From soaring logistics rates and gummed up supply chains, and eye-watering paid ad costs to fickle customers, DTC brands have a very uncertain future ahead of them.

And yet, there is immense opportunity for savvy operators to leverage inefficiencies and seek out new markets by upping their game.

In this post, we will cover the scope of challenges and opportunities in DTC using these 28 interesting stats (all as up-to date as possible).

- 1. Container shipping costs have increased dramatically

- 2. Shipping products from warehouses in China takes considerably longer

- 3. Most consumers are willing to wait up to five days

- 4. D2C subscription consumer loyalty still strong

- 5. The US has 225+ million DTC subscriptions

- 6. Curation DTC eCommerce subscriptions are the most popular

- 7. With every purchase, repeated purchases are more likely

- 8. Better price is the main motivator among buyers

- 9. More consumers are buying regularly form D2C brands

- 10. DTC websites can also serve as a source of inspiration

- 11. Shopify is home to half of all DTC brands

- 12. Amazon stock falls by 14%, loses over $200 billion in value in one day

- 13. The Chinese live-streaming market will generate $600 billion in sales

- 14. Most public ‘unicorn’ DTC brands have performed poorly

- 15. Facebook loses a record $232 billion in value in a single day

- 16. 50% of Gen Z buying decisions are driven by TikTok

- 17. 41% of customers are fine with shopping in the metaverse

- 18. 10% eCommerce revenue goes into combating payment fraud

- 19. 50% of US consumers are stressed out over purchase decisions

- 20. 74% Zoomers and 71% millennials bought from international brands

- 21. 82% of consumers look at brand values before buying

- 22. The majority of multinational companies invest significantly in D2C sales channels

- 23. D2C eCommerce expected to reach $213 billion by 2023 in the US

- 24. More than half a million jobs to be created in the UK by 2023

- 25. More than 100 million packages will be delivered in 2023

- 26. The ad spencing for D2C is undergoing a change.

- 27. 85% of the business leaders switched to a DTC model.

- 28. By 2025, Adidas intends for Direct-to-Consumer (DTC) to account for 50% of its sales.

- Key Takeaways

- Frequently Asked Questions

1. Container shipping costs have increased dramatically

According to data shared by Statista, container freight rates have increased significantly in the past couple of years. In October 2022, the global freight rate index (aka the average cost of transportation) was $3,100. One of the reasons for this increase was the pandemic. During the past few years, the global supply chain had to deal with labor shortages and port closures among others. The Russia-Ukraine war has also had a negative impact.

#DailyChart: #Shipping costs plummeting

Today's release from Drewry Shipping Consultants Ltd shows container shipping costs continue to fall, now down 24% from the peak in late September 2021. Bodes well for #inflation.

Slides: https://t.co/jrUCC48x5R pic.twitter.com/da3BLxuXrI

— economistluke (@economistluke) April 21, 2022

2. Shipping products from warehouses in China takes considerably longer

Thousands of ships are waiting to unload and load at ports around the world. According to data shared by Reuters, the result is that it can take up to 74 days longer than usual to ship a product from a warehouse in China to a warehouse in the US.

While this delay isn’t nearly as long in Europe, this continent is also experiencing delays. According to Reuters, ships from China en route to Europe are showing up four days late on average. This also has a domino effect and, for example, causes a shortage of empty containers.

At this stage, it’s difficult to say when these delays will improve.

#China's COVID lockdowns have worsened global supply chain woes. One-fifth of the world's container ship fleet is estimated to be stuck in port congestion (not just in China), and the number of ships awaiting berth at Shanghai are up 34% from last month. pic.twitter.com/92Jiha2Xx4

— Karen Braun (@kannbwx) May 5, 2022

3. Most consumers are willing to wait up to five days

While congestion at ports is causing significant delays, D2C consumers might not be that disappointed. A survey completed in 2022 has revealed that nearly half of shoppers in the US are willing to wait anything from three to fives days for a delivery of a D2C purchase. What might come as a bit of a surprise, though, is that more than 20% could wait up to eight days.

Only 5% expected a purchase that was placed directly on a brand’s store to be delivered within 24 hours.

That said, Amazon’s free shipping and super fast delivery policies have changed customer expectations forever. While it might not need to be delivered the same day or the next day, fast shipping remains essential.

4. D2C subscription consumer loyalty still strong

While D2C subscriptions have also been affected by increasing costs, irregular deliveries, and product availability, these problems haven’t impacted the majority, with 60% of customers feeling that they haven’t felt the effects. About a third (30%) of customers, however, felt that they were impacted negatively which in return has made them less loyal to D2C subscriptions.

