Crypto investing has gained momentum in recent years and is expected to grow continuously. There are moments of huge profits but also downturns in the decentralized blockchain-supported currency market. It’s exciting to calculate crypto earnings, but with each transaction comes the responsibility to pay tax.

Regardless of the market movement, investing in crypto comes with tax liabilities. You may already understand crypto trading and its fundamentals. However, making sure you're being compliant with the appropriate tax regulations is another matter to contend with.

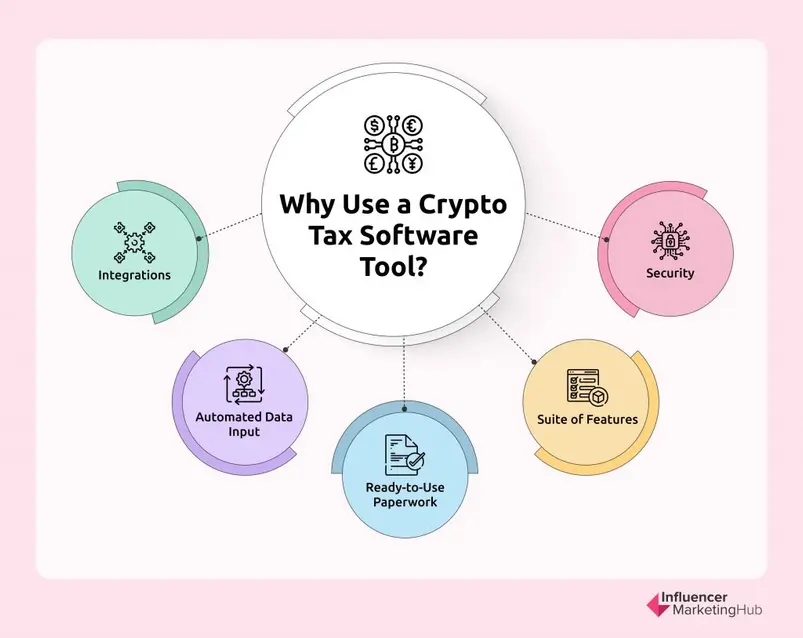

Why Use a Crypto Tax Software Tool?

Tax filing is a tedious task. With crypto investment, in particular, it can be hard to keep track of all transactions. Not to mention, you’d have to manually calculate the tax applicable for that particular activity. It can be too much of a burden for many investors.

This is why crypto tax tools come in handy. These software solutions are designed to optimize transaction tracking, calculate capital gains and losses, and generate accurate reports. There are several reasons why you would want to use a crypto tax software tool:

Integrations

One of the most important features that your crypto tax tool should have is support for all stable coins and popular tokens and exchanges. This way, you can use that one app to track all your activities, even if you are investing in different cryptocurrencies.

It’s too much work to switch between apps and manually calculate taxation on tokens that aren’t supported by a crypto tax tool. Getting highly versatile software allows you to broaden trading opportunities without having to worry about the tax computation by the end of the year.

Another important factor is that the software can be used where you live. Since tax laws differ per country, the app should reflect taxation standards that exist in your particular country.

Automated Data Input

Crypto transactions move at a fast pace. With crypto tax software, you’re essentially eliminating the burden of manually taking note of the date of transaction, the number of tokens in the transaction, their price at the time of the transaction, and so on.

Crypto tax software takes care of recording all the data and presenting it in spreadsheet form that’s understandable. Moreover, intuitive crypto tax programs ensure there will be minimal—if any at all—errors in computation. This is especially important for professional traders who make numerous transactions per day.

Ready-to-Use Paperwork

Aside from recording all transaction info and calculating for tax, crypto tax tools feature downloadable tax paperwork. Most crypto tax software tools include pre-filled paperwork, such as IRS Form 8949, which makes tax filing straightforward for you. Beyond the IRS form, there are many more pre-filled forms you can use. Not only that, but these tools will also usually feature audit tracking, real-time gains and losses data, and other important paperwork all while keeping on top of the latest tax regulations.

Suite of Features

Depending on the plan and the brand, most crypto tax software tools have their own set of features that will prove essential for your crypto tax management. For example, a software tool can detect transactions made between your own wallets. This smart transfer matching feature ensures that you won’t have to pay taxes on transactions where both the sender and receiver are yourself. Another feature is a double-checking capability that prevents duplicating transactions. There’s also the tax-loss harvesting feature that allows you to save money when calculating taxable transactions.

Having all of these features saves time and effort in preparing tax reports. Aside from being used by individuals, crypto tax software tools can also help tax professionals themselves to manage crypto tax specifics for their respective clients.

Security

Any software solution dealing with your profit info should be one that is reliable and secure. A trustworthy crypto tax software will always produce accurate reports, keep the data secure, and have a user-friendly interface where you can navigate all the features and info you would need.

