For marketers, consultants, and creators, the era of passive adaptation has ended.

The influencer marketing ecosystem stands at an inflection point, reshaped by unprecedented technological advancements, shifting consumer behaviors, and increasing demands for accountability.

As we enter 2025, the question is no longer whether influencer marketing works but how to unlock its next evolution. In 2024, influencer marketing propelled social media to become the world’s largest advertising channel, surpassing paid search with a staggering $247.3B, reaching $266.92B by end of 2025 in global spend, cementing its role as the epicenter of consumer influence and engagement.

Political and economic uncertainties, particularly surrounding TikTok, have significantly disrupted the influencer marketing space. Following its potential US ban in 2025, marketers’ investment intentions for TikTok in their influencer campaigns dropped by 17.2%, reflecting a cautious reassessment of platform reliability. This shift underscores the critical need for brands to diversify their strategies, ensuring resilience in the face of regulatory and geopolitical turbulence. The potential TikTok ban serves as a stark reminder of the risks associated with overdependence on any single platform.

This year’s Influencer Marketing Benchmark Report 2025 builds on this critical juncture, presenting the industry’s most comprehensive insights and strategies for navigating the road ahead.

Key Areas Covered in the Report

To provide a holistic analysis of the influencer marketing industry in 2025, we have focused on five critical areas that encompass the industry's macro trends, technological innovations, and operational nuances:

- Market Dynamics and Growth Trajectory of Influencer Marketing

- Sentiment Towards Influencer Marketing in 2025

- AI – The Catalyst of Influencer Marketing’s Evolution

- Influencer Marketing Distribution Channels and Influencer Tiers

- Expert Predictions on the Future of Influencer Marketing

This is not a moment for incremental change. It is a call to reimagine influencer marketing for an era defined by technological disruption and consumer expectation. Success in 2025 will depend on your ability to master this balance, blending innovation with human connection to drive enduring impact. Many of us are right now in a race to uncover the new road ahead, and this is exactly what we will be doing in this report.

- Notable Highlights - Influencer Marketing Benchmark Report 2025:

- Market Dynamics and Growth Trajectory of Influencer Marketing

- Sentiment Towards Influencer Marketing in 2025

- AI – The Catalyst of Influencer Marketing’s Evolution

- Influencer Campaign Strategy: Key Statistics and Insights

- Influencer Marketing Distribution Channels & Influencer Tiers

- Expert Predictions: Influencer Marketing in 2025

- The Lessons Learned in 2024 & Looking Ahead into 2025

Notable Highlights - Influencer Marketing Benchmark Report 2025:

- Influencer marketing projected to reach $32.55 billion in global market size by 2025

- Over 80% of marketers affirm influencer marketing as a highly effective strategy

- Nano-influencers accounted for 75.9% of Instagram’s influencer base in 2024

- AI integration improves campaign outcomes for 66.4% of marketers

- TikTok experiences a 17.2% drop in marketers’ investment intentions following its US ban in 2025

- 63.8% of brands confirm plans to partner with influencers in 2025

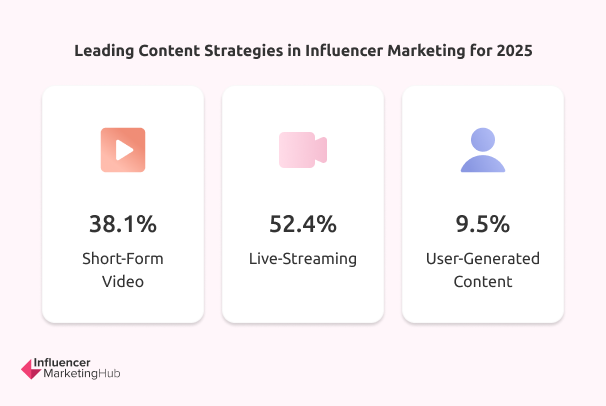

- Live streaming emerges as the leading content strategy, favored by 52.4%

- Experts emphasize 47% focus on long-term influencer partnerships

- Brazil secures 15.8% share as the global leader in Instagram influencers

- 73% of marketers believe influencer marketing can be largely automated by AI

Strategic Foundation for Comprehensive Industry Insights

Through a dual-pronged research framework, encompassing quantitative analysis of 315 influencer marketers and qualitative predictions from 100+ thought leaders, this report delivers an unparalleled synthesis of market sentiment, investment trends, and actionable recommendations.

This hybrid approach addresses a key challenge in influencer marketing: the divergence between operational realities faced by marketers and the forward-looking innovations proposed by executives. Quantitative findings ensure a grounded understanding of market benchmarks, while qualitative insights provide foresight into emerging trends such as AI's role in hyper-personalization and the rising importance of community-building.

Quantitative Analysis: Data from 315 marketers reveals how budgets are allocated, AI technologies are adopted, and ROI is measured. Key benchmarks and trends provide a comprehensive view of the market’s trajectory.

Qualitative Insights: In-depth interviews with 100+ industry leaders uncover expert predictions, identify challenges, and provide strategies for leveraging technology, engaging influencers, and navigating macroeconomic pressures.

Market Dynamics and Growth Trajectory of Influencer Marketing

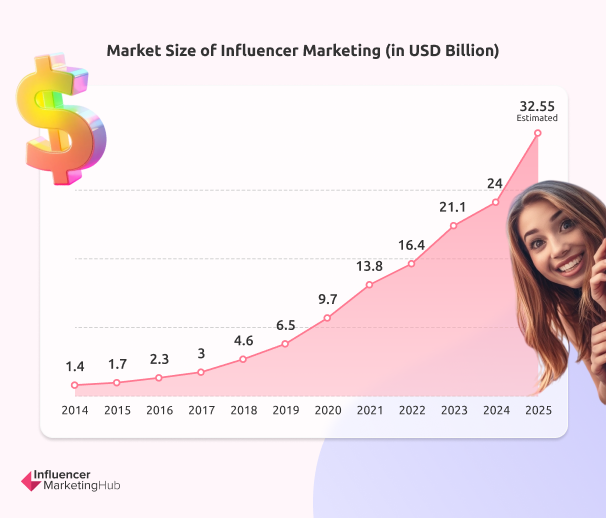

Influencer Marketing estimated market size reaching $32.55 billion in 2025

Influencer marketing continues to exhibit exponential growth, with the industry's estimated market size reaching $32.55 billion in 2025, compared to $24 billion in 2024 and a modest $1.4 billion in 2014. This represents a remarkable Compound Annual Growth Rate (CAGR) of 33.11%, showcasing the sector's sustained momentum and rapid expansion over the past decade.

Annual Growth Trends

Between 2024 and 2025, the global influencer marketing industry is projected to grow by an impressive 35.63%, significantly outpacing the average growth rates of traditional advertising channels. This year the surge is fueled by increasing investments in influencer-led campaigns, advanced AI-powered tools for campaign optimization, and the growing integration of social commerce platforms.

Historical Growth Context

- 2014–2019: The industry scaled from $1.4 billion to $6.5 billion, largely driven by the rise of social media platforms and the early adoption of influencer marketing strategies.

- 2020–2025: The pandemic-induced shift to digital accelerated growth further, with market size ballooning from $9.7 billion in 2020 to $32.55 billion in 2025, cementing influencer marketing as a cornerstone of modern advertising.

This trajectory not only highlights the growing relevance of influencer marketing but also its ability to adapt and thrive amidst evolving consumer behaviors and technological advancements. The sector's rapid expansion underscores its potential to rival, if not surpass, other major digital marketing channels in both scale and strategic importance.

Since 2014, average daily time spent on social media has surged by nearly 40%, reaching 143 minutes per day. As platforms evolve into hubs for entertainment, shopping, and connection, social media has become the undisputed battleground for consumer attention.

Social media became the world's largest advertising channel

In 2024, social media became the world's largest advertising channel, surpassing paid search, with a staggering $247.3 billion in global ad spend. This is expected to grow to $266.92 billion in 2025, driven by increasing investments in influencer collaborations, short-form videos, and live shopping experiences.

6,939 Companies Now Serve the Booming Influencer Marketing Industry

The influencer marketing ecosystem continues to expand at a rapid pace, with 6939 influencer marketing-focused service providers and platforms recorded in 2025, a significant increase from just 1,120 in 2019. This explosive growth highlights the increasing reliance on these companies to simplify complex workflows for both brands and influencers. While organic influencer marketing can be slow and resource-intensive, these companies have become essential in bridging the gap between brands and the creator economy.

Jasmine Enberg, VP & Principal Analyst of Social Media & Creator Economy, explains that the landscape is both consolidating and expanding in response to the creator economy's evolution. She predicts three transformative trends for 2025:

1. Consolidation Among Agencies:

Brands are consolidating their influencer marketing efforts with fewer agencies. Large holding companies, such as Publicis Groupe with their acquisition of Influential, are acquiring influencer-led agencies to strengthen their expertise. Influencer marketing is no longer optional but essential, pushing this consolidation trend further.

2. Niche Agencies Thriving:

Specialized agencies with unique, creative offerings remain in demand. Firms like Creator Authority, Influence by Verbatim, and ARCH are examples of how niche specialization ensures relevance in an otherwise saturated market. On the other hand, agencies that rely solely on software solutions are struggling to stand out, as brands increasingly demand a hybrid approach that combines human creativity and technological precision.

3. The Rise of Talent Management:

With creators building large-scale businesses, agencies are investing heavily in talent management. This trend mirrors acquisitions such as Whalar’s purchase of Sixteenth. Traditional Hollywood agencies are also increasingly focusing on digital talent, marking a shift in how creators are supported and represented.

These trends, supported by data insights from HypeAuditor, illustrate the dynamism of the influencer marketing industry, where growth is driven not just by quantity but by the strategic evolution of agency models to meet new demands.

Regional Insights

The United States leads the global landscape for influencer marketing with 22.7% of all sponsored posts made by influencers in 2024, totaling an impressive 18.9 million posts. Brazil ranks second, contributing 14.5% of sponsored posts, followed by India with 6.7%.

Countries Count of Posts Percentage United States 18,903,860 22.7% Brazil 12,034,485 14.5% India 5,576,769 6.7% Indonesia 3,104,724 3.7% United Kingdom 2,818,065 3.4% Japan 2,215,092 2.7% Spain 1,947,962 2.3% Germany 1,717,057 2.1% Italy 1,673,182 2.0% France 1,659,377 2.0%

Distribution of Instagram Influencers

Interestingly, Brazil leads in the number of Instagram influencers, with 3.83 million influencers accounting for 15.8% of the global share, followed closely by the United States at 3.78 million influencers (15.6%). India secures third place, with 1.99 million influencers (8.2%).

Country Number of Influencers Percentage Brazil 3,832,203 15.8% United States 3,779,041 15.6% India 1,995,353 8.2% Iran 1,209,171 5.0% Indonesia 863,517 3.6% Turkey 755,874 3.1% United Kingdom 720,543 3.0% Italy 653,392 2.7% Germany 520,173 2.1% France 513,253 2.1%

Emerging Regional Trends

- Brazil's Dominance: Brazil has surpassed the United States in the number of Instagram influencers, reflecting a dynamic influencer economy powered by its social commerce boom and mobile-first audience.

- India's Ascent: India's rapid growth in influencer adoption aligns with its expanding digital economy and its strong base of Gen Z and millennial audiences, making it a vital market for global brands.

