The holidays are here, and with it comes arguably the biggest sales and shopping event in the US every year—Black Friday, also known as Black Friday-Cyber Monday or BFCM (which includes the online sale on the Monday after Thanksgiving). After an initial upswing in retail sales in 2021, growth slowed as post-pandemic uncertainties and inflation impacted the economy. This year, consumers aren’t too keen on spending money aimlessly and are more cautious regarding their spending habits. You may feel that growing your eCommerce business in this environment is more challenging, but there are strategies for eCommerce growth that can help.

BFCM is an excellent way for brands and businesses to achieve record sales before the year ends, thanks to discounts and promotions that attract consumers, as well as the approaching holiday season. This year, Black Friday falls on November 24, the day after Thanksgiving, with Cyber Monday on November 27.

At this time, brands should already have a well-planned strategy for their holiday sales. However, shifts in consumer preferences, spending habits, and external factors such as inflation can necessitate changes in strategies you may have planned a year in advance. Here are some Black Friday buying trends you ought to know for 2023 so you can adapt your marketing initiatives to create the best possible shopping experiences for your customers.

Black Friday Buying Trends for 2023:

Black Friday Buying Trends to Watch in 2023

-

Increased consumer preference for shops with multiple payment options

The increase in online sales during COVID, followed by a dip post-pandemic, has made multiple payment options necessary for businesses. Whether in brick-and-mortar shops or eCommerce sites, consumers show a preference for sellers that offer many different payment options. Aside from debit and credit cards, shoppers also use e-wallets, prepaid cards, gift cards, and cryptocurrencies for shopping and dining. Financing options such as 0% installments and buy-now-pay-later (BNPL) schemes entice shoppers to purchase big-ticket holiday gifts. BNPL is particularly notable this year, as its use among retail shoppers has steadily increased since 2021. Insider Intelligence estimates that by 2026, 40% of internet users will have used BNPL at least once for a purchase.

However, not all businesses are able to afford costly digital payment solutions. If you are a small retail brand or a new entrepreneur, you can still meet this consumer need by partnering with a solutions provider. Look for one that has a POS system that enables multiple payment options.

-

More fulfillment options will give businesses an edge

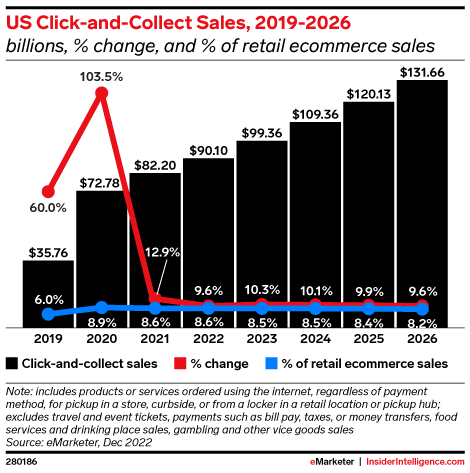

Aside from multiple payment options, consumers also expect businesses to offer more options for delivery and pickup. Because convenience is a significant factor among the younger generation, companies will do well to provide multiple options for buying and fulfillment. Buy Online, Pickup In-Store, known as BOPIS or Click-and-Collect, is a trend slowly replacing curbside pickup as a fulfillment option post-pandemic. BOPIS allows customers to buy something online and pick it up at a local store. It’s an excellent strategy for businesses with both a physical store and an online store, and it offers customers more flexibility with their fulfillment options.

BOPIS sales grew by 103.5% in 2020, and growth has continued, although slowly. The trend is projected to go upward, with sales via BOPIS estimated to comprise 8.5% of all retail eCommerce sales in 2023.

-

A younger demographic will dominate BFCM sales

Anything tech is understandably close to the younger generation aged 25 to 44. It’s the millennial and Gen Z consumers who are camping out in virtual storefronts to get first dibs when Black Friday opens. Both segments were born into the digital age and use online tools for just about everything. While they do not exclusively go digital in purchasing goods, they are known to spend a considerable amount of money on online shopping—most especially when it means enjoying more value for their money in terms of discounts and freebies.

In the US alone, there are over 65 million Gen Z consumers with an estimated total disposable income of about $360 billion. But this comes with a caveat as they save approximately a third of their income. Millennials, the generation before Gen Z, are more likely to spend more because they are older and more likely to hold a full-time job.

