The influencer marketing world is booming, and with it, the personal finance sector is tapping into the power of 'finfluencers' to reach new heights. As the global influencer market is set to hit a staggering $32.55 billion by 2025, the growth in financial content is outpacing the rest, with financial influencers on Instagram and YouTube experiencing double the growth of their peers.

But the influencer landscape is shifting. Gone are the days of flaunting extravagant lifestyles; audiences are seeking authentic, relatable content. This means brands must adapt, creating platform-specific content that resonates with audiences on TikTok and Instagram Reels.

So, how are brands navigating this new wave of authenticity? Take H&R Block’s Tax Pro Go Review campaign, for example. A perfect blend of targeted influencer selection and creative freedom, the campaign proved that when done right, influencer marketing in the finance world can lead to impressive results.

Keep reading to see how this campaign unfolded and discover other game-changing campaigns shaping the personal finance tools industry!

- 1. H&R Block's Tax Pro Go Review: An Influencer Campaign That Filed for Success

- 2. From Zero to Unicorn: How CRED’s Influencer Magic Built a $2.2 Billion Brand

- 3. L&T Finance’s Two-Wheeler Loan Campaign: Accelerating Engagement with Influencer Power

- 4. Future Generali: Breaking the Stigma, One Post at a Time

- 5. FinTron’s Finance App: Turning TikTok into a Financial Powerhouse

- 6. Security Bank: Amplifying Savings with Influencer Power

- Personal Finance Tools: Innovating Engagement and Trust in the Digital Age

- Frequently Asked Questions

1. H&R Block's Tax Pro Go Review: An Influencer Campaign That Filed for Success

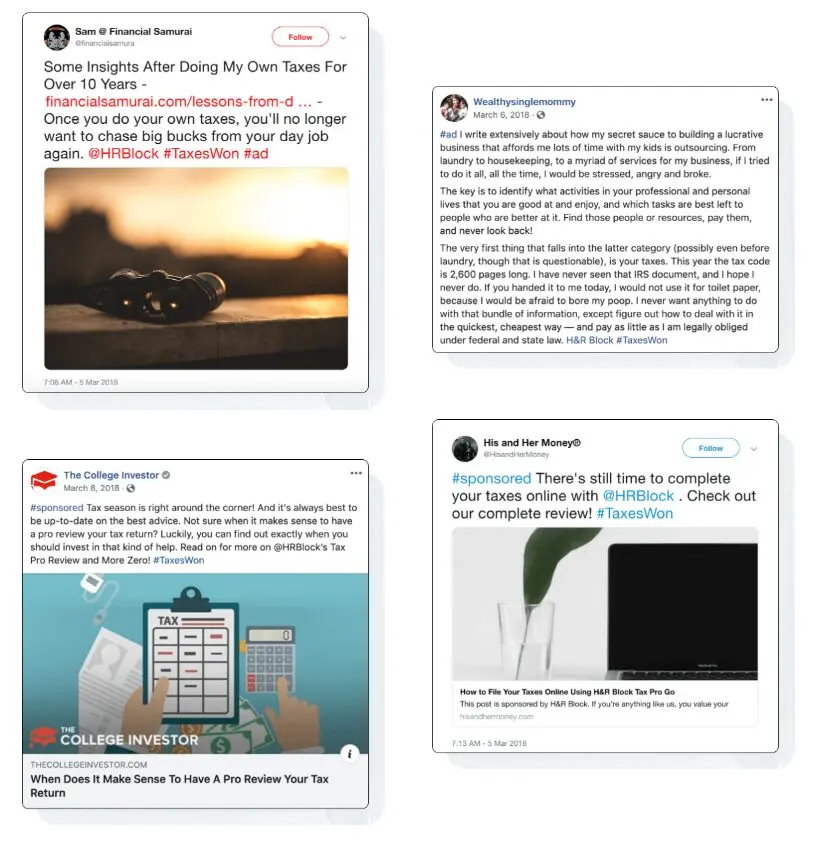

When H&R Block launched its Tax Pro Go Review, they faced a critical challenge: getting the word out about their new service before the 2018 tax season came to a close. Traditional advertising wasn’t going to cut it—too costly, too slow, and not exactly on brand for the audience they needed to reach.

Enter NeoReach and their influencer marketing strategy that proved, once again, that a carefully crafted campaign can not only raise awareness but also drive real, measurable results.

Strategic Approach

-

Targeted Influencer Selection: 36 finance-focused influencers, tapping into a mature, financially savvy audience. Millennials and Gen-Xers were the focus—people who’d rather read a detailed blog post than swipe through Instagram Stories.

-

Platform Focus: Facebook, Twitter, and blogs were the chosen battlegrounds. These platforms catered to the core audience that was already engaging with content about taxes and financial literacy.

