We carried out our first influencer marketing survey in 2017, giving us excellent insight into the state of the industry. We repeated the exercise last year, and have now made our study an annual look into how marketing agencies and brands see the state of influencer marketing.

UPDATE: CLICK HERE FOR THE LATEST BENCHMARK REPORT

In our Influencer Marketing Benchmark Report 2020, we surveyed 4000 marketing agencies, influencer marketing agencies, brands, and other industry professionals to gather their perspectives on the state of influencer marketing in 2020.

In addition to the results from our survey, we include some other relevant statistics related to influencer marketing that have come about thanks to recent research. Many of these come courtesy of our partner CreatorIQ, who provide an influencer marketing software cloud for enterprise brands, agencies, and publishers. CreatorIQ’s data comes from tens of thousands of influencer marketing campaigns and posts piloted through their influencer platform by their clients.

One thing is very clear from these results. Influencer marketing is still a highly popular and effective form of marketing. Although the media may at times run reports from naysayers criticizing the industry, those who actively participate can clearly see the effectiveness of influencer marketing.

Here are the main results from our Influencer Marketing 2020 Study, along with a selection of other relevant recent statistics we have found.

Notable Highlights

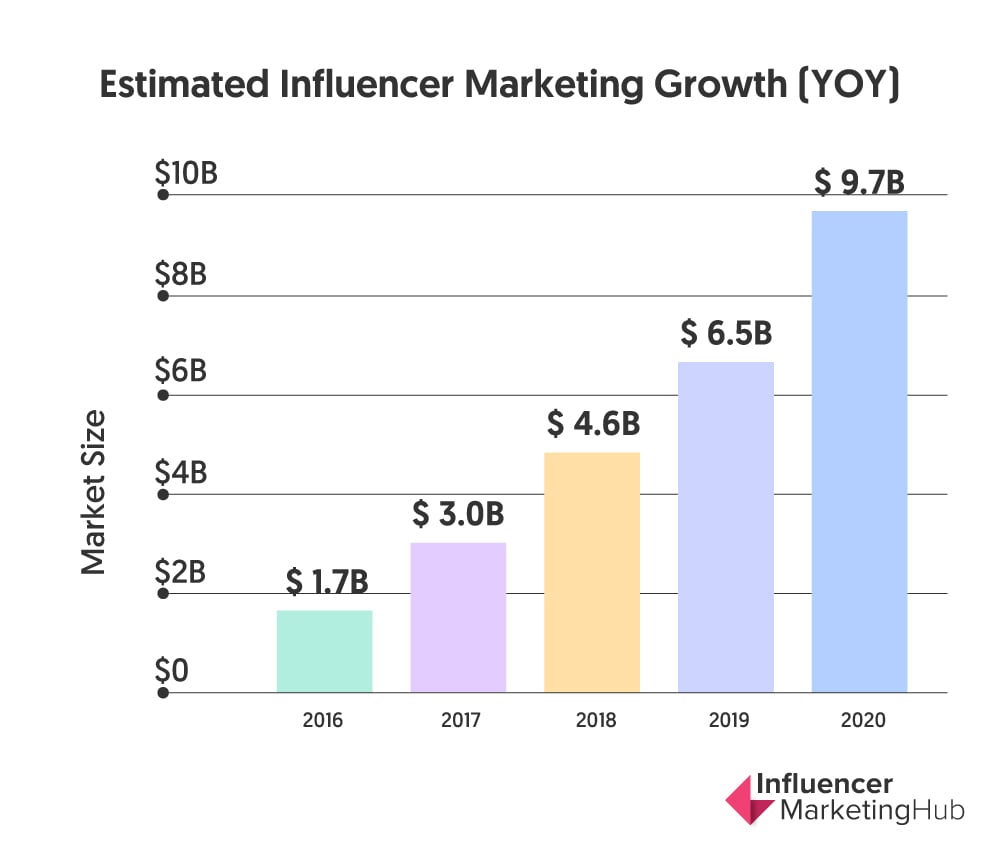

- Influencer Marketing Industry is set to grow to approximately $9.7B in 2020

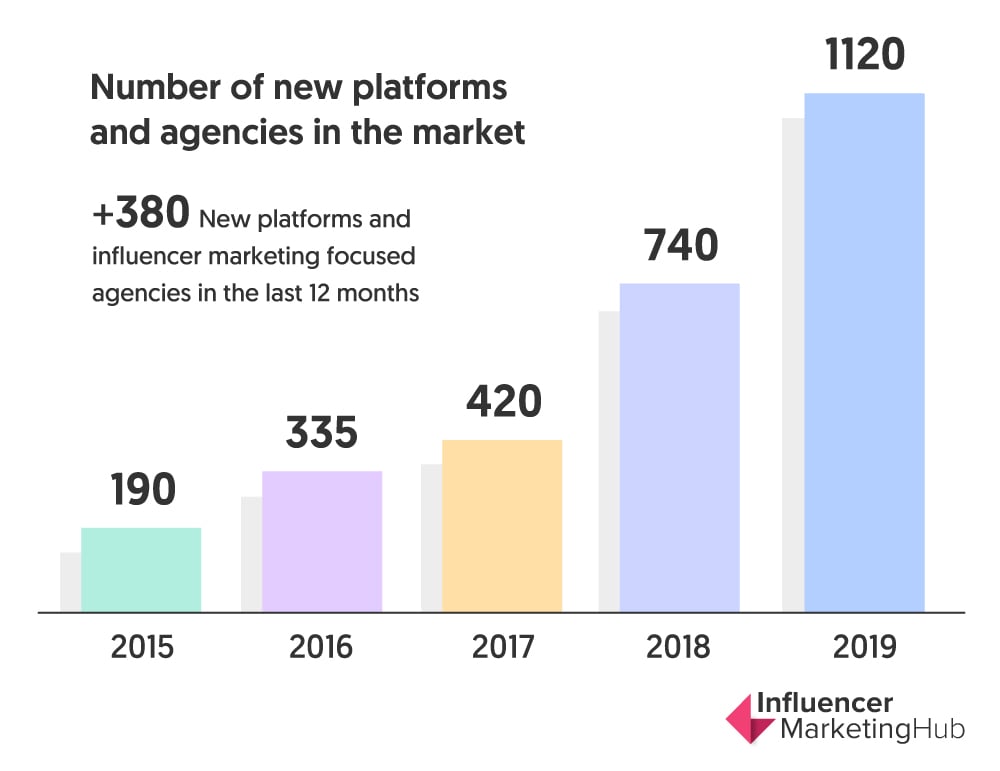

- More than 380 new influencer marketing agencies and platforms established in 2019

- Average earned media value per $1 spent has increased to $5.78

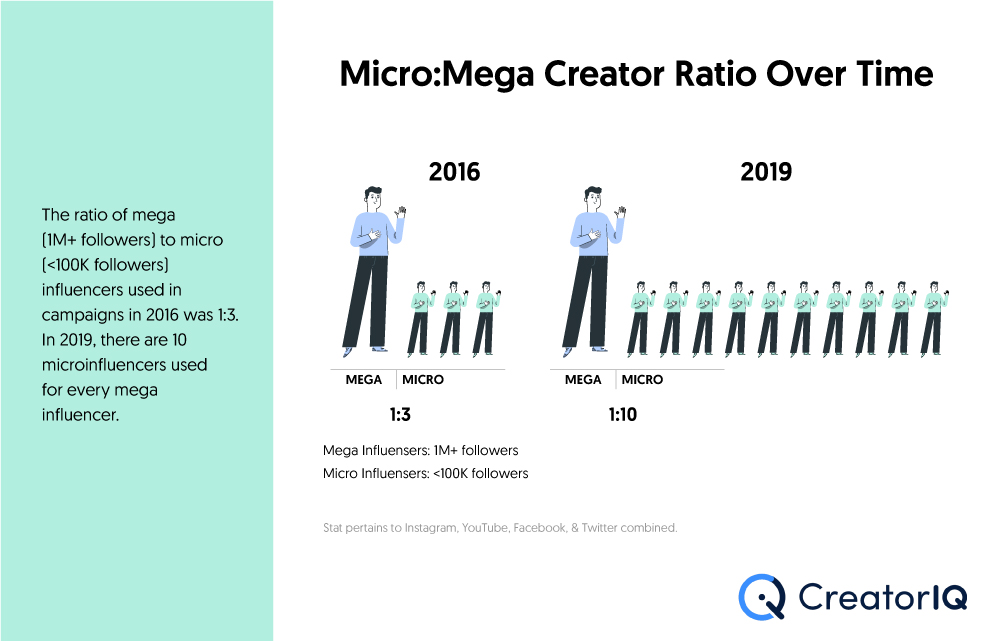

- 300% more micro-influencers utilized by large firms than in 2016

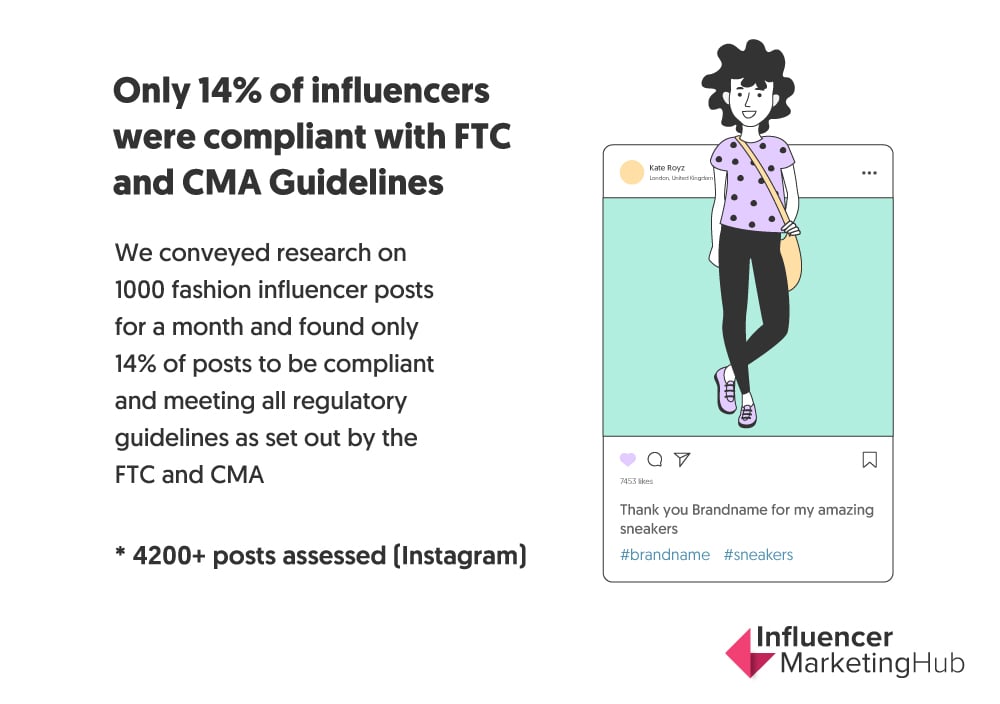

- Only 14% of influencer posts sampled were fully compliant with FTC guidelines

- Nearly 90% of all influencer campaigns include Instagram as part of the marketing mix