- MENA and LATAM: Emerging regions like MENA and LATAM are witnessing accelerated growth in influencer marketing. These markets are experiencing double-digit growth in influencer marketing budgets as brands increasingly target local influencers to drive regional relevance and engagement.

These regional dynamics underline the growing global influence of the influencer marketing industry. While the United States retains its leadership in sponsored posts, Brazil’s overtaking of the U.S. in influencer numbers showcases shifting trends in adoption. Emerging markets like India, MENA, and LATAM present exciting opportunities for brands aiming to capitalize on localized, culturally relevant influencer strategies.

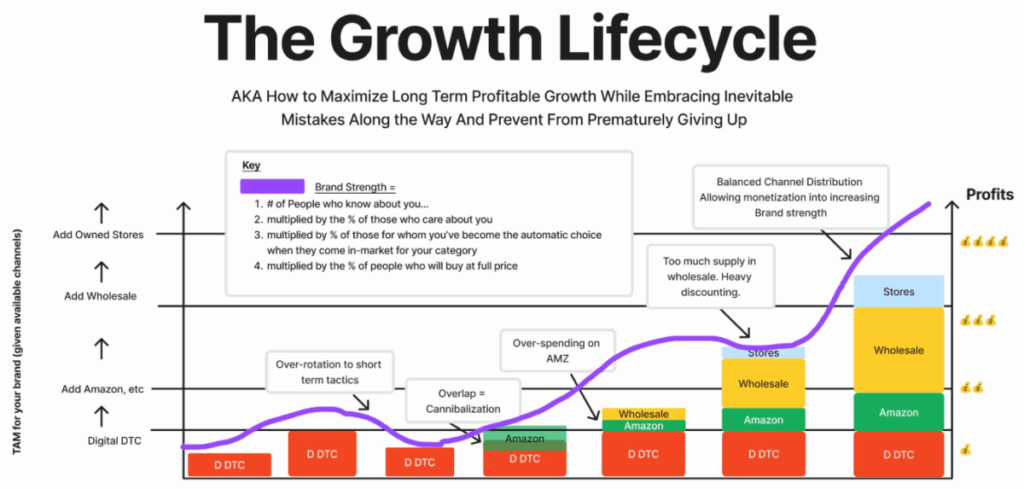

Increasing Focus on Brand Strength and Tech-Driven Efficiency Could Propel Influencer Marketing Further in 2025

Every brand’s growth lifecycle is unique, yet predictably similar. The rapid growth of influencer marketing, projected to reach $32.55 billion by 2025, is accompanied by a deeper focus on brand strength. Much like the "Growth Lifecycle" of DTC brands, the influencer marketing ecosystem is now at a critical inflection point where building sustainable brand strength matters as much as channel expansion.

In 2025, technology is becoming a crucial enabler, allowing for more efficient allocation of marketing spend. From AI-driven analytics to the rise of social commerce, brands now have unprecedented tools to optimize influencer campaigns and measure results with precision. These advancements, combined with regional expansions and the integration of sustainability into marketing strategies, are accelerating growth opportunities for both brands and influencers.

The influencer marketing industry, now supported by over 6,939 specialized agencies, is showing signs of maturity. Consolidation among agencies, the rise of niche players, and a stronger emphasis on talent management signal a shift toward more strategic and deliberate growth.

Sentiment Towards Influencer Marketing in 2025

As we enter 2025, influencer marketing continues to be regarded as a cornerstone of digital strategy, but industry sentiment reveals a shift toward cautious optimism. While 75.6% of respondents plan to dedicate a budget to influencer marketing in 2025, this marks a 10.2% decrease from the prior year, reflecting a recalibration driven by economic uncertainties and heightened scrutiny on ROI.

Influencer Marketing Hubs community Member, Laurent Verrier, reinforces this sentiment, highlighting how influencer marketing is transitioning from tactical, campaign-based activities to a strategic discipline commanding a larger share of overall marketing budgets. However, brands are increasingly deliberate, focusing on investments that demonstrate clear value and scalability.

Budget Allocation Trends

The data highlights a measured approach to influencer marketing budgets:

- 2023: 82% planned a dedicated budget.

- 2024: Increased to 85.8% (+3.8% YoY).

- 2025: Declined to 75.6% (-10.2% YoY).

This downward trend underscores macroeconomic factors such as inflation and cost pressures, prompting brands to reassess large-scale commitments in favor of smaller, more targeted collaborations.

Perception of Effectiveness

Despite a slight decline in perceived effectiveness (81.2%, down 3.6% YoY), over four in five marketers still view influencer marketing as a highly effective strategy. This sustained confidence highlights its enduring value but also signals an urgent need for improved ROI measurement and campaign optimization.

Another community member, Sherry Wu, Associate Director, Boston Consulting Group, points out that many brands still rely on ad hoc campaigns, which fail to leverage the full potential of influencer marketing spend. Shifting toward cohesive, long-term strategies will be critical for maintaining effectiveness:

“Brands are investing more in influencers (double digit working digital media growth), but are facing maturity challenges and common pain-points - not everyone knows how to make effective use of the increased spend (many campaigns are ad-hoc relying on agencies without firm in-house steer & expertise), nor how to make the influencer operations scalable with right tech choices”

- Sherry Wu

Investment Trends: Balancing Ambition with Prudence

Influencer Marketing Budget Growth

The proportion of respondents planning to increase their budgets dropped notably in 2025:

- 2023: 58% expected growth.

- 2024: Marginally rose to 59.4% (+1.4% YoY).

- 2025: Fell to 49.2% (-10.2% YoY).

This decline reflects a maturing market, where brands prioritize strategic, data-driven investments over unchecked spending. Jonas Westling attributes this shift to increased demands for accountability, as brands expect influencers and agencies to demonstrate measurable ROI from larger budgets.

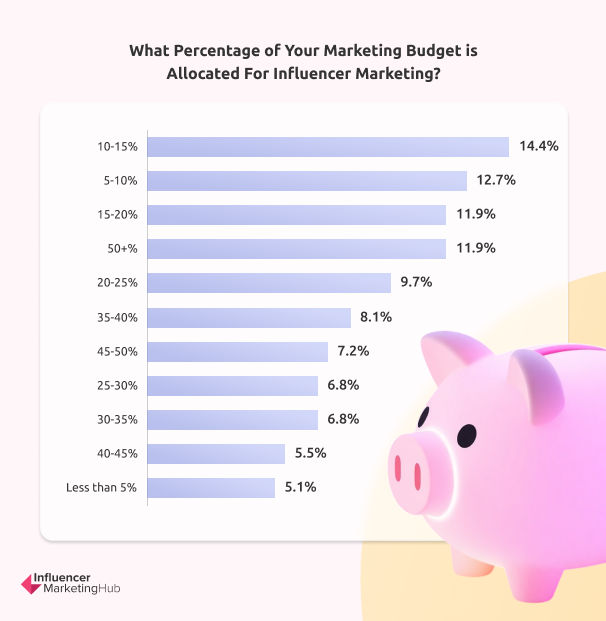

Budget Allocation Insights for 2025

The allocation of marketing budgets for influencer marketing in 2025 paints a picture of cautiousness:

- Top allocations: 10-15% (14.4%), 5-10% (12.7%), and 15-20% (11.9%).

- >50% allocations: Only 11.9%, indicating limited high-stakes investments.

Allocation Above 40% of Marketing Budgets

The share of brands allocating over 40% of their budgets to influencer marketing also dropped sharply:

- 2023: 23% allocated >40%.

- 2024: Slight increase to 24.2% (+1.2% YoY).

- 2025: Decreased to 11.9% (-12.3% YoY).

The steep decline suggests greater diversification of marketing spend as brands explore other channels like paid social and performance marketing to balance their portfolios.

The percentage of brands allocating more than 40% of their marketing budgets to influencer marketing has decreased significantly in 2025 compared to previous years. Influencer Marketing Hub community member, Emily Hare, explains that brands are moving away from mass influencer activations in favor of smaller, more impactful campaigns. This "quality over quantity" approach reflects a broader industry trend toward precision and efficiency, as brands seek to optimize their spending while maintaining relevance in a competitive market.

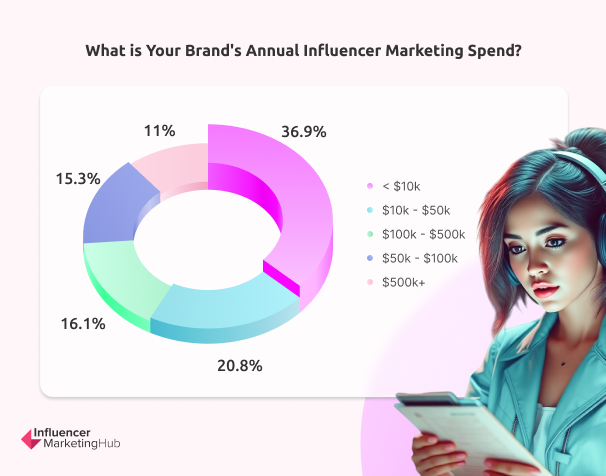

Annual Spend Trends

Lower annual spending (<$10K) declined by 10.5% in 2025, while spending >$500K decreased by 3.5%. This reflects a growing reliance on micro- and nano-influencers, emphasizing cost efficiency without compromising engagement quality.

This pattern highlights an industry leaning toward incremental, scalable investments rather than aggressive budget expansion, with brands balancing risk and opportunity in an evolving market.

Chelsea Larson-Andrews predicts that brands will increasingly collaborate with niche creators to drive ROI. These creators offer targeted engagement that macro influencers often fail to deliver, allowing brands to achieve better results on smaller budgets. This shift also democratizes budget allocation, giving more opportunities to creators with smaller but highly engaged audiences.

Plans for Creator Partnerships

2025 Data:

- 63.8% plan to partner with influencers.

- 26.8% remain undecided.

- 9.4% do not plan to partner.

The significant "Maybe" responses (26.8%) underscore hesitations stemming from challenges such as unclear ROI, influencer selection complexities, and aligning partnerships with broader business objectives.

Macroeconomic Pressures Influencing Budget Recalibrations

For the first time in recent years, positive sentiment around influencer marketing budgets has softened. While influencer marketing remains a critical strategy, the 2025 outlook highlights a focus on cautious, measured growth driven by:

- Macroeconomic pressures influencing budget recalibrations.

- Greater emphasis on ROI, scalability, and strategic alignment.

- A growing shift toward cost-effective, data-driven approaches leveraging micro- and nano-influencers.

To thrive in this environment, brands, creators, and consultants must adopt innovative strategies, leveraging AI, enhanced analytics, and targeted partnerships to navigate the industry's evolving landscape. The future of influencer marketing belongs to those who prioritize efficiency, authenticity, and adaptability.

Expert Sentiment Regarding Influencer Marketing Budgets in 2025

We interviewed the top 100 influencer marketing experts in our community on the matter to change our findings. The collective sentiment from industry experts reveals a nuanced and partly polarized outlook on influencer marketing budgets in 2025.

While some foresee increased investments driven by technological advancements and strategic innovations, others highlight concerns over ROI, efficiency, and market saturation that may temper budget growth. This dual sentiment reflects an industry in transition, grappling with both the opportunities and challenges of a rapidly maturing ecosystem.

Many experts express confidence in the continued growth of influencer marketing budgets, grounded in emerging technologies and shifting strategic priorities. This optimism stems from the following key factors:

1. Technological Advancements:

- AI-Driven Efficiency: Experts like Anthony Muller and Abraham Lieberman emphasize the role of AI in optimizing influencer marketing campaigns, allowing for hyper-personalization and precision targeting. This is expected to drive higher ROI, justifying increased investments.

