Methodology

The data presented in this report was collected from 100 brands owned by content creators. After collecting data on each brand, we filtered through them by their revenue, website traffic, ad spend, year founded, and social media reach across platforms.

By utilizing NeoReach’s proprietary data, we collected each brand’s growth rate and audience demographics, in addition to conducting a trending analysis to predict future growth.

This analysis allowed us to provide a comprehensive overview of the creator brand landscape. In this report, we will identify some of the most successful creator brands, the top industries and products, which brands are growing/slowing down, and which brands will continue to grow.

Top 100 Creator Brands:

Top 100 Creator Brands

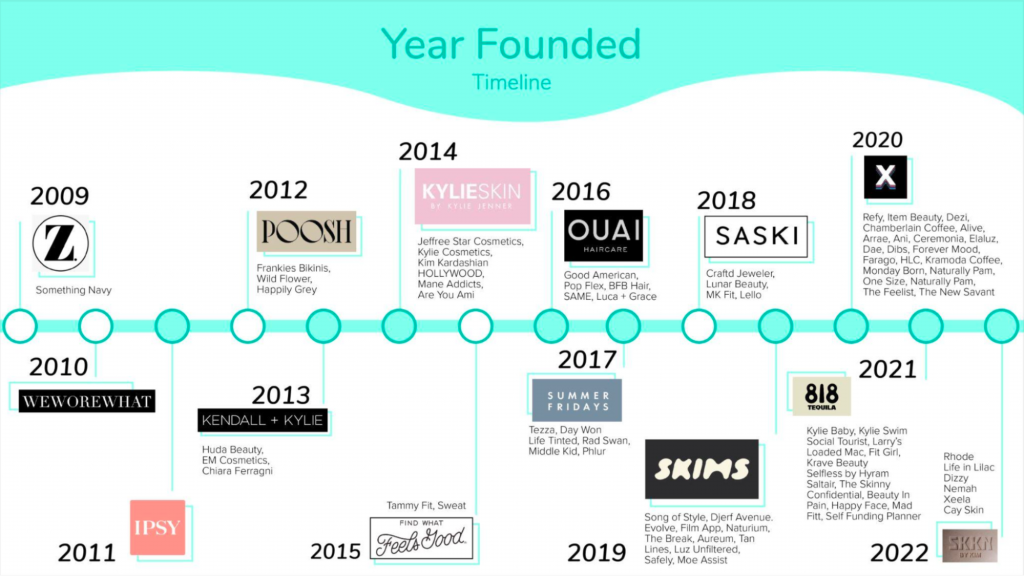

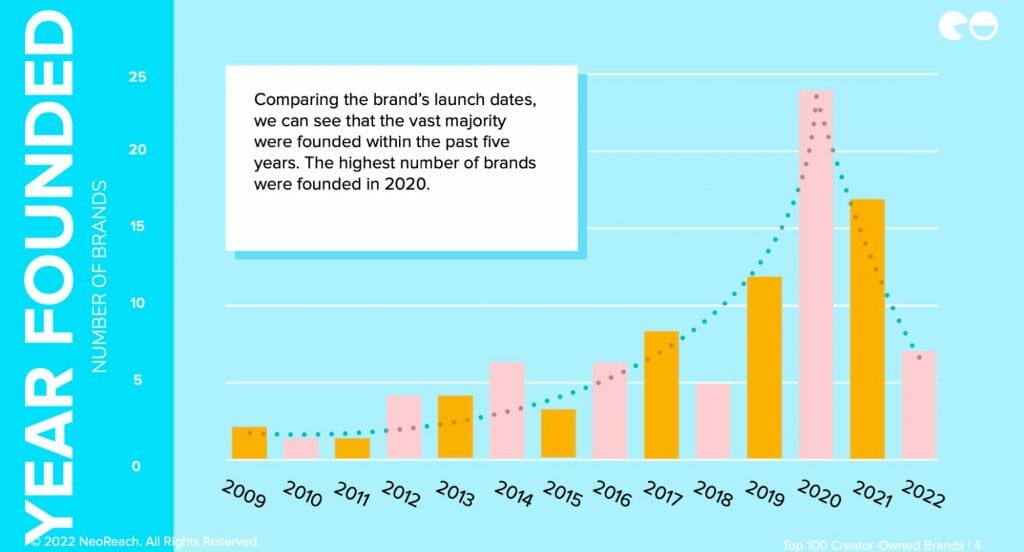

Year Founded Timeline

Comparing the brand’s launch dates, we can see that the vast majority were founded within the past five years. The highest number of brands were founded in 2020.

Top 10 Brands By Creators

Out of 100 top names, we have narrowed down the list to the top 10 brands founded by creators. With annual revenue up to $500M, the content creators who founded these ten brands have found tremendous success in their industries – from beauty to fitness. While some of these brands have been around since the early 2010s, a few were only founded in the past 5 years. Narrowed down by year founded, annual revenue, monthly website traffic, and monthly paid ad spend, let’s take a look at the ten creator-owned brands that made the list.

