Black Friday has evolved into one of the most critical shopping events of the year. For retailers, it's not just an opportunity to boost sales, but also a chance to engage with customers and build long-term relationships.

Here are over 50 recent statistics about revenue, demographics, and preferences that share predictions for Black Friday consumer behavior in 2024. From which marketing channels to zoom in on (including which ones to avoid) to how younger shoppers are approaching this time, continue reading to find out how your brand can reach (and grow) its target audience.

Black Friday Revenue Statistics

1. Black Friday expected to generate $10.8 billion in the US in 2024

Adobe’s 2024 US Holiday Shopping Forecast predicts that online spending on Black Friday will total $10.8 billion in revenue. This number is based on survey responses from 5,000 US consumers recorded during the first week of September 2024.

While Cyber Monday will see a bigger spend ($13.2 billion), Black Friday will enjoy the highest year-over-year increase (YoY) of 9.9%. On the other hand, Cyber Monday’s YoY is calculated at only 6.1%.

Cyber Week Forecast

2. In 2023, over 200 million US consumers shopped over Thanksgiving weekend

A survey released by the National Retail Federation (NRF) and Proper Insights and Analytics anticipated that 182 million US consumers planned to shop during Thanksgiving weekend in 2023.

In fact, this number turned out to be even higher. For the first time, over 200 million consumers shopped during this weekend.

Thanksgiving Weekend Shoppers Over the Years

3. In 2024, 71% of US consumers plan to shop on Black Friday

It’s predicted that 2024 will also see a massive shopper turnout on Black Friday, at least in terms of website traffic. About 7 out of 10 (71%) of US consumers plan to shop online on this day.

To put Black Friday’s popularity in the US into perspective, only about 40% of Canadian consumers have taken advantage of Black Friday deals since 2020.

4. About a third of Americans likely to buy something on Black Friday

While the majority of Americans plan to shop online, only about a third of them will likely make a purchase. If you combine this with Adobe’s data, this means that about half of those who plan to shop will end up buying something.

5. 27% of US shoppers will spend less in 2024

While Adobe’s survey anticipates that revenue will increase in 2024, a YouGov survey predicts that the majority will spend the same or less than last year. About a quarter (27%) plan to decrease their spending while 36% will leave their spending unchanged.

In fact, only 9% plan on spending more than in 2023.

Tentative Approach for Black Friday/Cyber Monday Shoppers

6. Peak-season discounts can be as high as 30%

Adobe’s forecast predicts that discounts will vary from 8% to 30%. Discounts are expected to start getting more attractive in the first three weeks of November and can reach as high as 30% between 22 November 2024 and 2 December 2024.

Seven out of 10 Adobe survey respondents also indicated that they’ll proactively check for these deals during Cyber Week, when discounts are set to be the most attractive.

Holiday Online Shopping Discounts

7. Electronics expected to generate over $55 billion in 2024

Most of 2024’s Black Friday revenue will be generated by spending on electronics. Adobe forecasts that this segment will generate $55.1 billion in online spending, enjoying a YoY of 8.5%.

Online Spend Forecast by Category

8. US consumers spent $321.41 on average on holiday-related buys in 2023

Aside from high-ticket products like electronics, Black Friday is also a popular time of year for holiday-related purchases. In fact, according to the NRF, 95% of US consumers made holiday-related purchases during Thanksgiving weekend in 2023.

On average, they spent $321.41 on these types of purchases with 70% of this total going towards gifts specifically.

Clothing and apparel were the most popular types of gifts, followed by toys.

9. US consumers expected to spend $1,778 on average in 2024

As for how much consumers will spend in total during 2024’s holiday season, Deloitte’s 2024 holiday retail survey forecasts that it will add up to $1,778. This includes gifts, non-gifts, and experiences.

10. Nearly 75% of US consumers earning more than $75,000 per year shop on Black Friday

As expected, Black Friday shopping is more common among higher income earners. An online survey completed in October 2023 found that nearly 75% of US consumers who earn an annual income of $75,000+ planned to shop on Black Friday. The same percentage also had intentions to buy a product on Cyber Monday.

Plus, according to Deloitte’s survey, higher income earners are also planning to increase their spending by more than double the average YoY increase of 8%. US consumers who earn between $100,000 and $200,000 plan to spend as much as 17% more in 2024.