-

Content Freedom: Influencers were given creative freedom to showcase how H&R Block’s Tax Pro Go service solved real problems—personalized, cost-saving, and convenient. The results? Genuine, engaging content that resonated.

Campaign Impact

By strategically leveraging influencer content, H&R Block reached over 4 million impressions, with a stellar 17.5% engagement rate—a number that stands out in the often-dry world of tax preparation.

The influencers didn’t just talk about the product; they engaged their followers in lively conversations about tax prep, a topic most people would rather avoid like the plague. Yet, the conversations were informative, authentic, and ultimately led to more than 6,000 engagements, a number that directly impacted sales as the tax season was winding down.

Source: NeoReach

The Numbers Tell the Story

-

Total Impressions: 4 million+

-

ROI: A solid 3:1 ratio based on influencer media value, a testament to the campaign’s efficiency.

-

Demographics: The campaign was spot on, with 94% of followers being married (hello, joint tax filing) and 75% in the 30-49 age range—prime Tax Pro Go territory.

-

Audience Interests: The bulk of the engaged audience had interests in news, business, and tech, the very people who would appreciate a streamlined tax solution.

NeoReach didn’t just send influencers to the battlefield—they equipped them with the tools to win. By selecting bloggers and content creators with deep knowledge of personal finance, the campaign gained credibility from the get-go. Influencers like Financial Samurai, The College Investor, and Wealthy Single Mommy lent their expertise, ensuring the message reached the right ears.

The beauty of this campaign? It wasn’t about flashy posts or viral stunts. It was about speaking to an audience that needed real, actionable information in a format they trusted. And it worked—H&R Block’s new service became a hit, with positive interactions translating directly into increased sales and long-term brand loyalty.

2. From Zero to Unicorn: How CRED’s Influencer Magic Built a $2.2 Billion Brand

CRED, a fintech platform founded in 2018, has skyrocketed to unicorn status in just three years, with a valuation of $2.2 billion and over 16 million users. While its business model, which rewards timely credit card payments, turned the concept of credit scores on its head, it was CRED’s savvy use of influencer marketing that truly supercharged its success.

Here's a closer look at how they’ve mastered the art of branding, influencer partnerships, and a bit of viral PR magic along the way.

Strategic Approach

-

Branding with Purpose: CRED’s brand pillars—trust, exclusivity, and innovation—are the backbone of its marketing strategy. By emphasizing trust (via high credit score requirements for membership), they ensure a community of responsible financial players. Exclusivity adds prestige, and innovation keeps the offerings fresh with features like CRED Stash and CRED Mint.

-

Influencer Partnership with Precision: CRED’s influencer marketing isn’t about plastering the platform across every corner of the internet. It’s about strategic collaborations with celebrities like Rahul Dravid and Virat Kohli, who speak to diverse audiences. From cricket legends to Bollywood icons, CRED’s influencer partnerships have been anything but conventional.

-

PR Stunts and Social Media Savvy: CRED mixes influencer marketing with creative PR stunts, such as sending hammers to influencers before Black Friday, teasing them to destroy their current watches and phones. It’s an attention-grabbing tactic that stirs curiosity, increases engagement, and strengthens brand presence.

Campaign Impact

CRED’s influencer campaigns have sparked viral moments that not only engage users but also build deep trust and brand loyalty. The campaign featuring Rahul Dravid, where the usually calm cricketer had a road rage moment, went viral across social media, generating massive buzz. By portraying celebrities in unexpected scenarios, CRED turns the ordinary into the extraordinary—something that makes their brand memorable.

The Numbers Speak

With over 16 million users and rapid growth, CRED’s influencer strategy has been a primary driver. The use of high-profile influencers helped CRED reach broader demographics, from the young, aspirational crowd to the older, more financially responsible segments.

The Takeaway

CRED’s success isn’t just about offering a smart product; it’s about creating a lifestyle brand that people want to be part of. By partnering with the right influencers, creating campaigns that break the mold, and tapping into cultural touchpoints, CRED’s marketing is a masterclass in how fintech can do more than just manage money—it can capture the hearts and attention of millions.

Boost Your FinTech Tool with Influencer Marketing Campaigns!

Click below to discover how top FinTech tools are partnering with influencers to drive brand awareness and customer trust. Learn the strategies behind the most successful campaigns that are helping these brands engage their audience and simplify financial management.

Top FinTech Influencer Marketing Campaigns

3. L&T Finance’s Two-Wheeler Loan Campaign: Accelerating Engagement with Influencer Power

L&T Finance, a leading non-banking financial company in India, had a simple yet ambitious goal: make two-wheeler loans the talk of the town. Their recent influencer marketing campaign, centered around promoting affordable and hassle-free loans for motorcycles and scooters, did just that — and more.

With a well-oiled strategy that blended local flavor, relatable content, and celebrity appeal, the campaign revved up L&T Finance’s brand presence in Kolkata, driving awareness and engagement like a turbocharged engine.

