Bitcoin, the first cryptocurrency, has consistently demonstrated its potential for high returns, drawing attention from investors worldwide. This high return on investment is the primary reason why millions of people flock to digital currency. As blockchain technology continues to evolve, the adoption of cryptocurrencies is expected to grow at an unprecedented rate in the coming years.

The potential gains of digital coins are clear. However, investors often find it hard to keep track of their holdings, especially since they’re mostly scattered across multiple wallets and exchanges. This ultimately makes it hard for crypto users to compute their earnings and file their taxes—a process that is altogether tedious.

Fortunately, crypto tax calculators are here to help you navigate the economy of digital currency. Aside from making crypto taxes more digestible for users, they also automate and optimize the accounting process and make sure that you comply with their country’s tax regulations.

What Is a Crypto Tax Calculator?

A crypto tax calculator is a software solution that helps you calculate your crypto profits, losses, income, and tax liabilities. The resulting numbers are based on your investing activity, data, and information, which crypto tax calculators retrieve from your exchanges, wallets, and other crypto platforms.

To reduce the hassle of filing taxes, crypto tax calculators compute your gains and losses in your home fiat currency.

Unlike crypto profit calculators, crypto tax calculators do more than tracking your profits. Aside from automating the tax reporting process, it can also help you optimize your portfolio all year round.

Why Should You Use a Crypto Tax Calculator?

For most governments around the world, cryptocurrencies are an asset. Just like with any other asset, you must track and report every transaction, as well as any income that you incur from investing in crypto.

However, crypto exchanges can’t generate your tax documents for you, and keeping an eye on all your trades and activities can be a chore. This is why many investors fail to file their crypto tax reports.

The Internal Revenue Service (IRS) is very serious about penalizing crypto holders who evade taxes though, whether they do it on purpose or not. Failure to file your taxes may result in fees, audits, and even jail time.

Crypto tax software solutions help streamline the process by retrieving your data across all your cryptocurrency platforms, auto-generating your tax reports, and ensuring total compliance with tax laws within your country.

How to Use a Crypto Tax Calculator

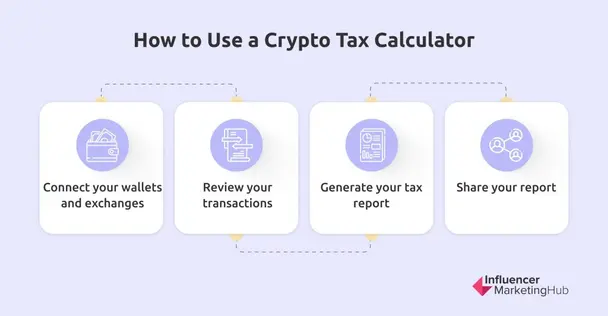

You can generate a tax report with a crypto tax calculator in four steps:

Connect your wallets and exchanges

First, import your data from your crypto exchanges to your crypto tax platform. You can import your data automatically via Application Programming Interface (API), or you can manually upload a Comma Separated Values (CSV) report of all your trades.

Review your transactions

Verify whether your transaction history is correct. In some cases, you will need to manually correct or edit some information to ensure accuracy.

Generate your tax report

Gain insights on your portfolio, optimize your cost basis accounting method, and save thousands on your taxes through tax-loss harvesting.

Share your report

Some crypto tax calculators support TurboTax, the leading platform for filing taxes in the US. This enables you to conveniently send your report directly to TurboTax. On the other hand, you can also hire a certified public accountant (CPA) to file your report for you.

What to Look for in a Crypto Tax Calculator

Available integrations

Choose a crypto tax software that can integrate with all the major exchanges such as Coinbase, Binance, Kraken, and eToro. This allows you to seamlessly pull in your data and transactions instead of manually keying them in. Aside from calculating your earnings, your tax calculator should also be able to track the number of coins you traded, your hold duration, and dates of transaction.