- Retail Media and Paid Amplification: Marie-Laure De Veyt and Danielle Whittaker highlight the growing integration of retail media platforms and paid amplification, which require dedicated budgets but promise measurable results through data-driven targeting.

2. Strategic Budget Reallocations:

- Hyper-Personalization and Performance: Experts like Sherry Wu and Suhit Amin argue that as traditional paid social costs rise, brands will allocate more to creator-led content and whitelisting strategies, which combine influencer authenticity with paid media’s scalability.

- Long-Term Partnerships: Sarah Letts and Laurent Verrier advocate for sustained collaborations with influencers, which allow brands to spread costs over time and generate deeper audience engagement. These strategies indicate a shift from short-term spending to ongoing investment.

3. E-Commerce and Social Commerce:

- Platforms like TikTok Shop and live shopping formats are encouraging brands to increase their budgets, as noted by Danielle Whittaker and Shalini Matta. These innovations make influencer marketing integral to the conversion-driven funnel, positioning it as a key area for investment.

This group of experts sees higher budgets as a natural evolution of a maturing industry, driven by data, efficiency, and the integration of influencer marketing into broader marketing strategies.

On the other hand, a significant subset of experts express arguments about declining or stagnating budgets for influencer marketing. These perspectives are shaped by the following challenges:

1. Economic Pressures and ROI Scrutiny:

- Budget Recalibrations: Experts like Emily Hare and Shira Zwebner point to the impact of macroeconomic uncertainties, which have led to leaner budgets and heightened scrutiny on ROI. Brands are shifting away from mass activations to smaller, more efficient campaigns, reallocating funds to channels with clearer measurement outcomes.

- Consumer Fatigue: Abhishek Roy warns of declining engagement due to oversaturation of promotional content, pushing brands to reduce spending on influencer collaborations in favor of more authentic, value-driven campaigns.

2. Rising Costs and ROI Challenges:

- Inflation in Sponsorship Rates:

Bill Hildebolt highlights how rising costs for influencer sponsorships are making ROI increasingly difficult to achieve. Brands are exploring alternatives like user-generated content (UGC) or flexible compensation models, reducing their reliance on high-budget influencer partnerships. - Shift Toward Smaller Creators:

Many experts, including Chelsea Larson-Andrews and Lindsey Mangone, note the trend of brands moving toward micro- and nano-influencers for more targeted and cost-effective collaborations. While this reflects smarter spending, it often entails lower overall budgets compared to macro-level campaigns. - Market Saturation:

With influencer marketing becoming a more competitive and crowded space, brands are focusing on quality over quantity, as Emily Hare suggests. This means reducing the number of campaigns and focusing on fewer, more impactful partnerships, which may result in smaller budgets overall.

This sentiment reflects a more cautious approach, with brands striving to balance ambition with prudence by reducing spend in areas where ROI is uncertain or costs are unsustainable.

The divergence in sentiment highlights a dual trajectory: while some brands are doubling down on influencer marketing as a core strategy, others are recalibrating their budgets in response to economic pressures and market saturation. This reflects an industry adapting to external macroeconomic factors as well as internal strategic shifts.

Across both positive and cautious sentiments, AI emerges as a unifying theme. While proponents of higher budgets see AI as a tool for unlocking new efficiencies and justifying increased spend, those advocating for leaner budgets see it as a way to do more with less.

The emphasis on long-term partnerships, paid amplification, and micro-influencers points to a significant evolution in how budgets are allocated. Brands are moving away from vanity metrics like follower counts and focusing on performance-based outcomes, whether through larger investments or more strategic cost reductions.

Influencer marketing is no longer in its experimental phase. Experts like Laurent Verrier and Sarah Letts highlight how it has become a strategic discipline, commanding substantial portions of marketing budgets. However, with this maturation comes greater accountability, as reflected in the demand for tangible ROI and streamlined operations.

The influencer marketing expert sentiments reflect an influencer marketing landscape at a crossroads, with a mix of optimism and caution defining budget strategies for 2025. While technological advancements and strategic realignments offer opportunities for growth, economic pressures and challenges in ROI measurement temper unrestrained investment.

AI – The Catalyst of Influencer Marketing’s Evolution

The power of artificial intelligence in influencer marketing cannot be overstated.

In 2025, AI is naturally positioned to redefine the industry, addressing long-standing barriers and unlocking unprecedented efficiencies across all core influencer activities, from identification to campaign optimization. BCG study on AI adoption stated that organizations with high AI maturity are 3.4 times more agile and responsive to changes.

AI’s Impact on Influencer Marketing Outcomes

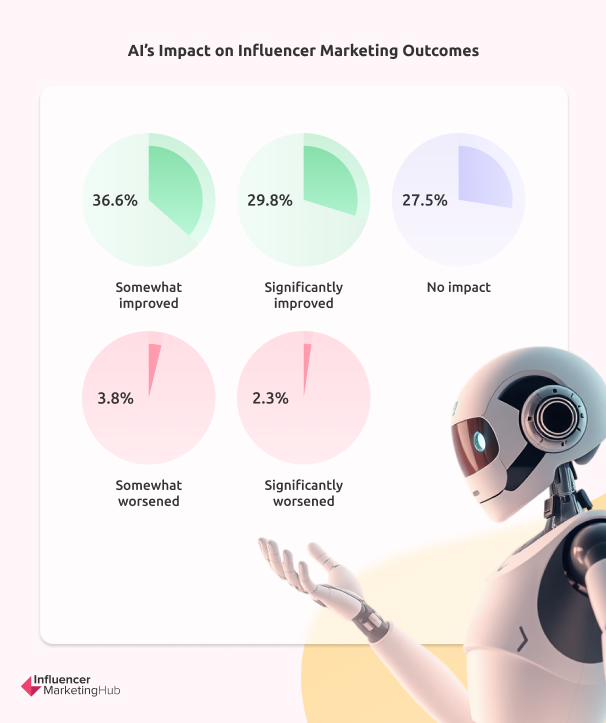

The data reveals a clear trend: AI is already delivering measurable improvements in influencer marketing outcomes for a significant proportion of practitioners. Among respondents, 66.4% reported that AI had somewhat or significantly improved their results, while only a marginal 6.1% experienced any worsening. These figures underscore AI’s ability to enhance existing processes and mitigate inefficiencies that have historically hindered the industry.

Interestingly, this year’s data aligns closely with prior findings, where nearly 75% of respondents believed that influencer marketing could be largely automated. However, the slight decline to 73.4% (down from 77% last year) may indicate growing caution around the overuse of automation. This underscores a nuanced challenge: while AI delivers tangible benefits, marketers must balance technological integration with the human touch that drives trust and engagement.

Current Adoption of AI in Influencer Marketing

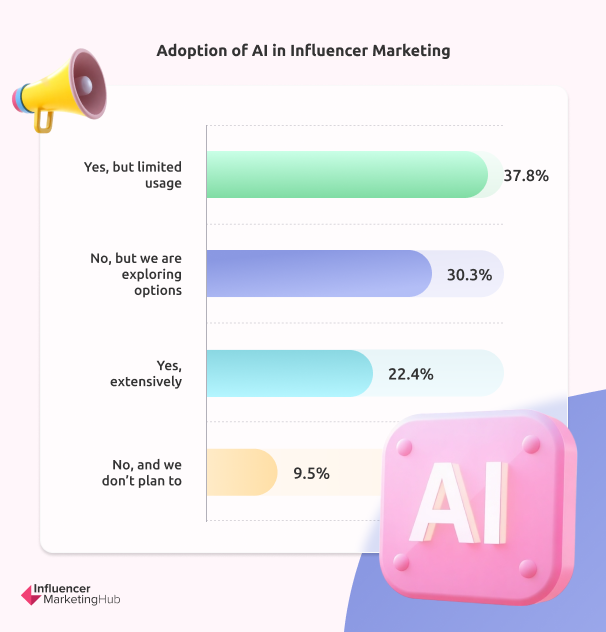

AI adoption continues to grow but remains uneven. In 2025, 60.2% of respondents reported actively using AI for Influencer Identification and campaign optimization, a figure consistent with last year’s 63% of respondents planning to adopt AI or machine learning. This consistency reflects the mainstreaming of AI but also highlights adoption plateaus. While 22.4% reported extensive usage, the majority, 37.8%, indicated limited application, signaling untapped potential and opportunities for deeper integration.

Key Benefits Realized Through AI

AI’s most significant contributions lie in its ability to streamline operations and deliver value in tangible ways. This year’s survey results reinforce its key benefits:

However, a comparative analysis reveals critical trends. While 55.8% of respondents last year identified influencer discovery as the primary use case for AI/ML, this year, only 10.5% highlighted better influencer matching and selection. This drop suggests that while initial efforts to adopt AI focused on discovery, the industry now demands tools that address broader needs, including predictive analytics, campaign optimization, and content curation.

Frequency and Tools of AI Application

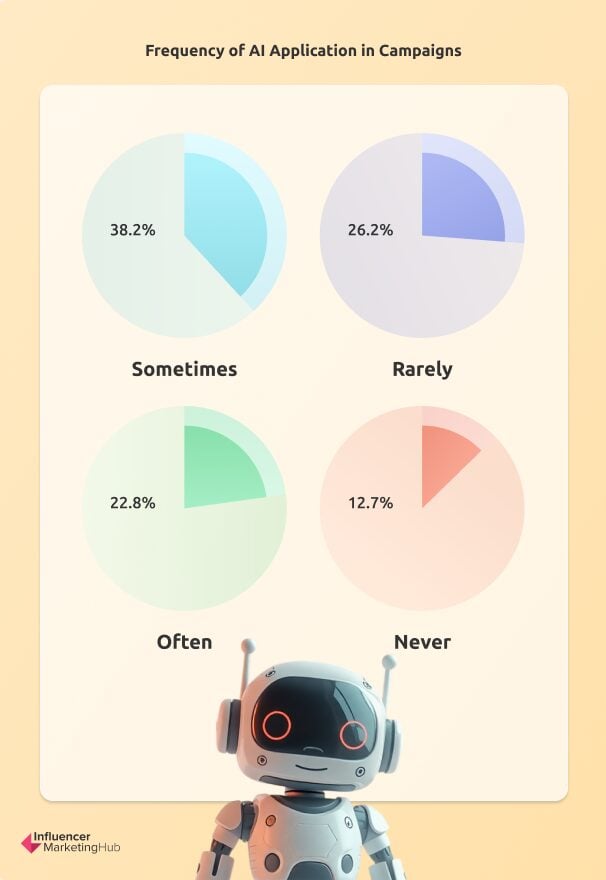

The frequency of AI application highlights a persistent gap between potential and practice. While 22.8% of respondents reported frequent use, the majority, 64.4%, use AI only sometimes or rarely. This reflects an ongoing challenge: transforming sporadic experimentation into consistent, strategic utilization.