To successfully tap this market, you need to learn their spending habits and how to attract them. Offer coupons and promotional deals and freebies in kind or in the form of service fee waivers. It would also be a good idea for brands to be on social media to connect with this market and create excitement and engagement for their products. The more popular platforms are Instagram and TikTok.

-

Early access campaigns for VIPs and loyal customers

Because of the enormity of BFCM, stores and brands are in stiff competition to attract more customers. Early access campaigns give brands a head start in the promotions for holiday sales. These campaigns, often targeted to members of loyalty programs and email subscribers, are an excellent way to attract the Gen Z crowd, of which 40% start their Black Friday planning at least two weeks in advance.

For these sneak peek, early access campaigns, stores and brands typically build their email list ahead of time and craft eye-catching emails to spark the interest of their subscribers in Black Friday deals. These offers can help consumers create a Black Friday wish list with the brands’ promos. As a bonus, offering these great deals to your valued customers can help increase their loyalty to you.

-

Omnichannel is still critical

Reaching out to consumers through omnichannel marketing remains to be the most effective strategy to keep brands top of mind. Millennials are more likely to be loyal to brands and stores that give them exceptional customer-centric experiences. The frictionless shopping experience in a reliable shopping platform should be supported by various other channels for customer touch points to create a strong connection with the customer.

Make sure that you have a solid eCommerce presence, follow your customers throughout the purchase process, and be intuitive enough to know when to deliver that nudge they need to make their purchase. Consistently deliver a personalized experience for your customers, no matter what channel they are on.

-

Hybrid shopping is gaining popularity

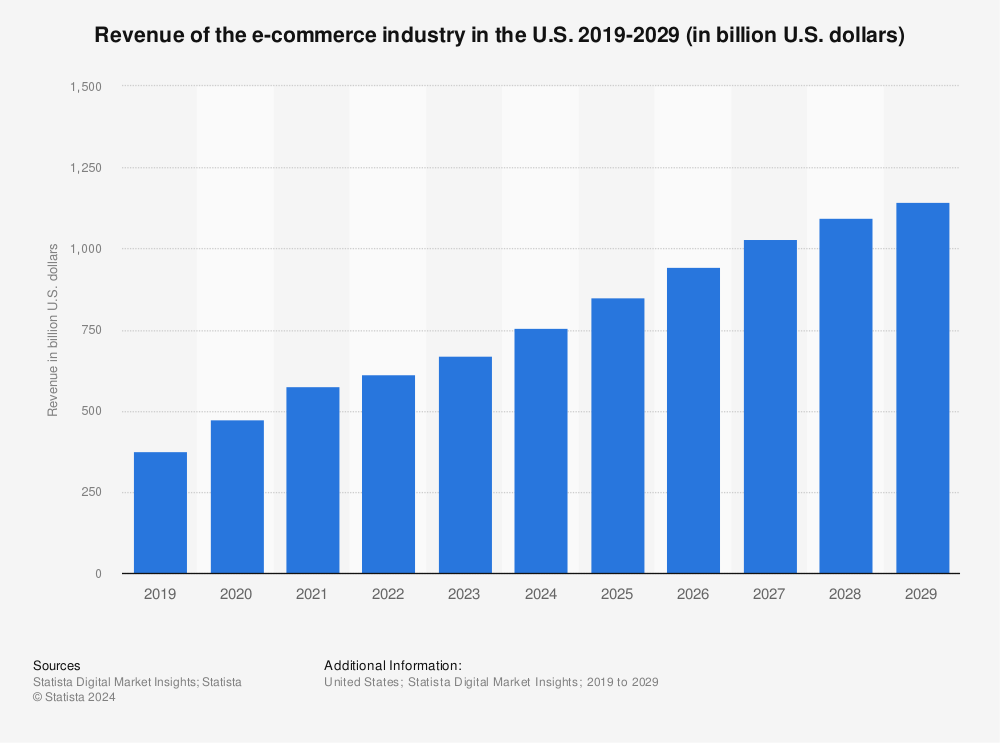

eCommerce may have reigned supreme during lockdown, but post-pandemic shopping habits favor a hybrid model. Many consumers still prefer shopping in-store, or at least visiting physical stores to browse and view products even if they’ll get them online. Online retail still only accounts for 15.4% of total retail revenue in the US in the second quarter of 2023, but the convenience of online shopping remains a huge factor. Statista forecasts retail eCommerce sales to increase annually, and an estimated $925 billion in eCommerce revenue is expected in 2023.