Aside from exchanges, you should also check available integrations and support for blockchains, Decentralized Finance (DeFi) protocols, and crypto coins, including futures, non-fungible tokens (NFT), and mining swap. With more integrations, you’ll be able to generate a more complete view of all your crypto transactions across different platforms.

Supported countries

Some crypto tax calculators provide full support for select countries and only partial support for others. Find software that can address the requirements in your country. More supported countries can also reduce the likelihood of switching to a different calculator or manually uploading your spreadsheet once you’re outside your region.

Other crypto tax tools provide downloadable tax forms, even for country-specific tax reports. Others also support countries that use exclusive accounting methods, namely First-In First-Out (FIFO), Last-In First-Out (LIFO), Highest-In First-Out (HIFO), and Adjusted Cost Base (ACB).

Reputation and security

A good reputation makes crypto tax calculators reliable and trustworthy. Partnerships with reputable financial technology and accounting companies are indicators of trust. For example, you can rely on a software program partnered with TurboTax. There’s also more trust for software solutions built by CPAs and crypto veterans.

In addition, make sure that your crypto tax calculator has a reputation for keeping your information secure. A transparency policy is often enough to ensure that nobody is selling the information that you provide. To protect your funds, your cryptocurrency calculator should use a read-only access to your exchange accounts when importing data.

Pricing per year and transaction limit

With most crypto tax calculators, prices depend on the transaction limit. Many platforms offer free services for calculating and previewing your tax report and charge only when you want to download those reports. This is a great way to gauge whether the software’s features are right for your needs before shelling out any amount.

Most calculators also start with a free plan for less than 30 transactions. If you’re a frequent trader, aim for a high number of transactions for just the right price. Review the included features too. Lower tier plans seldom include more advanced crypto transactions like mining and staking. If possible, try the free trial, keep your eyes open for hidden charges, and review the refund policy.

Ease of use and customer support

The main objective of crypto tax platforms is to simplify the tax accounting process. For this reason, a highly intuitive interface is important to allow beginners and experts alike to navigate through the platform. A crypto tax software should be able to import your data and generate your tax report within only a couple of minutes and with minimal error or manual adjustments.

A responsive customer support team will also be helpful. You should be able to connect with knowledgeable live chat support that can address your issues and provide you with more information about the software. Many crypto tax platforms also publish educational resources to help users learn more about digital currency taxes.

Top Crypto Tax Calculators

With those factors in mind, here are 11 of the best crypto tax calculators that you should try in 2025.

1. CoinTracker

With backing from Coinbase, Accel, Kraken, and other top investors, CoinTracker is a leading cryptocurrency tax calculator. It aims to provide crypto investors with the basic tools to build wealth and optimize their portfolio. It currently has 1 million users and has already tracked 3% of the crypto market cap and $50 billion of crypto assets.

CoinTracker keeps you tax compliant, generates your tax report within minutes, and automatically files your taxes for you. Its app feature also makes it easier to view your investment performance and filter your transaction history wherever you are. Full support is currently available in the US, India, and the United Kingdom (UK), while partial support is available to other countries.

Features

- Integration with over 300 exchanges, 8,000 cryptocurrencies, and 300 wallets

- Portfolio tracking across wallets and exchanges

- Automatic tax filing with TurboTax

- Forum support

- Multiple crypto tax forms and cost basis methods

- Tax-loss harvesting

- Read-only API integrations

Pricing per year

- Free: $0 for 25 transactions

- Hobbyist: $59 for 100 transactions

- Premium: $199 for 1,000 transactions

- Unlimited: Custom process for unlimited transactions

Pros | Cons |

Available to an extensive number of countries | Doesn’t support futures, swaps, and derivatives |

Supports a wide range of exchanges | Limited features for higher tier plans |

Convenient mobile app | |

Robust security features |

2. Koinly

In 2018, Robin Singh conceptualized Koinly after being frustrated with tax calculators that required a great deal of manual effort. The objective was to automate the entire process of tax accounting and portfolio tracking. Since then, Koinly has filed over 11,000 tax reports and $250 million in total funds.