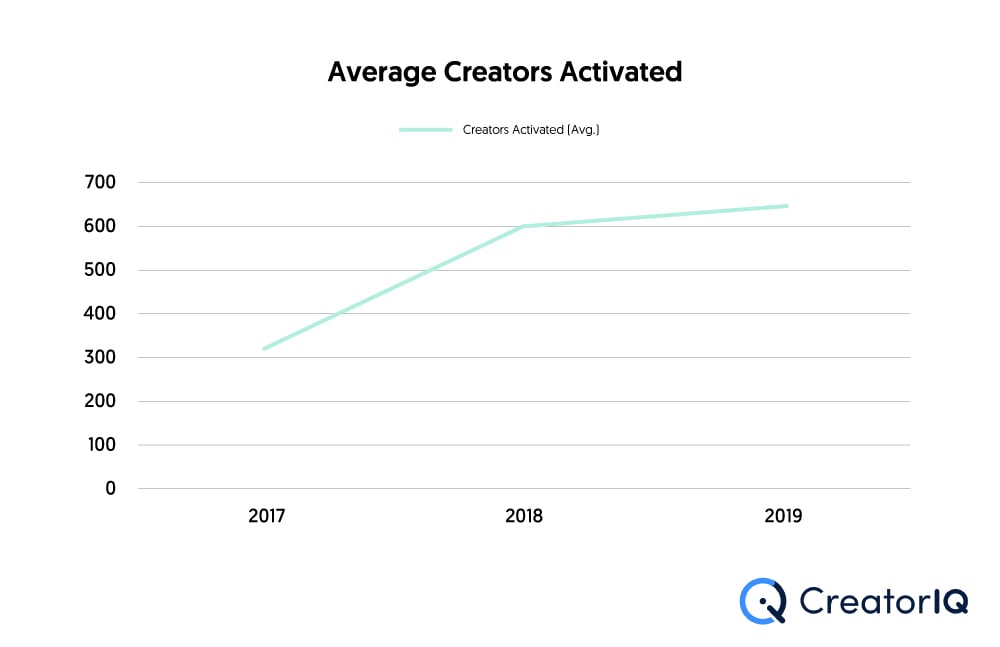

- Large companies have nearly doubled the amount of creators they activate per campaign in the past 2 years

- The majority (55%) admit to having a standalone budget for content marketing

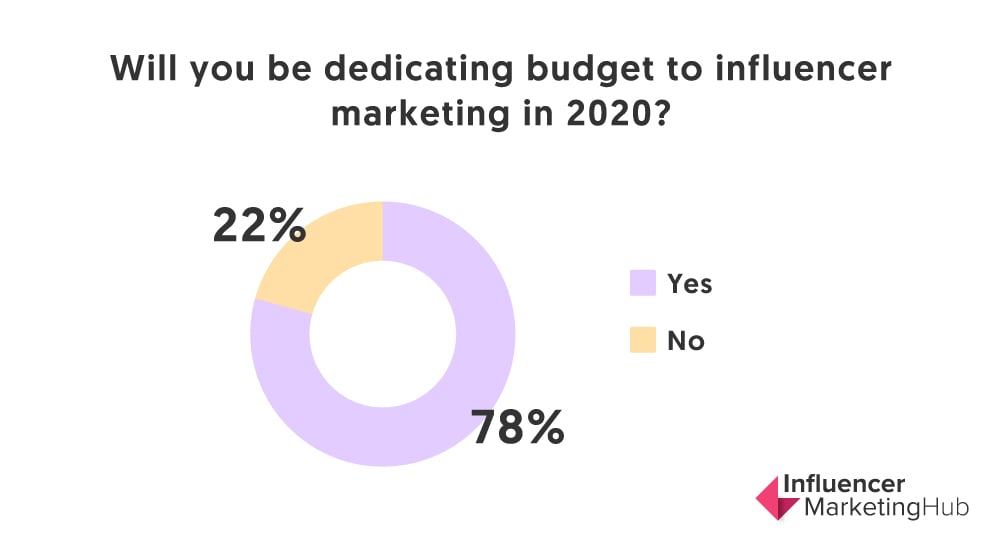

- Nearly 4/5 of our respondents intend to dedicate a budget to influencer marketing in 2020

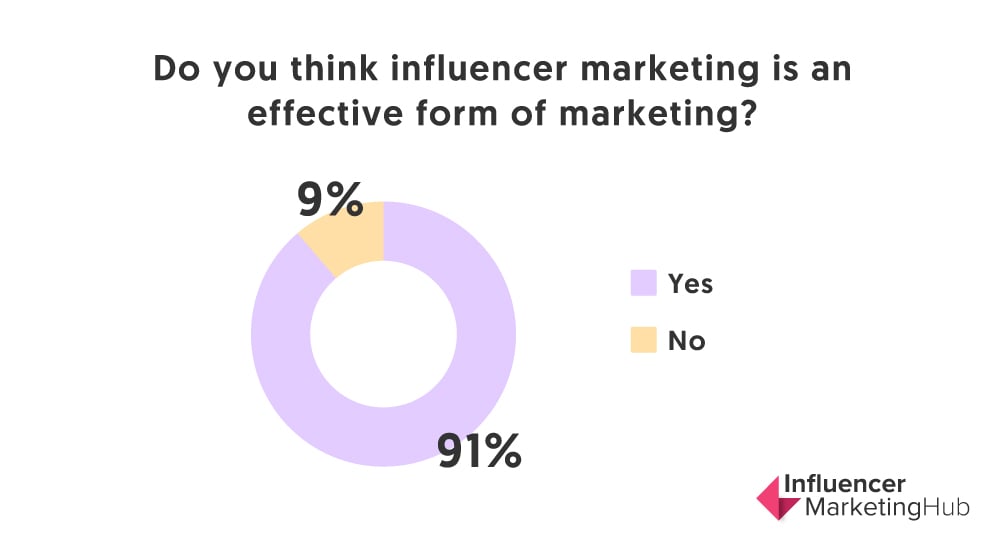

- 91% of our survey respondents believe influencer marketing to be an effective form of marketing

- 65% of our respondents measure the ROI from their influencer campaigns

- The most common measure of influencer marketing success is now conversions/sales

- 80% of firms take their influencer marketing spending from their marketing budget

- 87% of respondents use Instagram for influencer marketing

- Influencer fraud is of increasing concern to respondents

- More than 2/3 of respondents have experienced influencer fraud

- 68% of respondents prefer their influencer marketing to be campaign-based, rather than always-on

- Finding influencers is the greatest challenge for those who run campaigns in-house

Survey Methodology

We surveyed 4000 people from a range of backgrounds. Although we had to remove some responses due to a lack of clarity, the 2020 survey is our largest yet, with more than double the number of respondents compared to last year's study.

34% of our respondents consider themselves brands (or brand representatives). 31% work at marketing agencies (including those specializing in influencer marketing) and 4% are PR agencies. The remaining 29% represent a wide range of occupations and sectors.

70% of those surveyed focus on the B2C sector, with the remaining 30% running campaigns for firms in the B2B area. This shows a slight increase in the proportion of those engaged in B2C marketing (and a corresponding decrease in B2B) compared to last year, although the difference is insignificant.

The most popular vertical represented is Fashion & Beauty (24% of respondents), followed by Travel & Lifestyle (13%), Health & Fitness (12%), Gaming (7%), Sports (5%), and Family, Parenting & Home (5%). The remaining 31% grouped as Other, covers every other vertical imaginable. Due to the size of our survey sample, the proportions of each industry vertical represented here will likely be representative of the users of influencer marketing in general.

45% of our respondents came from the USA, 16% Europe, 12% Asia (APAC), 5% Africa, with 15% representing the ROW (Rest of World).

The bulk of our respondents came from relatively small organizations, with 40% representing companies with fewer than ten employees. 22% of the surveyees were from companies which has 10-50 employees, 14% 50-100, 13% 100-1,000, and 10% coming from large enterprises with more than 1,000 employees.

Influencer Marketing Industry Analysis 2020:

Influencer Marketing Expected to Grow to be Worth $9.7 Billion This Year

One of the best ways that we can see the growth of influencer marketing over the last few years is to compare the estimated market size of the industry each year. Back in 2016 (the distant days of influencer marketing), we figured the industry to be worth $1.7 billion. It has grown rapidly every year since then. We estimate that there has been an increase of at least 50% each year.

This means that the growth in influencer marketing over the current year, 2019 to 2020, has seen the estimated market size increase from $6.6 billion in 2019 to $9.7 billion in 2020. We are fast approaching a market size of $10 billion.

380 More Platforms and Influencer Marketing Focused Agencies Created Last Year

As influencer marketing has matured as an industry, it has attracted support companies and apps to simplify the process for both brands and influencers. Organic influencer marketing can be a slow and tedious process, particularly when it comes to finding and wooing influencers to promote your company’s products or services.

380 new influencer marketing-focused platforms and agencies entered the market over the last 12 months. Back in 2015, there were just 190 influencer platforms and agencies. This grew to 335 in 2016, 420 in 2017, 740 in 2018, and 1120 in 2019 – more nearly three times the number that existed just two years previously.

