What does it take to win Amazon’s most competitive shopping window—when ad costs surge, consumer attention fragments, and inventory vanishes overnight?

As Black Friday and Cyber Monday evolve into a month-long retail marathon, the old playbook of last-minute deals no longer works.

In 2024, Amazon’s holiday campaign ran 12 consecutive days, with early-bird shoppers driving record pre–Black Friday sales. At the same time, ad efficiency declined as brands fought for visibility across DSP, Sponsored Ads, and influencer-led traffic.

Success now belongs to marketers who plan early, integrate cross-channel strategies, and use data intelligence to guide every bid, creative, and conversion path.

This 2025 edition of the Amazon Black Friday & Cyber Monday Playbook unpacks how brands and agencies can build smarter campaigns, outpace competition, and turn seasonal chaos into measurable growth.

- Key Dates, Deadlines & Sales Timeline for Amazon’s 2025 Black Friday & Cyber Monday

- Advertising Strategy: Winning Amazon Ads Before, During & After BFCM

- Beyond Amazon: Cross-Channel Support & Traffic Amplification

- 2025 Trend Forecast: The Future of Black Friday/Cyber Monday on Amazon

- The New Rules of Amazon’s Black Friday & Cyber Monday Playbook

- Frequently Asked Questions

Key Dates, Deadlines & Sales Timeline for Amazon’s 2025 Black Friday & Cyber Monday

Success on Amazon during Black Friday and Cyber Monday depends on preparation. Brands and agencies that align their calendars with Amazon’s internal cutoffs gain visibility, ad approval, and eligibility for key promotions.

Amazon’s Extended BFCM Window

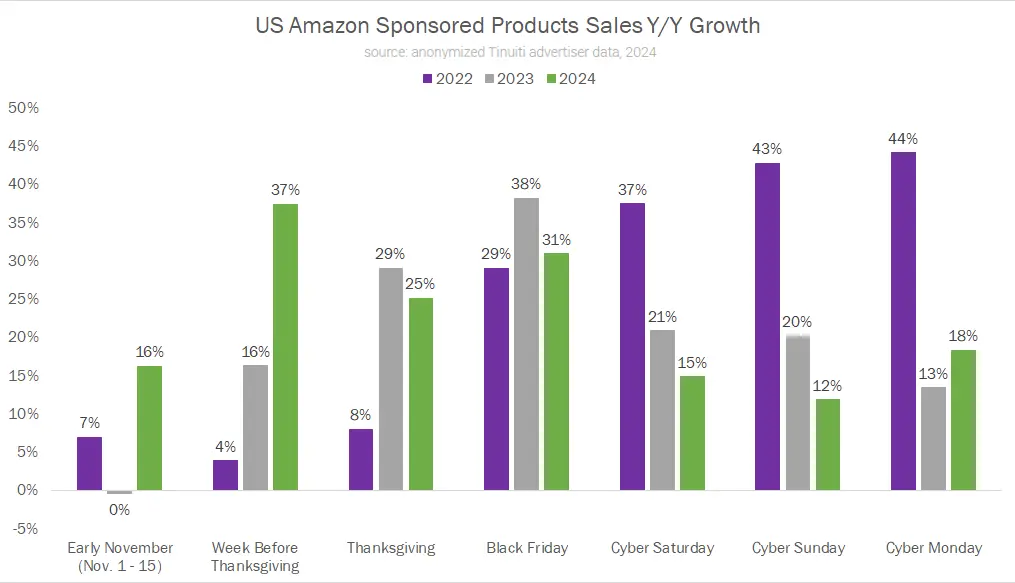

Amazon has steadily expanded its holiday event. In 2024, its Black Friday–Cyber Monday sale ran from November 21 to December 2, merging both events into a 12-day window. Shopper data from Tinuiti showed ad performance peaking in the days leading up to Black Friday, not just the weekend itself.

For 2025, expect a similar timeline: an early-access phase, a core BFCM window, and a short post-event tail where deals linger through “Cyber Week.”