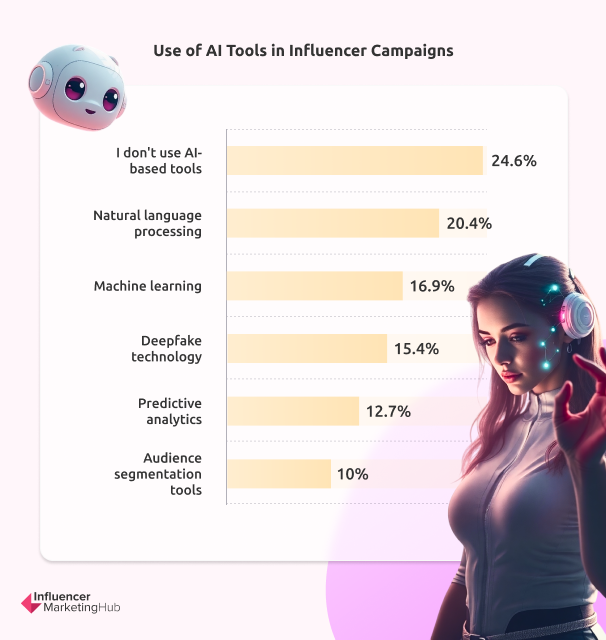

Among technologies employed, natural language processing (20.4%) and machine learning (16.9%) remain dominant. However, the emergence of deepfake tools (15.4%) and predictive analytics (12.7%) signals the increasing sophistication of AI-driven solutions. These trends reflect a shift from basic automation to advanced capabilities that redefine how brands engage with audiences and measure ROI.

Enhancing AI Tools for Influencer Marketing

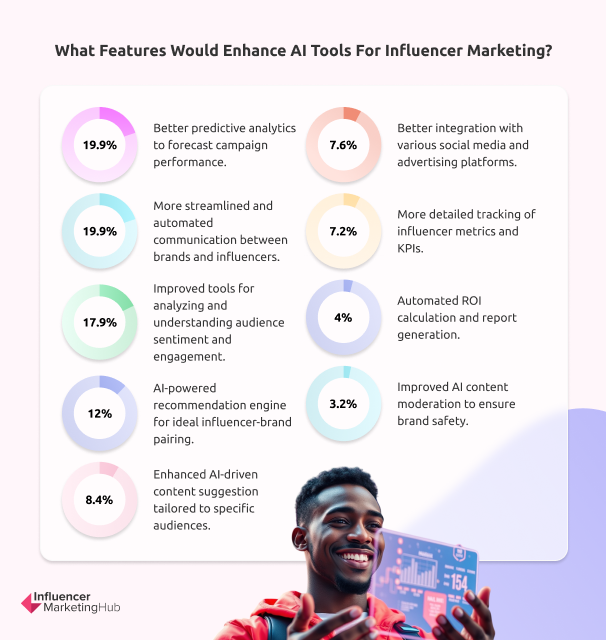

The evolution of AI in influencer marketing hinges on closing critical gaps identified in user feedback. This year’s respondents emphasized the need for tools that go beyond surface-level improvements to deliver impactful outcomes:

- Better predictive analytics to forecast campaign performance (19.9%)

- Streamlined and automated brand-influencer communication (19.9%)

- Improved audience sentiment analysis (17.9%)

These priorities align with the broader trends observed over the past year, including a 5.3% increase in the popularity of content distribution and a growing demand for advanced tools to ensure brand safety, measure campaign ROI, and foster authentic influencer relationships.

AI Redefines Authenticity and Storytelling in Influence

AI will change the influencer marketing space radically, in 2025. With 64 out of 100 thought leaders affirming it, AI is rewriting the DNA of influencer marketing in 2025

AI in influencer marketing has often been met with skepticism, viewed as a disruptor that risks diluting authenticity. In truth, AI should be recognized as an enabler, freeing marketers and creators from repetitive, low-value tasks and redirecting focus toward the core drivers of value: creativity, connection, and trust-building.

The intersection of technological advancements, rising adoption rates, and increasingly sophisticated AI applications signals a pivotal moment for the industry. AI is solving long-standing inefficiencies, especially in measurement and influencer identification, and enabling unprecedented precision and scalability. In reality AI isn’t reshaping the industry, it’s rebuilding it from the ground up.

However, the data underscores an important truth: AI’s potential lies not in its capacity to replicate human actions, but in its ability to amplify human ingenuity. Success in this evolving space will hinge on the ability of marketers, consultants, and creators to integrate technological innovation with the irreplaceable human elements of empathy and connection.

The future of influencer marketing will not belong to those who simply embrace automation or produce content at scale. It will belong to those who understand how to leverage AI as a tool to enhance authenticity, deepen storytelling, and drive meaningful engagement.

Influencer Campaign Strategy: Key Statistics and Insights

As the influencer marketing industry matures, campaign strategies have become increasingly nuanced, with brands adopting more data-driven approaches to maximize impact. This section dissects the critical elements shaping campaign strategy, from primary objectives and preferred channels to the operational models and challenges that influence execution. These insights provide a comprehensive view of how brands are refining their strategies to stay competitive in an evolving landscape.

1. Objectives of Influencer Campaigns

The primary objectives of influencer campaigns reveal a focus on balancing immediate business outcomes with long-term brand equity:

- Sales (35.6%) emerged as the leading goal, emphasizing the need for measurable ROI in a competitive economic environment.

- Awareness (24.4%) remains critical, as brands recognize the role of influencers in reaching new audiences and building visibility.

- Objectives like User-Generated Content (18.9%) and Community Building (12.4%) point to the growing value of influencers as co-creators and brand advocates.

The divergence between sales-driven and awareness-driven objectives highlights a critical strategic tension. Brands aiming for sustainable growth must integrate short-term performance goals with broader relationship-building strategies that drive long-term customer loyalty. Laurent Verrier emphasizes a strategic shift in influencer marketing from campaign-based tactics to a core discipline at the C-suite level, driving efficiency and aligning campaigns with overarching business goals.

2. Preferred Channels

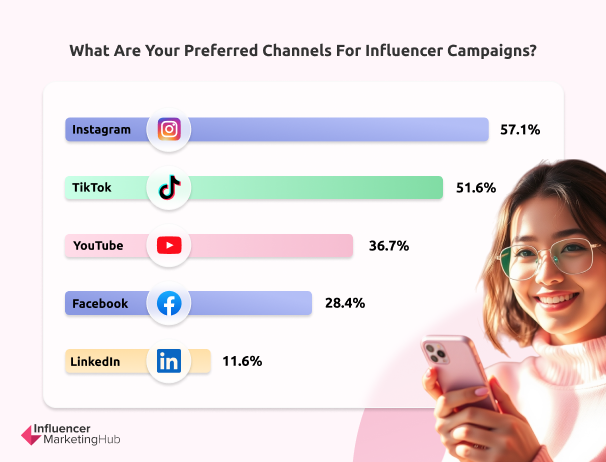

The dominance of platforms like Instagram and TikTok reflects shifting consumer preferences and platform-specific strengths:

- Instagram (57.1%) and TikTok (51.6%) lead as preferred channels, offering unparalleled reach and engagement for visual and short-form content.

- YouTube (36.7%) remains a stronghold for long-form content and in-depth storytelling.

- Facebook (28.4%) and LinkedIn (11.6%) cater to niche audiences, including community-driven and professional markets.

The rise of TikTok underscores the importance of agility in platform selection, as brands must continually adapt to emerging channels to stay relevant. However, the continued presence of Instagram and YouTube highlights the need for a multi-platform approach that balances experimentation with proven ROI. In the following section, we will be verifying platform specifics in depth.

In the coming period, we might see more diversification across new platforms, Steph Payas, NeoReach CMO states:

“After the TikTok ban, I think we'll see diversification across emerging platforms like Lemon8 and Bluesky. I think we'll see brands shift their strategies from TikTok and anchor on these emerging platforms and find success there.”

2024 vs. 2025: Year-Over-Year Changes

- Instagram (+0.5%): While Instagram's growth may seem modest, its ability to reclaim the top spot indicates its resilience and adaptability in a competitive market.

- TikTok (-17.2%): TikTok's significant decline reflects the fallout from its US ban, causing brands to diversify their platform strategies. While TikTok remains influential in regions like APAC and LATAM, its absence in the US has impacted global adoption rates.

- YouTube (+0.7%): A steady increase highlights YouTube’s continued importance for in-depth, educational, and product-driven campaigns.

- LinkedIn (+2.2%): A notable rise in LinkedIn adoption signals growing interest in B2B influencer marketing and professional creator partnerships.

3. Campaign Management Models

Brands are favoring in-house campaign management, with 60.4% managing campaigns internally compared to 39.6% relying on agencies or managed services. This shift may reflect an increased emphasis on cost control, data ownership, and integration with broader marketing efforts.

While in-house models offer greater control, they also require robust internal capabilities. Brands opting for this approach must invest in specialized talent and technology to overcome operational challenges and deliver consistent results. IMH Community Member, Senior Vice President of Dentsu Creative, Gary Orellana foresees greater efficiency in in-house models with the integration of AI tools, which will streamline day-to-day campaign tasks and performance tracking.

“AI will be important to create efficiencies in day-to-day tasks, and may eliminate some junior roles. There will be more companies that develop to service back-of-office along with talent reps vs creators.”

- Gary Orellana

4. Influencer Campaign Size and Frequency

Campaigns tend to focus on smaller-scale collaborations, with nearly half of respondents working with 1-5 influencers (49.6%). The use of more extensive influencer networks diminishes progressively, with only 2.8% engaging more than 100 influencers.

This trend reflects a shift toward micro- and nano-influencers, whose targeted, authentic engagement often outperforms broader campaigns. Brands leveraging smaller networks can achieve deeper connections with niche audiences while maintaining cost efficiency.

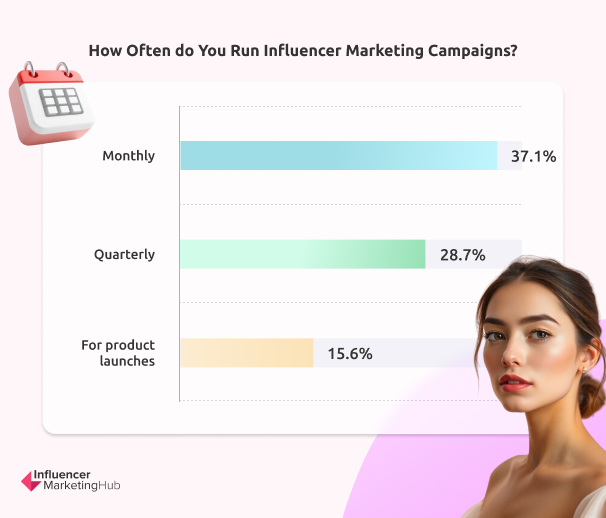

Beyond the scale of collaborations, the regularity of influencer campaigns is crucial for maintaining engagement and aligning with key business milestones. The key trends include:

- Monthly campaigns (37.1%) dominate, suggesting a consistent effort to maintain visibility and relevance.

- Quarterly campaigns (28.7%) and those tied to product launches (15.6%) indicate a complementary strategy that aligns influencer efforts with key business milestones.

Brands adopting frequent, smaller-scale campaigns are better positioned to maintain audience engagement while iterating on messaging and creative strategies. This approach balances the immediacy of short-term goals with sustained audience connection.

Our experts are aligned and underscore the role of AI in optimizing influencer matching, allowing brands to identify creators who align with audience values and campaign goals at a much higher scale in 2025.