Only 14% of Influencers are Currently Fully Compliant with Legal Guidelines

Both the US government agency, the FTC, and its British equivalent, the CMA, have taken a close look at influencer disclosure over the last couple of years. They have made clear guidelines and expectations.

The social networks (in particular Instagram) have made it easier for brands and influencers to comply with the requirements. However, influencers still have a long way to go to meet the requirements. We undertook research on a sample of 1000 fashion micro-influencer posts for a month (over 4200 posts analyzed). We found only 14% of posts to be fully compliant and meeting all regulatory guidelines as set out by the FTC and CMA. If influencers don't improve their performance soon, there is a real danger that the FTC and CMA will start prosecuting rather than just warning and educating.

However, it is an improvement on last year’s results. In the equivalent survey we made last year, we found only an 11% compliance rate.

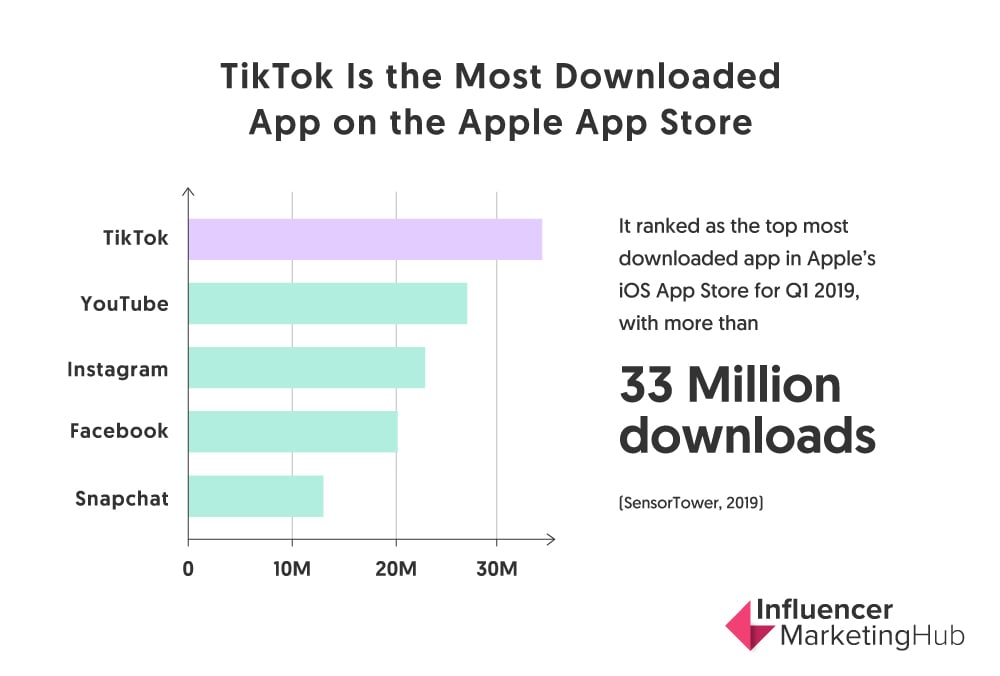

TikTok was the Most Downloaded App on the Apple App Store in Q1 2019

Although app download numbers vary significantly from month to month, there has been a definite surge in downloads of TikTok over the last couple of years. Indeed it ranked as the topmost downloaded non-gaming app in Apple iOS App Store for Q1 2019, with more than 33 million downloads.

It hasn’t kept that position every month since launch; however, it has always performed well. TikTok is no longer merely a niche social network and video sharing app. It is extremely popular and has real staying power with the young. Any brand with a youth-focus should build some form of TikTok presence, possibly working with the fashionable youngsters who broadcast on the app.

Better Engagement Rates for Nano- and Micro-Influencers Than for the Superstar of Social Media

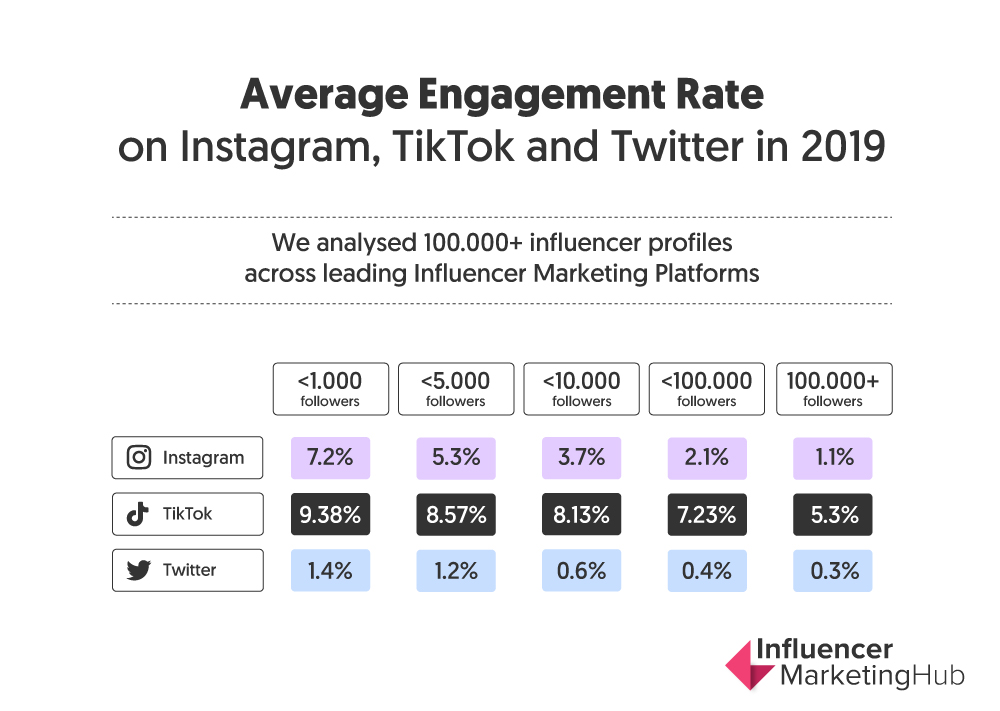

We analyzed 100,000+ influencer profiles across leading influencer marketing platforms, Instagram, TikTok, and Twitter to see if there were variations in the engagement rate depending on an influencer's number of followers. We made a definite conclusion: influencers with a high number of followers have lower engagement than those with fewer followers.

This is particularly evident on Instagram, where nano-influencers with fewer than 1,000 followers have seven times the engagement rate than mega-influencers with greater than 100,000 followers (7.2% vs. 1.1%). This pattern shows at every follower-number level in between these extremes.

The follower rate numbers on the other surveyed platforms may differ, but the pattern remains the same. Twitter has overall lower levels of engagement – people make so many tweets that go unanswered. But Twitter influencers with fewer than 1,000 followers have 1.4% engagement, while those with more than 100,000 followers have a mere 0.3% of their followers engaging with their tweets.

TikTok has much higher engagement at all follower levels, but even here, the same pattern is evident. Small TikTok users have 9.38% engagement, yet the superstars can only manage 5.3%. Again, the trend is visible at all follower levels.

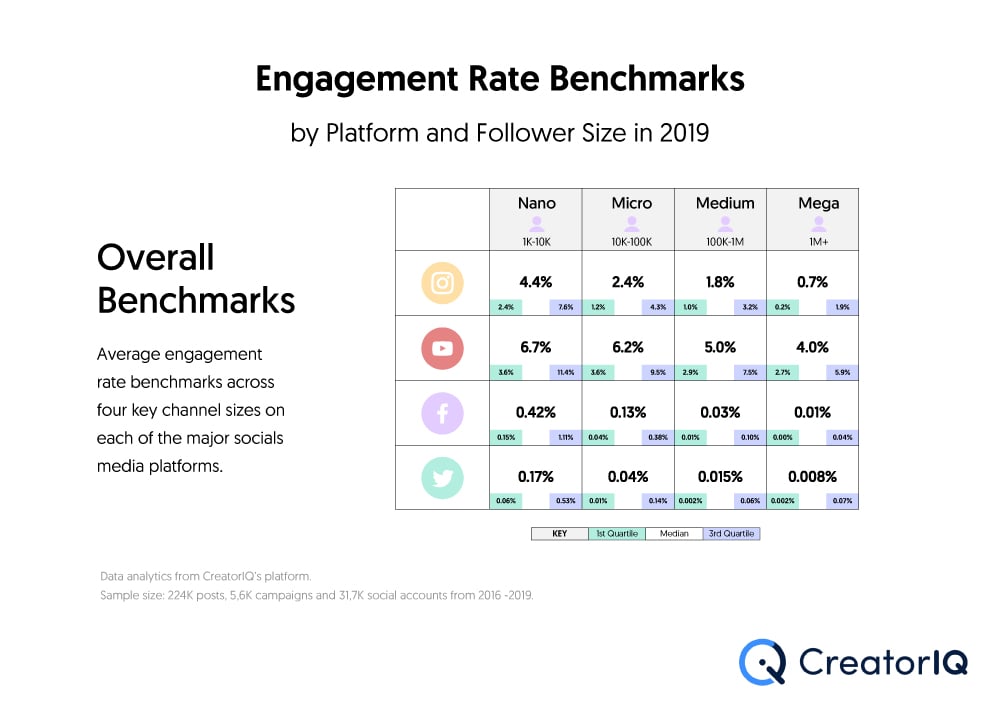

CreatorIQ also compared average engagement rate benchmarks across four key channel sizes on Instagram, YouTube, Facebook, and Twitter. While their study is not identical to ours (they use slightly different engagement bands), the results still come to the same conclusion. Smaller influencers have better levels of engagement than their larger counterparts.

Indeed these statistics highlight how pitiful the engagement rates can be for mega-influencers, particularly on Twitter (with just 0.008% engagement and Facebook (0.01% engagement). Even nano-influencers struggle to make much headway on these two platforms, (0.17% Twitter, 0.42% Facebook), so it is clear why so many brands prefer to use Instagram for their influencer marketing.