Submission & Ad Deadlines

Amazon typically requires deal submissions 4-6 weeks before the event for Lightning Deals, 7-Day Deals, and Coupons.

Storefront updates and creatives mentioning “Black Friday” or “Cyber Monday” must also be pre-approved to meet ad-policy standards. Brands should finalize creative, compliance, and copy by early October.

Practical Timeline for Brands & Agencies

- August–September: Forecast demand, lock pricing, and build creative.

- Early October: Submit deals and schedule Storefront changes.

- Mid-November: Begin full ad ramp-up and cross-channel promotion.

- November 21–December 2 (estimated): Execute and optimize daily.

A 2024 analysis from Incrementum Digital confirmed that brands that launched early gained a higher share of voice and avoided last-minute listing issues.

The message is clear: Those who prepare weeks ahead own the visibility—and the conversions—when the traffic surge begins.

Advertising Strategy: Winning Amazon Ads Before, During & After BFCM

A high-impact advertising plan is the backbone of winning Amazon Black Friday & Cyber Monday campaigns. For brands and agencies, the key is to layer targeting, creative, and budget decisions across phases—pre-event, event, and post-event—while leveraging Amazon’s deeper tools (e.g., AMC, DSP) to tie it all together. Below is a tactical blueprint all brands should follow.

1. Budgeting & Ramp Strategy: Front-load to Capture Momentum

Rather than waiting until Black Friday itself, top-performing brands begin scaling ad spend during the T-12 period (roughly 12 days before key sale dates). Monks calls this the “front-heavy” approach, suggesting that allocating a meaningful portion of the ad budget early helps establish momentum as shoppers begin researching and adding to cart.

By doing so, you build baseline impressions, engagement, and cart actions that algorithmic optimizations can amplify when peak traffic hits. In practice, brands might allocate 25-40% of their total BFCM ad budget to that pre-ramp window.

2. Mix of Ad Formats: Use the Full Amazon Arsenal

To maximize coverage and precision, brands should employ a multi-format strategy:

- Sponsored Products: Core workhorse. Use auto + manual + product targeting to harvest high-intent queries.

- Sponsored Brands / Video: Ideal for branding, storytelling, upsell, and bundling.

- Sponsored Display & DSP: Useful for awareness, retargeting, and reaching Amazon audiences off-platform.

- Amazon Marketing Cloud (AMC) for Audience Insights: Create custom and lookalike audiences based on prior behavior to fuel more efficient targeting.

Japanese fashion retailer Nissen achieved a 120% year-over-year increase in ad-attributed sales during Amazon’s 2022 Black Friday & Cyber Monday events by adopting a phased, full-funnel advertising approach.

In the weeks leading up to BFCM, the brand used Sponsored Products to build awareness and identify top-performing SKUs, then pivoted to Sponsored Brands video ads during the event itself to deepen engagement. Post-event, Nissen deployed Sponsored Display remarketing to re-engage non-purchasers and sustain momentum.

This structure ensured consistent visibility before, during, and after the peak sale window.

The key to Nissen’s success was its proactive optimization—adjusting bids daily to prevent downtime during high-traffic hours and aligning creative formats with each funnel stage. Instead of compressing all spend into the BF/CM weekend, Nissen spread its budget across pre-, mid-, and post-event phases, allowing algorithms to stabilize and ad performance to compound.

3. Bid & Optimization Tactics: Granularity & Dynamism

During BF/CM, static or “set-and-forget” bidding can cause you to miss an opportunity or overpay. The competitive environment is fluid — bids, demand, and ROI curves shift hour to hour. Below are advanced tactics that top brands use to maintain control and efficiency.

- Dynamic bids/bid modifiers: Ramp bids during high-intent times (e.g., evening, weekends) and scale back during lower-traffic hours.

- Separate high-conversion SKUs or bundles: Carve out your best performers into their own campaigns to give them more aggressive bidding without dragging down the whole account.