11. BNPL spend expected to total nearly $10 billion in November 2024

The reality, though, is that much of Black Friday’s revenue growth will be fuelled by consumers acquiring more debt. Adobe predicts that Buy Now, Pay Later (BNPL) spending will increase 11.4% from 2023 to reach $9.5 billion in November 2024. On Black Friday alone, it could amount to well over $600 million, while Cyber Monday’s BNPL purchases could come close to $1 billion to set a new record.

BNPL Spend During Cyber Week

Mobile Shopping on Black Friday

12. 51% of US consumers prefer mobile devices for Black Friday shopping

To quote Adobe, 2024 will be “first ‘mobile-first’ holiday season” with more than half of US consumers using their mobile devices to shop online. When given an option, 51% will rather use their mobile device than desktop for online shopping.

13. Nearly $130 billion will be spent via mobile devices

Not only are consumers comfortable to browse online, but also to purchase. Adobe predicts that $128.1 billion will be spent via mobile devices in 2024. This works out to an impressive YoY of 12.8%.

14. About 75% of BNPL payments will be made via mobile

US consumers are also happy to use their mobile devices for BNPL payments. In fact, mobile shopping trends reveal that it’s the driving force behind BNPL orders.

Adobe forecasts that between 74% and 79% of BNPL transactions made during the 2024 holiday season will come via a mobile device. This amounts to about $14 billion.

Projected BNPL Spend on Mobile Devices

15. More than half of US consumers use mobile shopping when in store

Over half of US consumers use their mobile devices to streamline their in-store shopping experience. For example, an online survey completed by Google and Ipsos in 2023 found that over half of US holiday shoppers searched for online product reviews while they were in store.

Price comparisons is another popular use case. Adobe found that as much as 82% of US consumers turn to their mobile device to compare prices while they’re in a physical store.

In-store vs Online Shopping Traffic

16. About 40% still shop in store

While mobile shopping has received the confidence vote from the majority, there’s still a sizable group of consumers who brave brick-and-mortar stores for Black Friday sales. In 2023, about 43% of US consumers had definite plans to do in-store shopping. In fact, only 1% said that they would definitely not visit a physical store to take advantage of a Black Friday sale.

As for how many will brave the malls on the actual day, another survey found that less than a third had the patience and courage.

17. In 2023, 76.2 million US consumers visited a physical retail store on Black Friday

According to the NRF’s data, Black Friday was the most popular day over the course of the holiday weekend for in-store shopping in 2023. Just over 76 million shoppers visited a physical location in 2023 on this day, nearly 4 million more shoppers than the previous year.

18. US brick-and-mortar retail stores attracted 4.6% more visits in 2023

According to Sensormatic Solutions, in-store traffic in 2023 was 4.6% higher than the previous year. Grant Gustafson, Sensormatic’s head of retail consulting and analytics, attributes this to the fact that retailers have improved the in-store shopping experience.

19. The peak time for in-store shopping is between 2 p.m. and 3 p.m.

Early afternoon is the busiest time for in-store shopping on Black Friday. Sensormatic’s data shows that between 14:00 and 15:00 most shoppers in the United States head to the malls and stores.

20. In 2023, Black Friday attracted 90.6 million online shoppers

While in-store traffic during Thanksgiving weekend was higher in 2023, online shopping is still the preferred choice. Black Friday attracted the most online shoppers, with just over 90 million online shoppers.

In fact, the Saturday after Black Friday was the only day during the five-day weekend that there were more in-store than online shoppers and that only by about 700,000.

Black Friday Statistics by Gender

21. Men are more likely to shop for tech products

The vast majority of US men (about 78%) shop online on Black Friday or Cyber Monday to buy electronics. That said, it’s still a popular product category among women too, with 60% of US women adding consumer electronics to their Black Friday shopping list.

22. Women are more likely to shop for clothing

Clothing and accessories is the most popular product category among female shoppers in the United States and that by a long shot. Over 80% (82.7%) planned to buy clothing or accessories online in 2023, compared to only 70.3% of men.

Perhaps surprisingly, electronics was more popular than health and beauty products among women with 62% vs 52.5% planning to buy products from these two categories respectively.

23. Men are more likely to shop in store than women

Men might claim that they hate going to the store, but interestingly enough, a 2023 survey reveals that men are slightly more likely to visit a brick-and-mortar store on Black Friday. About a third of US men planned to do in-store shopping compared to about a quarter of women.