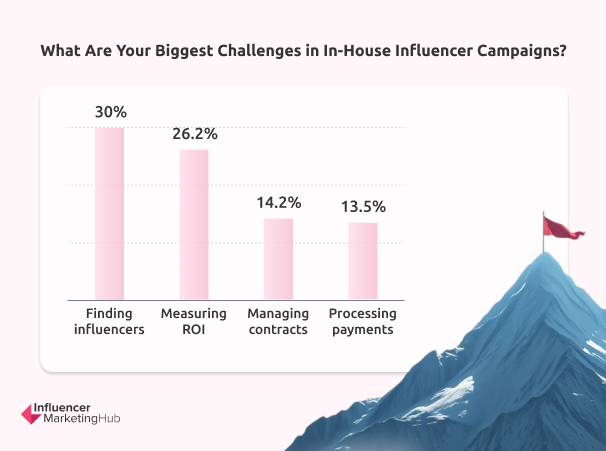

6. Biggest In-House Challenges

The operational complexities of influencer marketing are evident in the top challenges identified:

- Finding influencers (30%) and Measuring ROI (26.2%) are persistent obstacles, emphasizing the need for improved tools and methodologies.

- Administrative tasks like Managing contracts (14.2%) and Processing payments (13.5%) further highlight inefficiencies in campaign management.

Addressing these challenges requires a twofold approach: implementing AI-driven tools for influencer discovery and ROI measurement, and streamlining operational workflows through automation and centralized platforms.

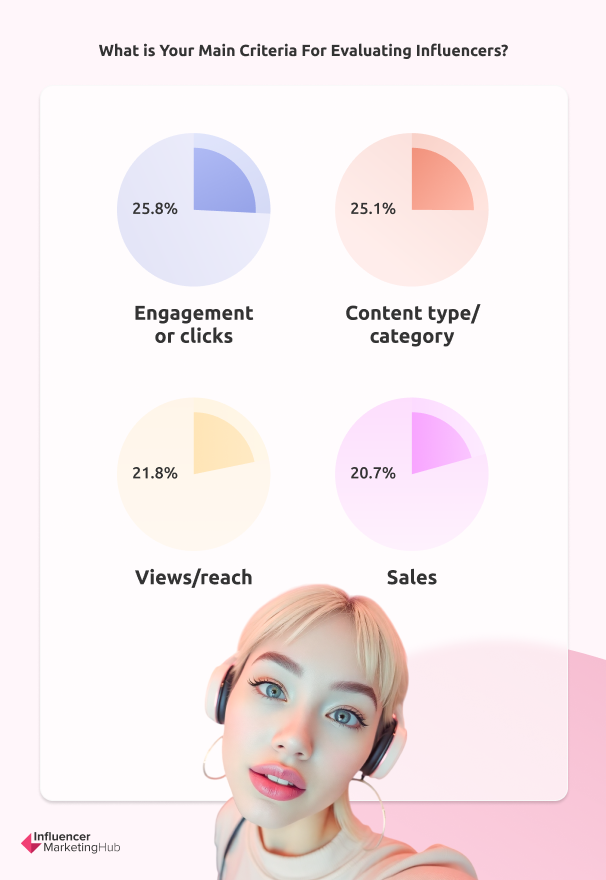

7. Main Criteria for Evaluating Influencers

The criteria for influencer selection reflect a balance between quantitative metrics and qualitative alignment:

- Engagement or clicks (25.8%) and Content type/category (25.1%) top the list, showcasing the importance of both performance and relevance.

- Metrics like Views/reach (21.8%) and Sales (20.7%) underline the growing pressure to demonstrate tangible outcomes.

An over-reliance on quantitative metrics may overlook the strategic value of influencers as brand storytellers. Brands should consider a more holistic evaluation framework that incorporates both qualitative alignment and performance indicators.

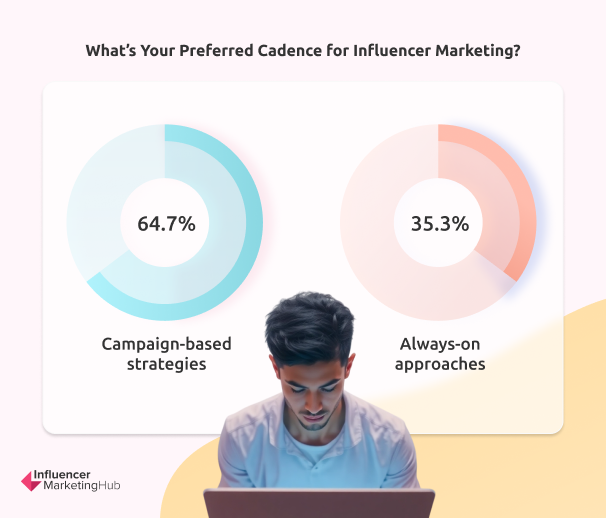

8. Cadence of Campaign Execution

The preference for campaign-based strategies (64.7%) over always-on approaches (35.3%) reflects a tactical mindset, where influencer marketing is activated around key events or product launches.

While campaign-based execution offers flexibility and focus, an always-on approach can foster deeper audience relationships and drive continuous engagement. Brands should evaluate the trade-offs and align their cadence with broader marketing goals.

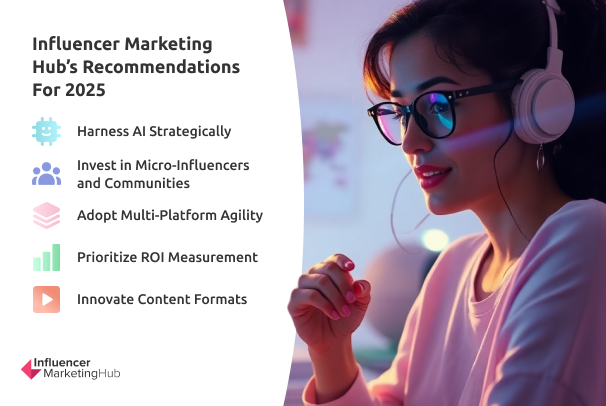

Actionable Strategies for 2025 Success

To thrive in the evolving influencer marketing landscape, brands must adopt forward-thinking strategies that address operational challenges, enhance campaign effectiveness, and capitalize on emerging trends. The following recommendations provide a roadmap for maximizing ROI and staying competitive in 2025:

- Adopt Data-Driven Campaign Planning: Leverage analytics to align campaign objectives with audience insights, ensuring a balance between sales, awareness, and engagement.

- Diversify Platform Strategy: Invest in emerging platforms like TikTok while maintaining a strong presence on proven channels like Instagram and YouTube.

- Prioritize Influencer Alignment: Develop a comprehensive evaluation framework that integrates performance metrics with qualitative alignment.

- Enhance Operational Efficiency: Address in-house challenges through automation, AI-driven tools, and streamlined workflows.

- Reconsider Campaign Cadence: Experiment with always-on strategies to complement campaign-based activations, fostering sustained audience connection.

This data-driven analysis of influencer campaign strategies offers actionable insights for brands seeking to refine their approaches in 2025. By leveraging these recommendations, organizations can maximize ROI, optimize operational efficiency, and stay ahead in a competitive market.

Influencer Marketing Distribution Channels & Influencer Tiers

Influencer marketing distribution channels have evolved into the backbone of campaign success. With Instagram and other platforms playing an increasingly central role, marketers must navigate a complex ecosystem defined by shifting audience preferences, platform algorithms, and technological advancements. Utilizing data provided by HypeAuditor, this section delves deep into the distribution channels shaping the influencer marketing landscape in 2025, supported by strategic implications, and actionable insights.

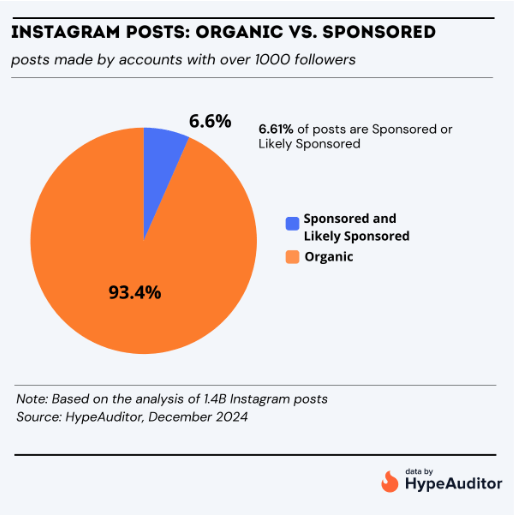

The foundation of influencer marketing lies in effectively reaching target audiences through the right channels. In 2024, influencers collectively created 1.4 billion posts, generating $236 billion in Earned Media Value (EMV). This represents a remarkable 8.4x return on investment, underscoring the critical role of distribution strategies in maximizing impact.

In 2025, influencer marketing remains an essential component of digital strategies, with platforms and influencer tiers offering varied yet complementary value propositions. Insights from a survey of marketers reveal the nuanced dynamics shaping influencer marketing campaigns and how different platforms and influencer tiers influence purchasing decisions.

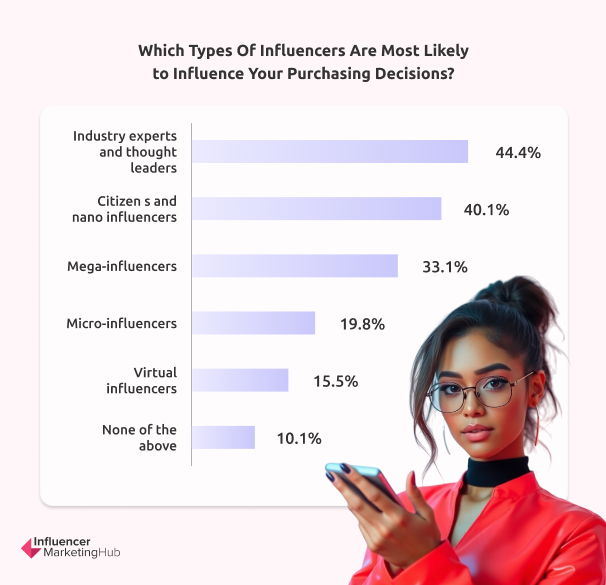

Influencer Tiers: Nano-Influencers and Thought Leaders Dominate

According to our survey in partnership with Google, consumers increasingly prioritize authenticity and niche expertise over broad reach in terms of effectiveness of influence. Survey findings reveal:

The data underscores the importance of aligning influencer selection with campaign objectives. For example, while nano-influencers excel at fostering niche engagement, mega-influencers are better suited for large-scale awareness campaigns.

1. Instagram: The Powerhouse of Influencer Marketing

Demographics: Connecting with Younger, Female-Skewed Audiences

Instagram remains the dominant platform for influencer marketing, with 84% of its users aged 34 or younger. The 25-34 age group accounts for 44.7% of global users, making millennials the platform's core demographic. Female users lead this group, representing 23.6% compared to 21.1% male users.

Age range Female Male 13-17 4.2 2.4 18-24 19.4 9.9 25-34 23.6 21.1 35-44 5.8 6.7 45-54 2.1 2.1 55+ 1.5 1.2

This demographic distribution positions Instagram as the go-to channel for brands targeting younger, tech-savvy audiences with significant purchasing power. For marketers, this means:

- Prioritizing campaigns that resonate with younger audiences' values, such as sustainability, inclusivity, and authenticity.

- Leveraging gender-based insights to design campaigns that align with women's higher engagement levels on Instagram.

Influencer Tiers: Why Nano-Influencers Dominate

Over 75.9% of Instagram influencers fall into the nano-influencer tier (1,000–10,000 followers), followed by micro-influencers (13.6%). These tiers are known for:

- Higher Engagement Rates (ERs): Nano-influencers achieved an average ER of 1.73% in 2024, significantly higher than macro-influencers (0.61%) and mega-influencers (0.68%). This reflects their stronger, more personal connections with audiences.