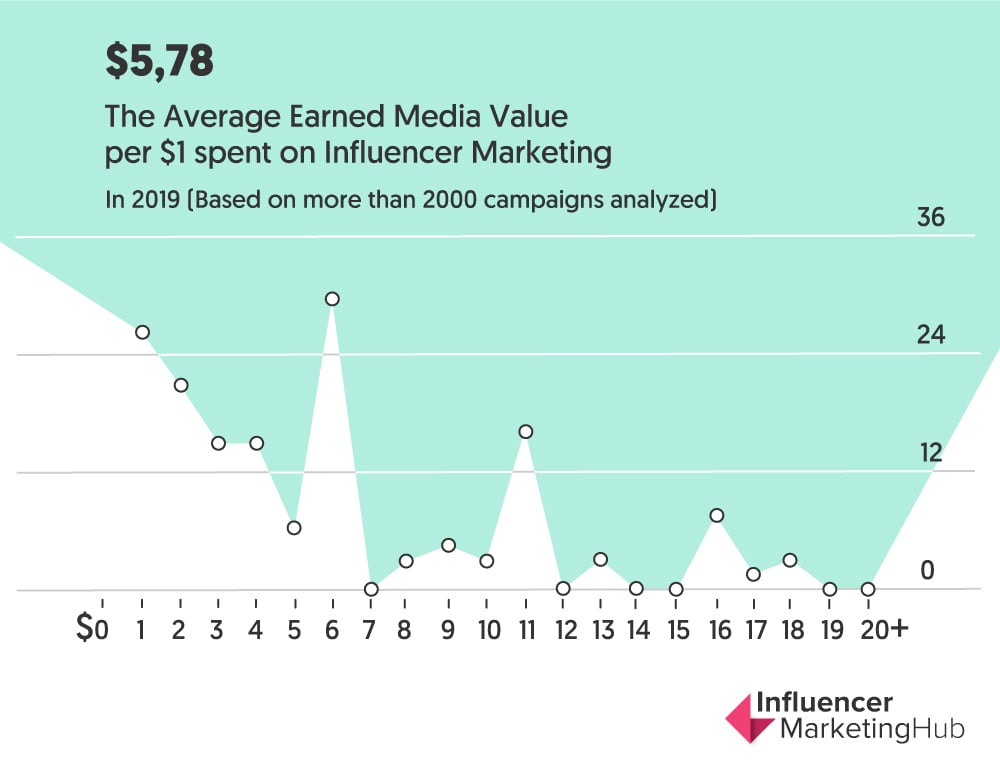

Increasing Average Earned Media Value per $1 Spent on Influencer Marketing

Earned media is publicity gained from promotional efforts other than paid advertising. Earned media value is a monetary representation of this publicity. Businesses who understand influencer marketing gain impressive returns: up to $18 in earned media value for every dollar spent on influencer marketing.

Even average firms achieve dramatic results, with an average earned media value of $5.78 per dollar they spent on influencer marketing in 2019. This is up from $5.20 in 2018, indicating that there is now a better understanding of influencer marketing, with fewer firms failing to meet their marketing objectives.

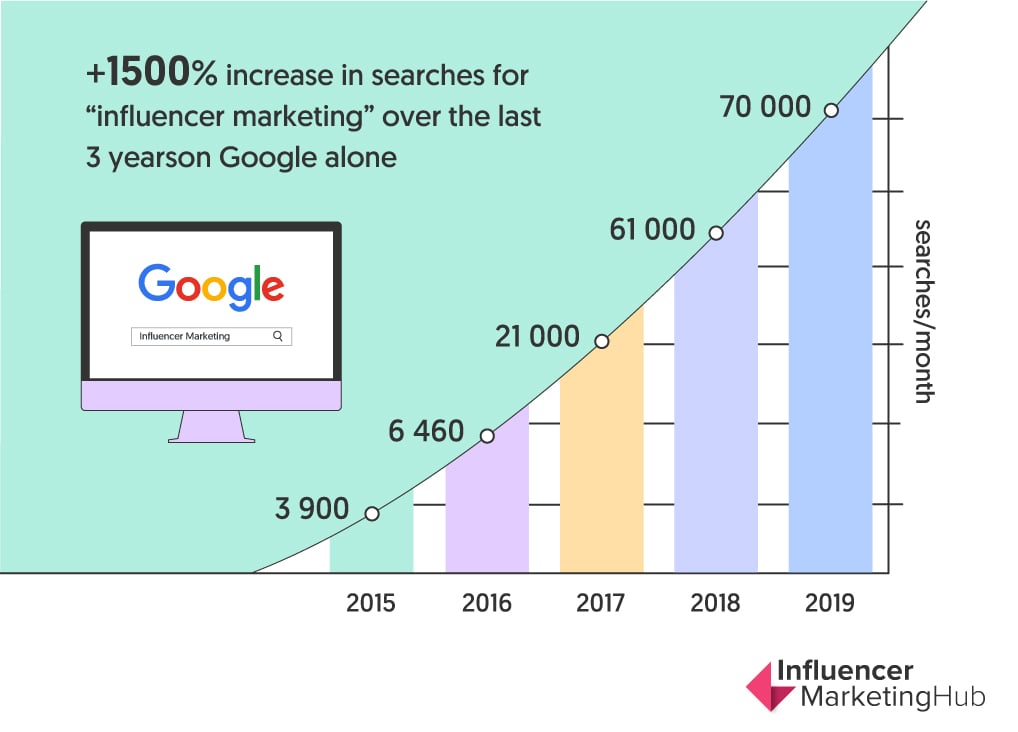

Searches for “Influencer Marketing” in Google Continue to Grow

Searches rose from 3,900 searches per month in 2015, to 6,460 in 2016, 21,000 in 2017, and then 61,000 in 2018. While the latest year’s rate of increase may have fallen, the number of searches continues to grow. In 2019, searches for the phrase “influencer marketing” rose to 70,000. At this rate, it won’t be long before this number exceeds 100,000 searches for the year.

Additional Metrics

We also want to highlight a few other influencer marketing statistics that have come to light, assembled in coordination with CreatorIQ.

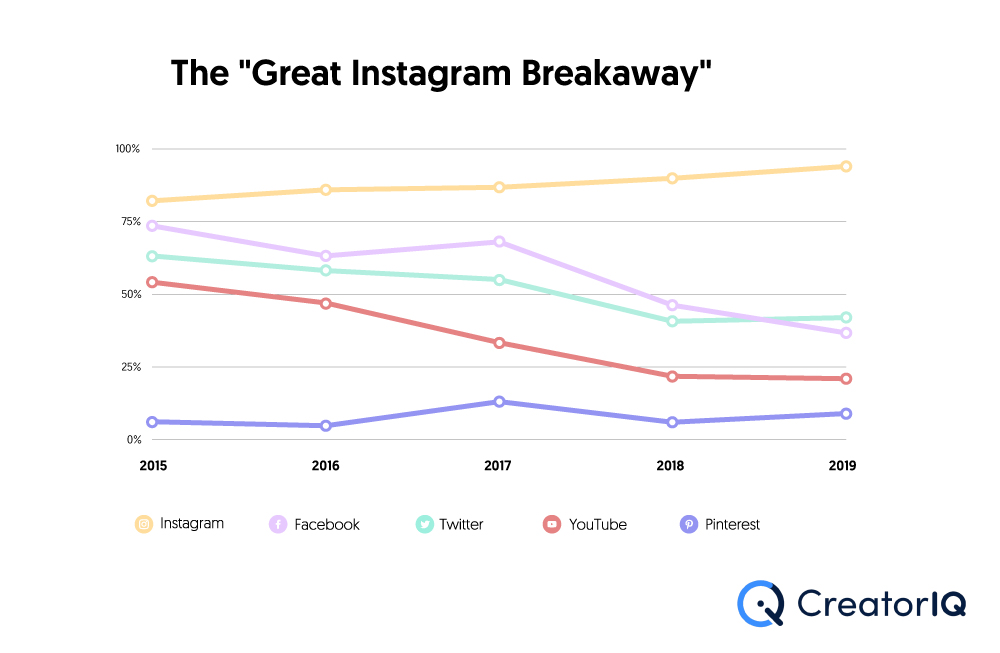

Instagram Now Used by Nearly All Influencer Campaigns

CreatorIQ analyzed the social platforms that brands make use of most when running influencer campaigns. While Instagram has continually led the pack during the years surveyed (2015 onwards), its usage has continued to rise each year. Now more than 90% of all influencer campaigns include Instagram as part of the marketing mix.

Conversely, Facebook has noticeably lost favor over that period. Back in 2015, Facebook was included in 75% of all influencer campaigns. In 2018, Facebook was used in less than half of the influencer campaigns, and its support dropped even further in 2019, to approximately 40%. Other traditional platforms to lose favor between 2015 and 2018 were Twitter and YouTube. However, both these platforms arrested their falls in 2019, with support leveling at about 45% for Twitter and 20% for YouTube. Notably, CreatorIQ found Twitter support to be higher than Facebook. We tend to focus more on Facebook in our Influencer Marketing coverage (and considerably more on YouTube than its support would suggest).

Pinterest usage has fluctuated over the years, but it is currently used in approximately 10% of influencer marketing campaigns, one of its highest figures over the period.

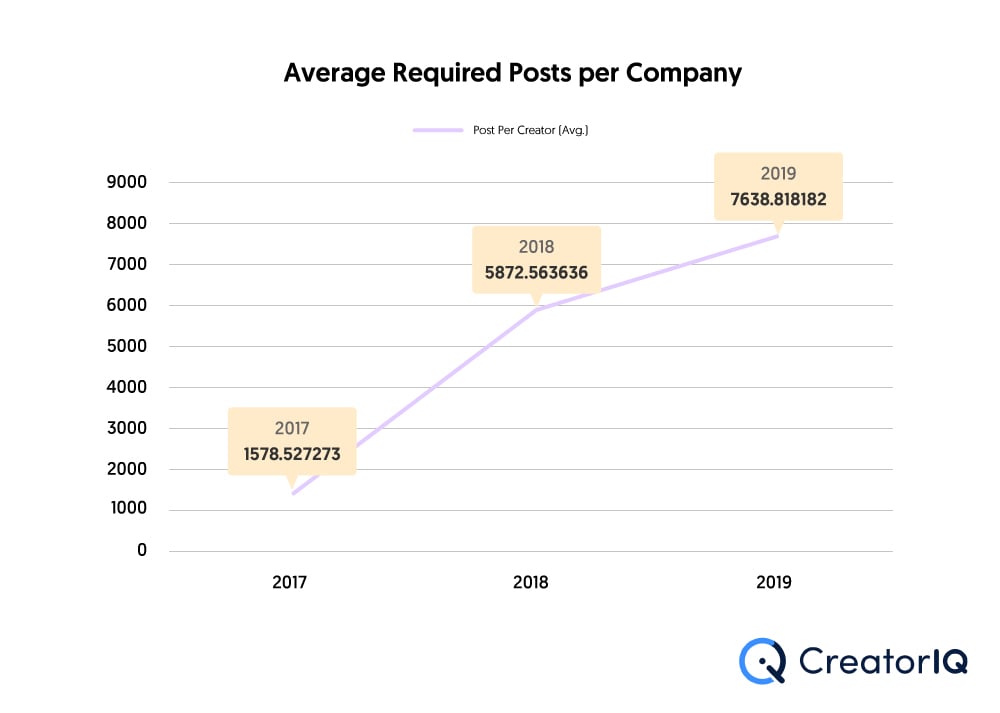

Big Companies are Increasing the Number of Creators They Activate

CreatorIQ findings show a clear increase in the average number of creators activated per organization. Numbers nearly doubled from 320 in 2017 to 600 in 2018, and have continued to rise (albeit at a slower rate) to 660 in 2019.