24. About two out of 10 men shop exclusively for themselves

In 2023, men were more likely than women to buy something for themselves during Cyber Week. Just over 20% (21.43%) of men shopped exclusively for themselves, while less than 10% of women had the same intention.

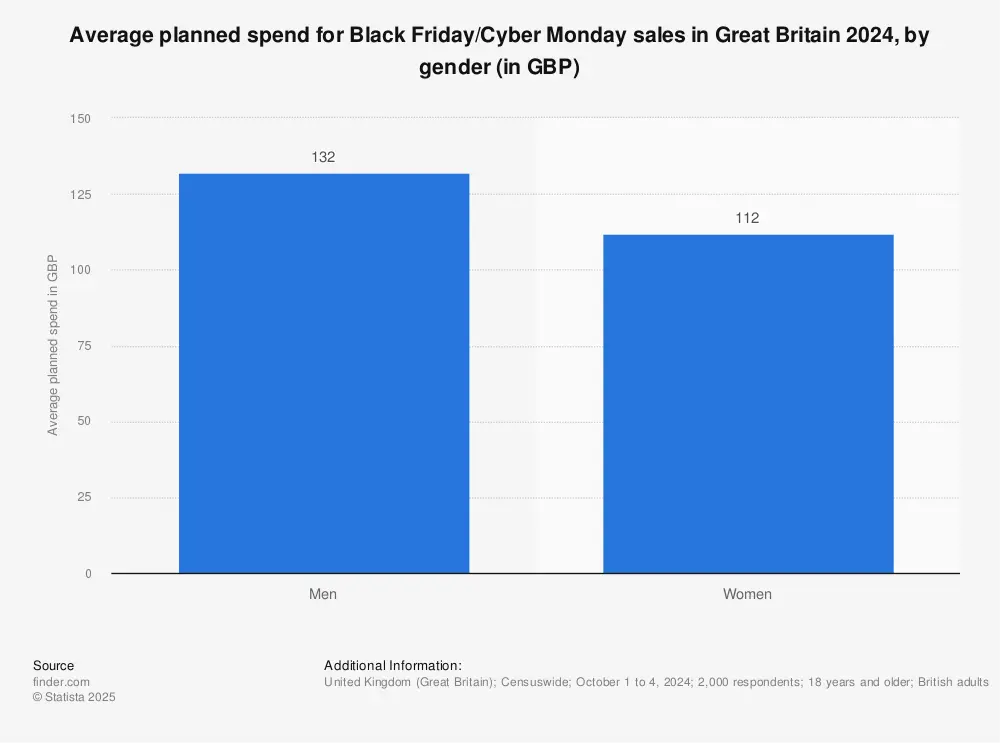

25. Men are more likely to spend more than women

In the US as well as Great Britain, men typically spend more than women. In 2023, US women most commonly spent between $101 and $250, compared to US men who were most likely to spend between $251 and $500.

In Great Britain, the average planned spend for Black Friday in 2024 among men is estimated at £20 more than women.

Black Friday Statistics by Age Group

26. Millennials are the most likely to shop on mobile

As expected, younger generations are more inclined to use their smartphone for holiday shopping. The Adobe Consumer Survey 2024 reveals that just over 60% of millennials and Generation Z prefer a smartphone over desktop, with slightly more millennials showing this preference.

Deloitte’s numbers are about the same with 62% of millennials and 58% of Gen Z planning to shop on their smartphone.

Consumers Shop on Smartphone Even When Desktop is Available

27. Nearly 60% of Gen Z and millennials plan to use GenAI for holiday deals

Referrals from GenAI sites like ChatGPT are expected to increase rapidly this holiday season. As expected, much of this growth will be driven by younger consumers. Almost 60% of Gen Z and millennials are expected to use GenAI for holiday shopping.

Plan to Use Generative AI This Holiday Season

28. Gen Zs are the most likely to regret Black Friday purchases

Who hasn’t bought something during a Black Friday sale only to regret it later? If you’re a baby boomer, you’re not familiar with buyer’s remorse over Black Friday. Of all the age groups, they’re the only generation claiming that they haven’t regretted a purchase this time of the year.

However, if you belong to Gen Z, you probably have. Six out of 10 Gen Z consumers in the United States have regrets about a past purchase.

29. 20% of Gen Z plan to buy gifts on social media

According to Deloitte, two out of 10 Gen Z shoppers are planning to buy gifts on social media. They’re closely followed by millennials, with 18% sharing the same plans.