- Hourly/daily budget reallocation: Monitor performance hourly and shift budgets toward winning campaigns in real time.

- Negative targeting & exclusion: Turn off low-performing search terms to preserve ad spend for high-intent queries.

In their Black Friday/Cyber Monday campaign across multiple European markets, Haier Europe (via Kiliagon) used real-time reports from the Amazon Ads API to adjust daily budgets and bids on the fly.

During different phases, they reallocated spend dynamically: in early phases, they focused on awareness formats, then shifted more aggressive budgets to high-performing SKUs close to the event, and finally — when many promoted items had sold out — they pivoted and concentrated bids on remaining bestsellers still in stock.

This illustrates all four tactics above in action:

- They moved budget (reallocation)

- They changed bidding strategies dynamically

- They segmented SKUs into prioritized buckets

- They trimmed less effective ad exposure to concentrate spending

The result? They exceeded growth targets in every market, delivered YoY ad sales growth of 213%, and boosted ROAS by 190%, all while closing the campaign €25,000 under budget.

4. Attribution & Analytics: Tie Together the Full Customer Journey

Understanding how each marketing touchpoint contributes to a final sale is critical during Black Friday and Cyber Monday, when traffic sources multiply and ad costs surge. Advanced attribution and analytics tools let brands track, quantify, and optimize the full customer path—from discovery off-Amazon to conversion on-Amazon—ensuring every dollar spent is accounted for.

- Amazon Attribution/AMC: Use these tools to understand how off-Amazon ads (social, display) feed into Amazon conversions.

- AMC Audiences & Lookalikes: Use past-event shopper segments and lookalikes (e.g., “2025 BFCM buyers”) to seed campaigns early.

- Post-campaign modeling: After the core window, run cohort analyses, compare incremental lift, and isolate which ad formats or audiences drove the highest ROI.

Men’s grooming brand Dr. Squatch partnered with Quartile to use Amazon Marketing Cloud (AMC) for audience discovery during its peak holiday campaigns. By analyzing multi-touch paths, Quartile identified a high-value “holiday gift-seekers” segment and targeted them through Amazon DSP and Sponsored Ads.

The campaign generated a 58.7% increase in average order value while keeping advertising cost of sales (ACoS) 5% below target, setting a new sales record for the brand. This demonstrates how attribution-driven insights and AMC-powered segmentation can turn data into precise, high-ROI actions during the most competitive shopping period of the year.

Beyond Amazon: Cross-Channel Support & Traffic Amplification

When done right, off-Amazon channels don’t just send noise — they feed qualified, high-intent traffic into your Amazon campaigns and amplify your reach during the holiday surge. Below are three core levers brands should use.

1. Integrating Off-Amazon Channels via Amazon Attribution

Amazon Attribution enables you to tag and measure how external channels (e.g., Google Ads, Facebook, display, email) contribute to Amazon conversions. By doing so, you can shift budgets away from underperforming media and toward channels proven to fatten your Amazon funnel.

Haleon (a large CPG group) worked with Skai to implement Amazon Attribution so they could send paid search traffic from Google directly into Amazon product pages (instead of to their own brand site).

This allowed them to optimize bids and media investments based on Amazon sales data, rather than guesswork. Through the collaboration, they achieved:

- 26% increase in ROAS

- 15% growth in purchases

- 20% more units sold

- 18% increase in revenue

- 52% decrease in CPA

The example shows how major brands can use cross-channel attribution to bring external spend into Amazon’s measurement ecosystem, letting them amplify and justify external media where it truly adds value.

2. Influencer & Affiliate Collaboration Focused on Amazon

Influencers and Amazon-affiliated content creators can extend reach, social proof, and traffic directly to your listings — especially if they use Amazon links, storefronts, or affiliate paths. This is especially meaningful during high-visibility windows like Black Friday/Cyber Monday.

Branded, a digital-first brand group, partnered with Upfluence to unify its influencer activations with Amazon Ads and Amazon Attribution. Influencers were given personalized Amazon storefront links and tracked through Attribution tags, enabling Branded to measure precise sales impact from each creator.