- Cost Efficiency: Brands with limited budgets can maximize ROI by collaborating with nano- and micro-influencers, achieving higher audience trust and authenticity without the high costs associated with celebrity partnerships.

Influencer tier Percentage Nano-influencers (1K - 10K) 75.9 Micro-influencers (10K - 50K) 13.6 Mid-tier influencers (50K - 500K) 3.4 Macro-influencers (500K - 1M) 0.2 Mega-influencers & Celebrities (Over 1M) 0.1

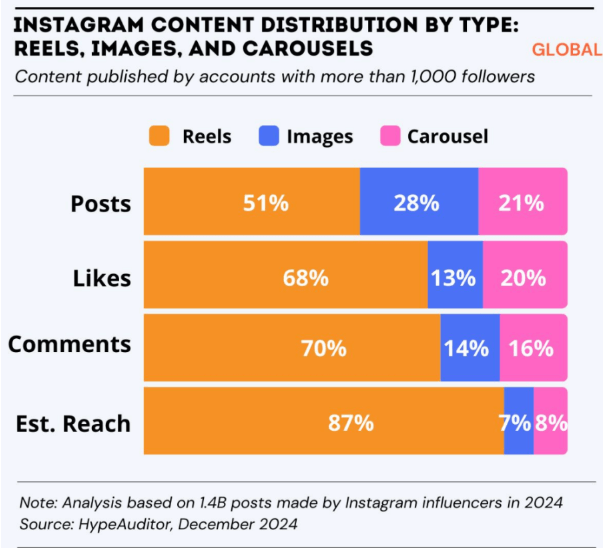

Content Formats: The Rise of Reels

Instagram Reels dominate as the preferred content type, outperforming images and carousels in engagement, reach, and likes. This trend reflects the broader consumer shift toward short-form, video-first content. For marketers:

- Prioritize Reels to maximize visibility and algorithmic favorability.

- Focus on storytelling through dynamic, engaging formats that appeal to short attention spans.

While Instagram remains powerful, its average engagement rate (ER) across all influencer tiers declined from 2.18% in 2021 to 1.59% in 2024. This decline highlights:

- The challenge of maintaining audience interest amidst increasing platform saturation.

- The need for brands to innovate through content strategies like gamification, interactive polls, and collaborations with diverse creators.

Influencer Tier 2022 2023 2024 Nano 1K-10K 2.53 2.19 1.73 Micro 10K-50K 1.06 0.99 0.68 Mid-tier 50K-500K 0.91 0.86 0.54 Macro 500K-1M 0.86 0.87 0.61 Mega Over 1M 0.92 0.94 0.68 Average ER 1.90 1.85 1.59

ER on Instagram is calculated as the total number of likes and comments divided by the total number of followers, multiplied by 100%: ER=(Likes+Comments)/Followers x 100% Nano-influencers tend to have stronger connections with their audience, and as such their ER is higher than the ER of other influencer groups: 1.73% The Average Engagement Rate (ER) for Instagram brand accounts stands at 0.5%, a figure three times lower than the average ER seen among influencers. This stark contrast highlights why brands should consider influencers in their marketing strategies, as influencers tend to garner higher engagement rates.

The most talked-about brands on Instagram

Instagram has proven itself to be captivating, attracting countless users who consume millions of pictures and videos daily – and as such, presents a golden opportunity for brands and marketers wanting to reach wider audiences.

Brand Username Mentions Influencers Estimated Impressions 1 @zara 274,292 96,968 8,599,331,997 2 @nike 198,094 82,533 5,938,784,236 3 @hm 157,566 61,747 6,464,492,867 4 @sheinofficial 222,477 59,256 6,570,073,548 5 @amazon 113,908 44,457 6,061,020,118 6 @dior 88,421 42,859 6,178,194,744 7 @adidas 89,372 41,657 3,355,610,066 8 @target 99,997 39,410 5,939,692,931 9 @youtube 99,610 38,900 4,027,313,344 10 @maybelline 90,717 36,270 5,260,979,614

Fast-fashion brands like Zara, Shein, and H&M dominate with high mentions and impressions, showcasing their effective use of influencers. Despite fewer mentions, luxury brands like Dior achieve significant impressions due to high-value collaborations.

Top growing Instagram accounts in 2024: Cristiano Ronaldo remains the most-followed individual on Instagram

Account Instagram Followers 2024 Follower Growth Follower Growth Percentage Engagement Rate (ER) 1 cristiano 644,643,056 29,985,553 5 1.299 2 mr.thank.you 44,608,650 27,638,272 163 0.191 3 jj_mobile_world 31,455,406 22,409,703 248 1.453 4 realmadrid 170,040,878 20,053,945 13 0.211 5 lamineyamal 24,354,392 19,772,000 431 14.066 6 instagram 681,950,965 17,366,197 3 0.014 7 mrbeast 62,876,761 16,199,661 35 3.095 8 itsruyter 21,610,021 15,848,667 275 0.049 9 yong.lixx 24,254,697 13,817,833 132 13.093 10 judebellingham 37,703,071 13,815,028 58 5.687

3642 instagram accounts gained over 1 million followers in 2024. Cristiano Ronaldo is still the most-followed individual on Instagram, with steady growth and solid engagement. Giveaway campaigns remain an effective strategy for rapid follower growth, as demonstrated by accounts like Mr. Thank You, JJ Mobile World, and Its Ruyter. These accounts achieved significant percentage growth, proving that incentivized audience-building tactics still have a strong impact in 2024. However, the low engagement rates seen in some of these accounts question the quality and long-term value of such motivated audiences. Marketers should weigh the trade-offs between rapid follower acquisition and meaningful engagement when considering giveaway-driven strategies.

2. TikTok – The Now US-Banned King of Social

As of 2025, TikTok’s influence on global social media and influencer marketing remains unparalleled, even amidst regulatory challenges and its ban in the United States. Despite these obstacles, TikTok has cemented itself as the go-to platform for younger demographics, reshaping content consumption, influencer engagement, and brand marketing strategies. This section dissects TikTok's unique attributes, its rise to prominence, and the ripple effects of its regulatory status on the broader influencer marketing ecosystem.

Unmatched Demographics: A Platform for the Young and Engaged

TikTok boasts a user base heavily skewed towards younger audiences, with over 53.7% of users under the age of 24, and 36% aged 18-24—a demographic with significant purchasing power and brand loyalty potential. The platform’s demographic composition reflects its appeal to Gen Z and younger Millennials, a group driving shifts in consumer trends and digital marketing strategies.

Age Range Female Male 13-17 11.6 5.7 18-24 24.3 12.1 25-34 15.2 15.6 35-44 3.7 7.4 45-54 1.1 2.3 55+ 0.3 0.7

- Gender Dynamics: TikTok’s female audience outnumbers males, accounting for 56.2% of its user base. This gender distribution aligns with broader trends in social commerce and influencer marketing, where women dominate key purchasing decisions.

- Drop-off Among Older Demographics: Engagement drops significantly in users over 45, with only 1% aged 55+, positioning TikTok as a youth-centric platform. Brands targeting older demographics may find less ROI on TikTok, underscoring the importance of aligning product-market fit with platform audiences.

The King of Engagement: High ER Across All Tiers

TikTok consistently outperforms its social media counterparts in engagement rates (ER), reflecting its unique algorithm and content culture. For nano-influencers, the average ER in 2024 stood at 10.3%, significantly higher than Instagram's 1.73% for the same tier. Across all influencer tiers, TikTok’s ER averages remain robust, further cementing its role as an engagement powerhouse:

- Nano-Influencers: At 10.3%, they drive authentic connections and engagement, making them ideal for brands with smaller budgets seeking high ROI.

- Mega-Influencers: Even at the upper tiers, TikTok's ER, though declining slightly, remains strong at 7.1%, outpacing most other platforms.

Influencer Tier 2021 2022 2023 2024 Nano 1K-10K 15.7 15.2 11.97 10.3 Micro 10K-50K 12.2 12.4 10.21 8.7 Mid-tier 50K-500K 10.8 10.9 9.48 7.5 Macro 500K-1M 10.6 10.8 9.39 7.1 Mega Over 1M 11.1 11.3 9.67 7.1

This engagement prowess stems from TikTok’s algorithmic precision, which prioritizes content relevance and viral potential, ensuring even creators with small followings can achieve massive reach.

The Rise of Nano and Micro-Influencers

TikTok’s influencer ecosystem is dominated by nano-influencers (87.68%) and micro-influencers (8%). These creators excel in fostering niche communities and delivering authentic messaging, making them the backbone of the platform’s influencer economy.

- Why Nano and Micro Matter: With their higher ER and closer follower relationships, these influencers provide an ideal balance of cost-effectiveness and impact. Their dominance on TikTok reflects the platform’s democratized content approach, where authenticity triumphs over celebrity.

Influencer Tier Percentage Nano-influencers (1K - 10K) 87.68 Micro-influencers (10K - 50K) 8.00 Mid-tier influencers (50K - 500K) 1.89 Macro-influencers (500K - 1M) 0.09 Mega-influencers & Celebrities (Over 1M) 0.06

Brand Collaboration and Content Impact

TikTok continues to redefine brand collaboration with innovative formats and viral potential. In 2024, beauty and fashion brands dominated mentions, with Shein, Sephora, and Rare Beauty leading the charge. Meanwhile, TikTok’s role in driving Earned Media Value (EMV) was unparalleled:

- Collaborative Content: TikTok has become synonymous with interactive and relatable content, from viral challenges to creator-led campaigns. Brands like Toyota Gazoo Racing and Rare Beauty leverage these opportunities to amplify reach and engagement.

@toyotagazooracing.com Can you pause this car as this white line? #toyotagazooracing #toyota #車好き #wrc #pausechallenge #ビタ止めチャレンジ ♬ POKÉDANCE - Pokémon/ポケモン【公式】

The Impact of a potential US Ban

Despite the potential ban in the United States, TikTok’s global dominance remains unchallenged. However, this regulatory move has caused ripples across the influencer marketing ecosystem, leading to:

- Platform Diversification: Brands and creators are redistributing their efforts across platforms like Instagram Reels, YouTube Shorts, and emerging players like Lemon8 and BeReal.

- Regional Imbalances: While TikTok retains strongholds in markets like LATAM and Asia-Pacific, its absence in the US shifts marketing dollars to alternative platforms, affecting global strategies.

- Perceived Risk in Long-Term Planning: The ban has introduced hesitancy among US-based brands, prompting a cautious approach toward platform reliance.

- Donald Trump:

The ongoing uncertainty surrounding the TikTok ban underscores the critical need for diversification in influencer marketing strategies. While the platform’s potential reinstatement may alleviate immediate concerns, reliance on a single platform exposes brands to regulatory, geographic, and consumer behavior risks. Diversifying across multiple platforms, such as Instagram Reels, YouTube Shorts, and emerging players like Lemon8, ensures resilience against unforeseen disruptions. By building a multi-platform presence, brands not only safeguard their campaigns but also unlock opportunities to connect with diverse audiences, adapt to shifting market dynamics, and sustain long-term growth in an evolving digital landscape.