There is a Clear Move from Mega-Influencers to Micro-Influencers

CreatorIQ data emphasizes the shift in focus from brands using mega-influencers to micro-influencers. We have written extensively about the increased effectiveness of micro-influencers compared to offline superstars on social media. Micro-influencers tend to be regarded as experts on a subject, and have laser-focused supporters who take an avid interest in their views. While many people follow mega-influencers and celebrities, they often do so, simply because they recognize the name, rather than for any great interest in the topic of the posts.

The ratio of mega-influencers (with one million-plus followers) to micro-influencers (with fewer than 100,000 followers) rose from 1:3 in 2016 to 1:10 in 2019. In other words, there are now 10 micro-influencers for every mega-influencer, compared with 3 micro-influencers per celebrity in 2016.

Results from our 2020 Influencer Marketing brand survey

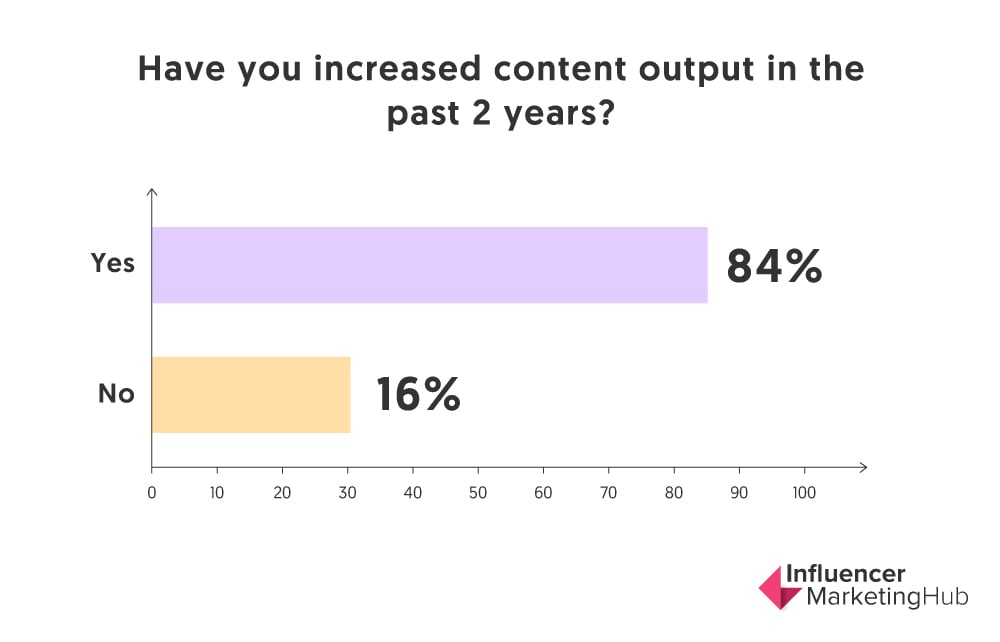

Massive Increase in Content in Recent Years

Our respondents were asked whether they had increased content output over the last two years. A colossal 84% of them admitted to having upped the amount of content they produced.

This (partially) comes on top of the 75% increase in content claimed by last year’s respondents. Clearly, many firms now realize the insatiable demand for online content nowadays,and are increasing their content marketing accordingly. Judging by the recent uptake in influencer marketing, much of this increase in content must be made and delivered by influencers on behalf of brands.

Most Respondents Believe Influencer Marketing to be Effective

Unsurprisingly, considering the overall positive sentiment expressed about influencer marketing, 91% of our survey respondents believe influencer marketing to be an effective form of marketing.

This statistic has hovered around the same level in each of our surveys. It is clear that most firms that try influencer marketing are happy with the experience, and are willing to continue with the practice.

Nearly 4/5 of Our Respondents Intend to Dedicate a Budget to Influencer Marketing in 2020

The general satisfaction felt by firms that have engaged in influencer marketing seems to flow through to their future planning. 79% of our respondents indicated that they would be dedicating a budget to influencer marketing in 2020.

This is a drop from last year’s 86% result, although still well up from the 37% who claimed they would dedicate a budget in 2017. This reduction could simply be a result of a change in the mix of respondents to our survey. We had comparatively more marketers instead of brands replying this year (and it is, of course, the brands who provide the budgets for influencer marketing, and the marketers who implement them).

2/3 of Respondents Intend to Increase Their Influencer Marketing Spend in 2020

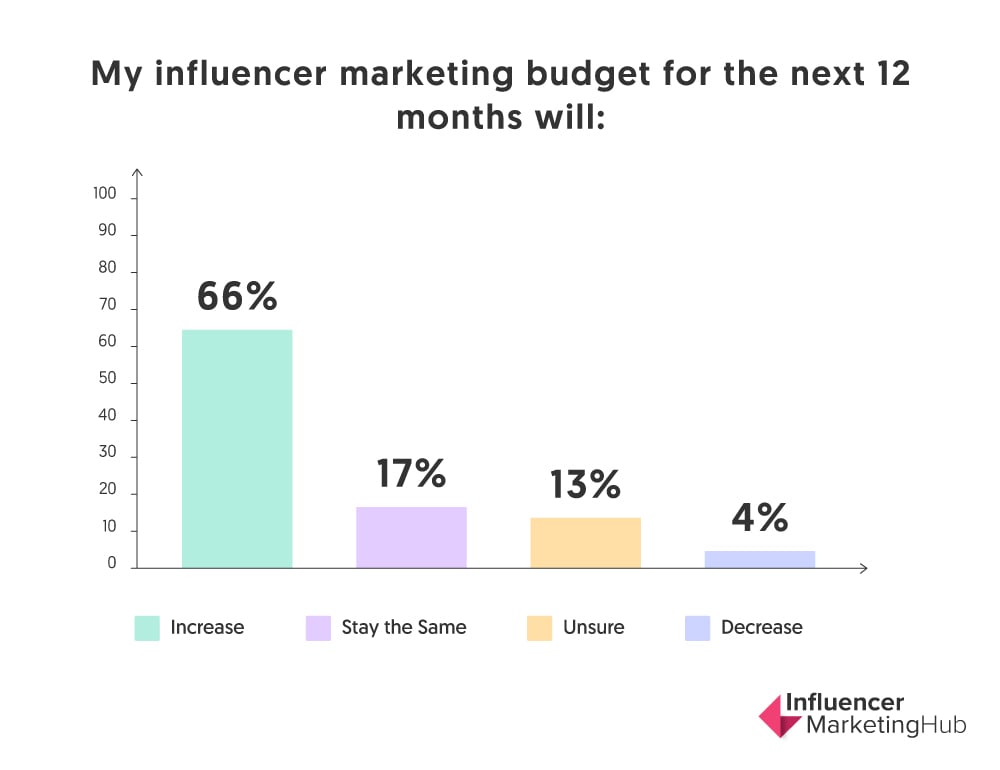

66% of those respondents who budget for influencer marketing intend to increase their influencer marketing budget over the next 12 months. An additional 16% indicate that they expect to keep their budgets the same as in 2019. A further 13% stated that they were unsure about how their influencer marketing budgets would change. This leaves a mere 4% intending to decrease their influencer marketing budgets.

While these figures are again similar to the 2019 results, they are slightly more favorable ("only" 63% of respondents intended to increase their budgets last year).

This is further proof that influencer marketing remains successful and shows no sign of slowing down. After a few years of robust growth in influencer marketing, you might have anticipated the movement of marketing budgets to "the next big thing." However, that hasn't happened yet – brands and marketers can still see the effectiveness of influencer marketing and are not yet searching for something new.