Koinly can help you check your total holdings and trading activity across crypto platforms, generate a summary of your income, and even reduce your taxes for the following year. Its double-entry ledger system can also help you easily find issues and fix them. Koinly is available in more than 20 countries, including Canada, Germany, Sweden, the US, and UK.

Features

- Integrations with 350 exchanges, 50 wallets, 50 blockchains, and 11 services

- Cross-account tracking of crypto assets and taxes

- Free report preview

- Integrations with TurboTax and TaxAct

- Imports via API and CSV files

- Supports DeFi, margin trades, and futures

Pricing per year

- Free: $0 for 10,000 transactions (limited features)

- Newbie: $49 for 100 transactions

- HODLer: $99 for 1,000 transactions

- Trader: $179 for over 10,000 transactions

| Pros | Cons |

| Intuitive user interface | No option for unlimited transactions |

| Useful mobile app | |

| Comprehensive tax report |

3. Crypto.com Tax

One of the fastest growing cryptocurrency exchanges today, Crypto.com is a place where crypto investors can buy and sell over 250 digital currencies. Crypto.com Tax is its response to users’ demand for crypto tax support. It prides itself of being the first tax software that is entirely free for anyone who needs it.

Even if you’re a beginner, you’ll find it easy to navigate Crypto.com Tax and generate your tax report in five easy steps. It is available in 11 countries, including Australia, Canada, New Zealand, the UK, and the US.

Features

- API and CSV support

- Full integration with four wallets and 25 exchanges

- Supports over 10,000 cryptocurrencies

- FIFO, LIFO, HIFO, ACB, and Sharing Pool

- Capital gain/loss calculation

- Multiple tax reports

Pricing per year

- $0 for unlimited transactions

| Pros | Cons |

| Absolutely free of charge | Limited functionality on mobile |

| Straightforward and easy-to-use interface | Small number of supported exchanges |

| Supports many cryptocurrencies |

4. CoinLedger

CoinLedger began in 2018 as CryptoTrader. Tax in response to the challenges of crypto tax reporting. It’s a cryptocurrency and NFT tax calculator that helps automate the crypto tax reporting procedure. Since it began, CoinLedger has become a trusted name in cryptocurrency. It currently serves more than 300,000 investors.

CoinLedger can help you closely track your holdings, report your transactions within minutes, and learn more about crypto taxes through educational posts and content.

Features

- International support

- Library of educational crypto content

- Integrations with 55 exchanges, one blockchain, and three DeFi protocols

- Supports more than 10,000 cryptocurrencies

- Live chat customer support

- Multiple tax reports

- API and CSV support

Pricing per year

- Hobbyist: $49 for 100 transactions

- Day Trader: $99 for 1,500 transactions

- High volume: $199 for 5,000 transactions

- Unlimited: $299 for unlimited transactions

| Pros | Cons |

| TurboTax partnership | No free plans |

| Excellent live chat support | |

| Reasonable prices |

5. TaxBit

TaxBit began in 2018 as a tool to empower the widespread adoption of digital currency. Its founders were CPAs, tax attorneys, and software developers who wanted to simplify crypto taxes by automating the process of filing and accounting while staying compliant with tax regulations. Now it’s partners with some of the leading crypto and fintech investors, like PayPal and Sapphire Ventures.

Sign up with TaxBit to automate your cryptocurrency tax forms, track your portfolio in one place, and optimize your investments. It currently offers support to individuals, enterprises, and the government. At this time, it’s available only to users in the US.

Features

- Integrations with more than 500 exchanges

- Free downloadable cryptocurrency tax forms

- Tax impact preview for every trade you make

- Real-time monitoring

- TaxBit Network

Pricing per year

All TaxBit plans include unlimited transactions while differing in terms of available core features.

