Gaming is a booming sector that is expected to fetch $268.8 billion by 2025. While the number of people who buy console games is rising, there is also a simultaneous increase in the number of people who love watching online gamers at work. And they are ready to pay to cheer on their favorite players.

On top of that, companies sponsor popular players to endorse their products and games. All in all, live game-streaming has become a lucrative avenue for players. Plus, gamers get to share their gameplay with followers and build communities of like-minded gamers. For all of these reasons, live game-streaming platforms are becoming very popular among viewers and players alike.

In the live-streaming platform war, one name shines bright. Facebook Gaming. Though a new entrant, it is gaining ground amidst tough competition from the likes of Twitch. It has seen a noticeable increase in users since its top competitor, Mixer (a former Microsoft platform), was successfully integrated into Facebook Gaming.

Just like its namesake, Facebook Gaming is becoming a goldmine of opportunities for marketers and influencers alike. Brands with gamers and streamers as target audiences can benefit a lot from marketing on this platform.

If you need solid numbers to build a case for Facebook Gaming, this post is perfect for you. We have covered a number of relevant stats about the usage and trends on the platform. With each stat, we offer contextual insights and analysis. Facebook Gaming is the new kid on the livestreaming block. As it grows, we will discover new data about it. To give you a great head start, we have compiled some basic stats about the platform and its users.

Top Facebook Gaming Stats Every Brand Should Know in 2023:

Market Share

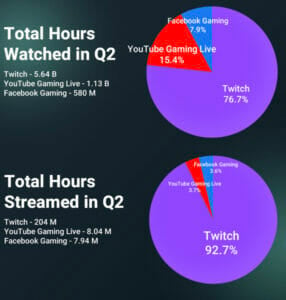

While Twitch and YouTube Gaming control the lion's share of the game-streaming market, Facebook Gaming saw a steady increase in market share during 2018-2019. In 2018, the platform's market share (by hours watched) was only 1%. In 2019, this figure rose to 3%. 2021 saw the social media giant blow past the 1 billion gaming hour mark in Q1. With Mixer fully merged with Facebook Gaming, it's easy to see how these numbers could grow even more.

However, although Facebook Gaming managed to surpass YouTube Gaming both in terms of hours watched and hours streamed in 2021, it started to witness a downfall in 2022. Facebook Gaming once reached 1.29 billion total gaming hours in Q3 of 2021 and commanded 15.7% of the market share. But by Q2 of 2022, the total hours watched on Facebook Gaming only managed to reach 580 million. This amounts to 7.9% of the market share. In the first quarter of 2023, Facebook Gaming experienced a significant downturn, with its market share plummeting to 3%. This downturn led to its exit from the top three gaming platforms in the previous quarter.

Meanwhile YouTube Gaming continues to remain at around 1.17 billion in total hours watched in 2023 Q1, now commanding 15% of the market. Twitch’s market share increased significantly from 2021, with 5.64 billion hours watched, which amounts to 81% of the market.