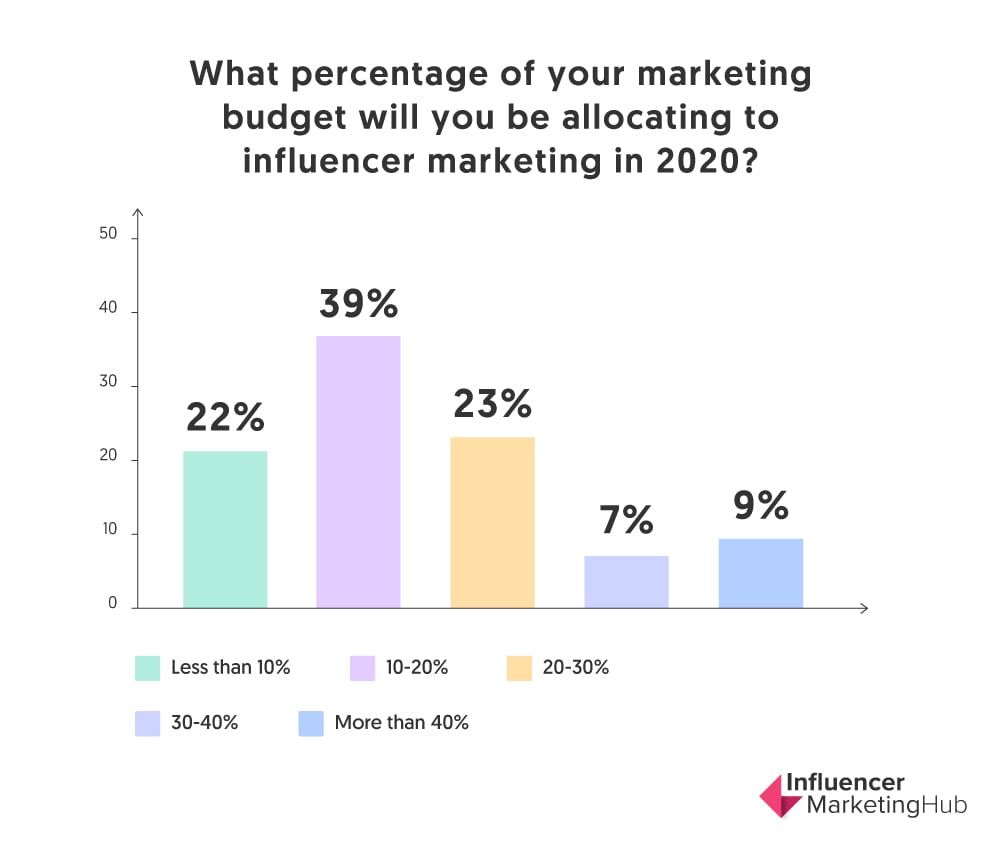

80% of Respondents Intend to Spend at Least 10% of Their Marketing Budget on Influencer Marketing

Influencer marketing is of course, only part of the marketing mix. Most businesses will balance their marketing budget across a range of media to ensure that they reach the greatest possible audience. However, the vast majority of firms intend to include at least some influencer marketing in their mix.

The most common percentage of marketing devoted to influencer marketing comes in the 10-20% range, with 39% of respondents intending to spend in this range. An additional 23% plan to allocate 20-30% of their total marketing spending to influencer marketing.

9% of respondents are clear advocates for influencer marketing, intending to spend more than 40% of their marketing budget on influencer campaigns.

Although Most Brands Spend Less Than $50K on Influencer Marketing, 5% Spend More than $500K

Brands of virtually every size tackle influencer marketing, therefore it should be no surprise that there is quite some variation on what firms spend on the practice. 43% of the brands surveyed said they spend less than $10K annually on influencer marketing, with 29% spending between $10K and $50K. A further 11% spend $50K to $100K, 10% $100K to $500K, and 5% spend more than $500K.

Clearly, the amount that a firm spends depends on the size of its total marketing budget and the proportion it chooses to devote to influencer marketing. Brands that opt to work with mega-influencers and celebrities typically spend more than brands that work alongside micro- or nano-influencers.

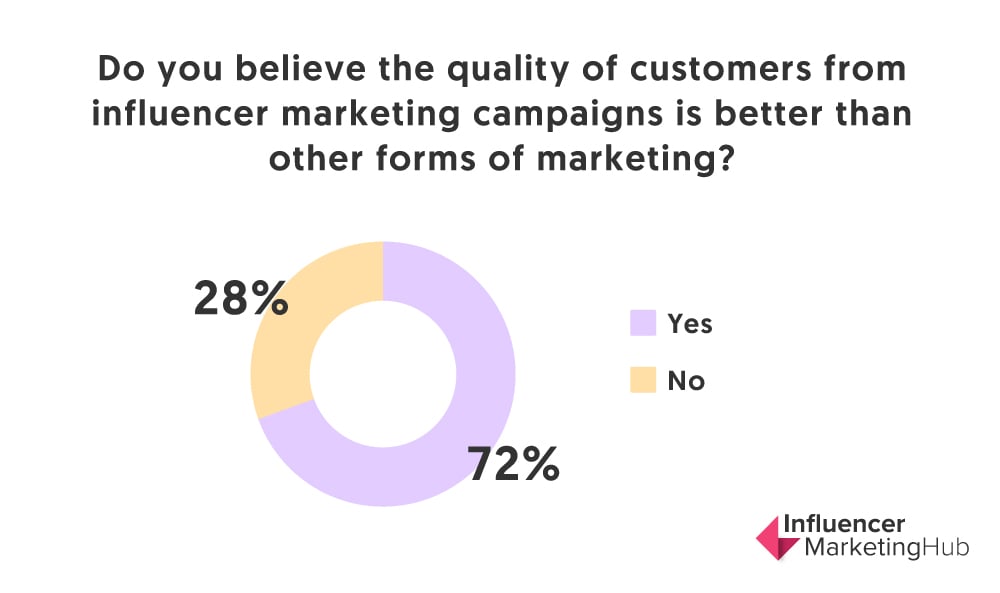

Most Still Recognize the High Quality of Customers from Influencer Marketing Campaigns, Although Support is Down on 2019

Brands carry out influencer marketing for a range of purposes. Many campaigns are designed to increase brand awareness rather than encourage sales. Some customers are more lucrative for a business than others – they buy high-margin products and add-ons. In some cases, influencer marketing may bring new customers to the brand, but the additional spending may be less than the cost of running the campaign.

Our survey respondents are generally positive about the value of influencer marketing overall. Most agree that influencer marketing attracts high-quality customers. 72% believe that the quality of customers from influencer marketing campaigns is better than other forms of marketing. Although this is positive, it must be noted that the figure is down from last year, when 82% were positive about the types of customers generated by influencer marketing.

Nearly 2/3 Measure the ROI on Their Influencer Marketing

We found that 65% of our respondents measure the ROI from their influencer campaigns. While this is positive, and much improved on the results we found in our first survey, it is surprisingly down on last year’s 70% positive response.

It is hard to believe that businesses would have gone backward in their influencer marketing practices. As recently as 2018, 76% of marketers in a Linqia study claimed that the most significant influencer marketing challenge that year would be determining their campaign ROI. The small reduction this year is most likely to reflect the increased sample size of our survey, with a broader range of people answering the study, some of who will not have been responsible for influencer marketing (and therefore not having an ROI to measure).

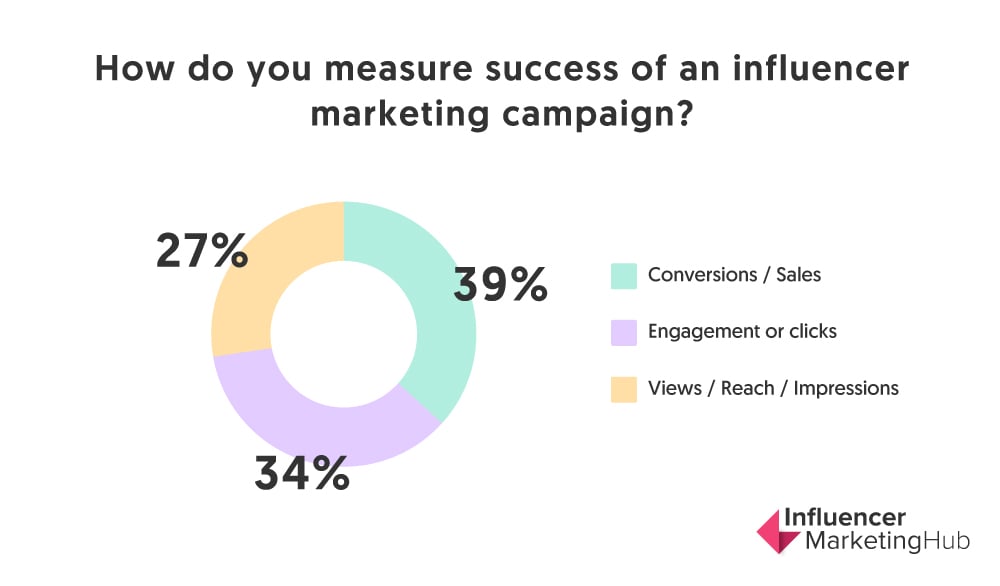

Most Common Measure of Influencer Marketing Success is Now Conversions / Sales

This is the first significant change that we have noticed in this year’s survey. A year ago, the focus on influencer marketing measurement was relatively evenly balanced between differing campaign goals, but Conversion/Sales was the least-supported reason. This year, it has a clear, undisputed lead.

Influencer marketing is sufficiently widespread now that most businesses understand that the best way to measure your influencer marketing ROI is by using a metric that measures the goals of your campaigns. Clearly, more brands now focus on using their influencer marketing to generate tangible results. 39% believe that you should gauge a campaign by the conversions/sales it drives.

The remaining respondents have differing goals for their campaign, with 34% most interested in engagement or clicks generated as the result of a campaign (this topped last year’s poll), and 27% interested in views/reach/impression (down from 34% last year).

Most Consider Earned Media Value a Good Measure of ROI

Earned Media Value has become more recognized over the last couple of years as a measure of the ROI on influencer campaigns. We asked our respondents whether they considered it a good representation. This year 77% favor the measure, as against 22% who don’t. This is almost identical to last year’s result.

Earned Media Value provides a proxy for the returns on the posts that an influencer has historically given the firms he or she has worked with. It indicates what an equivalent advertising campaign would cost for the same effect. EMV calculates the worth you receive from content shared by an influencer.

The only negative of using this measure is that the calculation of EMV can be complicated. As such, it can sometimes be difficult for marketers to explain the concepts to their managers.

Presumably, most of the 22% who are against using the statistic either don’t understand it or struggle to communicate its worth to their management team.

80% of Firms Take Their Influencer Marketing Spending from Their Marketing Budget

This is another statistic showing little change over the last year. 80% of the respondents in our survey take their influencer marketing spending from the budget of their Marketing Department. The remaining 19% (there is some rounding error) take their influencer marketing spending from their PR Department’s funds.

Presumably, the firms in the minority group use influencer marketing predominantly for awareness purposes, rather than as a direct means to sell their products or services.

About 4/5 of Influencer Marketing Campaigns are Run In-House

Although the change isn't substantial, more firms appear to be running their influencer campaigns in-house than in the past. 78% of our survey respondents claimed that they ran their influencer campaigns in-house, with the remaining 22% opting to use agencies or managed services for their influencer marketing.

In the past, firms found influencer marketing to be challenging because they lacked the tools to facilitate the process – organic influencer marketing can be very hit-and-miss, making it frustrating for brands trying to meet their goals. Nowadays, however, many firms use tools (whether in-house or from third parties) to facilitate the process.