Stores should offer both options to make the most out of Black Friday sales. The fashion industry is a prime example of benefiting from in-store shopping, as millennials still prefer to shop for clothes in physical stores to see the actual items and try them on. In addition, data from Google shows an increase in “open now near me” searches by a whopping 400% year-over-year, suggesting that consumers start their search online before ultimately purchasing from a physical store.

-

Heightened digital expectations from consumers

Consumers have become wiser when it comes to spending their money. Even the younger generation is not exactly as careless in handling their finances as they seem to the older generation. They just spend their money differently. The demand for digital is for great value in all aspects of the digital experience. The consumer has to feel good about the product to want to know more about it and eventually buy it. It’s less about impulse buys of branded items displayed on store windows but more about high product value delivered in a manner that delights the customer.

The challenge for businesses is to highlight and deliver great value—they should convince the customers that they are offering products of value, and they should make the customers feel valued. Knowing your customers is the key to being able to not only meet their expectations but also exceed them high enough to make them loyal customers. Gain significant insight into customer preferences and behavior by taking a closer look at customer information and transactional data.

-

Mobile shopping continues its upward trend

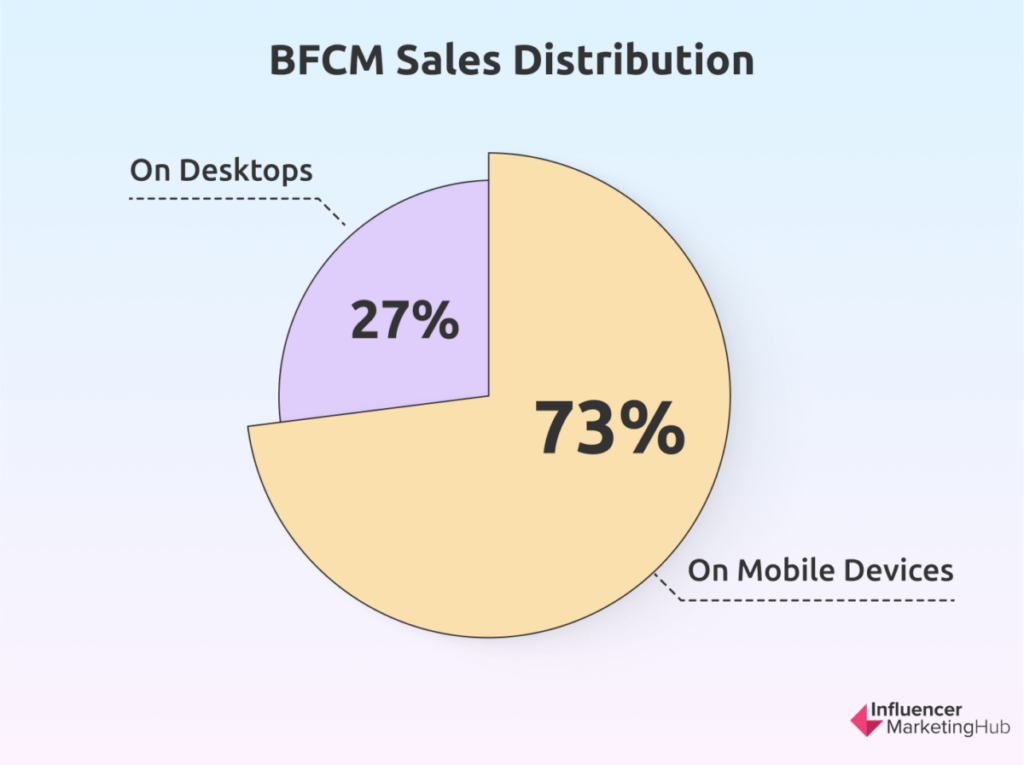

Mobile use has expanded beyond messaging and online searches and is gaining value in eCommerce. M-commerce, or mobile commerce, is predicted to continue its growth in 2023. Last year, Shopify reported that 73% of BFCM sales were made on mobile devices, compared to 27% on desktops. In the last quarter of 2022, m-commerce spending made up 38% of overall digital spending in the US, a marked increase compared to 24% in 2017.

To reach this market, businesses must make their platforms mobile-friendly. In previous years, consumers tended to switch devices to make online purchases, mainly because online shops were difficult to navigate using smartphones. But with a mobile-responsive online shop, you can provide these consumers with a seamless shopping experience without the hassle of switching devices.