Choosing a trusted crypto tax software also prevents any discrepancies in your tax report that could potentially lead to penalties. Checking users’ reviews can give you an idea of how reliable the tool is.

5 Best Crypto Tax Software Tools in 2025

In order to make your crypto investing activities fool-proof from tax errors, we have compiled these top crypto tax software tools in 2025. From mining to trading, these tools can automate the tracking of every transaction. You can generate reports ready for your accountant or directly to the IRS.

We've laid out the pros and cons for each crypto tax tool, so it will be up to you to check which one will work best when you review and file your crypto tax report.

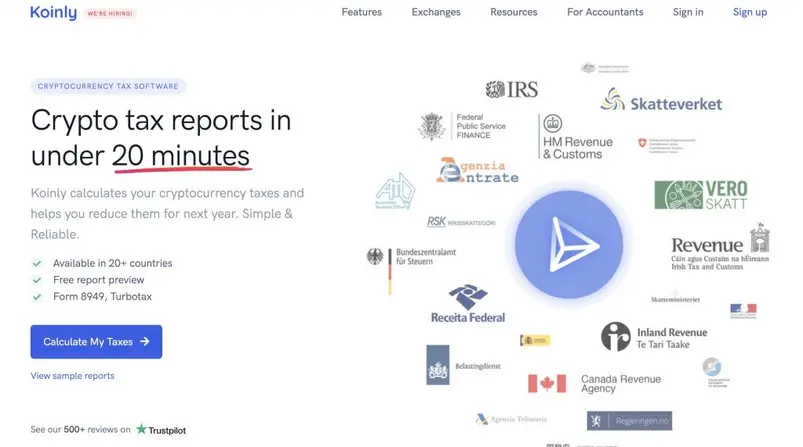

1. Koinly

Source: koinly.io

Koinly is one of the most popular crypto tax software around. It reigns supreme in providing fast calculations—you can complete your crypto tax report in under 20 minutes.

Koinly can integrate with many exchanges and wallets, therefore eliminating any risk of your transaction record not being tracked with their system. Because of their automated data importing, you can track all imported info and reconcile every fee on your exchanges.

Aside from ease of calculation and report generation, Koinly also offers advanced transaction filtering and transaction sorting. With this, you can gauge which transactions resulted in certain gains.

Connecting your wallets and exchanges is pretty straightforward. Either upload a .csv file or use the API to link your investment accounts and let the software import all the data in your account. The software is compatible with more than 300 exchanges and wallets, making it one of the most user-friendly and versatile crypto tax software.

Pros

- User-friendly dashboard highlighting your real-time profit and loss, total growth, ROI, and more

- Comprehensive tax reports

- Double-entry ledger system for better transaction tracking

- Automates data importing

- Allows data exporting to other tax software

- Best for international tax calculations and filing

- Connects with 353 crypto exchanges, 74 wallets, and 14 blockchain addresses

Cons

- Tax report is not included in free plan

- Email support is only for Trader plan subscribers

| FREE | NEWBIE | HODLER | TRADER |

| $0 | $49 | $99 | $179 |

| Up to 10.000 Transactions and portfolio tracker | Per year | Per year | Per year |

2. CoinLedger

Source: coinledger.io

CoinLedger (formerly CryptoTrader.Tax) is another reliable crypto software that makes tax report generation fuss-free. Around 300,000 customers use the tool, as it supports unlimited exchanges and provides profit and loss reports in real-time.

CoinLedger allows importing of tax data from different crypto platforms and gives you a downloadable tax form that can be sent to your other tax software or to your accountant. The platform is user-friendly, perfect for individuals who are not too techy.

CoinLedger can support more than 10,000 cryptocurrencies in numerous exchanges and wallets around the world. With the software, you get tax-loss harvesting tools, crypto tax tips, and a complete suite of auditing instruments.

CoinLedger’s customer service is also noteworthy. Its customer support agents are available on chat and email with high response rates.

Pros

- Effortless exportation of transaction data into different platforms like TurboTax, TaxAct, and more

- Create short and long-term sales reports, crypto income, gain and loss, etc.

- Includes tax report (IRS Form 8949)

- Integrates well with most cryptocurrency exchanges

- Calculates Ethereum blockchain and NFT transactions

- Comprehensive audit support

- Includes tax-loss harvesting

- Customer service is reliable 24/7 via chat or email

Cons

- Does not accept cryptocurrency as payment

| FREE | Hobbyist | Day Trader | High Volume | Unlimited |

| $0 | $49 | $99 | $199 | $299 |

| Data import and Portfolio Tracking | Per year | Per year | Per year | Per year |

3. Accointing

Source: accointing.com

Accointing is a crypto tax tool that simplifies crypto tax work. It's one of the most suitable apps for beginner crypto holders who may not need the more complex technical features that other tools have.