Some brands prefer to use social media marketing agencies with influencer marketing experience or solely focused influencer agencies when working with micro- and nano-influencers because the agencies are more experienced at working with influencers at scale.

Many Firms Use Tools or Platforms to Execute their Influencer Marketing Campaigns

Organic influencer marketing can be challenging to execute successfully. It can sometimes be exceptionally time-consuming for little reward. It can be especially challenging to find suitable influencers with whom to cooperate if you aren't regular participants in the social sphere.

For this reason, many brands now use tools to help expedite the process. According to our respondents, 44% currently use tools developed in-house to execute influencer marketing campaigns and 40% use 3rd-party influencer marketing platforms.

On the surface, this looks like fewer firms use tools than a year ago, but it is essential to realize that the survey questions have changed concerning this. Last year, 58% admitted using tools developed in-house to execute their influencer marketing campaigns. We did not ask a separate question about using third-party-developed tools, so these results are not strictly comparable.

87% of Respondents Use Instagram for Influencer Marketing

Instagram remains the network of choice for influencer marketing campaigns. 87% of our survey respondents consider Instagram important for their influencer marketing campaigns (up from last year’s 79%).

The percentages using the other social channels are all relatively similar to last year. 46% of the respondents tap into Facebook for their campaigns, 36% YouTube, 22% Twitter, 16% LinkedIn (presumably those involved with B2B companies), and a further 15% spread across more specialist social networks.

The most notable differences are a decline in Twitter from 24% to 22%, an increase in LinkedIn from 12% to 16%, and an increase in other networks from 12% to 15%. Presumably, the rise reflects the recent popularity of Twitch and TikTok.

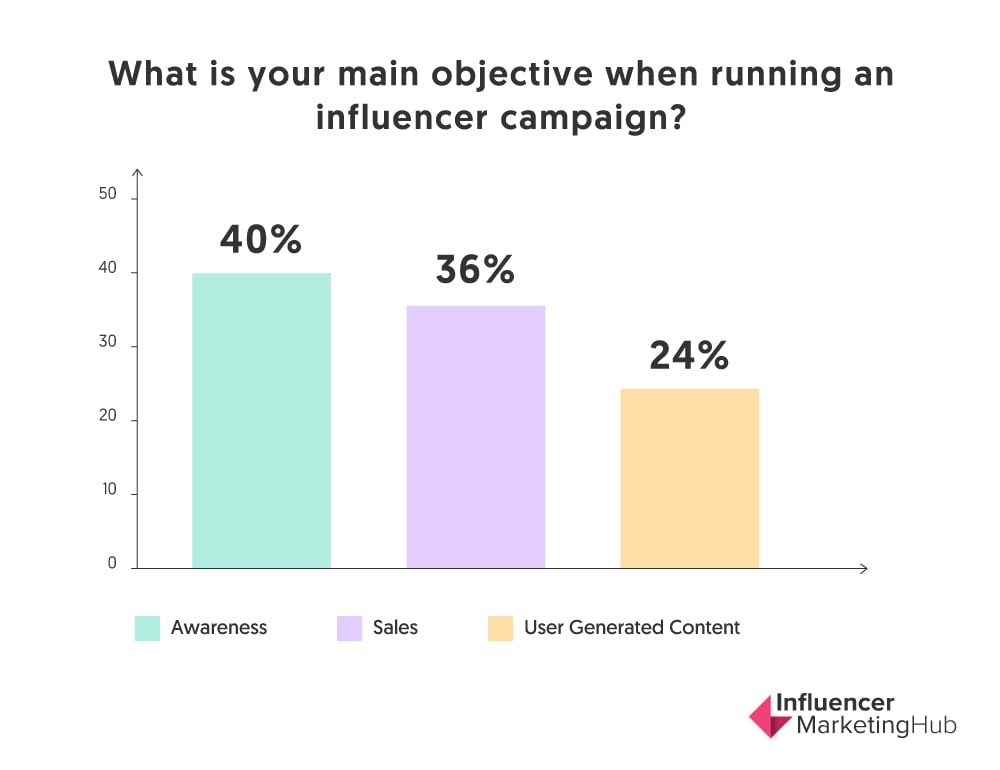

Awareness is Still the Main Objective for Running an Influencer Campaign, But Sales is Increasing in Popularity

We noted above that the most common measure of influencer marketing success is now Conversions / Sales. That is not yet the main objective for running influencer campaigns, but it is growing in importance.

40% of our respondents claim their influencer campaign aims to increase awareness. 36% place more emphasis on Sales. Somewhat less popular, at 24%, is the group of respondents who engage in influencer marketing to build up a library of user-generated content. This percentage has fallen quite noticeably as an objective, from last year’s 31%

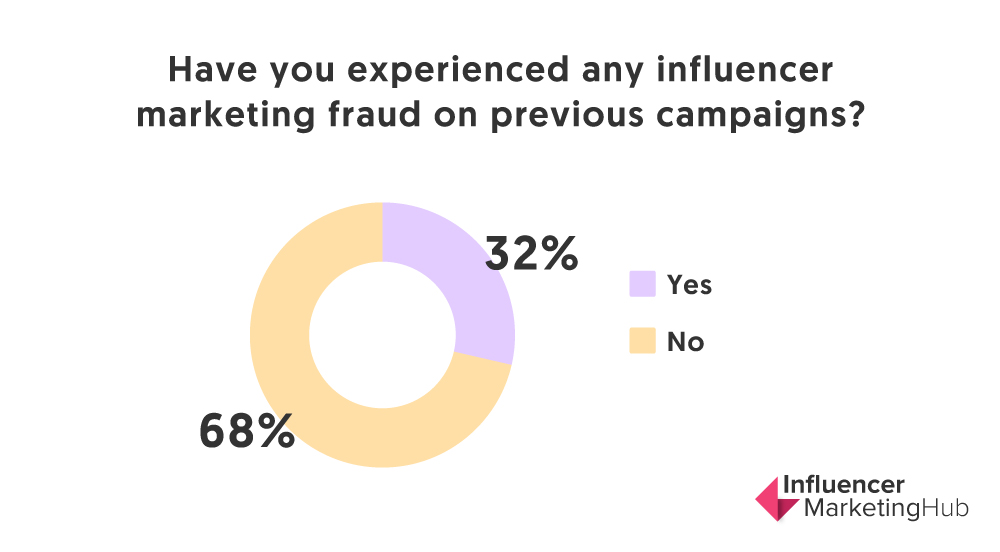

Influencer Fraud is of Increasing Concern to Respondents

A big topic in the news in recent times has been a concern about influencer fraud. Luckily there are now plenty of tools to help detect fraudsters, and this should reduce the effects of influencer fraud. Hopefully, it will soon merely be a chapter in the history of the industry.

However, influencer fraud has not been wholly vanquished from brands and marketers’ minds yet. Indeed they are more concerned this year than last, with 68% of our survey respondents expressing their concern, up from 64%.

More Than 2/3 of Respondents Have Experienced Influencer Fraud

One of the possible reasons for the increase in concern about influencer fraud is that more firms have now experienced such fraud. Indeed 68% claim to have experienced influencer fraud, up from 63% last year.

In many ways, this statistic is surprising. There has been much more publicity regarding influencer fraud of late, and there are more robust fraud solutions now available. Maybe this is one of the reasons for the increase in the use of third party influencer tools and platforms.

Interestingly, the percentages are the same for both influencer fraud questions. Is it just those firms who have experienced influencer fraud who express concern about the practice?

Brands are Finding it Harder to Find Appropriate Influencers

We asked our respondents how they rated the difficulty of finding appropriate influencers with whom to work their industry. 23% stated that it was very difficult, and 62% suggested that they had medium difficulty. A mere 14% of respondents reported finding appropriate influencers to be easy.

In some ways, this is something of a backstep from last year's results. Despite having more platforms and other influencer discovery tools available than before (as well as influencer agencies for those wishing to outsource the entire process), most brands still struggle to find suitable influencers.

This stat suggests that the influencer platforms need to do a better job at marketing their services. There are still many potential customers out there who require assistance at discovering and then reaching out to potential influencers.

Mixed Views on Whether Brand Safety is a Concern in Influencer Campaigns

A headline-making issue over the last couple of years has been influencers acting in a way deemed inappropriate by the brands they represent. For example, Logan Paul caused an internet storm over a tasteless video he shared, and brands wondered whether they wanted any connection with him. YouTube also had to do significant damage control over the types of videos they allow, and have brought in stronger rules for channels that target children.

The key to a successful influencer marketing campaign is matching your brand with influencers, whose fans are similar to your preferred customers, and whose values match your own.

Nearly half (49%) of our respondents believed brand safety could occasionally be a concern when running an influencer marketing campaign. 34% (up from last year’s 30%) gave a more definitive belief that brand safety is always a concern.

The remaining 16% believe that it is not really a concern. Presumably, this last group has mastered the art of finding appropriate influencers for their brands, and they have little concern about a values mismatch. It is perhaps a concern that this group is noticeably higher than last year’s 21% who lacked concern.

Majority Believe Influencer Marketing Can be Automated, Although Significant Numbers Disagree

A contentious issue in influencer marketing is the amount of automation you can successfully use. Some people believe you can automate virtually the whole process from influencer selection through to influencer payment. Others value the personal touch and think influencer marketing is a hands-on process.

The majority of respondents (54%) still believe that automation has a role to play in influencer marketing, but this number has declined from last year’s 57% support. Those who disagree with this sentiment have a corresponding increase in numbers, 45% now, compared to 43% a year ago.

Audience Relationship Still Considered Most Valuable When Partnering with Influencers

53% of the survey respondents believed audience relationship to be the most valuable factor when considering collaborating with a particular influencer. They see little value in working with somebody who doesn’t have a real influence on his/her audience, or perhaps has an excellent relationship – but they are the wrong audience for that brand. The support for audience relationship has increased from last year’s 48%.

The second most important factor is content production on 27% (down from last year’s 31%). This will be particularly so for the group who named user-generated content as being their primary objective when running an influencer campaign, in our earlier question on influencer campaign objectives.