Creator Shea Whithney featured Branded's Fullstart Veggie Chopper in her list of must-have Amazon gifts, sending direct traffic to their Amazon storefront.

The collaboration delivered a 10× ROI on influencer-driven Amazon sales, proving that influencer marketing can be a primary conversion lever, not just an awareness play .

3. Cross-Channel Measurement (Attribution + Analytics)

To get full clarity, you need to stitch together how your off-Amazon and on-Amazon strategies interplay across the buyer journey. Without unified measurement, media investments can cannibalize each other or leave gaps.

Lumineux, in one of Amazon’s brand-owner case studies, used Amazon Attribution + the Brand Referral Bonus to drive external traffic to its Amazon listings and capture incremental sales. In one Deal of the Day, the brand did $2.1M in sales, with $1M attributed via external traffic channeled through Amazon Attribution.

The integration lets them more precisely manage how off-Amazon media (ads, influencer placements, affiliates) contributes to Amazon sales — and reap “bonus” credit via Amazon’s referral system.

2025 Trend Forecast: The Future of Black Friday/Cyber Monday on Amazon

Black Friday and Cyber Monday have evolved from two shopping days into a multi-week retail ecosystem, one where Amazon’s influence sets the pace for global eCommerce.

In 2025, brands and agencies must prepare for a season defined by longer sales cycles, smarter attribution, AI-driven pricing, and a consumer base more focused on value than discounts.

Below are the key trends shaping how Amazon’s BFCM will look in the year ahead.

1. The BFCM Window Will Keep Expanding

In 2024, Amazon began its Black Friday sales on November 21 and ran them through December 2, effectively merging Black Friday and Cyber Monday into a single event window. This longer cycle proved highly effective: More sales were generated in the pre-event phase than on Black Friday itself, as shoppers sought early deals and price security.

For 2025, expect BFCM to operate as a month-long funnel, with teaser deals in early November, the main event mid-month, and carryover promotions into December. In fact, you can shop for Black Friday deals on Amazon right now (we're in October!)

Brands that plan creative refreshes and inventory pacing around this cadence — rather than a 48-hour spike — will dominate share of voice.

2. Precision Attribution Will Redefine Performance Measurement

Marketers are demanding transparency on what truly drives conversion. Amazon’s latest multi-touch attribution (MTA) models — powered through Amazon Marketing Cloud (AMC) — now allow brands to map every impression and click across Sponsored Ads, DSP, and external media.

In 2025, expect agencies to move beyond last-click logic toward data-weighted credit allocation, identifying how upper-funnel DSP or influencer traffic contributes to final sales. This evolution transforms AMC from a reporting tool into a strategic command center for holiday campaign optimization.

3. Value-Conscious Shoppers Will Outperform Deal-Hunters

The 2024 BF/CM season showed that heavy discounting no longer guarantees growth. Incrementum Digital reports that shoppers are becoming more selective, seeking quality and utility over sheer price cuts.

In 2025, winning Amazon sellers will pivot toward bundled offers, limited editions, and loyalty incentives rather than race-to-the-bottom pricing. Expect creative formats like “exclusive early-access bundles” and “buy-more-save-more” campaigns to rise, positioning brands as value leaders rather than discount dealers.

@ashlilareta Testing these Amazon bundles for my upcoming sew-in. Where do you buy your bundles? Let me knowwww. I’ll update yall soon on how i like these. Linked on my @Amazon storefront! 🔗🔗 #humanhair #amazonhair #amazonbundles #affordablehair #affordablehair #amazonfinds #amazonmusthaves #sewin #blackgirlhairstyles

4. AI Will Power Real-Time Pricing and Bidding Decisions

Artificial intelligence is transforming how brands manage inventory, pricing, and ad spend during volatile periods. Amazon’s retail science teams already deploy machine-learning pricing and supply-chain forecasting that adapt to demand spikes in near real time.