- Free: $0 for three core features

- Basic: $50 for five core features

- Plus+: $175 for eight core features

- Pro: $500 for all core features

| Pros | Cons |

| Large network of supported cryptocurrency platforms | Expensive if you need more features |

| Responsive customer service | Exclusive to the US |

| Unlimited transactions for all plans |

6. CryptoTaxCalculator

CryptoTaxCalculator offers a stress-free tax season by making taxes simple, straightforward, and timesaving. The Brunette brothers co-founded the software in 2018 in Sydney, Australia, but its “remote-first” culture has made it accessible in over 20 countries. With more than 100,000 users, the platform has overseen more than 150 million transactions.

Use CryptoTaxCalculator to easily organize your crypto activity across wallets, blockchains, and exchanges. You can complete your tax filings in three easy steps. The software’s transparency policy not only secures your records but also makes your taxes easy to understand.

Features

- NFT, DeFi, and DEX transactions

- Integrations with over 500 exchanges, including major international exchanges

- Provides a full breakdown of every calculation

- API and CSV support

- Categorization of your transactions

- Blog articles and guides to help users comply with tax rules

Pricing per year

- Rookie: $49 for 100 transactions

- Hobbyist: $99 for 1,000 transactions

- Investor: 189 for 10,000 transactions

- Trader: $299 for 100,000 transactions

| Pros | Cons |

| Highly accurate tax reports | No option for unlimited transactions |

| User-friendly interface | Supports a limited number of countries |

| Great customer support |

7. ZenLedger

In 2017, veterans in the fields of accounting, finance, and technology built ZenLedger to automate and optimize the process of filing digital currency taxes. The goal was to make crypto tax accounting simple and user-friendly. Now, ZenLedger has a growing client base of over 50,000 users.

If you want a seamless tax filing process to save you money while staying compliant with the IRS, then ZenLedger is the perfect software. Its downloadable documents are exclusive to US users, but other countries can still use it to compute their taxes.

Features

- Tax-loss harvesting tool

- Grand unified accounting

- TurboTax support

- Free advice from tax professionals

- Integrations with over 400 exchanges, 40 blockchains, and 20 DeFi protocols

Pricing per year

- Free: $0 for 25 transactions

- Starter: $49 for 100 transactions

- Premium: $149 for 5,000 transactions

- Executive: $399 for 15,000 transactions

- Platinum: $999 for unlimited transactions

- Tax Professional Prepared Plans: $3,500

| Pros | Cons |

| User-friendly interface | NFTs and DeFIs are only supported in the professional prepared plans |

| Knowledgeable customer service | More exclusivity to US users |

8. Cointelli

If you’re looking for reliability, Cointelli is your best bet. CPAs and the tech experts who are updated on the current tax laws comprise the Cointelli team. Their mission is to offer a reliable and accurate service to make crypto tax reporting quick and painless. It handles every type of investor, from individuals to enterprises.

Cointelli is best for a stress-free accounting. You can compile your transactions and get your tax report in four simple steps. With the software’s specialized security team, you can also be sure that your data are in good hands. The software is currently available to US taxpayers.

Features

- Integrations with more than 100 crypto platforms, exchanges, and wallets

- Free tax guides and insights from CPAs

- Multiple types of tax reports

- API coverage

- DeFi, NFTs, and staking

- Required tax forms for TurboTax and other tax software

- 24/7 customer service

- Blog on crypto tax resources

Pricing per year

- For everyone: $49 for 100,000 transactions

- For enterprise: Prices are subject to the customer’s needs

- For free: $0 for import and review online

| Pros | Cons |

| Streamlined and affordable prices | Exclusive to the US |

| Fast and accurate tax reports | Doesn’t track your total crypto portfolio |

| Easy to use | |

| Wide range of supported platforms |

9. Coinpanda

Coinpanda started in Scandinavia in 2019 as a purely “bootstrapped company”. As a cryptocurrency portfolio tracker and tax solution, it’s one of the most trusted and tax compliant software solutions for cryptocurrency today.