The third popular reason favored by 19% of our respondents (down from 23%) found for working with influencers is distribution. Although this seems low, it clearly connects with audience relationship – influencers use their audience to distribute content relating to a brand.

68% of Respondents Prefer Their Influencer Marketing to be Campaign-Based

Last year we reported a trend towards brands cultivating more long-term relationships with influencers. Brands traditionally thought in terms of influencer marketing campaigns. Once they completed one campaign, they would plan, organize, and schedule another one. We noticed at that point that brands were discovering the advantages of cultivating relationships on a longer-term basis. Brands were finding that influencers they have worked for on previous campaigns come across as more genuine. At that stage, while 65% of influencer marketing relationships were campaign-based, 35% were “always on,” suggesting that those influencers were in long-term relationships.

A year on, however, we have seen something of a reversal of this trend. 68% of this year’s respondents prefer campaign-based influencer marketing compared to 31% always-on (the remaining 1% is just rounding error).

This could be a sign of more brands entering the industry, dipping their toes in the water, before they make any long-term commitments to influencers. Time will tell whether the nature of brand-influencer relationships changes in any significant way.

Large Majority Consider Influencer Marketing to be a Scalable Tactic in their Marketing Ecosystem

One of the most significant advantages of influencer marketing over social activity using official company accounts is the ease with which you can scale the activity. If you want to create a bigger campaign, all you need to do is to work with more influencers with larger followings – as long as they remain relevant to your niche.

While organic influencer marketing may be challenging to scale, because of the time needed for influencer identification and wooing, there are now over 740 platforms and influencer-focused agencies that businesses can use to help scale their efforts.

50% of our respondents believe that influencer marketing is definitely a scalable tactic in their marketing ecosystem, and a further 41% think that it is somewhat of a scalable tactic. Only 7% disagree with the sentiment. There has been a noticeable movement from those who believe it is definitely scalable to those who think it is somewhat scalable; nevertheless, the vast majority recognize that influencer marketing is, to some extent, a scalable tactic in their marketing ecosystem.

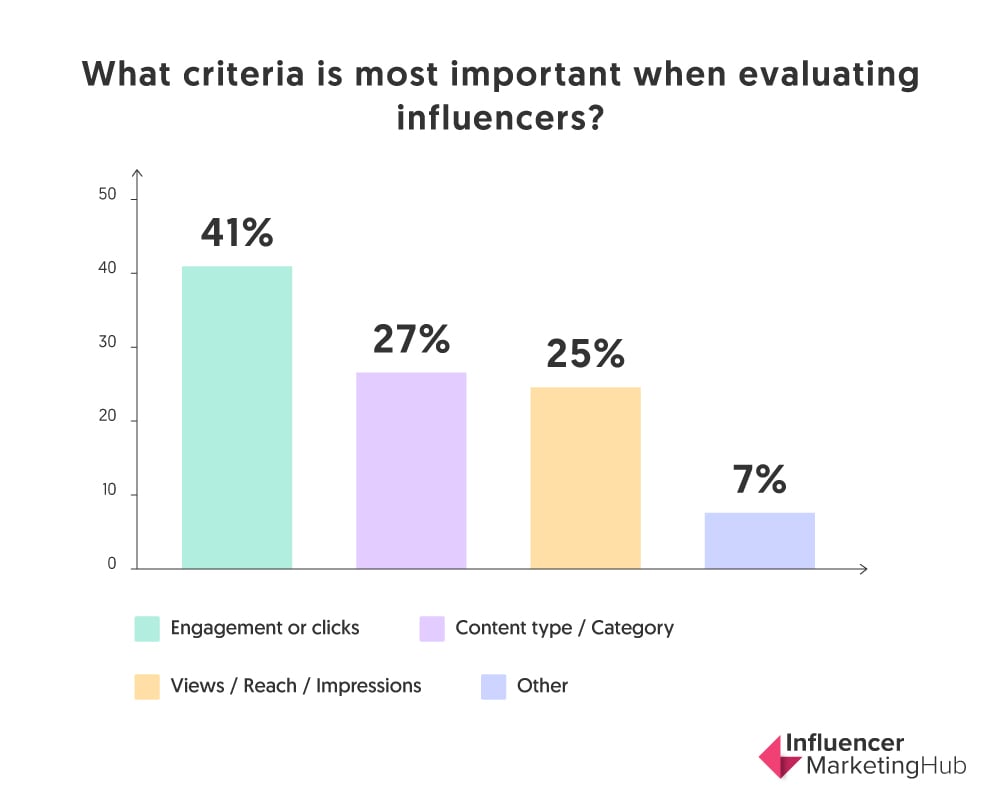

Engagement or Clicks is Most Important Criteria When Evaluating Influencers

We have regularly seen that businesses have a variety of objectives when they create influencer marketing campaigns. While the criteria by which our survey respondents evaluate influencers, does not precisely match their differing goals, there is some clear correlation.

41% of our respondents rated engagement or clicks as being their most important criterion compared with 26% who opted for content type/category or 25% who consider views/reach/impressions to be the most important. All these percentages are down on last year, because 7% of the respondents have different ideas on this topic, opting for Other as the most important criterion when evaluating influencers.

Although only 26% claim that content type/category is the most important criterion, this percentage may be understated. Indeed this is the only category to increase in importance and has risen to the second spot this year. Most brands start their influencer search by narrowing down the possibilities to just influencers in a particular niche – a beauty brand is unlikely to work with a home improvement influencer, no matter how engaged he is with his followers.

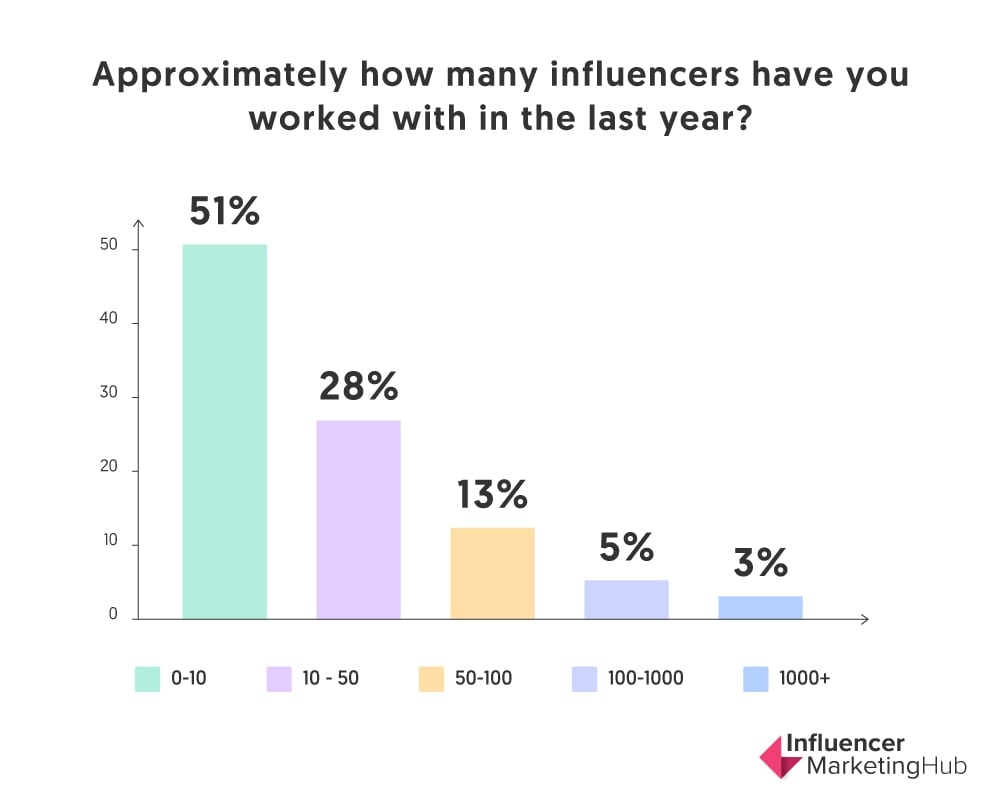

More than 50% of Brands Work with Fewer Than 10 Influencers

We asked those of our respondents who engaged in influencer marketing how many influencers they had worked with over the last year. Half of them stated that they had worked with 0-10 influencers. A further 27% had worked with 10-50 influencers and 12% with 50-100 influencers.

Some brands, however, have undertaken influencer marketing on a large-scale, with 5% of those surveyed admitting to working with 100-1000 influencers. Incredibly, a further 3% had worked with more than 1,000 influencers. These brands clearly see the value of working with nano- or micro-influencers, using a large number of influencers with small but dedicated audiences to spread the word

There Has Been a Trend Towards Quarterly Campaigns, Although Monthly Campaigns Are Still the Most Common

Although there is no set way to run an influencer campaign, monthly is still the most common frequency for our respondents. There is an apparent movement towards quarterly campaigns, however.

In an earlier question, we discovered that 68% of the survey respondents preferred to execute campaign-based influencer marketing, while the remaining 31% now run “always-on” campaigns.

Of those who operate discrete influencer campaigns, 33% (down from 39%) prefer to run them on a monthly basis. A further 30% (up from 28%) run quarterly campaigns, and 15% (up from 14%) prefer to organize campaigns on an annual basis. The remaining 20% (up from 19%) take a different approach, and only run campaigns whenever they launch a new product.

Finding Influencers is the Greatest Challenge for Those Who Run Campaigns In-house

We asked those survey respondents who ran campaigns in-house what they saw as the greatest challenges they faced. 39% found it most difficult to find influencers to participate in their campaigns. This ties in with the similar concern they expressed to the previous question about the difficulty in finding appropriate influencers.

Other notable areas of concern included managing the contracts/deadlines of the campaign (21%), bandwidth/time restraints (16%), and processing payment to influencers (11%).

Survey Respondents Spend 47% of Their Influencer Budget on Micro-Influencers

Respondents spent 47% of their influencer budget on micro-influencers (compared to just 23% for celebrity influencers).

One of the problems the influencer marketing industry has had has been convincing people that celebrity does not equate with influence. The reality is that people trust micro-influencers far more than they do stars, and are far more likely to take notice of a micro-influencer's recommendation than one made by a celebrity. Therefore it should come as no surprise that brands are moving their influencer marketing towards micro-influencers as education about the industry improves.