30. Over 40% of Gen Z and millennials plan to self-gift

More than 40% of Gen Z and millennials are planning to self-gift in 2024. The average budget for self-gifts are set at $250. While clothing and accessories are the top choice, millennials are the most likely to self-gift with an experience and about a third of them will treat themselves to some type of experience.

Percentage of Respondents Planning to Self-Gift

31. About 40% of millennials and Gen Z plan to use BNPL

As mentioned earlier, BNPL purchases are expected to fuel Black Friday sales in 2024. It’s mostly millennials and Gen Z who’ll use it, with 39% and 38% respectively planning to use BNPL services.

On the other hand, only about a quarter of Gen Z plan to use such services this holiday season.

Plan to Use BNPL This Holiday

32. Gen Z the most likely to use influencer recommendations

Adobe’s survey reveals that of all the age groups, Gen Zers are the most likely to have bought a product because an influencer recommended it. Nearly four out of 10 of Gen Z respondents have been swayed by an influencer’s recommendation.

Buyer Behavior Trends on Black Friday

33. Half of US consumers will likely start their search in October already

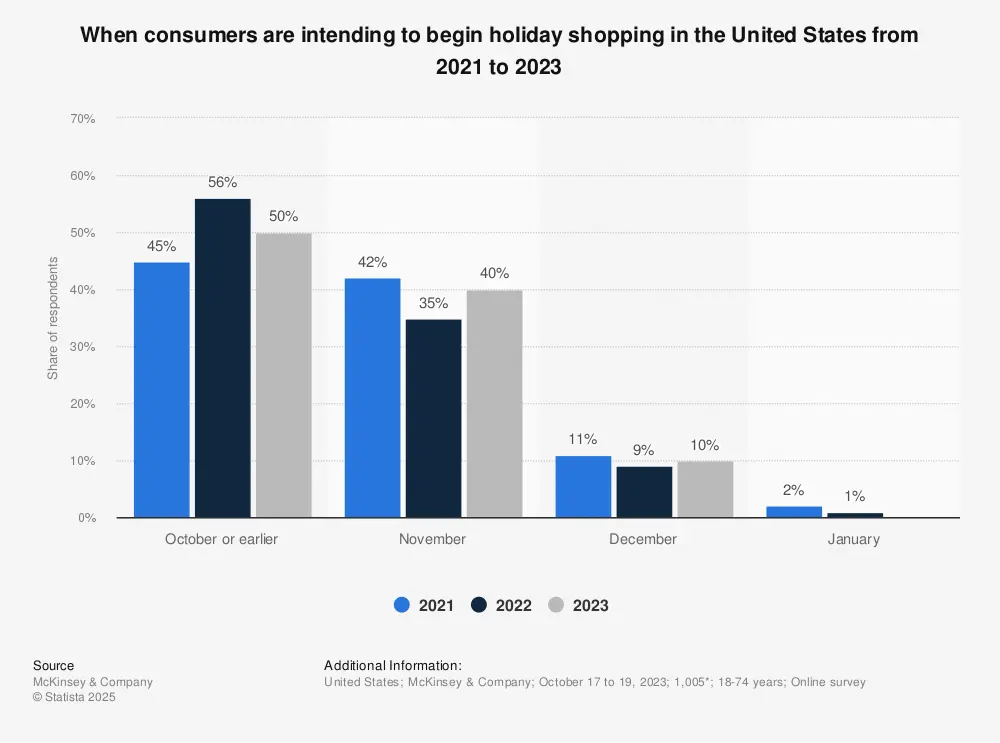

One of the main questions that marketers ask is, “When should I start launching my Black Friday campaigns?”

Half of Adobe’s survey participants indicated that they’ll probably start their holiday shopping before November already. This is echoed by Statista data about the intended holiday shopping start among US consumers. It’s about a 10% decrease from 2022, though, when 56% of US consumers already started in October.

In the UK, there’s also a substantial group who’ll start shopping beforehand with about 25% indicating they’ll start their search in October (or possibly earlier).

34. Cost is the main reason why US consumers choose to shop early

Top Reasons to Shop Early This Season

Most US consumers are driven by financial reasons to start their holiday shopping before November. Just over half (55%) want to use early discounts, while the same percentage takes this approach to spread out the cost.