Source: streamlabs.com

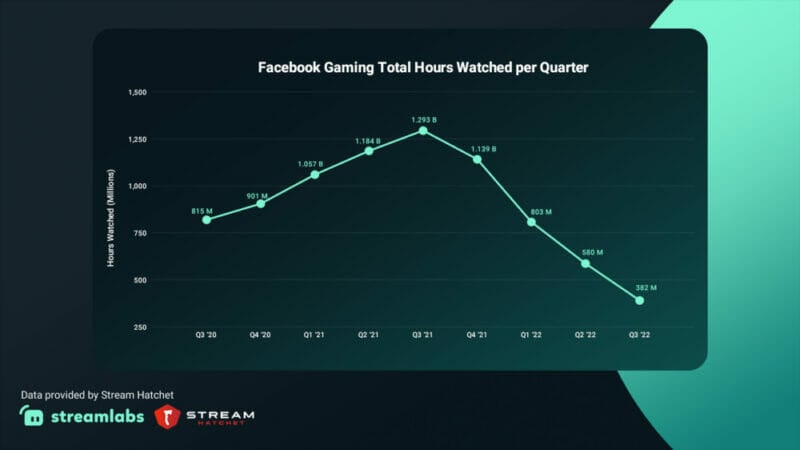

Decline in Total Hours Watched

Facebook Gaming has been seeing a steady increase in total hours watched since 2020, going from 815 million hours in Q3 of 2020 to peaking at 1.29 billion hours in Q3 of 2021. However, these numbers seem to be on a declining trend with only 382 million hours watched during Q3 of 2022. Between Q1 of 2021 and Q2 of 2022, there was a 24.2% YoY decline in hours watched. By Q3 of 2022, the YoY decline in hours watched was a shocking 70.5%.

Source: streamlabs.com

While at one point, it seemed like Facebook Gaming was quickly heading for the top spot, these declining numbers show that the platform is struggling to compete with Amazon’s Twitch. Admitting defeat, it announced in August 2022 that the Gaming app will no longer be available for iOS and Android devices. However, the Gaming features will still be accessible within the main Facebook app.

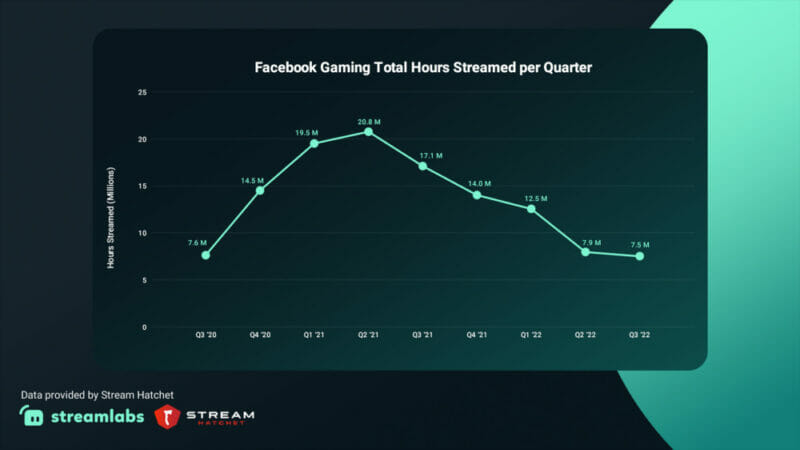

Reduction in Total Hours Streamed

Along with the decline in hours watched, streamers on Facebook Gaming also began to stream less in 2022. This meant that viewers had fewer streams to choose from, which might have been a contributing factor to the reduction in hours watched.

In Q3 of 2022, there were only 7.5 million hours of live streams broadcasted, going back to 2020-level, and amounting to a 5.1% decline from the previous quarter. The YoY decrease in hours streamed was a whopping 56.1% as Facebook Gaming managed to reach 17.1 million hours streamed in Q3 2021.

Source: streamlabs.com

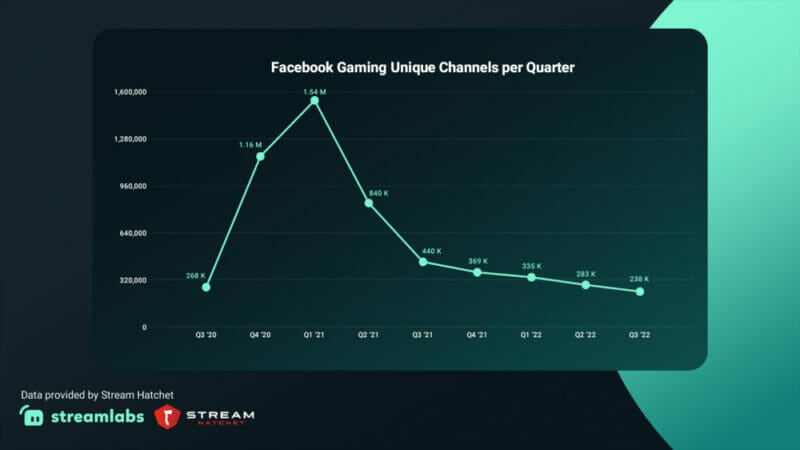

Number of Unique Channels on the Decline

In 2021, Facebook Gaming managed to sustain the new gamers it attracted during the pandemic. However, the trend couldn’t continue into 2022 as the number of unique channels on the platform began to dwindle. It reached a peak in Q1 of 2021 when the platform saw 1.54 million unique channels. But by the next quarter, there was a sharp decline in these numbers, with only 840,000 unique channels sustained on the platform.