Accointing is a Swiss-based software that has one of the most straightforward interfaces. Beginners can easily import all transactions through modes like API Connect and via manual input. You can import from different platforms, manage crypto profits and loss, and more.

One of its amazing features is the cryptocurrency tax calculator, which is made to comply with IRS tax guidelines. Not only does Accointing fit US regulations, but there are also Swiss, Australian, UK, German, and Austrian-based tax calculator iterations. The tool supports over 300 exchanges and wallets and has the valuable tax harvesting feature.

Pros

- Simple UI that allows you to extract data easily

- Lets you generate US and European tax reports

- Customizable tax schemes

- Integrates with over 300 crypto and exchanges

- Includes tax-loss harvesting

Cons

- Hobbyist plan allows only up to 500 transactions

- Limited customer service for non-Pro plans

| FREE | HOBBYIST | TRADER | PRO |

| $0 | $79 | $199 | $299 |

| 25 Transactions per year | Per year | Per year | Per year |

4. CoinTracker

Source: cointracker.io

CoinTracker is another popular crypto tax software with over a million users. The tool makes it easy to track your portfolio, import transactions, and save money through tax-loss harvesting.

CoinTracker lets you generate tax reports in minutes, ready to send to TurboTax or your very own accountant. You can calculate capital gains as well as profits and losses. And, if necessary, you can consult a personalized CPA under the unlimited tier.

CoinTracker has comprehensive customer support in several countries, including the US, the UK, Canada, Australia, and India as well as partial support for others. The tool supports over 10,000 cryptocurrencies, which covers a lot.

Pros

- Has an app for Android and iOS systems

- Offers 12 distinct methods for furnishing tax reports

- Supports over 10,000 cryptocurrencies

- Easy report generation to send to TurboTax or your accountant

Cons

- Chat support is not a priority for free plan subscribers

- Free plan allows for 25 transactions only

| FREE | HOBBYIST | PREMIUM | UNLIMITED |

| $0 | $59 | $199 | Priced individually |

| 25 Transactions per year | Per year | Per year |

5. ZenLedger

Source: zenledger.io

ZenLedger is a trusted crypto software tool that makes tracking and importing transactions easy. This platform is designed to make your crypto taxes free from errors and protects you from overpaying or neglecting transactions, all while being user-friendly.

ZenLedger has numerous tax forms for different requirements you may have, and it can handle the calculations to report your capital gains and losses. The tool also has Grand Unified Accounting, a proprietary feature that combines all transactions from your different wallets to be reported in a single spreadsheet. It also enables tax-loss harvesting to save you money on your trading decisions.

ZenLedger supports more than 400 exchanges and 30 DeFi protocols. It has a user-friendly interface suited for both novice and experienced crypto investors. Aside from its comprehensive features, ZenLedger has built a reputation for its reliable customer support. Customers can reach out for support on any technical issue 24/7 via chat, email, and phone calls.

Pros

- Simple tracking and combining of all transaction details

- Detailed tax reports and numerous templates available

- Includes tax-loss harvesting

- Excellent customer service

Cons

- For people operating in the US only

- Pricier unlimited transactions

| STARTER | PREMIUM | EXECUTIVE | PLATINUM |

| $49 | $149 | $399 | $999 |

| Per year | Per year | Per year | Per year |

Final Thoughts

Crypto investing involves multiple transactions across wallets and exchanges. To make tax reports error-free and easy, we’ve discussed five of the most notable options right now. With a multitude of crypto tax software tools out there, it can get confusing to decide on one. That’s why we’ve outlined these options in the hopes that we’ll make it easier for you to weigh your options.

As discussed, each crypto tax software has its own pros and cons. There are some that provide comprehensive forms, while some offer tax-loss harvesting. There are also price differences that could impact your decision. Whichever tool you choose, as long as you have a trusted crypto tax software tool, you’ll have your accurate tax documentation and reporting in order.

Frequently Asked Questions

Is crypto tax software free?

Crypto tax software can be free. Crypto.com Tax is entirely free for anyone who needs it. No matter how many transactions, they will handle the calculation for you at no cost.

What is the best way to file crypto taxes?

The IRS treats cryptocurrency as “property.” If you buy, sell or exchange cryptocurrency, you will be on the hook for crypto taxes. You will need to use Form 1040 Schedule D as your crypto tax form to reconcile capital gains and losses. You may need to use Form 8949.

What is the best tax software for crypto?

The best tax software is Accointing, Koinly, TaxBit, TokenTax, ZenLedger, and Bear. Crypto taxes can help you sync your transaction data with a high number of exchanges that can give you profit and loss reports as well as tax reports.

Can I do my crypto taxes myself?

If you are self employed, you need to report your crypto on your taxes. Instead of reporting income on Form 1040 Schedule 1, you will need to report it on Form 1040 Schedule C and pay crypto self-employment tax.