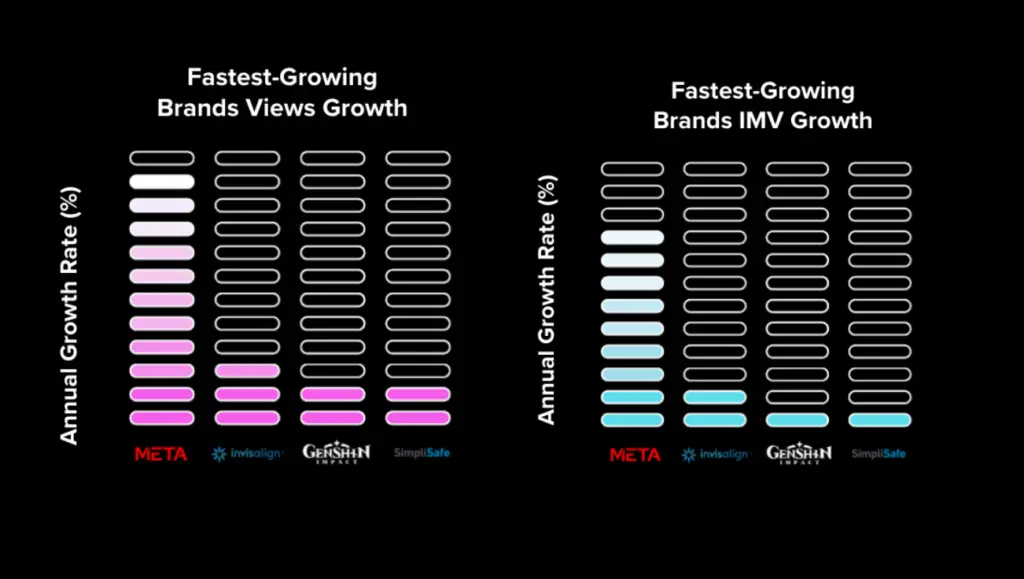

Brands to Watch in 2022

In our analysis, we identified the top 4 brands that experienced a significantly high growth in IMV and views over 2021: (1) Meta PC, (2) Invisalign, (3) Genshin Impact, and (4) SimpliSafe. These are the fastest-growing brands breaking into the influencer marketing space as part of their social media marketing strategy. Meta PC had the greatest jump in IMV from Q1 to Q4 2021 with a 9393% increase in spend and 11665% growth in views on sponsored content. Each of these brands increased from an IMV of under $100K to one reaching nearly $1M or even higher.

Top Sponsored Video of 2021

The Top Sponsored Video of 2021 was a video posted by top creator, @mrbeast6000. The video had an IMV of $3.1M and a reach of 42.2M. The video was sponsored by Honey, the top spending brand of 2021.

CPV Campaign Feature

Competing for the top campaign of 2021 spot, we wanted to look into the calculated CPV for brands activating influencers based on our Social Intelligence API’s IMV calculation. Displayed are the top 5 and lowest 5 campaigns ranked by estimated cost per view. We then calculated the estimated CPV, cost per 1000 views. We also included a couple of recognizable brands with extremely low CPV values to compare to the industry average.

Best Brand Sentiment

Which brands had the best response from their audiences? Brand sentiment was determined by taking the average like to dislike ratio for brands in the top 5 industries. Melody Susie was the most positively viewed sponsorship with a like to dislike ratio of almost 2900. Paperlike was close behind with a like to dislike ratio of almost 2300.

Industry Winner

Of the top 5 industry spenders, which one should be crowned the industry winner for 2021? Expanding on the top five industry data we shared earlier in the report, we are taking a better look at all of the industry metrics side by side to see where the winners break away. Clearly, the Tech industry takes the crown.

Brands’ Social Media Growth

Does being a top spender correlate with a rise in followers? Taking our top 10 brands overall, we looked at their social media following growth over the 12 month period from January to December 2021 on Instagram. Skillshare experienced the biggest increase with a 58.46% growth in following. Squarespace was close behind with an increase of 36.13% over the year.