Top growing TikTok accounts in 2024: Sabrina Carpenter grew her audience by 18.8M

Account TikTok Followers 2024 Follower Growth Follower Growth Percentage Engagement Rate (ER) 1 sabrinacarpenter 33,793,775 18,815,196 126 12.51 2 billieeilish 68,805,407 17,783,814 35 13.02 3 mrbeast 106,582,372 14,955,550 16 6.84 4 realmadrid 52,342,652 14,593,896 39 11.32 5 omari.to 42,775,048 14,282,635 50 5.57 6 omahi.tiktok 29,765,330 13,006,958 78 7.98 7 ishowspeed 36,134,471 12,974,421 56 9.94 8 toyotagazooracing.com 12,770,353 12,730,118 31,639 8.67 9 williesalim 59,322,608 12,643,805 27 4.85 10 billieeilishhome 16,316,821 12,015,691 279 16.74

In 2024, TikTok saw explosive growth in individual accounts, with celebrities like Sabrina Carpenter and Billie Eilish achieving remarkable follower gains. For brands, the platform’s viral mechanics provided fertile ground for campaigns like Toyota Gazoo Racing’s 31,639% growth. These examples illustrate TikTok’s unique ability to amplify content in ways unmatched by its peers.

The most talked-about brands on TikTok in 2024

Account Total Mentions Number of Influencers Views 1 @shein_official 81,385 20,656 3,273,328,952 2 @sephora 34,628 13,476 2,515,248,625 3 @rarebeauty 35,719 11,867 1,812,209,474 4 @elfcosmetics 24,692 11,079 846,363,204 5 @maybelline 28,007 11,069 3,602,183,831 6 @lorealparis 26,371 11,018 8,311,523,326 7 @fentybeauty 29,209 10,675 1,664,953,392 8 @maccosmetics 24,544 9,475 1,758,165,222 9 @yslbeauty 24,304 9,269 2,447,673,495 10 @walmart 20,179 9,113 2,000,933,275

The 2024 TikTok brand landscape is dominated by beauty and fashion, with brands like Shein, Sephora, and Rare Beauty leading in mentions and influencer collaborations. L’Oréal Paris and Maybelline stand out for achieving the highest views, highlighting the effectiveness of their strategies. While Elf Cosmetics and Rare Beauty generate significant buzz, they lag in views, showing room for growth in content impact. Walmart’s inclusion clearly showcases TikTok’s reach beyond beauty, making it a valuable platform for diverse industries. TikTok remains a key space for brands to drive visibility and relevance in 2025.

TikTok’s Path Ahead

TikTok’s trajectory in 2025 depends on its ability to navigate regulatory hurdles while retaining its core value propositions. Key areas of focus include:

- Content Innovation: Maintaining its edge in short-form content with features like live streaming and AR tools.

- Expanding Monetization: Scaling TikTok Shop and other social commerce features to solidify its role in driving conversions.

- Global Growth: Strengthening its foothold in regions like LATAM and APAC, where it remains a dominant force.

TikTok’s story is one of paradoxes; despite its ban in the US, it will continue to dominate the global social media landscape. In mid-January, after a tumultuous weekend involving executive orders, Supreme Court rulings, and intervention from former President Donald Trump, TikTok was temporarily taken offline but swiftly reinstated following a 75-day delay in the ban's enforcement. These unprecedented actions highlight the intense political scrutiny TikTok faces in the US, while its unparalleled engagement rates, the dominance of nano and micro-influencers, and the platform's innovative content culture make it a non-negotiable asset for global marketers.

As TikTok shapes the future of social commerce and content creation, its influence on the broader industry will persist, proving that the king of social isn’t defined by borders but by its ability to innovate, engage, and inspire.

3. YouTube – The Resilient Powerhouse in Influencer Marketing

YouTube remains an integral pillar of the influencer marketing ecosystem in 2025, with its unmatched ability to cater to diverse audience demographics and deliver long-form, high-value content. Despite the rise of competing platforms like TikTok and Instagram Reels, YouTube's enduring appeal lies in its capacity to balance entertainment, education, and commerce while providing measurable ROI for brands. This section explores YouTube's unique position in the digital landscape and its continuing influence on the marketing industry.

Demographics: Broad Reach with a Male-Dominant Edge

YouTube’s audience spans a wide age range, with 64% of users aged between 18 and 34. This demographic group represents a lucrative segment for brands seeking to capture millennial and Gen Z audiences with disposable income and a penchant for digital consumption.

- Teen Influence: Younger audiences (ages 13-17) make up 14% of users, highlighting YouTube’s foothold among early adopters of new trends.

- Gender Split: Unlike platforms like TikTok, YouTube skews male, with 58.6% of users being male. This imbalance is most pronounced in the 25-34 age bracket, where male users account for 22.7%, compared to just 12.5% female users.

Age Range Female Male 13-17 8.5 5.8 18-24 15.0 13.6 25-34 12.5 22.7 35-44 3.7 11.5 45-54 1.3 3.8 55+ 0.4 1.2

These demographic patterns make YouTube a key platform for male-oriented campaigns, tech enthusiasts, and creators delivering educational content.

Engagement and Growth: Consistency in Numbers

YouTube's ecosystem thrives on its ability to cultivate deep engagement through long-form content and an established creator economy. The platform's strength lies in its consistent growth and ability to host creators with diverse styles and objectives:

Top Creators of 2024:

MrBeast (Jimmy Donaldson) gained an impressive 117M new subscribers in 2024, reaching 336M total subscribers, showcasing his unparalleled ability to attract and retain global audiences.

Cristiano Ronaldo, traditionally known for Instagram dominance, gained significant traction on YouTube, illustrating cross-platform opportunities for brands and celebrities.

Account 2023 YouTube Subscriber Growth (M) YouTube Subscribers (M) Follower Growth Percentage 1 mrbeast 117,178,301 336,162,276 54 2 stokestwins 75,899,213 101,409,711 298 3 cristiano 55,266,041 71,614,080 338 4 kimpro828 42,836,663 72,044,506 147 5 torung 34,897,059 41,816,232 504 6 alanchikinchow 33,801,073 69,511,398 95 7 markrober 31,628,332 60,612,864 109 8 zamzamelectronicstradingllc 29,009,697 69,208,094 72 9 anayakandhal 28,314,796 46,917,885 152 10 shriprashant 27,909,452 53,809,721 108

Engagement Rates:

While average engagement rates (ER) vary, creators on YouTube often report deeper connections with their audiences due to the platform's emphasis on long-form, immersive content.

The Power of Long-Form Content

Unlike short-form platforms like TikTok, YouTube excels in long-form storytelling, offering brands the opportunity to engage audiences in meaningful and sustained ways. This is particularly evident in:

- Product Reviews and Tutorials: Educational content continues to dominate, with creators like Mark Rober and Linus Tech Tips showcasing the platform's value in driving product awareness and purchase intent.

- Branded Content: With YouTube Shorts complementing long-form videos, brands can execute multi-format campaigns targeting various audience preferences.

This adaptability reinforces YouTube’s unique position in the marketing funnel, balancing upper-funnel brand awareness with mid-to-lower-funnel conversions.

Challenges and Opportunities for Brands

Despite its strengths, YouTube is not without challenges. Brands must navigate the platform's complex algorithms, which prioritize content relevance and watch time. To succeed, marketers need to:

- Invest in Authenticity: Partner with creators whose content aligns with brand values to foster trust and relevance.

- Leverage Shorts Strategically: YouTube Shorts, introduced as a response to TikTok, is growing rapidly, offering a hybrid solution to short- and long-form content needs.

- Prioritize SEO: Optimizing video titles, descriptions, and tags remains critical for discoverability on YouTube, where search intent plays a significant role.

Regional Dominance and Global Trends

YouTube’s global footprint remains robust, with notable regional trends:

- North America and Europe: These regions dominate ad spend and influencer collaborations, driven by high purchasing power and brand demand for premium content.

- Emerging Markets: Countries like India are witnessing rapid growth, with creators leveraging vernacular content to capture untapped audiences. This aligns with the broader trend of localized influencer marketing strategies.

Monetization and ROI

YouTube continues to innovate with monetization options, including:

- Memberships and Super Chats: Direct monetization tools that strengthen creator-audience relationships while offering brands integration opportunities.

- YouTube Shopping: E-commerce features are gaining traction, enabling seamless integration of product discovery and purchase within the platform.

- ROI Measurement: YouTube’s comprehensive analytics empower brands to track performance metrics like watch time, engagement, and conversions, ensuring accountability for ad spend.

Future Outlook for Youtube

YouTube’s trajectory in 2025 positions it as a resilient platform capable of withstanding competition from short-form video platforms. Its ability to integrate long-form storytelling with e-commerce innovations ensures its relevance across the marketing funnel. For brands, YouTube remains a vital channel for driving awareness, engagement, and conversion.

The platform’s focus on improving creator tools, expanding shopping features, and refining its algorithmic precision ensures that it will continue to thrive as a cornerstone of influencer marketing. Success will depend on brands’ ability to leverage YouTube's unique strengths while adapting to evolving consumer behaviors and technological advancements.

As the industry adapts to rapid shifts in technology and consumer expectations, YouTube’s role in influencer marketing remains indispensable. Its dominance in long-form content, ability to engage diverse demographics, and expanding monetization features position it as a critical asset for brands and creators alike. While challenges persist, YouTube’s commitment to innovation ensures that it will continue to lead the way in delivering measurable impact and meaningful connections.

Expert Predictions: Influencer Marketing in 2025

The influencer marketing industry is at a pivotal moment, driven by technological advancements, shifting audience dynamics, and the rising importance of data-driven strategies. Through a rigorous analysis of interviews with over 100 industry leaders, key themes and predictions have emerged, outlining the trajectory of influencer marketing in 2025. Below, we unpack these insights, offering a roadmap for brands and creators to thrive in this rapidly evolving landscape.

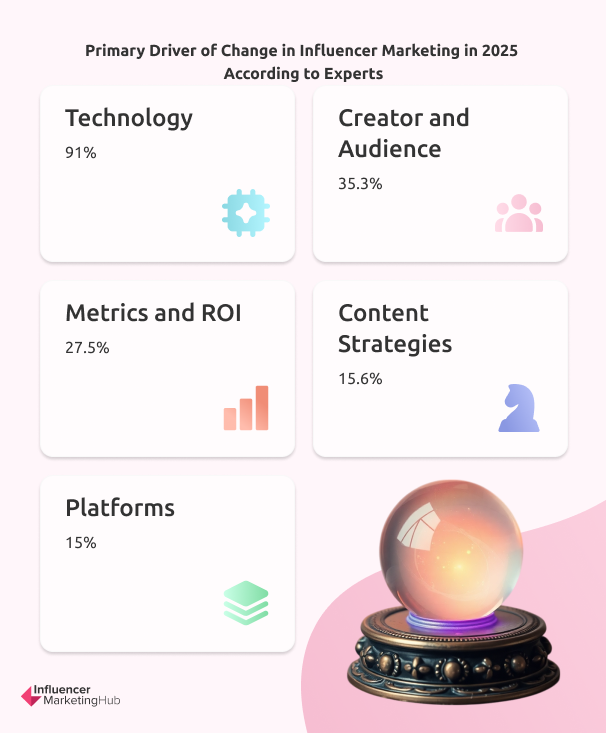

Technology: The Unstoppable Catalyst

Technology dominates the discourse among experts, with 91% identifying it as the primary driver of change in influencer marketing. Artificial intelligence (AI), influencer discovery, tracking, and advanced analytics are transforming every aspect of the industry.