By 2025, AI-enabled tools will empower advertisers to adjust bids hourly, reprice SKUs dynamically, and trigger creative swaps when conversion likelihood peaks. For agencies, the focus will shift from manual optimizations to predictive campaign orchestration, using live data to prevent stockouts and wasted impressions during BFCM surges.

5. Cross-Channel Orchestration Will Become a Core Growth Lever

As Amazon’s ad ecosystem grows more competitive, external traffic sources — social ads, influencers, affiliate media — will become indispensable. Amazon’s Attribution and Brand Referral Bonus programs now make this measurable, rewarding brands for driving off-site conversions back to Amazon.

Brands like Branded, through their work with Upfluence, have already proven the model, integrating influencer content with Amazon Attribution links to achieve a 10× ROI on influencer-driven sales. Expect 2025 to bring a surge of creator-led campaigns tied directly to Amazon deals and limited-time offers, blurring the line between social commerce and marketplace performance.

6. Supply Chain Agility Will Decide Profitability

With Amazon’s logistics capacity stretched every Q4, fulfillment precision will make or break profitability. Brands will rely on predictive inventory allocation and FBA-plus-FBM hybrid models to maintain delivery speed while minimizing excess storage fees.

The lesson from 2024: Overstocking during Cyber Week can erode margins faster than under-supplying. Expect brands to adopt real-time stock visibility dashboards and dynamic promotion throttling to align offer pacing with fulfillment capacity.

BFCM 2025 on Amazon will reward strategic patience, precision data, and human-plus-AI coordination. The winners won’t be those who shout the loudest on discount day — they’ll be the ones who orchestrate a month-long ecosystem of optimized offers, omnichannel measurement, and adaptive intelligence.

The New Rules of Amazon’s Black Friday & Cyber Monday Playbook

Black Friday and Cyber Monday have outgrown their flash-sale roots—on Amazon, they now represent a precision sport where timing, data, and storytelling decide who wins. The 2025 season will reward brands and agencies that think beyond two chaotic days and operate like portfolio managers: forecasting early, layering media intelligently, and tracking every click from social post to final checkout.

The most successful campaigns will blend Amazon-native tactics—like Sponsored Ads, DSP, and AMC insights—with external accelerators such as influencer traffic, paid search, and creator-led content. It’s a season that favors orchestration over volume and insight over instinct.

For marketers, the message is clear: Amazon’s BFCM future isn’t about reacting to a sale—it’s about engineering momentum long before the sale begins. Those who master data-driven strategy today will own the holiday marketplace tomorrow.

Frequently Asked Questions

How early do Amazon shoppers start looking for Black Friday deals?

Many shoppers begin searching for promotions in early November as deal discovery now starts weeks before the event, reshaping how brands pace campaigns.

What’s the best way to budget between Black Friday and Christmas?

Marketers often apply a tiered holiday budgeting strategy, front-loading spend during BFCM but reserving 30-40% for December retargeting and gift-related traffic.

Which products tend to dominate Amazon during Cyber Week?

Electronics, small appliances, and trending household products consistently top sales charts, as seen in the annual trending products on Amazon reports.

How should brands balance influencer content with paid ads?

Using Amazon’s affiliate integrations, brands can connect creators directly to listings—aligning influencer marketing with Amazon’s conversion funnel for measurable ROI.

How does Amazon’s BFCM performance compare to Shopify sellers?

Amazon maintains higher sales volume, but Shopify merchants often outperform in AOV growth, highlighting distinct brand ownership advantages.

What campaign formats tend to perform best during BFCM?

Time-limited offers, personalized retargeting, and bundle promotions dominate across categories in standout Black Friday campaign examples.

How should brands schedule their BFCM campaigns across channels?

Using a structured holiday marketing calendar helps sync Amazon ads, influencer pushes, and social content for maximum visibility.

What’s the advantage of using FBM during BF/CM?

Brands using Amazon FBM fulfillment can better control delivery timelines and mitigate FBA stockouts during peak demand.