5. The US has 225+ million DTC subscriptions

Overall, DTC subscriptions are still going strong and the number of subscription brands has continued to grow. According to PipeCandy’s State of the US Direct-to-Consumer Subscriptions 2022 — Industry Report, there are more or less 27,000 DTC subscription companies in the US which is also the biggest market for this niche.

As for the number of subscriptions, PipeCandy calculates it at more than 225 million. Considering that there are just over 60 million subscribers in the United States, this works out to an average of 3.7 subscriptions per person.

6. Curation DTC eCommerce subscriptions are the most popular

Subscriptions can broadly be divided into the following three groups:

- Replenishment

- Curation

- Membership

According to PipeCandy, curated monthly boxes containing items like clothing, cosmetics, and snacks prove to be the most popular and make up more than half (55%) of all DTC subscriptions.

Replenishment is in second spot accounting for about a third of all subscriptions. This category includes subscriptions that focus on pet supplies, toiletries, etc. You know, the boring but essential stuff.

7. With every purchase, repeated purchases are more likely

According to data shared by Statista, in 2022 the leading global brands’ repurchase rate from the first to second order was 45%. After the third order, the chances that the customer will make a follow-up order increases to over 60%.

8. Better price is the main motivator among buyers

A study completed in 2022 has found that the main factor that would encourage consumers across the world to buy online directly from a brand would be a better price. Almost half cited this as their main motivator. Free delivery was in close second with 47% citing this as their biggest motivator, while 35% valued free returns more.

9. More consumers are buying regularly form D2C brands

In the past few years, the number of consumers across the globe who regularly make D2C purchases online have increased steadily. In 2022, it is set to be 64%, an increase of 15% in three years.

10. DTC websites can also serve as a source of inspiration

A survey completed in 2022 has found that about 14% of consumers across the globe used D2C websites and apps to find inspiration and 15% used it to search for products. These numbers show that D2C sites enjoy significant consumer attention during the purchasing

stage.

11. Shopify is home to half of all DTC brands

While Shopify’s stock might have plunged dramatically in 2022, PipeCandy estimates that it’s still home to 50% of all DTC brands. Much of its popularity is thanks to its powerful eCommerce functionalities like payments and native subscriptions.

In second spot, it’s WooCommerce. About 10% of DTC brands in the United States use WooCommerce as their eCommerce platform. It’s especially popular among brands that generate less than $5 million in gross merchandise value (GMV).

12. Amazon stock falls by 14%, loses over $200 billion in value in one day

Since a large number of DTC brands depend upon Amazon, such a drastic fall in Amazon stock signals trouble in the larger eCommerce ecosystem.

Amazon has long been the bellwether eCommerce brand and its weak Q1 2022 sales data (7% rise compared to 40% for the same time last year) is an indicator of tougher times ahead.

As the Forbes article linked above states, the fall comes on the back of high inflation numbers in Q1 2022, supply chain issues, and the knock-on effects of the Russia- Ukraine war.

These issues are not just relevant to Amazon and will affect the bottom lines of any DTC brand.

13. The Chinese live-streaming market will generate $600 billion in sales

China has the world's largest live streaming market, with a single live streamer often able to move billions in merchandise over the course of a several-hour-long live stream. According to estimates shared by eMarketer, live streaming eCommerce sales in China will reach almost $480 billion in 2022. It will continue to grow strongly and it’s predicted that it will exceed $623 billion in 2023.

This market, however, is in the nascent stages in the US and early-mover DTC brands can gain an unfair advantage.

Interestingly, the Chinese government is seeking to clamp down on this market, imposing tax evasion fines worth millions of dollars on top live streamers.