35. 80% of US consumers worried about inflation

While Deloitte’s survey found that increasingly more US consumers expect the economy to improve in the next year, inflation remains a big concern. Adobe’s data found that four in five consumers are still concerned about inflation this holiday season to some degree.

Concern About the Impact of Inflation This Holiday Season

36. Nearly half will avoid buying full-priced items

As inflation remains a concern among US shoppers, retailers can expect to see increased price-consciousness among consumers. According to Adobe, nearly half will:

- Compare prices more in 2024 (48%)

- Buy cheaper alternatives more often (48%)

- Avoid paying full price for an item (46%)

37. 55% of purchases were driven by a sale in 2023

While consumers are expected to become even more influenced by price and discounts in 2024, sales also had a big impact on 2023’s Black Friday buying trends. The NRF reports that consumers admitted that on average 55% of their Thanksgiving weekend buys in 2023 were motivated by a promotion or sale (up from 52% in 2022).

38. 95% make holiday-related purchases

Holiday-related purchases remained the main motivator in 2023. A massive 95% of Thanksgiving weekend shoppers bought a holiday-related item in 2023, according to the NRF.

39. Standard shipping is used for the majority of orders

When it comes to shipping preferences, standard shipping is still used for the bulk (80%+ of orders) during Cyber Week. That said, Adobe predicts that about 3% fewer orders will use standard shipping in 2024 compared to 2023.

On the other hand, expedited shipping and buy online, pick up in-store (BOPIS) is expected to see a decrease during Cyber Week. These shipping options will only see an increase in the two weeks before Christmas (probably fuelled by consumers who left Christmas shopping for the last minute).

Black Friday Marketing Statistics

40. Limited-time promotions convince about a third of shoppers

Let’s start with one of the most obvious Black Friday marketing tactics—promotions. According to the NRF, 55% of purchases made during Thanksgiving weekend were motivated by a promotion or sale. Limited-time promotions or sales specifically are proving effective, with 31% of shoppers admitting that it has convinced them to buy a product they were unsure about purchasing.

That said, you don’t necessarily have limited time to run your promotion. The NRF found that more than half of consumers (55%) are using early holiday sales and promotions, compared to only 35% who leave it for the week before Thanksgiving. In fact, in 2023, 48% of US shoppers were already halfway with their holiday shopping as Thanksgiving weekend approached.

41. Social media referral volume expected to surge by as much as 65%

Adobe predicts that social media referral can increase by between 60% and 65% during the holiday season. Most US marketers also realize the importance of using social media marketing for Black Friday, with 75% indicating that they plan to use social media channels for holiday season advertising.

42. TikTok’s share of traffic to retail sites will increase by 70%

Even more impressive is that TikTok’s traffic to retail websites can grow by between 70% and 75% this holiday season, according to Adobe’s predictions. That said, significantly fewer consumers actually purchase via the platform. It’s the most popular among Gen Z, but even less than half have purchased from TikTok.

On the other hand, more than half of millennials, Generation X, and baby boomers have purchased from Facebook, making it the preferred platform for purchases, ahead of TikTok.

43. Facebook will be the preferred platform for finding deals

While Facebook’s share of retail traffic is only expected to increase by about 15% according to Adobe’s data, it remains the preferred platform for finding deals.

On top of that, it’s also the preferred platform for purchases among older generations. Only more Gen Zers have used TikTok and Instagram for purchases than Facebook.

44. Instagram’s traffic share to decline by about 5%

Unlike Facebook and TikTok, Instagram is expected to be less popular this holiday season. Adobe anticipates that its share of traffic will actually decline between 1 and 5%.

45. Organic search to drop by as much as 6% in 2024’s holiday season

Adobe predicts that the total revenue generated by means of organic search could decrease by between 3% and 6% over 2024’s holiday season.

On the other hand, paid search’s revenue contribution is expected to remain pretty much unchanged. Adobe anticipates that if it increases, it will be by 3% at most.

46. A third of consumers more likely to support retailers that offer BNPL

As mentioned earlier, BNPL will drive a big percentage of purchases going forward. In fact, one out of three consumers answered in Adobe’s survey that they are more likely to buy from a retailer that offers BNPL as payment option.

While it will help you to reach consumers who don’t have a credit card, less than 10% cite this as a reason for using BNPL. It’s also not necessarily because it’s the preferred payment option. Only about 10% prefer BNPL to credit cards.

BNPL’s popularity is driven by cash flow. Nearly a quarter use it to free up cash, while about 20% won’t be able to afford the item without BNPL.