Coinpanda is highly compatible with Web 3.0. You can seamlessly track your performance, calculate your taxes in under 20 minutes, and even reduce your taxes for the following year. It’s currently available to more than 65 countries and supports those that use FIFO, LIFO, HIFO, and ACB cost basis, as well as country-specific calculation methods for the UK, Canada, Japan, and France.

Features

- Integrations with 75 wallets, 500 exchanges, 125 blockchains, and 38 crypto-related services

- API and CSV support

- Mining, staking, and income reports

- NFT and DeFi transactions

- Custom tax reports and forms for specific countries

- Live chat support

- Articles and guides on crypto tax rules

Pricing per year

- Free: $0 for 25 transactions

- Hodler: $49 for 100 transactions

- Trader: $99 for 1,000 transactions

- Pro: $189 for over 3,000 transactions

- Satoshi: Prices available upon request for more than 20,000 transactions

| Pros | Cons |

| Extremely detailed tax report | Low transaction limits compared to others |

| Supports a wide selection of countries, as well as localized reports | Expensive for active traders |

| Easy integration with an extensive list of exchanges |

10. CoinTracking

The world’s first cryptocurrency tax reporting software, CoinTracking has become a household name since launching in 2013. It has over 1.1 million active users across 100 countries and $41.5 billion total value of all portfolios. Its network of over 160 tax advisors has also helped crypto traders from around the world generate their tax reports.

CoinTracking is for a diverse set of audiences, from individuals and companies to pros and beginners. It can help you understand your transaction history, calculate your gains and losses, and plan and manage your crypto portfolio. Best of all, it covers crypto tax laws in all of its supported countries.

Features

- Real-time transaction tracking

- Detailed guides and tutorials on crypto taxes

- Integrations with more than 110 exchanges

- API support

- Data and API encryption

- Chart history and latest prices of all cryptocurrencies

- 25 customizable crypto reports and 13 tax methods

- Total backup of your portfolio, which you can retrieve any time

Pricing per year

- Free: $0 for 200 transactions

- Pro: $10.99 for 3,500 transactions

- Expert: $16.99 for 20,000 transactions, $21.99 for 50,000 transactions, $27.49 to 100,000 transactions

- Unlimited: $54.99 for unlimited transactions

- Corporate: Customized pricing for 10 Unlimited accounts

| Pros | Cons |

| Convenient and timesaving | No API feature for free account |

| Complete set of robust features | |

| Affordable prices | |

| App availability |

11. TokenTax

TokenTax is a crypto tax software by crypto tax experts. While other platforms started out as portfolio trackers, TokenTax had tax accounting in mind from the get-go. The initial product in 2017 imported data directly from Coinbase until it acquired tax accounting firm Crypto CPAs in 2019. Now, TokenTax not only calculates crypto taxes but also offers full accounting services to investors worldwide.

TokenTax helps you with your taxes from beginning to end. Whether you’re dealing with HODLers or hedge funds or simply want to convert your DeFi activity into transactions, you can find support for any crypto tax-related issue.

Features

- Full-service tax filing

- In-house team of CPAs and other tax professionals

- Live chat support

- DeFi and NFTs

- Real-time tax liability preview

- Multiple tax forms, including internal forms

- TurboTax integration

- Tax loss harvesting tool

Pricing per year

- Basic: $65 for 500 transactions

- Premium: $199 for 5,000 transactions

- Pro: $799 for 20,000 transactions

- VIP: $3,499 for 30,000 centralized exchange transactions

| Pros | Cons |

| Great customer support | No free trial |

| International support and availability | More expensive than competitors |

| Supports advanced crypto tax needs like tax-loss harvesting | No refunds |