This downward trend continued into 2022, albeit not as drastic as the previous year. The year began with 335,000 unique channels and by Q3, the number had dropped to 238,000 unique channels. This amounted to a 46% YoY decline in the number of unique channels.

Source: streamlabs.com

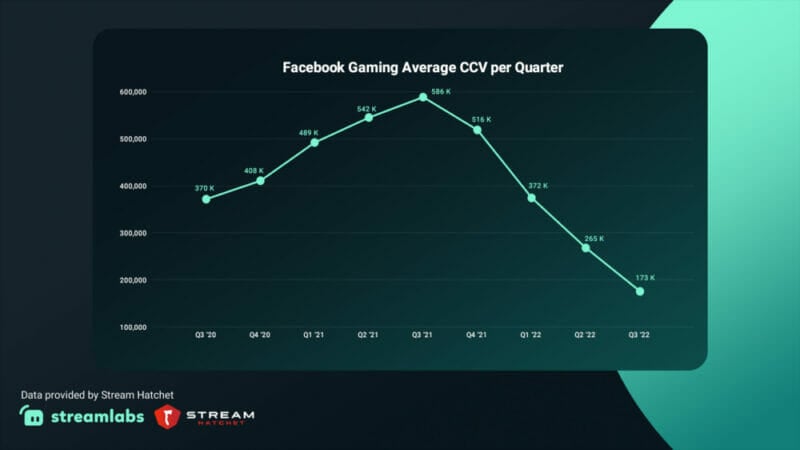

Average Concurrent Viewers Drop Drastically

While the average concurrent viewers on Facebook Gaming peaked in Q1 2021 at 586,000, the numbers have since started to drop at an alarming rate. In Q3 2022, an average of 173,000 concurrent viewers tuned into Facebook Gaming. This was a drastic drop from 265,000 in the previous quarter–a 35% decrease to be precise. Compared to the previous year, the decline in average concurrent viewership stood at a whopping 70%.

Source: streamlabs.com

Stream Hatchet analyzed the top live streaming creators in Q2 2023 across Twitch, Facebook Gaming, and YouTube Gaming in terms of hours watched. Unsurprisingly, Twitch streamers dominated the list, taking over ranks 1 through 9. The top Twitch streamer was xQc with 55.9 million total hours watched. BeamNG Speed from YouTube Gaming was the only non-Twitch streamer to make it to the list with 19.4 million hours watched.

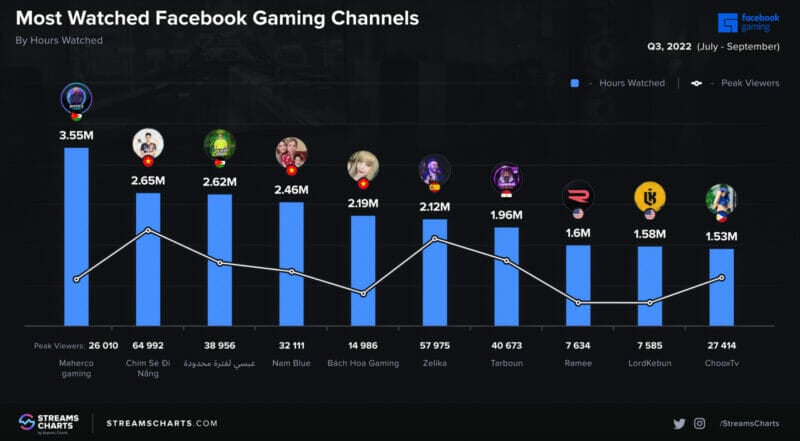

Streams Charts focused their analysis specifically on Facebook streaming channels. Most of the leading channels were non-English-based, with Asian streamers dominating the list. According to their report, the top Facebook streamers in Q3 2022 by hours watched were:

- Maherco gaming (3.55 million)

- Chim Sẻ Đi Nắng (2.65 million)

- عبسي لفترة محدودة (2.62 million)

- Nam Blue ( 2.46 million)

- Bach Hoa Gaming (2.19 million)

- Zelika (2.12 million)

- Tarbourn (1.96 million)

- Ramee (1.6 million)

- LordKebun (1.58 million)

- ChooxTv (1.53 million)

Source: streamscharts.com

Who’s Using Facebook Gaming?

In spite of the decline in user base and viewership, Facebook Gaming still saw gamers from different parts of the world playing for a variety of reasons. While most gamers from the U.S, U.K, and Germany played to pass the time, most South Korean gamers were playing to relieve stress.

Source: Facebook Gaming

Which Devices Do Gamers Use?

As gaming expands to more connected devices, gamers are spoilt for choice as to where they will stream from. A YouGov study found that smartphones and mobile devices capable of playing videogames were the most popular choice among gamers in the U.S and Great Britain. This is followed by Windows-based desktops and laptops, which are also the top preference for gamers in China and Australia.

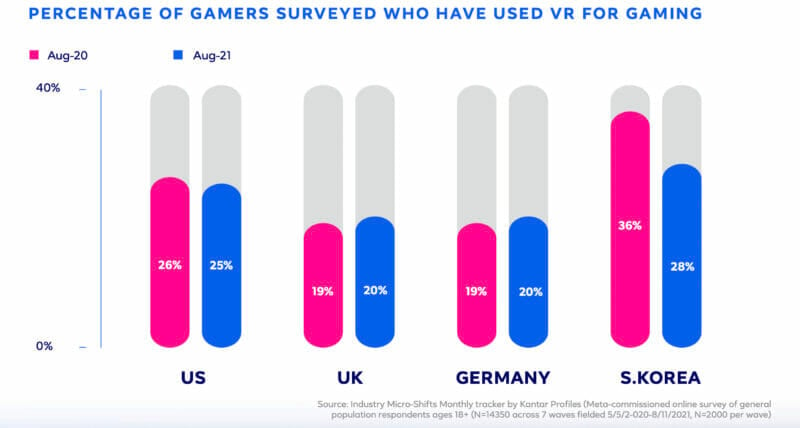

Standalone gaming devices like Nintendo Switch and Sony PlayStation 4 ranked among the top four most-used devices for gaming. Meanwhile, virtual reality headsets are also starting to grow in popularity among gamers across various countries.

Source: Facebook Gaming

But with Facebook discontinuing its Gaming app, we’re also likely to witness a further drop in the number of gamers playing from mobile devices. While the main Facebook app still makes some gaming functionalities accessible, there’s a chance it might not be as robust as the Gaming app once offered.

Revenue

According to StreamScheme, a full-time streamer on Facebook can earn around $2,750-$5,500 per month on average. Meanwhile, small streamers on Twitch reportedly make between $50 and $1,500 a month. Based on these reports, gamers have a better potential to earn on Facebook Gaming than on Twitch, especially since the platform isn’t as saturated.

There are two monetizing options in Facebook Gaming, "Level Up" and Partner Program. Both require Facebook to choose streamers who fit their bill of "successful" streamers. To qualify for Level Up, streamers need to build a creator page, collect 100+ followers, and stream gaming content dedicatedly for at least two days.

Qualified streamers can unlock "Stars" which can be exchanged for real money. The current exchange rate is one cent. Additionally, they can charge subscribers (or followers) at the rate of $4.99 a month.

The Partner program is more intense. Facebook Gaming hand-picks streamers who get Facebook Managers, a monthly paycheck, and first digs at pilot features like ads and stickers.