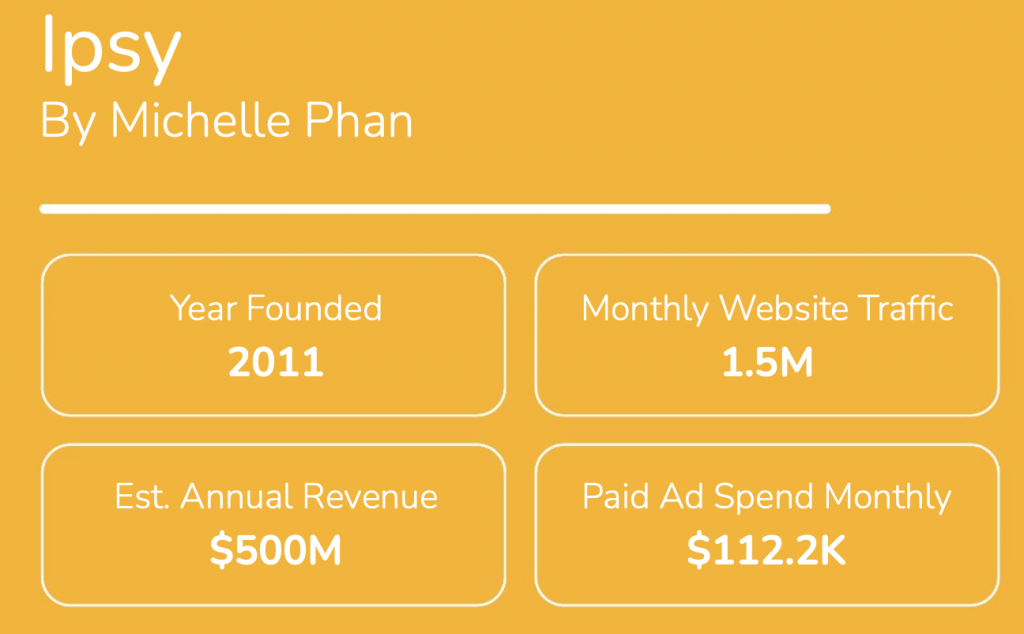

1. Ipsy by Michelle Phan

Ipsy was founded in 2011 by Michelle Phan, a popular beauty YouTuber. With annual revenue reaching an estimated $500M, Ipsy has solidified a spot as the top creator brand. After over ten years in the industry, monthly website traffic remains in the millions and Ipsy continues to be one of the most well-known creator brands.

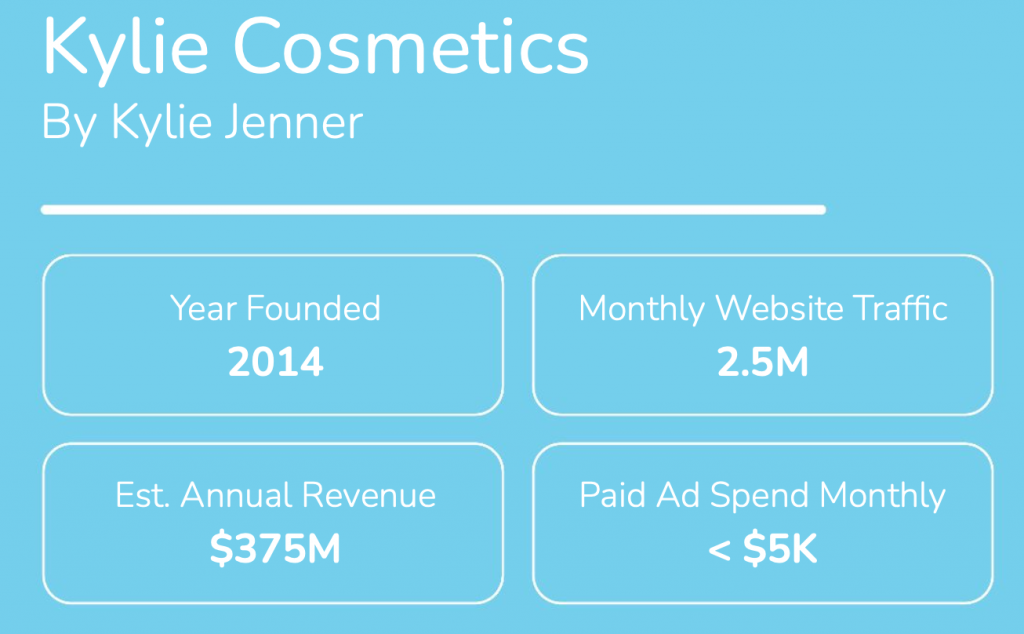

2. Kylie Cosmetics by Kylie Jenner

Kylie Cosmetics was founded in 2014 by Kylie Jenner, an influencer and reality TV star. This was the first of multiple brands founded by Jenner under her name. The brand’s monthly website traffic is higher than that of Ipsy, and estimated annual revenue stands at an impressive $375M.

