In the fast-paced and dynamic world of business, companies are constantly searching for ways to stay ahead of the competition and maximize their returns on investment. While return on investment (ROI) has long been a key metric for measuring profitability, it may not always provide the full picture when it comes to marketing investments. As businesses grow and invest more in marketing, it becomes increasingly important to understand the concept of marginal ROI, which measures the additional return on investment gained by making small incremental changes to an existing investment.

Imagine a scenario where a small business owner invests in a new marketing campaign, hoping to attract more customers and increase sales. They diligently track their ROI and see positive results, but they also realize that there may be room for improvement. By analyzing the marginal ROI of investing more in that campaign, they may uncover new opportunities for growth and profitability, such as investing in a different channel or targeting a specific audience segment. Marginal ROI can help businesses make informed decisions about where to allocate their resources to achieve maximum returns.

In this article, we will delve deeper into the differences between ROI and marginal ROI, and explore how to calculate marginal ROI and marginal ROAS. We will also discuss where to invest your advertising dollars for maximum impact, and how to use marginal ROI analysis to plan for the future. Whether you are a small business owner or a marketing professional, understanding the concept of marginal ROI can help you make informed investment decisions and achieve sustained growth and profitability over time. So, let's dive in and explore the world of marginal ROI together!

What is Marginal ROI vs ROI?

In the world of business, there are few metrics as important as return on investment (ROI). After all, businesses are built on the foundation of making profitable investments that will yield returns in the future. Calculating ROI is a relatively straightforward process - simply divide the gain from an investment by the cost of that investment. But what happens when a business wants to invest more in a particular area? That's where marginal ROI comes in.

Imagine a company that invest $50,000 in a marketing campaign and achieves an ROI of 20%, resulting in a profit of $10,000. But by analyzing the marginal ROI of investing an additional $5,000 in that campaign, they might discover that the potential return is even greater, resulting in a profit of $15,000. This concept can be applied to any area of business, from product development to employee training, allowing businesses to identify areas with the greatest potential for growth and profitability..

Source: econsultancy.com

In fact, measuring marginal ROI allows marketers to optimize their paid search campaigns by identifying which keywords, ad groups, and targeting methods generate the most revenue per dollar spent. For example, Bing Ads recently used a machine learning algorithm to analyze billions of data points from their campaigns, which helped them identify the ad groups that had the highest marginal ROI. By reallocating their budget to these high-performing ad groups, Bing Ads was able to increase their ROI by 43% while simultaneously reducing their cost per click. This is just one example of how measuring marginal ROI can help businesses maximize the value of their paid search campaigns.

Real-life examples of companies that have successfully used marginal ROI to their advantage include Amazon and Netflix. Both companies have invested heavily in data analysis and customer insights, allowing them to identify areas of potential growth and refine their investments accordingly. This has helped them stay ahead of the competition and maintain their positions as industry leaders.

It's important to note that while ROI is still an important metric for measuring profitability, it may not provide the full picture when it comes to investments. By analyzing marginal ROI, businesses can identify areas with the greatest potential for growth and profitability, and make informed investment decisions that will yield the best possible returns. So the next time you're considering investing in a new initiative, don't just think about the ROI - think about the marginal ROI as well, and discover new opportunities for growth and success.

How do you calculate Marginal ROI in Marketing?

As mentioned in our Marketing Channel ROI Guide, marketing is a crucial component of any business's success, and investing in the right marketing strategies can mean the difference between stagnation and growth. But with so many different marketing options available, it can be challenging to determine where to invest your resources to achieve the best possible returns. That's where the concept of marginal ROI comes in.

Calculating marginal ROI in marketing involves comparing the ROI of an existing marketing campaign or investment to the potential ROI of a slightly modified or increased investment. For example, a company invests $1,000 in a digital advertising campaign and sees an ROI of 10%. They're pleased with the results, but they're also curious about what might happen if they invest just a little bit more. By analyzing the marginal ROI of investing an additional $500 in that campaign, they may discover that the potential return is even greater than the original investment.

Let's take a look at Nike and Coca-Cola. Nike has invested heavily in social media marketing and personalization to engage with customers and drive sales. By analyzing marginal ROI, they have been able to refine their marketing strategies and achieve significant growth in recent years. Similarly, Coca-Cola has used marginal ROI analysis to optimize their product launches and marketing campaigns, resulting in increased brand awareness and customer loyalty.