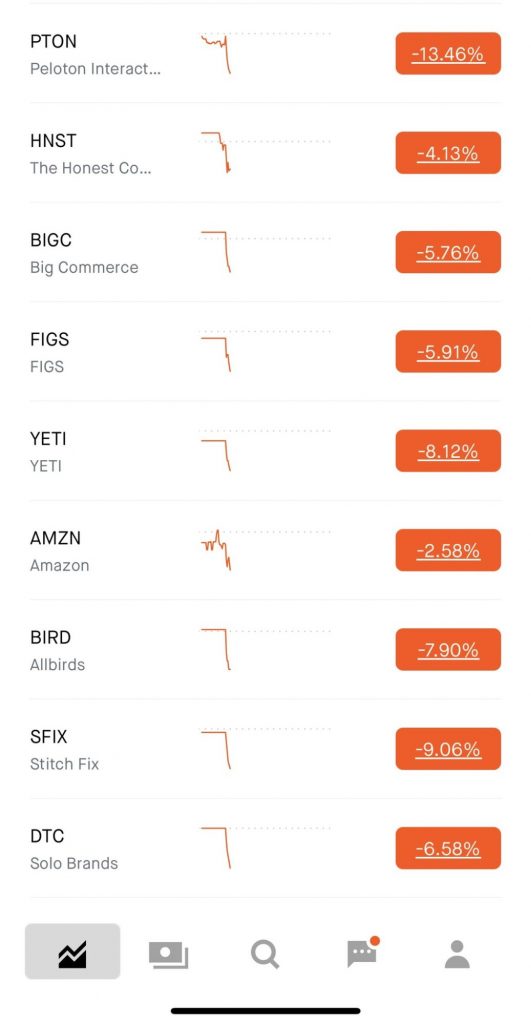

14. Most public ‘unicorn’ DTC brands have performed poorly

Along with the fall in Shopify and Amazon stock, DTC public companies with market capitalization above $800 million have seen major downgrades in value.

This fire sale in so-called WFH stocks is ongoing, as the chart shows.

Source: bigtechnology.substack.com

Warby Parker (63%) and Stitchfix (40%) lead at the top of the stocks with the highest losses.

While inflation and supply chain issues are being blamed on the poor performance of DTC bellwether stocks, the overall stock market as represented by the S&P500 index has fallen by just 11% in the same time period.

This bearish environment is expected to continue for quite some time, as the world economy has been thrown into a tailspin following the Ukraine invasion.

15. Facebook loses a record $232 billion in value in a single day

Following Meta (Facebook’s parent company) weaker than expected earnings, Facebook lost a record $232 billion in a single day. This number is the biggest one-day drop in the history of the stock market

Facebook's plunge can be reasonably attributed to iOS14 updates that kneecapped the platform’s ability to serve highly targeted ads at scale.

While this is definitely good from the privacy point of view for normal users, advertisers like DTC brands that primarily relied on Facebook to acquire customers will have to face testing times.

And, skyrocketing Facebook ad prices are also hurting the DTC industry a lot, as highlighted by Big Technology. Basically, in a span of two years the ad rates have doubled.

According to data shared by Statista, 27% of D2C ad spending is spent on Facebook. In 2021, it was just over a third. So, even before this one-day drop, D2C ad spending on Facebook has started to decline. On the other hand, D2C advertising spending on Google increased. It would be interesting to see if ad spending on Facebook for this sector will continue to decrease and which other avenues in addition to Google D2C brands are turning to instead.

16. 50% of Gen Z buying decisions are driven by TikTok

TikTok has rapidly become the social media platform of choice for Gen Z, and a study shows that 80% of this cohort are using it for everything, from purchase recommendations, news sources, and even as a search engine.

And 50% of Zoomers base all buying decisions on TikTok videos, as evidenced by the virality of the #TikTokMadeMeBuyIt hashtag.

This data point is extremely important for DTC brands to consider, especially in the fashion, food, and CPG niches where it is easy to depict the products visually.

17. 41% of customers are fine with shopping in the metaverse

Roblox, Fortnite, and their likes have become virtual worlds and gained immense hype and media attention. From behemoths like Nike and Adidas down to smaller DTC brands, many seem to have gotten in on the metaverse bandwagon.

And consumers are responding.

According to a survey by CommerceNext, 41% of consumers would like to shop in the metaverse, even though 48% have never heard of it and only 5% are familiar with it.

Unlike that time in the early 2000s when Second Life fizzled out, the metaverse has now become a part of popular culture - sold-out music concerts in Fortnite being one example - and is here to stay, and overwhelmingly popular with Gen Z.

DTC brands need to have a metaverse strategy sooner rather than later.

18. 10% eCommerce revenue goes into combating payment fraud

The eCommerce industry has long struggled with payment fraud, and a Visa supported study titled Global Payments and Fraud Report estimates that merchants spend 10% of their revenue globally combating payments fraud.

For most online-only DTC brands, big or small, fraud prevention should be an important item on their operational checklist.