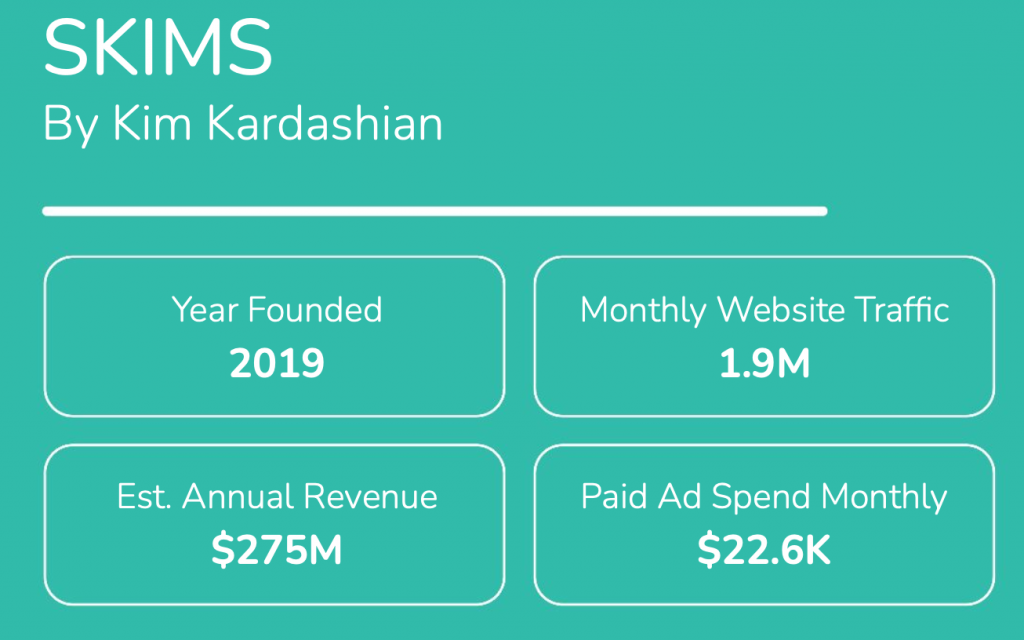

3. SKIMS by Kim Kardashian

SKIMS, founded by Kim Kardashian, is one of the newer brands on the top 10 list. Since 2019, the shapewear brand has achieved an estimated annual revenue of $275M and sports a massive monthly website traffic of 1.9M. It is also worth noting that SKIMS is the only brand in the top 10 that is categorized within the fashion industry.

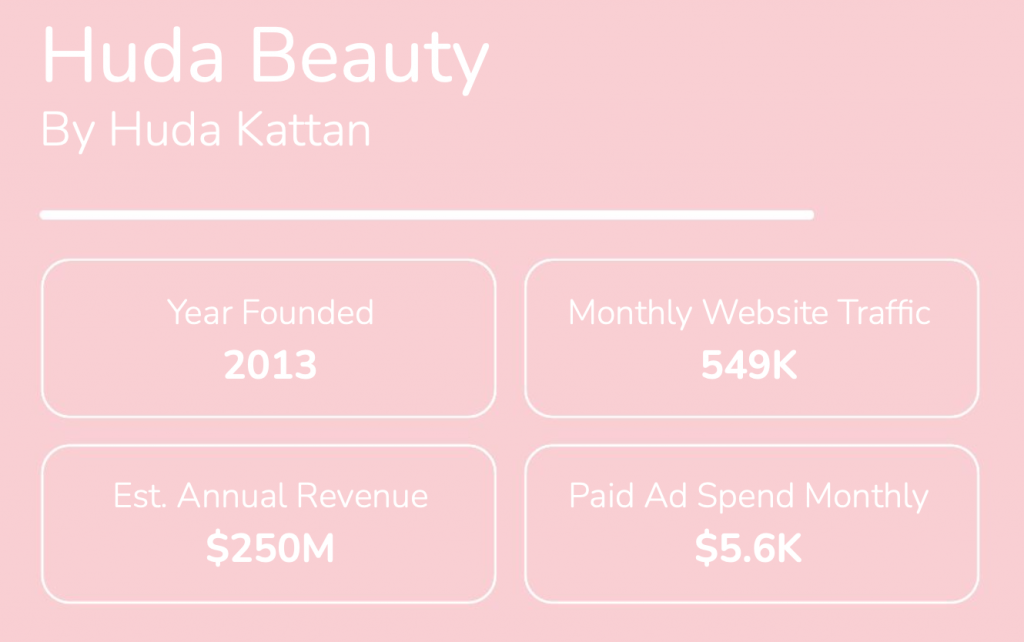

4. Huda Beauty by Huda Kattan

Huda Beauty was founded in 2013 by Huda Kattan, a makeup artist and popular beauty influencer. With estimated annual revenue reaching an estimated $250M, Huda Beauty is ranked fourth among the top creator brands. Reaching millions across Instagram, TikTok, and YouTube, the brand has solidified its place in the beauty industry over the past 10 years.