-

Influencers continue to have clout on consumers

Consumers today make their purchase decisions based on the information that they find online and the recommendations of people they know. Many seek out influencers to check out products that they are thinking of buying and see what the influencer has to say about them. There are even consumers who follow influencers and pick products based on what they present in their posts.

While the influence status comes from the number of followers the endorser has on social media, it’s not just about numbers. The online clout should have been built from giving authentic reviews about the products presented. For this reason, one of the current trends in influencer marketing is a shift toward a more long-term, ongoing partnership instead of one-off projects. For some brands, the more preferred ambassadors are micro-influencers and nano-influencers with smaller audiences who are more engaged and have higher conversion rates. Brands have to consider working with influencers that match their brand culture and those who will present authentic brand promotions.

-

Brand value that goes beyond economics

There’s a consciousness among consumers nowadays to be more mindful of their purchases. Results of market research have actually shown a marked preference for products that are locally sourced, ethically produced, and carbon-neutral. There’s also a growing trend for products that have a positive impact and contribution to local communities. Consumers now are more likely to purchase products from brands that give back to the community and have sustainable practices rather than those just cashing in on profits.

We can see these conscious-minded campaigns during Black Friday with so-called “Anti-Black Friday” campaigns popularized by brands like Patagonia. These campaigns highlight bigger social issues and encourage younger audiences to veer away from hyper-consumerism.

To appeal to more conscious-minded consumers, brands can add a ‘social enterprise’ component to their promotional campaigns. This, however, has to be done with care and sincerity. Partnering with a charity or choosing a community to give back to needs to be in line with what the brand truly stands for and supports. The message should be planned and crafted meticulously, as it should not come across as merely a gimmick to jack up sales.

-

BFCM is becoming more global

Black Friday started as an American practice the day after Thanksgiving in the US. However, partly due to the rise in global eCommerce, countries outside the US also want in on this tradition. Shopify’s BFCM sales in 2022 had high revenue from Canada and the UK, with London ranking as one of the top cities of BFCM shoppers worldwide. This presents a new opportunity for businesses that are not in the US to participate in BFCM sales and marketing. It also underscores the need for brands to localize BFCM deals per area.

How Brands Can Prepare for Black Friday-Cyber Monday

Brands should ideally prepare for Black Friday a year ahead. It should be part of your annual integrated strategic marketing plan. With the economy improving, albeit a bit slowly, it seems fair to say that the situation will look better soon. Any surprises are still possible, though, as the pandemic showed us three years ago, so businesses must still have backup plans. Tweaks and even full makeovers are often necessary to cope with more recent developments. Also, smaller businesses and retail startups might not have the capacity for such long-term preparations. As BFCM is now on the horizon, the landscape is much clearer, and brands can quickly work on their sales and marketing strategy.

It is assumed that all the basics of knowing your customers and all the basics of marketing have already been covered. What now needs to be done is to identify what products to push, what channels to tap, and what messages to send. Do the math and make a compelling offer that will make it difficult for your customers to resist. Get things moving and drum up excitement in your social media accounts. If necessary, hire social media creators and managers to take care of your postings and engagements. You can get a sense of what’s popular and what your customers are most likely to buy when you ‘listen’ to their social media interactions. This should give you a good idea of what products you might have to bulk up on in your inventory.

Use our Free eCommerce Money Calculator below to calculate your own earnings' potential

Monthly Revenue Potential

$10,000

Yearly Revenue Potential

$120,000

Leverage Insights to Maximize Black Friday Sales

There is no doubt that eCommerce is growing bigger and stronger every day. Consumers’ expectations for digital experiences are increasing, so brands have to keep up. It would be the wisest move for brands to fortify their online presence. The focus should be on creating an exciting place where customers can shop for products that give them more value. They have to provide products and shopping experiences that exceed their customers’ higher expectations.

With BFCM quickly becoming global, brands would definitely benefit from getting ready for the biggest digital sales day this year. Strategically building up promotions leading to Black Friday would be a good move to get into your customers’ shopping lists—you can even have an advance event cart that customers can fill up with promo items, so they can simply check out conveniently on the sale date. Leverage insights about your customers and their online shopping preferences and behavior. Gather your arsenal of digital tools and knowledge to deliver the best ever shopping experience to your customers.