Calculating marginal ROI in marketing can help businesses identify areas with the greatest potential for growth and profitability, and make informed investment decisions. By investing in marketing initiatives with high marginal ROI, businesses can achieve sustained growth and profitability over time. So, the next time you're considering a marketing investment, don't just think about the ROI - think about the potential of marginal ROI to unlock new opportunities for success.

How do you calculate Marginal ROAS?

ROAS stands for return on advertising spend, which is a marketing metric used to measure the effectiveness of advertising campaigns. It is calculated by dividing the revenue generated by an advertising campaign by the cost of that campaign.

Calculating marginal ROAS is a crucial step in determining the effectiveness of your advertising campaigns and maximizing your returns on investment. ROAS stands for return on advertising spend, and it measures the revenue generated by an advertising campaign compared to the cost of that campaign. Calculating ROAS is a simple formula:

For example, if your advertising campaign generates $10,000 in revenue and costs $2,000 to run, your ROAS would be:

ROAS = $10,000 / $2,000 = 5

This means that for every dollar you spend on advertising, you generate $5 in revenue.

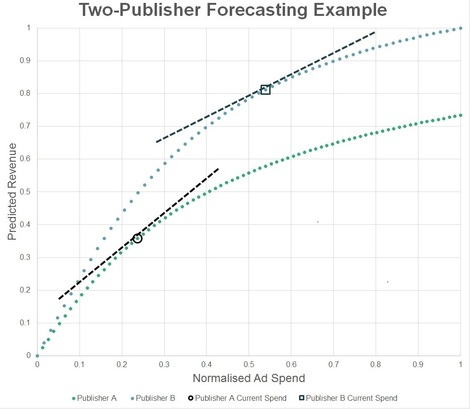

Calculating marginal ROAS involves comparing the ROAS of an existing advertising campaign or investment to the potential ROAS of a slightly modified or increased investment. This can help businesses determine where to allocate their advertising budget to achieve maximum returns.

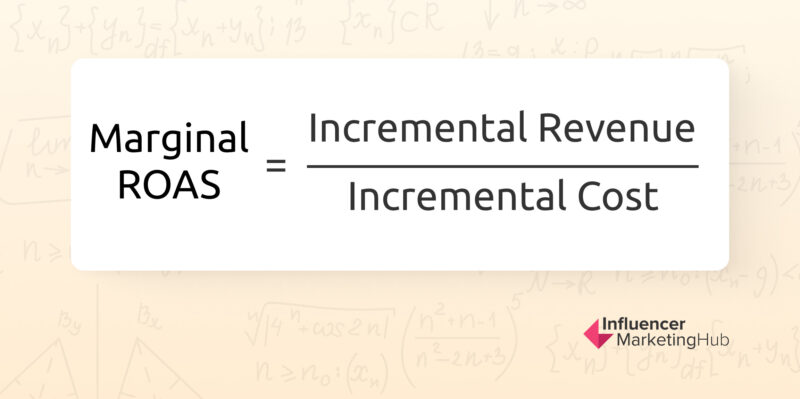

To calculate marginal ROAS, you first need to calculate the incremental revenue and incremental cost of the additional investment. The formula for incremental revenue is:

Similarly, the formula for incremental cost is:

Once you have calculated the incremental revenue and incremental cost, you can calculate the marginal ROAS using the formula:

For example, let's say that your initial advertising campaign generated $10,000 in revenue and cost $2,000 to run, resulting in an ROAS of 5. If you invest an additional $1,000 in the same campaign and generate an additional $2,000 in revenue, your incremental revenue would be:

Incremental Revenue = $12,000 - $10,000 = $2,000

Your incremental cost would be:

Incremental Cost = $3,000 - $2,000 = $1,000

Using the formula for marginal ROAS, we can calculate the marginal ROAS for this additional investment:

Marginal ROAS = $2,000 / $1,000 = 2

This means that for every dollar you spend on the additional investment, you generate $2 in revenue.

By analyzing the marginal ROAS of different advertising campaigns and investments, businesses can identify areas with the greatest potential for growth and profitability. For example, if the marginal ROAS of an additional investment in one campaign is higher than the existing campaign's ROAS, it may be worth reallocating resources to that campaign to achieve greater returns.

By using the formulas and examples outlined in this guide, you can make informed investment decisions and achieve sustained growth and profitability over time. \

Marginal ROI: A Window into Future Returns.

Marginal ROI analysis can provide businesses with valuable insights into the potential future impact of an investment. According to a study by Bain & Company, businesses that invest in marketing initiatives with high marginal ROI can achieve up to 10x higher revenue growth than those that invest in lower-margin initiatives. By analyzing the marginal ROI of different investment scenarios, businesses can identify areas with the greatest potential for future growth and profitability.