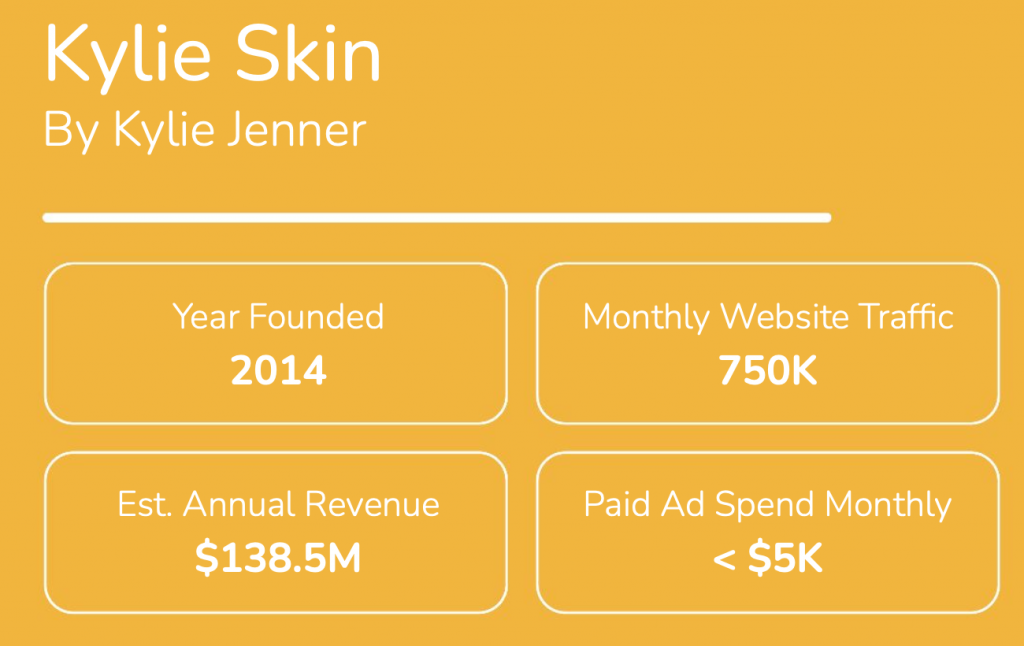

5. Kylie Skin by Kylie Jenner

Kylie Skin was founded in 2014 by Kylie Jenner, making it the second of her brands to earn a spot on the leaderboard. The company’s annual revenue has reached an estimated $138.5M and the website’s monthly traffic stands around 750K.

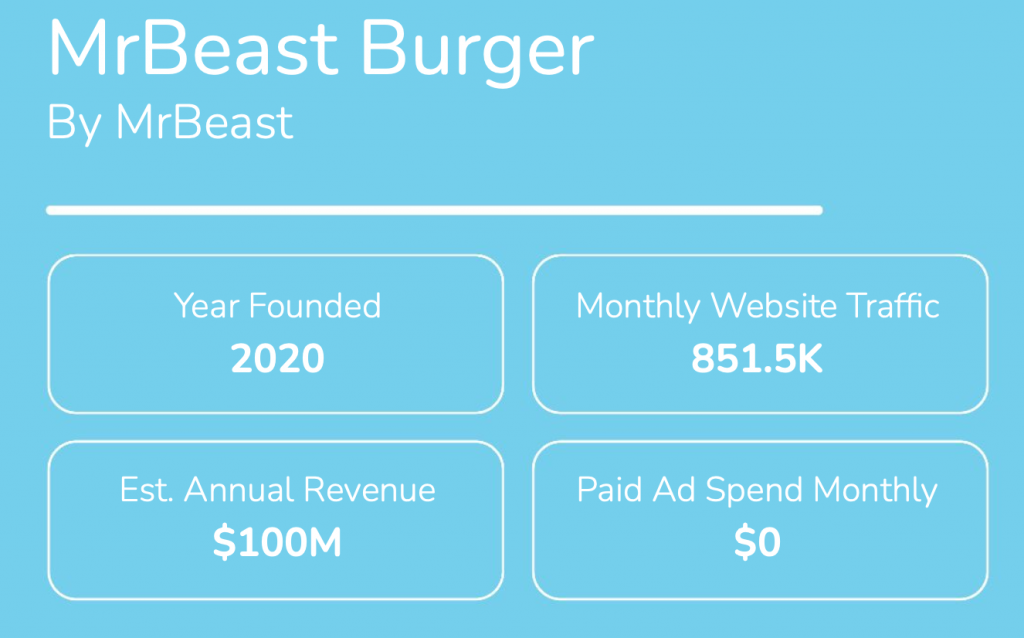

6. MrBeast Burger by MrBeast

MrBeast Burger was founded in 2020 by popular YouTuber, MrBeast. With an estimated annual revenue of $100M, this is the newest company and only brand in the food and drink industry on the top 10 list.

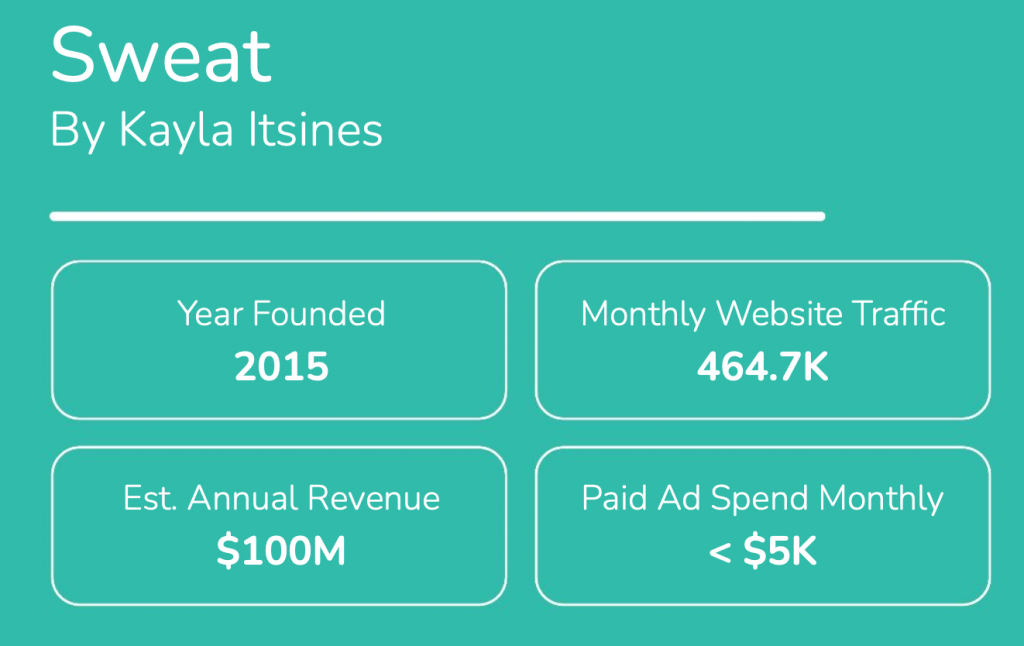

7. Sweat by Kayla Itsines

Sweat is a fitness app founded by wellness influencer Kayla Itsines in 2015. This is the only fitness brand to make the top 10 list. The estimated annual revenue is $100M and the app averages 70,000 monthly downloads.