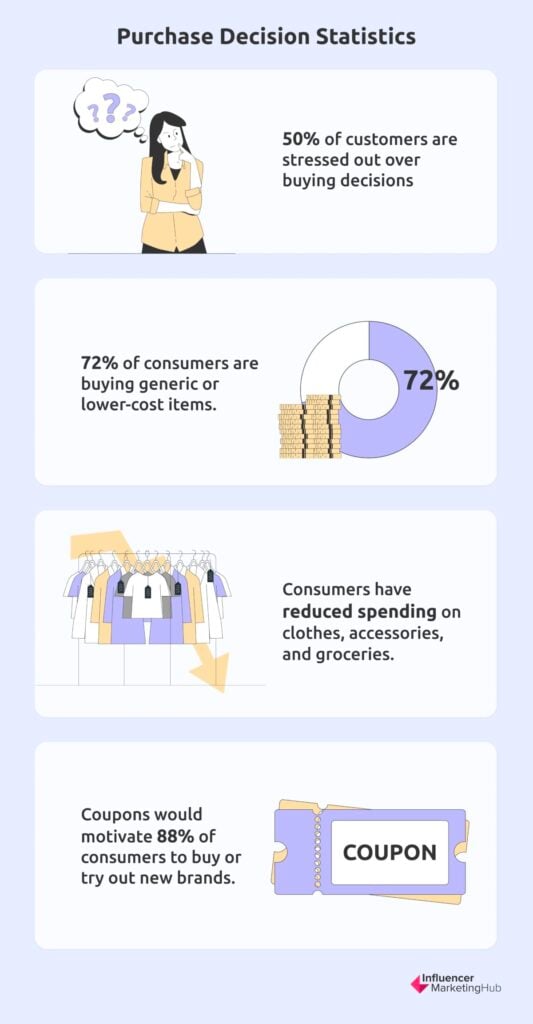

19. 50% of US consumers are stressed out over purchase decisions

The highest inflation rate in 40 years has turned shopping from therapy to punishment.

According to a survey by Vericast:

These trends will also affect DTC brands. They will need to test lower pricing tiers, discounts, and explore bundling to give consumers better value per dollar in order to acquire new customers and keep older ones loyal.

20. 74% Zoomers and 71% millennials bought from international brands

DTC brands looking to enter the US market would have a much higher ROI by focusing on younger consumers who drive international purchases.

The Retail Brew/Harris Poll survey also found that:

- Only 17% Gen X and 13% Boomers bought from international brands

- 29% of Gen Z and millennials bought from overseas brands at least once every month

- Fast fashion (45%), electronics (41%) and personal care (41%) were top categories

- 66% of consumers bought online, either from marketplaces or brand websites

21. 82% of consumers look at brand values before buying

A Harris Poll survey has found that a large percentage of consumers will buy from companies whose values align with their own.

- 52% support sustainable brands

- 66% want to buy from eco-friendly businesses

- 55% are willing to pay more

However, 72% of consumers are savvy to greenwashing attempts by brands, while 98% of consumers are willing to buy from alternate brands if the item was not in stock.

22. The majority of multinational companies invest significantly in D2C sales channels

According to online stats shared on Statista, 57% of senior execs indicated that their multinational company had plans to invest significantly in D2C sales channels in 2022. On the other hand, only 1% didn’t plan to invest at all in this niche, while just over 10% would invest minimally.

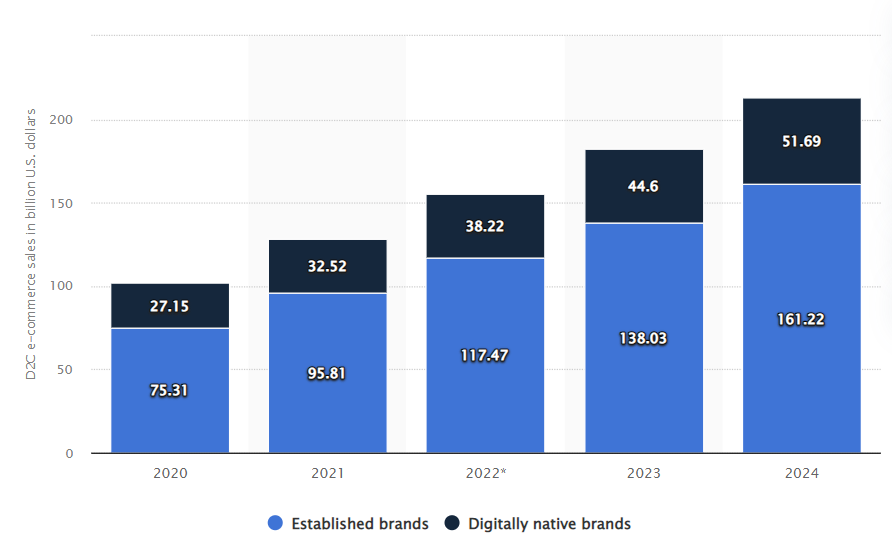

23. D2C eCommerce expected to reach $213 billion by 2023 in the US

According to data shared by Statista, it’s predicted that the D2C online market in the United States will reach nearly $213 billion by 2023. Much of this growth will be attributed to the competitiveness among the stakeholders in terms of pricing, delivery, and returns.