For example, Apple's investment in the iPod provides a compelling case study on the power of marginal ROI analysis. When Apple launched the iPod in 2001, it was a new and untested product with uncertain prospects for success. However, by analyzing the marginal ROI of investing more in the iPod, Apple was able to identify opportunities for growth and refinement, such as adding new features, expanding the product line, and improving the user experience. Over time, Apple's investment in the iPod paid off, with the iPod becoming a major driver of growth and profitability for the company.

In another example, the online retailer Zappos used marginal ROI analysis to identify opportunities for growth and expansion. By analyzing the marginal ROI of investing more in customer service, Zappos was able to identify customer service as a key area for growth and invest in initiatives such as free shipping and returns, 24/7 customer support, and a focus on creating emotional connections with customers. These investments paid off for Zappos, with the company becoming a leader in customer satisfaction and loyalty and being acquired by Amazon for $1.2 billion.

Where to Spend Your Advertising Dollars

To maximize the impact of your advertising dollars, it is important to consider both ROI and marginal ROI when making investment decisions. By comparing the ROI of existing campaigns to the potential ROI of new investments, businesses can make informed decisions about where to allocate their advertising budget to achieve maximum returns.

Additionally, businesses should consider the long-term impact of their advertising campaigns on customer lifetime value and brand awareness. Investing in brand building and customer relationship management can have significant long-term benefits that may not be immediately visible in ROI calculations, but can contribute to sustainable growth and profitability.

When deciding where to spend your advertising dollars, it is also important to consider the specific needs and preferences of your target audience. Conducting market research and using data analytics can help you identify the most effective channels and messages to reach your target audience and maximize your returns on investment.

Companies that focus solely on short-term sales activation strategies may see immediate returns, but may struggle to maintain long-term growth and profitability. For example, Groupon's reliance on daily deal promotions led to a decline in customer loyalty and revenue over time, highlighting the importance of balancing short-term and long-term investment strategies in marketing.

Wrapping Up

As businesses continue to compete in a fast-paced and dynamic market, understanding and utilizing the concept of marginal ROI becomes increasingly important. While traditional ROI is still an essential metric for measuring overall profitability, it may not provide the full picture when it comes to marketing investments. Calculating marginal ROI and ROAS helps businesses to identify areas with the greatest potential for growth and profitability, enabling them to make informed investment decisions that will yield the best possible returns.

By combining ROI, marginal ROI, and ROAS, businesses can make effective and profitable advertising investment decisions that balance short-term and long-term growth strategies. Understanding and utilizing marginal ROI helps businesses to identify areas with the greatest potential for future growth and profitability, and to invest in initiatives that will drive sustained success over time. By doing so, businesses can create value for their customers and stakeholders, achieve long-term growth and profitability, and stay ahead of the competition.

ROI measures the overall return from an investment by dividing the profit by the cost of the investment. Marginal ROI, on the other hand, evaluates the additional returns generated by a small, incremental change in investment. For example, if a business invests more in a marketing campaign, marginal ROI helps assess if the additional investment yields higher returns than the original outlay. Marginal ROI is calculated by comparing the additional revenue generated by an incremental investment to the cost of that investment. The formula is: Marginal ROI helps marketers optimize their spending by identifying diminishing returns from additional investments. By understanding when further investments yield minimal returns, businesses can allocate resources more effectively, ensuring that every dollar spent maximizes profitability without overspending. Companies like Amazon and Netflix use data analytics to measure marginal ROI and identify growth opportunities. By refining their investments based on marginal ROI insights, they can target high-performing areas like customer personalization and product development, leading to sustained growth and industry leadership. Marginal ROAS (Return on Advertising Spend) compares the revenue gained from an additional advertising investment to its cost. Unlike traditional ROAS, which looks at the total return from a campaign, marginal ROAS focuses on incremental changes. This helps businesses fine-tune advertising strategies and budget allocation for maximum impact.Frequently Asked Questions

What is the difference between ROI and Marginal ROI in marketing?

How do you calculate Marginal ROI in marketing campaigns?

Marginal ROI = (Incremental Revenue - Incremental Cost) / Incremental Cost

This helps marketers identify whether extra spending on a campaign delivers sufficient value and if further investments should be made.Why is Marginal ROI important for marketing optimization?

How do companies like Amazon and Netflix use Marginal ROI to drive growth?

How does Marginal ROAS differ from traditional ROAS, and why is it useful?