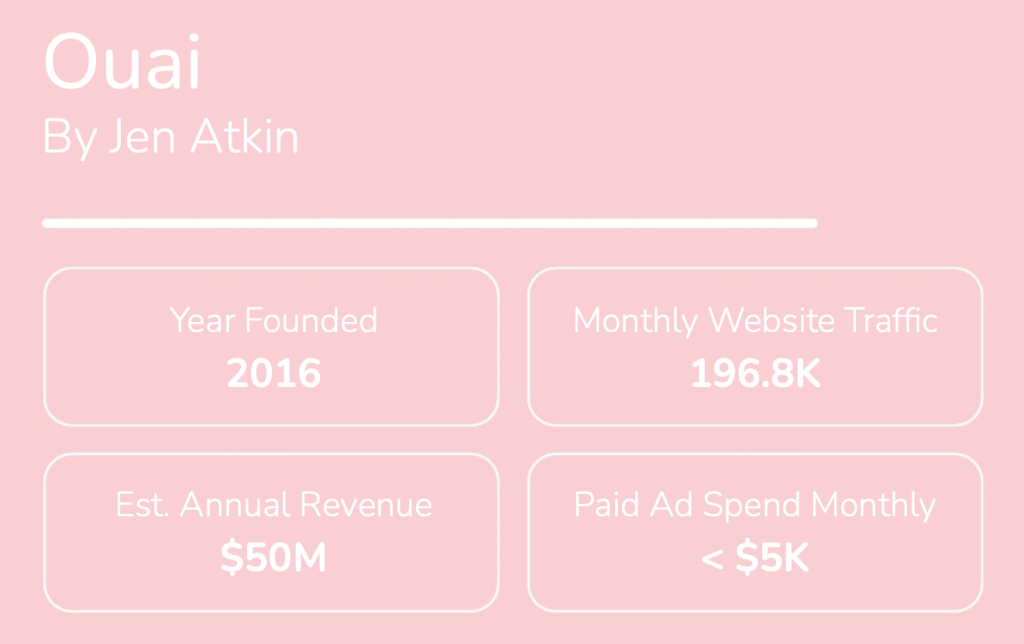

8. Ouai by Jen Atkin

Ouai is a hair care brand founded by Jen Atkin. Launched in 2016, the brand now sports an estimated annual revenue of $50M and has a monthly website traffic of 196.8K. One of many beauty brands on this list, Ouai is the only dedicated hair care brand that has made the top 10.

9. Jeffree Star Cosmetic by Jeffree Star

Jeffree Star Cosmetics was founded in 2014 by Jeffree Star, who has become one of the biggest names in the beauty and makeup industry. The company’s annual revenue has reached an estimated $45M, which has earned it a spot on the top 10 list of creator brands.

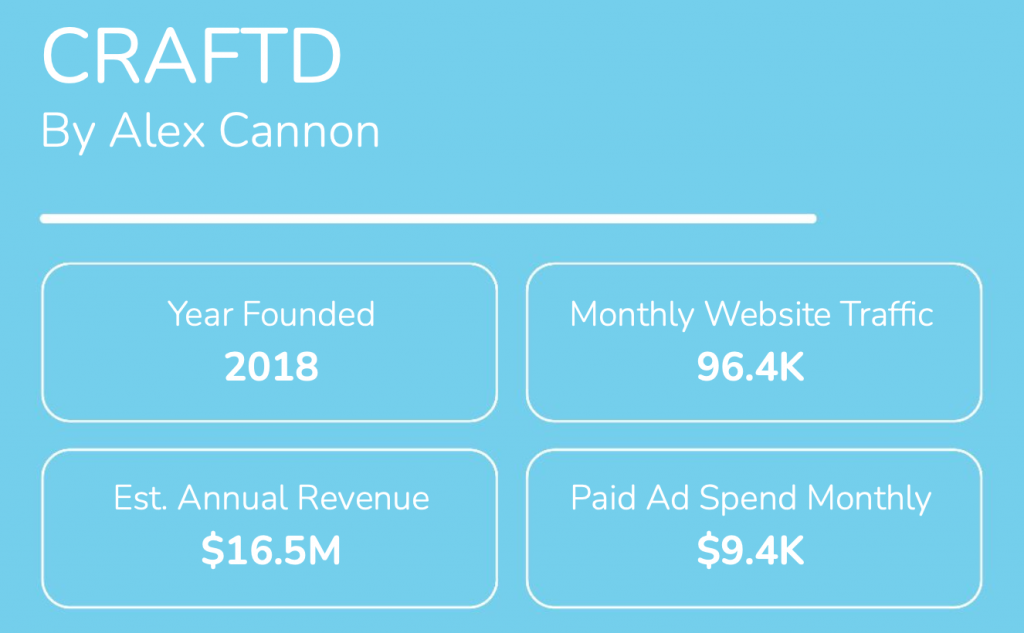

10. CRAFTD by Alex Cannon

CRAFTD, founded by Alex Cannon in 2018, is a popular men’s jewelry brand. The brand’s estimated annual revenue is an impressive $16.5M, making it the final brand on the list of top 10 creator brands and the only jewelry brand in the top 10.