Spending on Facebook Gaming

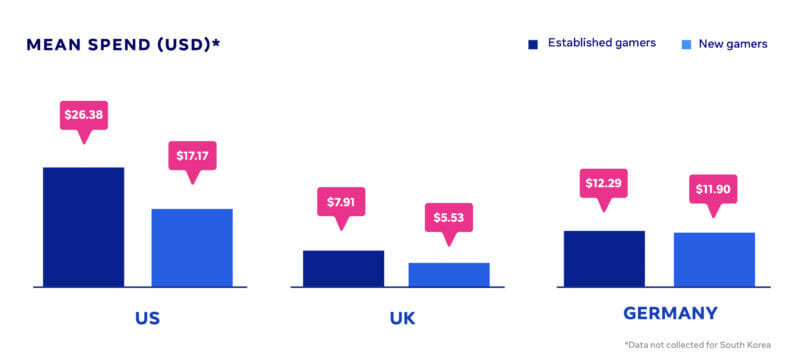

Established gamers spent more than new gamers across the board, with established gamers in the U.S spending the most at a mean spend of $26.38. Meanwhile, new gamers had a mean spend of $17.17–still far more than what established gamers in Germany and the U.K spent.

Source: Facebook Gaming

Insights about Audience

Influencers, content creators, and marketers on Facebook Gaming need to understand how and why people use the platform. Only then can they create resultful content and strategies.

Take a look at these stats about the goals and challenges of gaming audiences:

Passing Time and Stress Relief

Most gamers across different countries are playing to pass the time between different activities. Stress relief is another major reason for playing games.

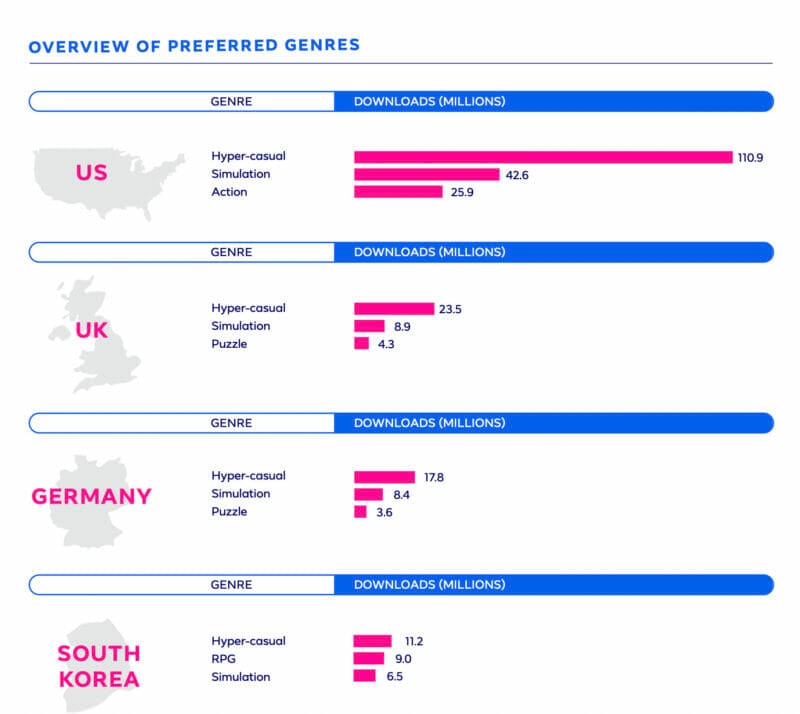

Hyper-casual Games Come Out on Top

Hyper-casual games are the most downloaded genre across all major countries in the Facebook Gaming study. However, people are also looking for an immersive experience with simulation games being another popular choice.

Source: Facebook Gaming

Most Gamers Prefer Ad-Supported Games

Ad-supported games are the top preferred monetization model across the board. Free-to-play with in-app purchase games are also a popular choice.

Gamers Value Representation

Representation matters, and it extends to the gaming world as well. A majority of gamers across markets would feel more connected to the game or play it more often if it featured more characters that represented them or people like them. 83% of Brazilian gamers, 78% of South Korean gamers, 71% of U.S gamers, 68% of U.K players, and 60% of German gamers shared this sentiment.