Monthly Top Spenders

NeoReach ranks the Top Spenders on YouTube every week. We’ve taken that data for all 52 weeks of 2021 and chosen the top spender each month. Basketball Arena was the highest monthly top spender with $7.5M spent in the month of March. Following in second is Honey with an IMV of $6M in April.

Express VPN topped the list for four total months. Their top month being January with $5.1M and their lowest being November with $1.1M. November was the month with the lowest top spending.

Year in Review

Among the top 5 industries of 2021, it is no surprise that Tech continues to be the highest spending industry – bringing in the most views, having the greatest reach, and attributing the most brands to activating influencers on YouTube.

Quarter Over Quarter Comparison

Analyzing the four quarters of 2021, we can see the total IMV at various different levels. While there was steady growth in 2020, we saw a different trend in 2021. The highest IMV of the year was in Q1 at an impressive $199M. As the year progressed, the total IMV decreased significantly before rising up to $122M in Q4. Therefore, over the course of 2021, we saw an overall decrease in IMV of about $77M. This trend could also be seen in the total sponsored videos posted during each quarter, as well as the total views and reach.

Tech Industry Overview

Throughout the year, Tech has held the top spot as the highest spending industry on YouTube influencer marketing with a total IMV of $195.2M. Now, we will take a look at how the 2021 looked for brands in the technology space.

Tech was able to reach nearly 14 billion users with exactly 6,619 sponsored videos. That equates to an average reach of over 3.3M per video.

Our top industry spender accounts for nearly one third of the total IMV on YouTube in 2021, just as it did in 2020. Brands in the Tech space and have been consistently investing in influencer marketing, and it is clearly missing out.

Top 5 Tech Spenders on YouTube

It’s likely that these top 5 brands look familiar, they’re some of the biggest names in the game. Additionally, they have been featured in multiple of our reports before. Together, these brands invested more than $188.7M in YouTube sponsored videos.

Amassing over 1.3 billion views, these five brands also account for over half of the total Tech industry views. Honey, ExpressVPN, NordVPN, Squarespace, and Raycon are leading the Tech industry, and have been for the past few years. How are they doing it? You’ve guessed it – Influencer marketing.

Tech: Compare Q1 – Q4

Looking at the Tech industry’s success quarter-by-quarter, we can see that the IMV, views, and number of videos created a U shape. But, one area saw a growth by the end of the year that surpassed the Q1 number. Total reach, while also forming a U shape throughout the year, ended at a peak of 4 Billion in Q4.

Top Tech Spender Spotlight

Once again, Honey is the Tech Brand Spender Spotlight for 2021. Additionally, the brand had the highest overall investment in YouTube influencer marketing during the year. Honey spent $28M on 223 videos. With 14% of the total Tech industry spend, Honey also achieved 14% of the total sponsored views.

Top Influencers: Tech Industry

In 2021, the Tech industry activated some of the largest creator accounts for its campaigns. These top five influencer YouTube channels have a combined reach of more than 235M. The total spending on these five creators, alone, was $47.2M.

Gaming Industry Overview

Gaming is the second highest industry spender of 2021. Similar to Tech, this is the same spot the Gaming Industry held in 2020. Surpassing 6 billion in reach, the Gaming industry gained some pretty impressive results.

With an IMV of $86.5M, the Gaming industry accounted for 14% of the total IMV of YouTube Influencer Marketing. Additionally, Gaming as an industry is solely responsible for around 13% of the total reach of sponsored videos in 2021.

Top 5 Gaming Spenders on YouTube

These top 5 Gaming brands have consistently been high spenders on YouTube Influencer marketing throughout the year. Together, Bisect Hosting, Epic Games, Raid Shadow Legends, Xidax, and AFK Arena deployed $21.2M on sponsored YouTube videos.

In the top spender spot, Bisect Hosting is responsible for 28% of that investment. The brand clocks in at a grand total of over 47M views and an IMV of $6.4M.