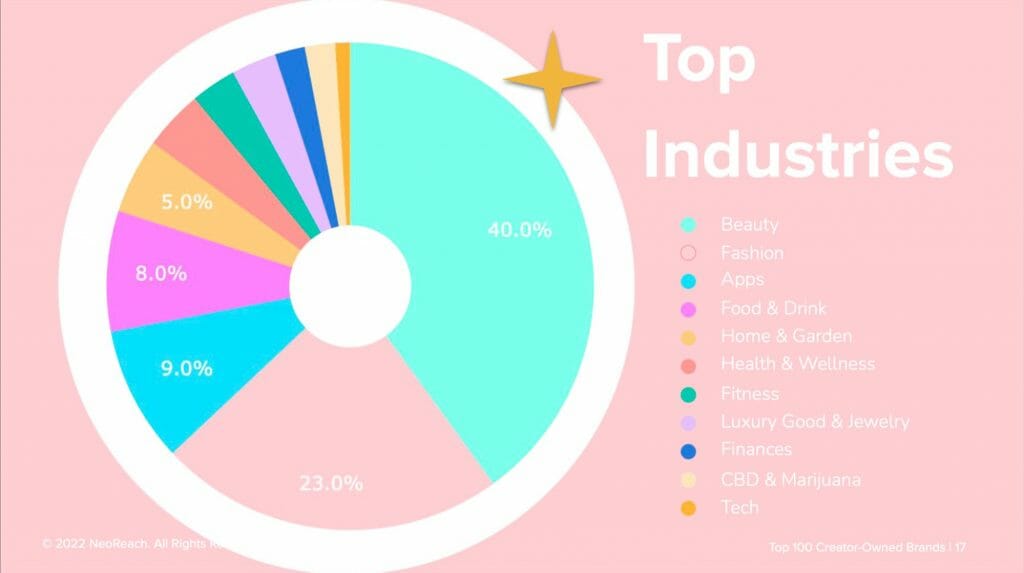

Top Industries

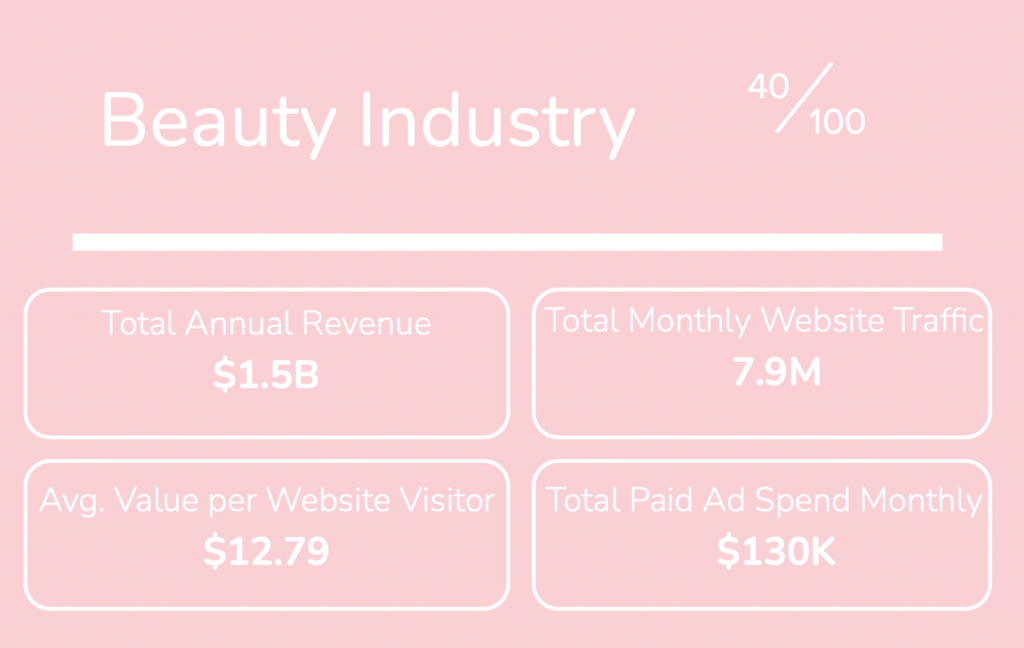

Beauty Industry

40% of the top 100 creator brands are in the beauty industry. With a total annual revenue of $1.5B and a total monthly website traffic of 7.9M across all 40 brands, creator-led beauty brands are dominating the industry.

Beauty Top Products

The top beauty products were facial cosmetic items like eyeshadow palettes and blush. Huda Beauty, DIBS, and Ipsy are all examples of creator brands that sell these top products.