D2C sales by established brands will make up the biggest chunk. Predictions anticipate that D2C sales by established brands will amount to just over $138 billion in 2023, while D2C sales by digitally native brands (aka brands that were born and evolved online) will add up to nearly $45 billion in 2023.

Source: statista.com

Currently, more than 75% of DTC brands in the United States fall into fashion and apparel, home and garden, or food and beverage.

24. More than half a million jobs to be created in the UK by 2023

Data shared on Statista reveals that the D2C sales sector’s workforce in the United Kingdom will grow to 618,000 positions by 2023.

25. More than 100 million packages will be delivered in 2023

In the United Kingdom, it’s predicted that in 2023 more than 110 million packages will be delivered direct-to-consumers by manufacturers. It’s an increase of 30% in three years, up from 85 million parcels in 2020.

26. The ad spencing for D2C is undergoing a change.

In the beginning of 2021, Meta secured more than one-third of the advertising spend from D2C brands. However, since the introduction of ATT (AppTrackingTransparency), there has been a drop in Meta's market share. Concurrently, TikTok has seen an upswing, with D2C brands increasing their ad expenditure on the platform by 231% in the second quarter of 2022, amounting to $30 million, according to Triple Whale.

27. 85% of the business leaders switched to a DTC model.

85% of business leaders have already transitioned to a DTC (Direct-to-Consumer) model. Furthermore, an additional 13% expressed intentions to make this shift in 2023.

28. By 2025, Adidas intends for Direct-to-Consumer (DTC) to account for 50% of its sales.

In 2021, Nike prioritized its digital operations and launched compact stores like Nike Live, sidelining retailers like Macy’s and DSW. Following this trend, brands like Adidas, Under Armour, and San Francisco's Levi’s have shifted focus. Levi’s has notably minimized wholesale in favor of its own stores and online sales. Meanwhile, Adidas targets 50% of its sales from DTC by 2025.

Key Takeaways

Even though you might cut out the middleman by selling directly to the consumer, there are still many other factors that you need to keep in mind and which can have a massive impact on your operations. Advertising costs, supply chain disruptions, changes in regulations, you name it. As the whole world has seen and experienced, events can have a lasting ripple effect.

While the DTC market has experienced many challenges over the past year, the future looks promising, especially if you’re running a subscription-based business. Just like with any other industry, it’s key that you stay up to speed with developments and trends. In fact, as you’ll be selling directly to the person who will use your product, it’s even more important that you make time to find out what it is that makes them tick, whether it’s by reading a blog post like this one or attending an in-person event.

While you’re at it, you can also download our The State of the Direct-to-Consumer (DTC) Industry - 2022 report that’s based on thousands of US DTC businesses curated by PipeCandy.

Major challenges for DTC (Direct-to-Consumer) brands include increased container shipping costs, longer shipping times from countries like China, high logistics rates, supply chain disruptions, and rising paid ad costs. These issues create uncertainties but also opportunities for brands to innovate and find new markets. Despite challenges such as increasing costs, irregular deliveries, and product availability issues, consumer loyalty to DTC subscription services remains strong. About 60% of customers have not felt the negative impacts, while around 30% have experienced issues that have affected their loyalty. The primary motivators for consumers to buy directly from DTC brands are better prices, free delivery, and free returns. A study found that nearly half of consumers cited better prices as their main motivator, with 47% valuing free delivery and 35% prioritizing free returns. Shopify is the most popular eCommerce platform among DTC brands, hosting 50% of all DTC brands. Its popularity is due to its powerful eCommerce functionalities, including payments and native subscriptions. WooCommerce is the second most popular platform, used by about 10% of DTC brands in the United States. Gen Z's buying decisions are significantly influenced by TikTok, with 50% of their purchase decisions driven by TikTok videos. This highlights the importance of visual and engaging content on TikTok for DTC brands targeting younger consumers, especially in niches like fashion, food, and consumer packaged goods.Frequently Asked Questions

What are the major challenges currently facing DTC brands?

How has consumer loyalty to DTC subscription services fared amid recent challenges?

What motivates consumers to buy directly from DTC brands?

Which eCommerce platform is most popular among DTC brands?

How are Gen Z's buying decisions influenced by social media platforms?