Gaming: Compare Q1 – Q4

By analyzing the Gaming Industry’s metrics from Q1-Q4, we can see that there was an overall increase in IMV, views, and reach throughout the quarters. The amount of videos in Q4 were slightly lower than that of Q1, but that is the only overall decrease. In Q4 of 2021, the IMV had increased from Q1 by $5M and the reach by more than 1 billion.

Top Gaming Spender Spotlight

Bisect Hosting is the Gaming Brand Spender Spotlight for 2021. Unlike the Tech Industry’s top spender, Bisect Hosting was not featured on the top five Gaming brands in 2020. This year, the brand spent $6.4M on only 34 videos. Through those videos, Bisect Hosting gathered a reach of 18M and an average of almost 1.4M views per video.

Top Influencers: Gaming Industry

Gaming’s high scoring YouTube channels have a combined reach of 26.2M users on the platform. Channels like coryxkenshin, ssundee, and MegaToadStonie not only have a massive reach, but they also drive high views and exceptional engagement among their audiences to drive knockout success for brand partners.

Food & Drink Industry Overview

The third top spender on YouTube Influencer Marketing in 2021 is Food & Drink. The total IMV stands at $66M, which is almost 11% of the total 2021 spending.

Although the IMV of the Food & Drink Industry is only 33% of the Tech industry, brands in the industry continue to make waves through their sponsored videos. The total reach of the Food & Drink Industry in 2021 was over 8.7 billion with 3,343 videos.

Top 5 Food & Drink Spenders on YouTube

These 5 brands were the highest spenders in the Food & Drink Industry in 2021, with a total IMV of $42.2M. The comprises a grand 63% of the industry IMV.

Three out of the top five brand spenders in the Food & Drink industry were in the top five of the 2020 report. Magic Spoon and Built Bar have joined the list in 2021, alongside GFuel, Hello Fresh, and Bang Energy. Together, these 5 brands gathered a total of 288 million views.

Food & Drink: Compare Q1 – Q4

Looking at the Food & Drink Industry across quarters, we can see an overall decrease on all fronts. It is clear, with the IMV at its peak in Q1 and at its lowest in Q4, that the brands in the industry utilized influencer marketing less towards the end of 2021. With the decrease in spend, there was also a decrease in views, reach and total videos.

Top Food & Drink Spender Spotlight

Just as it was in 2020, GFuel is the Tech Brand Spender Spotlight for 2021. The brand spent $18M on 781 videos, reaching an overall audience of 4.9B. GFuel’s IMV constitutes an impressive 27% of the total IMV for the Food & Drink Industry.

Top Influencers: Food & Drink Industry

Each of these channels are powerhouse influencers among multiple of the top industries. You’ve probably heard of one, if not all, of the channels before. These channels comprise a total reach of over 226M, proving how important they were to the industry in 2021.

Get in Touch!

Ready to launch your most lucrative influencer marketing campaign ever? Are you prepared to go viral with your biggest powerhouse influencers on YouTube? Tensor Social has the software and data capabilities for your brand to tap into the most strategic influencer initiatives. Discover how Tensor Social can help your brand reap the benefits of influencer marketing.

To learn more, head over to Tensor Social to claim your 5 FREE reports today AND 20% off your first 3 months!

Editor’s Note

In the past few years, there has been a monumental shift in the marketing industry as a whole. Through this shift, we have seen the rise of the Influencer Marketing industry and the ever-growing Creator Economy. In 2020, we saw an exponential increase in the size of the Creator Economy. More brands than ever before were investing in influencer marketing and the amount of Creators had grown astronomically. Now, after the conclusion of 2021, it is clear that the rapidly expanding Creator Economy will continue to grow for years to come.

This is evident through the data we collected and analyzed in the past year. Not only have we seen the size of industry expand as more brands start investing in the industry, but we have seen more and more brands continue investing in Influencer Marketing.

With this, we have seen the rise of the Creator. We have seen how the Creator Economy extends to all ends of the digital sphere, constantly growing and revolutionizing the world we live in. This report is intended to demonstrate the impact and growth of the Influencer Marketing industry in the past year, and the numbers speak for themselves – it is not slowing down anytime soon.