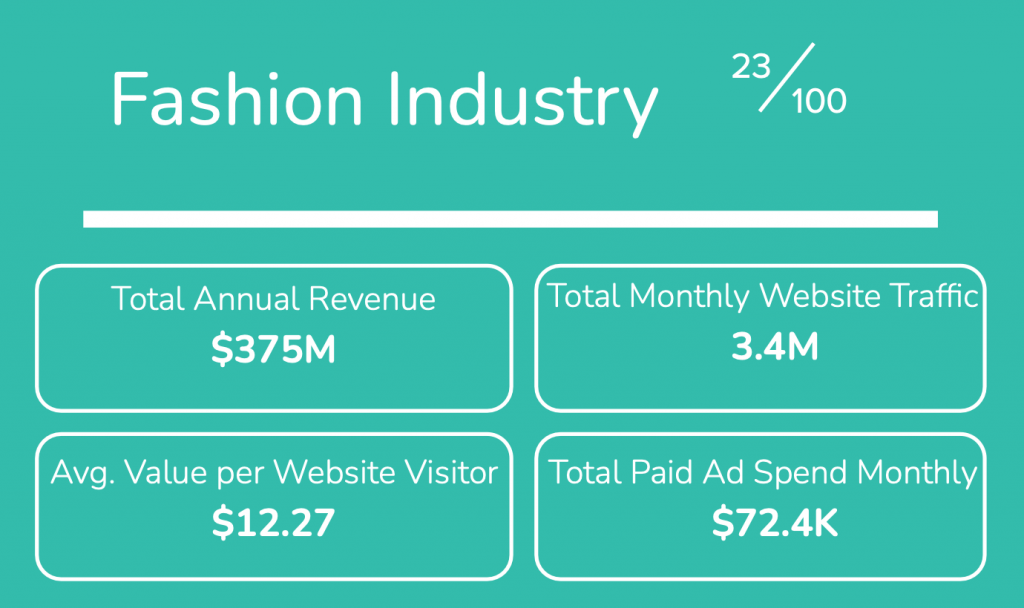

Fashion Industry

The fashion industry comprises 23% of the top 100 creator brands. Although the fashion industry represents around half of the amount of brands in the beauty industry, the combined metrics of these brands are still impressive. The total annual revenue is $375M and the combined monthly website traffic is 3.4M.

Fashion Top Products

In the fashion industry, the top products were swimwear, shapewear, and loungewear provided by creator brands like Frankie’s Bikinis, SKIMS, and Djerf Avenue.

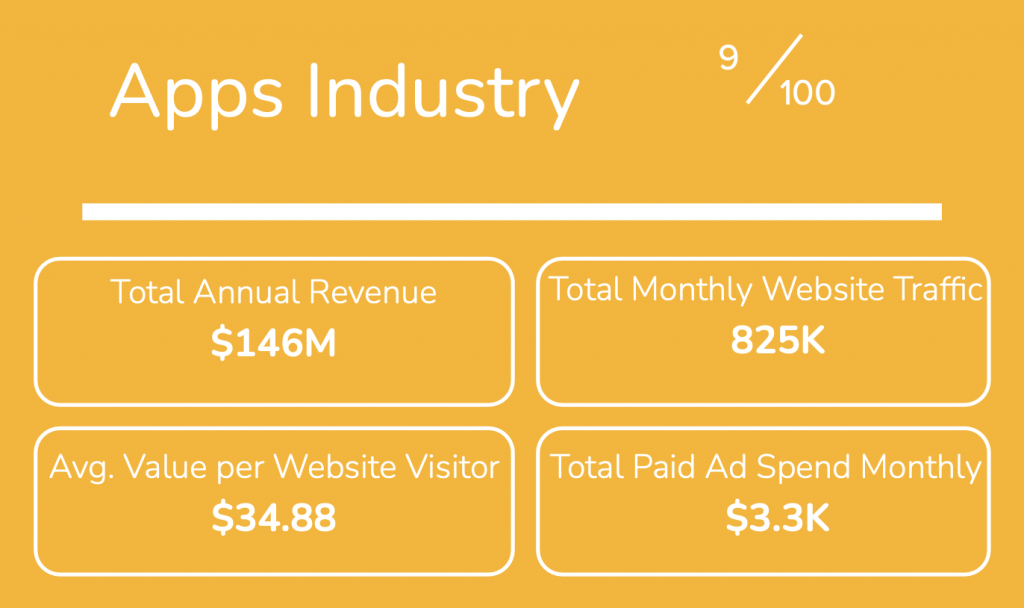

Apps Industry

9% of the top 100 creator brands are in the apps industry, ranging from fitness apps to mobile games. The combined annual revenue of these apps is $146M, and the combined monthly website traffic is 835K.

Apps Top Products

Among the creator-owned apps, the majority focus on fitness and wellness such as The MadFit App, Alive, and MKFit.