Moreover, most mobile gamers would also be more likely to download, buy, or make in-app purchases if the game featured more characters that represented them or people like them. This is particularly significant in Brazil, where 81% of total gamers shared the sentiment.

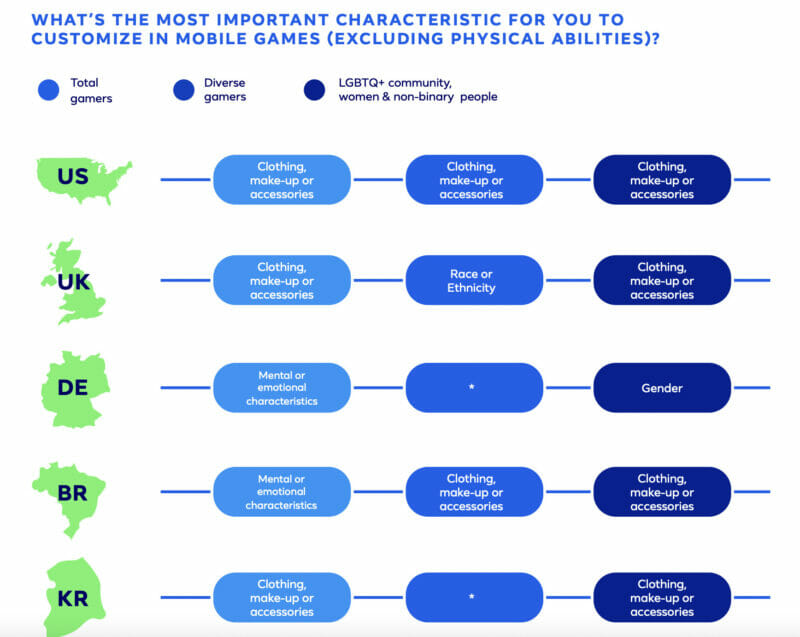

Customization Capability is a Major Win

Most mobile gamers across markets enjoy creating or customizing characters, environments, and worlds in mobile games. Many of them also feel that mobile games that offer more customization capabilities are of higher quality.

45% of mobile gamers in the U.S even say that they’d be willing to spend more money on games that offer more character customizations. Here’s a look at the different characteristics that gamers want to customize in mobile games.

Source: Facebook Gaming

Ads Need to Be More Compelling

Gamers want to see gameplay in ads for games. A majority of mobile gamers say they’re more likely to download a mobile game if the ad featured exciting or challenging gameplay. Seeing a diverse set of characters in the ad is also another key reason for gamers to download a game.

Wrapping Up

The growth of Facebook Gaming seems to be on the decline, with the platform resorting to discontinuing the app. However, the gaming facilities are still accessible through the main Facebook app. And with gamers on Facebook Gaming have a huge potential to earn and make it big, Facebook Gaming itself isn’t likely to go away soon.

It still commands significant viewership, making it a good platform for brands that want to advertise through the platform and creators who want to grow their audience. The stats and facts highlighted in this article can be a good starting point.

Frequently Asked Questions

How is Facebook Gaming doing?

Facebook Gaming has an average concurrent viewership of 586,000 in Q1 in 2021. However, since then, by the end of 2022, Facebook Gaming has an average of 173,000 concurrent viewers tuning into Facebook Gaming.

Who is the biggest Facebook Gaming streamer?

Here are 5 talented Facebook Gaming streamers who are Facebook partners.

- KingSlayer

- Darkness429

- DooM49

- GoodGameBro

- Alodia Gosiengfiao

- Gina Darling

What is the most streamed game on Facebook?

The most popular Facebook Gaming category is PUBG Mobile. PUBG Mobile accumulated more than 38 million hours watched in a month.

Does Facebook Gaming have an algorithm?

Facebook Gaming does not have an algorithm. Facebook, however, does have an algorithm and it is difficult to game the algorithm. Every Facebook user is different and it is impossible to create content that will connect every user to you.