47. Over 80% of US retailers feel Black Friday only benefits mega retailers

While deals are an effective marketing strategy, most US retailers feel that it only works for mega retailers. More than 80% of US retailers believe that Black Friday and Cyber Monday only benefit a specific group of mega retailers.

48. Only about 30% of US consumers feel sales offer good value

Like most US retailers, the majority of US consumers also aren’t necessarily convinced by sales. Sure, they encourage them to buy certain products, but only about three out of 10 thought they actually received a good deal, according to a survey completed in October 2023.

One of the reasons is that about a quarter believe that retailers increase the price before Black Friday only to “discount” them on the actual day.

Even if it offered good value, it didn’t mean that it was worth the effort to shop on Black Friday, at least not for another 34% of survey respondents.

Most Popular Product Picks on Black Friday

49. Electronics is the leading product category in Europe

As you would’ve picked up by now, the electronics product category is causing quite a buzz on Black Friday. In Europe, shoppers are mainly looking to buy electronics.

The other most popular product categories that European consumers are interested in are clothing and accessories (no surprise again), followed by home appliances and decor.

50. Clothing/apparel is the leading product category in the US

In the United States, clothing and apparel is set to be the top product category for Black Friday in 2024. Nearly half (47%) of US consumers plan to buy clothing. As expected, electronics is in second spot, with 39% planning to buy an item from this category.

51. A quarter buy gift cards as a gift

The majority of US consumers still give personal gifts over Thanksgiving weekend. Only 25% settle for buying a gift card as a gift.

52. Spending on experiences expected to increase by 16%

An interesting trend to watch going forward is spending on experiences. Deloitte anticipates that spending on entertaining at home, concert tickets, dining out and other types of experiences will increase by 16%. The average expected holiday spend on experiences is expected to add up to $735 in 2024, of which about $463 will be spent on experiences away from home.

Expected Holiday Spend: Experiences vs. Retail

53. TVs and sporting goods are expected to enjoy record discounts in 2024

As mentioned earlier, data suggests that consumers can look forward to discounts of as high as 30% towards the second half of November. This high discount will likely only apply to electronics and possibly toys, but televisions and sporting goods are expected to enjoy new record discounts this year.

TVs are anticipated to enjoy discounts of 24% on Black Friday, while sporting goods will see 20% off on Thanksgiving, according to Adobe.

54. Skechers is the top-performing fashion retail brand

As mentioned earlier, clothing and apparel is a firm favorite among both American as well as European consumers, especially female consumers. Skechers was the fashion retail brand that put the best foot forward during Black Friday in 2023.

This is based on YouGov’s BrandIndex US, YouGov’s always-on, syndicated brand tracker, that measures the net buzz score of various apparel, footwear, accessories, and watches.

Top Performing Fashion Retail Brands During Black Friday/Cyber Monday

55. Dove is the top-performing skincare brand

During November 2023, Dove had the highest positive buzz score in the cosmetics category (and by quite a margin). In fact, of all the skincare, hair and cosmetics brands that made the top 10, Dove boasted the biggest lead over its competitor, which in this case was Olay.

Top Performing Skincare, Hair and Cosmetics Brands During Black Friday/Cyber Monday

56. Samsung is more popular than Apple

When it comes to buzz around Apple and Samsung during Black Friday, there’s an interesting trend. Samsung slightly leads Apple, but the iPhone outperforms Samsung’ smartphones.

Apple’s iPad and Apple Watch also made the top 10 top-performing tech and home electronics brands.

57. Super Mario Bros. is the top-performing video game brand

As for games, Super Mario Bros. was the top-performing video game brand in 2023. It was more than double as popular as games like The Legend of Zelda, Call of Duty, and Grand Theft Auto. Much of this popularity was probably driven by the Super Marios Bros. Movie that premiered early that year.

Top Performing Video Game Brands During Black Friday/Cyber Monday

Key Takeaways

Black Friday is set to be another major event on the retail calendar in 2024. While inflation remains a concern, spending is expected to increase this year. For brands and marketing teams looking to increase their slice of the (pumpkin) pie, focus on:

- Increasing your discounts gradually as Cyber Week approaches

- Adding electronics, clothing, or accessories to your product range (if possible)

- Including alternative payment options like BNPL

- Ensuring your website is optimized for mobile shopping

- Using social media marketing, specifically TikTok and Facebook.