AI Revolutionizing Campaigns

AI accounts for 40.1% of the subtheme mentions, reflecting its central role in reshaping influencer marketing workflows. From automating repetitive tasks to enabling hyper-personalized content at scale, AI is accelerating efficiency and driving higher ROI. Lara Highfill, a leading industry expert, emphasizes,

"AI will fundamentally change campaign contracts, tying performance metrics to outcomes with unmatched precision."

Generative AI in Content Creation

Generative AI is enabling influencers to produce tailored visuals, videos, and virtual experiences with minimal resources. These tools allow brands to reach niche audiences with precision, reducing costs while enhancing engagement. Danielle Whittaker highlights the rise of AI-driven virtual influencers, who are scandal-proof and always aligned with campaign goals.

Predictive Analytics and Personalization

Representing 6.9% of subthemes, AI-powered analytics is enabling marketers to predict audience behaviors and craft data-driven strategies. Predictive insights ensure campaigns resonate deeply, reducing inefficiencies and driving measurable outcomes.

Creator and Audience Dynamics: Trust, Niche Focus, and Community Building

Experts are increasingly highlighting the evolution of influencer roles, with 35.3% focusing on creator-audience dynamics. The future belongs to influencers who cultivate trust, foster meaningful community connections, and cater to niche interests.

Micro-Influencers Gaining Ground

Micro-influencers, accounting for 27.3% of subthemes, are becoming critical players in influencer marketing. Their ability to engage deeply with niche audiences makes them indispensable for brands seeking authentic connections. As Madeline Lavone Ferguson notes,

“Micro-influencers will dominate, offering targeted, trust-based engagement that macro influencers often fail to deliver.”

Community Building as the New Priority

Community-building accounts for 46.9% of mentions, signaling a shift from one-off promotional campaigns to long-term value-driven relationships. Influencers are evolving into community leaders, fostering loyalty and ongoing engagement. Marta Migliore, General Director at Buzzoole, observes,

"The influencer is no longer just a promoter but a builder of sentiment-driven conversations and value-aligned communities."

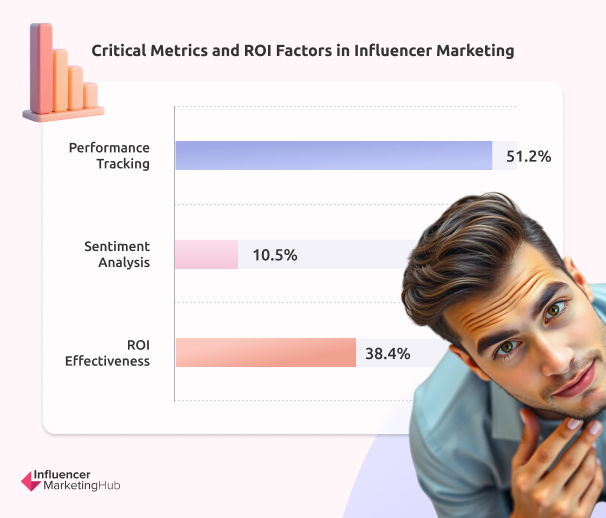

Metrics and ROI: The Push for Accountability

Metrics and ROI remain critical for brands, with 27.5% of experts emphasizing the need for precise performance tracking and measurable outcomes.

Performance Tracking Leads the Pack

Performance tracking accounts for 51.2% of metrics-related mentions, reflecting the growing demand for real-time monitoring of campaign results. Advanced tools powered by AI are enabling brands to track engagement, conversions, and audience sentiment with unprecedented granularity.

ROI Effectiveness Gaining Momentum

At 38.4%, ROI effectiveness underscores the shift from vanity metrics (e.g., likes, views) to hard measures like sales and customer loyalty. Sherry Wu from Boston Consulting Group explains,

"Brands are moving away from ad hoc campaigns toward integrated strategies that deliver sustained ROI."

Content Strategies: Short-Form Video and Live Streaming Dominate

Innovative content strategies are central to influencer marketing success, with 15.6% of experts identifying content as a critical theme.

Live Streaming: Real-Time Engagement

Live streaming emerges as the leading content strategy, representing 52.4% of mentions. Experts highlight its ability to foster authenticity and immediate interaction, making it a cornerstone of campaigns, with some predicting that live shopping will redefine how influencers drive conversions, combining entertainment with commerce.

Short-Form Video: Capturing Attention in Seconds

Platforms like TikTok and Instagram Reels dominate short-form video trends, with 38.1% of experts recognizing their impact. These bite-sized videos maximize virality and engagement, making them indispensable for brands looking to tell compelling stories.

Platforms: Major Players and Emerging Opportunities

Platforms remain the backbone of influencer marketing, with 15.0% of experts focusing on platform trends.

Major Platforms Lead the Way

TikTok, Instagram, YouTube, and LinkedIn dominate with 61.0% of mentions, driven by their advanced features and expansive user bases. These platforms are integrating AI-driven analytics, live streaming, and social commerce to enhance campaign effectiveness.

Social Commerce: A Game-Changer

Accounting for 31.7% of mentions, social commerce is emerging as a key trend. Features like TikTok’s live shopping and Instagram’s integrated purchasing tools are redefining the buyer journey, blending entertainment with direct conversions.

Emerging Platforms Offer Niche Potential

Platforms like Lemon8 and Bluesky, though accounting for a smaller share (7.3%), present opportunities for diversification. Steph Payas, CMO at NeoReach, states,

"Emerging platforms are critical for brands seeking to connect with niche audiences."

Unifying Insights Driving the Future of Influencer Marketing

The insights from these expert interviews underscore a transformative year ahead for influencer marketing. AI, data-driven strategies, community-building, and platform-specific innovations are shaping a future where authenticity meets efficiency.

Brands and influencers that integrate these trends into their strategies will not only drive measurable results but also foster meaningful, long-term connections with their audiences. As the industry matures, the winners will be those who can adapt quickly, think strategically, and leverage technology to amplify human creativity and trust.

The Lessons Learned in 2024 & Looking Ahead into 2025

The influencer marketing industry stands at a pivotal crossroads. With an estimated market size of $32.55 billion in 2025 and a CAGR of 33.11%, it is no longer a question of whether influencer marketing works, it is about mastering its potential fast enough. By blending data-driven precision with human creativity, brands and influencers can unlock a future defined by authenticity, innovation, and measurable impact.

The influencer marketing industry stands at a pivotal juncture, where the rise of AI-driven agents is poised to reshape the boundaries of work. As automation takes hold of executional tasks—content generation, data analysis, campaign optimization, the value of human contribution must shift decisively toward areas where we are irreplaceable: creativity, strategic vision, and authentic connection.

Success will depend on their ability to:

- Leverage AI to amplify creativity, not replace it.

- Build enduring communities that transcend transactional campaigns.

- Align short-term performance with long-term brand equity.

- Localize strategies to harness regional opportunities.

As we move forward, the winners in this space will be those whose AI adoption is higher than their competitors, adopting strategies that align with the evolving dynamics of consumer behavior, technology, and engagement. By doing so, they will forge lasting, authentic connections in an increasingly complex digital ecosystem.

Technology as a Transformative Force: Consensus with Divergences

Both qualitative and quantitative research emphasize technology, particularly AI, as the cornerstone of influencer marketing’s evolution. However, their perspectives diverge on its current adoption and perceived limitations:

AI is unanimously recognized as a game-changer. Survey data shows 66.4% of respondents have experienced improvements from AI in campaign outcomes, while experts underscore AI's role in automating repetitive tasks, enabling hyper-personalization, and enhancing campaign precision. While 37.8% of respondents report limited AI usage, experts push for deeper adoption, citing the untapped potential of AI in predictive analytics and audience sentiment analysis. This divergence suggests that while the value of AI is acknowledged, operational challenges and technical expertise are barriers to full integration.

Closing this gap requires a two-pronged approach: (1) investment in accessible AI tools tailored to smaller teams and (2) education on leveraging AI beyond surface-level automation to advanced analytics and predictive modeling.

Creator Dynamics: Bridging Trust with Community Leadership

The rise of micro- and nano-influencers is a recurring theme across both qualitative and quantitative data, reflecting a shared belief in their ability to foster trust and niche engagement. However, the community-building narrative reveals nuanced perspectives:

With 49.6% of brands collaborating with 1–5 influencers per campaign, there is a clear shift toward smaller, community-driven networks. This trend reflects a focus on deeper engagement rather than broader reach. Experts emphasize influencers evolving into community leaders rather than mere promoters. 46.9% of expert mentions underscore the importance of long-term, value-driven relationships over transactional campaigns.

The shift toward community-driven influencer marketing is not merely about smaller audiences; it represents a structural evolution in influencer roles. Brands must view influencers as long-term partners, crafting co-owned narratives that prioritize sustained engagement over short-term promotions.

ROI Accountability: Diverging Expectations

The survey and interviews agree on the critical importance of measuring ROI, but their interpretations reveal differing priorities:

While 51.2% of respondents prioritize performance tracking, the reliance on vanity metrics (engagement and views) indicates a lingering gap in fully embracing ROI-driven frameworks. Experts, such as Sherry Wu from BCG, advocate for a paradigm shift toward performance-based contracts and long-term strategic alignment. They warn against over-reliance on vanity metrics, urging a focus on tangible outcomes like sales, brand loyalty, and community sentiment.

Bridging this divide will require integrating sentiment analysis and predictive ROI models into campaign evaluation. Marketers must move beyond engagement metrics and adopt systems that quantify emotional resonance, long-term brand trust, and purchase intent.

Content Strategies: A Crossroads of Innovation and Saturation

Content formats like short-form video and live streaming dominate both survey and expert responses, but saturation challenges are evident:

Live streaming (52.4%) and short-form video (38.1%) are preferred formats, reflecting their unmatched engagement potential. However, declining engagement rates on Instagram (1.59%) signal audience fatigue on oversaturated platforms. Experts emphasize the role of innovation in maintaining relevance. They advocate for immersive formats like AR/VR and personalized content strategies to differentiate campaigns in crowded digital spaces.

To combat saturation, brands must adopt interactive content formats that combine entertainment with utility. For example, integrating live shopping into AR-driven experiences can blend commerce with engagement, offering fresh value to audiences.

Platform Strategies: Unified Themes with Regional Nuances

While the dominance of platforms like Instagram and TikTok is evident, regional insights reveal untapped opportunities:

The survey highlights Instagram (57.1%) and TikTok (51.6%) as the most utilized platforms, but TikTok’s 17.2% decline in usage reflects its regulatory challenges in the U.S. Experts draw attention to regions like LATAM and MENA, where double-digit growth in influencer marketing budgets is creating fertile ground for localized strategies. This aligns with India’s rapid ascent in influencer adoption, reflecting strong digital economies and mobile-first audiences.

Brands must adopt a dual-platform strategy: leveraging global platforms for scale while investing in localized platforms and culturally tailored campaigns to maximize relevance in emerging markets.

Macro Trends: Divergent Sentiments on Budget Allocations

Budget trends highlight a cautious yet optimistic outlook:

The proportion of brands planning to increase influencer budgets dropped from 59.4% (2024) to 49.2% (2025), signaling economic pressures. However, 63.8% of brands still plan to partner with influencers, reflecting sustained confidence. Experts are divided between those advocating for increased budgets (driven by AI and social commerce innovations) and those urging prudence amidst rising costs and market saturation.