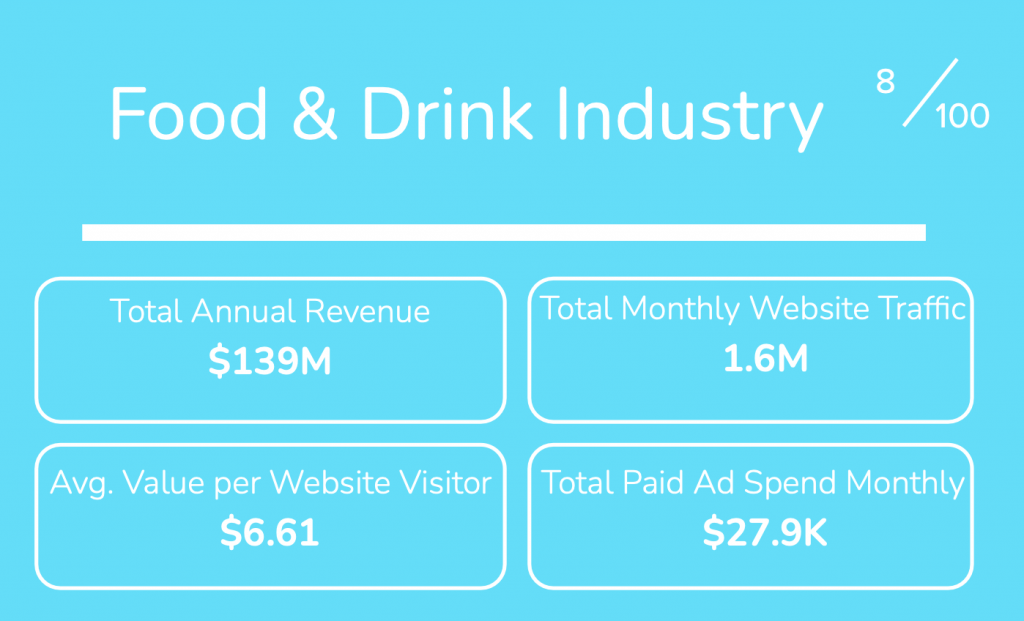

Food & Drink

The food & drink industry represents 8% of the top 100 creator brands. With a total annual revenue of $139M and monthly website traffic of 1.6M, the food & drink industry closely rivals the apps industry in metrics.

Food & Drink Top Products

The top products in the Food & Drink industry were drinks like coffee and alcoholic beverages from creator brands Kramoda Coffee, 818 Tequila, and Chamberlain Coffee.

Fastest Growth

Xeela

With an estimated growth rate of 10.56% over the last 6 months, Ilya Fedorovich’s Xeela Fitness is tied for first as the fastest growing creator brand.

Rhode

Rhode Skin, founded by Hailey Bieber, also experienced a rapid 10.56% growth in social media following in the past 6 months.

Nemah

Mary Lawless Lee’s Nemah is the second fastest growing creator brand, with a growth rate of 3.21% over the past 6 months.

Trending Analysis

Trending Up

Using the Neoreach Trending Analysis Tool, we were able to determine that Jeffree Star Cosmetics, XMONDO Hair, and POPFLEX have a strong chance to trend upward in the coming months.

Brands To Keep An Eye On

Xeela Fitness, Happyface, and Smoke Roses are three brands to keep an eye on. Each of these brands will continue trending upward in the coming months, growing in engagement and revenue.

Marketing Strategy

Instagram Reach vs. Value Per Follower

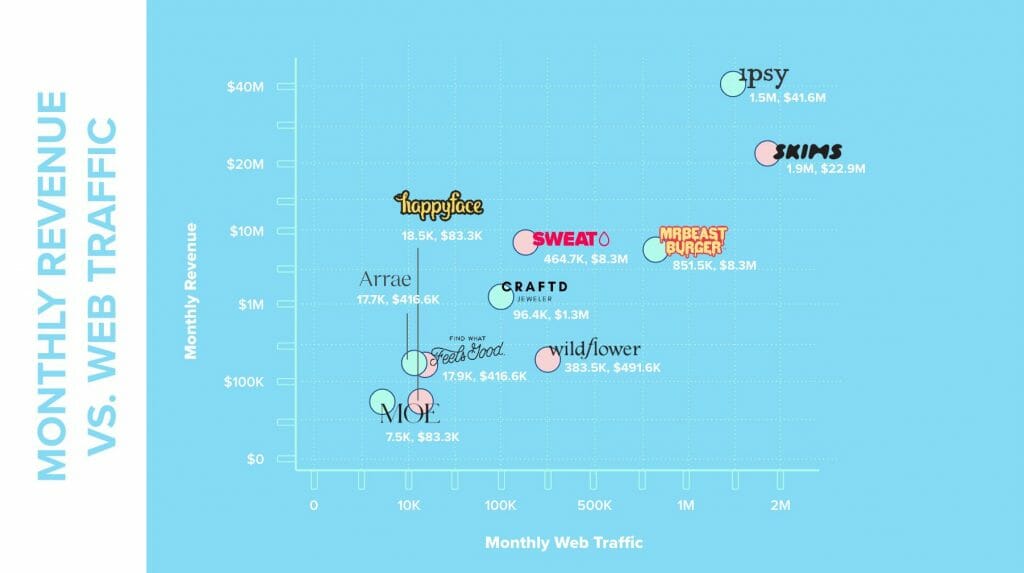

Monthly Revenue vs. Website Traffic

Monthly Ad Spend vs. Website Traffic

Skims and Ipsy, two of the top creator brands, provide a good example of the complementary relationship between website traffic and ad spend.

Monthly Revenue vs. Website Traffic

While monthly website traffic does not have to be in the millions in order for a brand to be successful, we can see here that the two often correspond with one another.

Notable Highlights

- Average Instagram Account Size: 1,425,800

- Average TikTok Account Size: 212,920

- Average YouTube Account Size: 183,103

- Average Paid Ad Spend: $2,499.28

- Total Funding: $689,217,500.00

Editor’s Note

In the past 10 years, we have seen a number of content creators take on the challenge of brand ownership. From billion dollar beauty brands like Ipsy to groundbreaking fashion brands like SKIMS, many of these companies became notable competitors in their respective industries.

This report presents data from 100 creator brands, with launch dates spanning from 2009 to 2022. Some of them have grown to enormous heights, while others are standing in their shadows.

As the creator economy grows in size, the number of creator brands will grow as well. More than ever before, creators will be tasked with standing out and making their mark on the industry. Originality and dedication must be at the forefront of their minds if they are hoping to succeed.