Strategic Approach

-

Targeted Influencer Selection: L&T Finance knew their audience well: young, dynamic individuals aged 20-40, living in a fast-paced city like Kolkata. They carefully selected influencers with a strong local following, ensuring their content resonated with the target demographic. These influencers weren’t just popular—they were trusted figures in the community, giving the campaign an authentic, relatable touch.

-

Local Relevance: By incorporating real-time experiences at local dealerships into influencer content, L&T Finance created an immersive and believable narrative. Viewers weren’t just hearing about two-wheeler loans—they were seeing them in action. This real-world connection strengthened the brand's appeal, making the loan process feel more accessible.

-

Celebrity Collaboration: The cherry on top? Motorcycle lifestyle influencer and travel vlogger Mouna Nanaiah went to the IBW2024 motorcycle event and created videos by the L&T Finance booth, explaining their two-wheeler loans.

Campaign Impact

The results speak for themselves. With a total reach of 997,853 and over 1.1 million views, L&T Finance captured the attention of their target audience. Engagement numbers were equally impressive, with 81,501 likes, 419 comments, and 1,013 shares.

The use of both Instagram and YouTube helped diversify content formats, reaching audiences across various platforms with different content consumption preferences.

The strategic integration of Mouna Nanaiah amplified the campaign's visibility, helping L&T Finance stand out in the competitive financial services sector. Her presence added star power while keeping the message grounded in trust and local relevance—an essential element when marketing something as personal as a loan.

The Takeaway

L&T Finance’s campaign was a well-calculated blend of influencer marketing and celebrity clout, proving that success in the financial sector isn’t just about numbers—it’s about building trust and relatability. By aligning their message with influencers who genuinely resonated with their target demographic, L&T Finance turned a mundane financial product into an aspirational purchase.

In a space dominated by generic ads, this campaign’s authenticity and local relevance helped it break through the noise and make an impression that stuck.

4. Future Generali: Breaking the Stigma, One Post at a Time

When it comes to raising awareness about mental health, the usual approach tends to be a lot of talking and very little engagement. But Future Generali’s campaign for World Mental Health Day was a game-changer, using influencer power to not only spark conversations but also drive real interaction with their audience.

Strategic Approach

-

Micro-Influencer Magic: Instead of relying on a handful of big names, Future Generali took a micro-influencer marketing approach. With 22 influencers spanning health, wellness, fitness, and entertainment niches, the brand made sure to reach a broad yet targeted audience. It’s like playing chess with an army of pawns that move fast and strategically—except in this case, they’re all over Instagram and Twitter, creating real buzz around mental health.

-

Celebrity Backing: While the micro-influencers handled the intimate, personal touch, the campaign still played its ace card with macro influencers. Celebrities like Shilpa Shetty and Mandira Bedi lent their names to the cause, boosting the campaign’s credibility and reach. Their involvement was the perfect blend of authenticity and authority, bringing the campaign into mainstream discussions while also keeping it relatable.

-

Interactive Engagement: What truly set this campaign apart from the noise of generic mental health awareness campaigns was the interactive element. The "Total Health Score" test on Future Generali’s website was a stroke of genius, allowing the audience to assess their own mental health and feel like they were part of the conversation. Influencers even shared their not-so-perfect scores, making the campaign feel inclusive rather than preachy. It’s the digital version of "Hey, we’re all in this together."

Campaign Impact

-

Reach: 476.5K people in four days. That’s like having your mental health message blasted to a stadium of people—and it was all done organically, thanks to those influencers.

-

Engagement: With a 2.36% engagement rate, the campaign didn't just reach people; it resonated with them. That's a solid figure in the influencer marketing world, especially when you’re dealing with a sensitive subject like mental health.

-

Hashtag Power: #healthinsideout and #TotalHealthScore became the campaign's rallying cry. It’s no surprise that the conversations these hashtags generated weren’t just about the campaign—they were about normalizing mental health discussions in real life.

The Takeaway

Future Generali’s campaign didn’t just create awareness about mental health; it made people feel like they were part of a movement. By engaging influencers from diverse fields and giving the audience a platform to assess their own mental health, the campaign achieved something rare: it made mental health feel approachable and important.

In the crowded space of World Mental Health Day content, this campaign stood out not by being louder but by being smarter.

5. FinTron’s Finance App: Turning TikTok into a Financial Powerhouse

When FinTron set out to teach Gen Z how to manage their money, they didn’t just post a couple of ads and hope for the best. No, they went straight to the source—the heart of viral content on TikTok.

Teaming up with The Influencer Marketing Factory (IMF), they unleashed a wave of financial wisdom that went viral and shook up the app’s algorithm, resulting in a whopping 5.6 million views. How’s that for making money move?

Strategic Approach

-

Finance Meets Fun: FinTron’s strategy was clear: make money management accessible and fun. To do this, they enlisted some of the most influential voices in the personal finance space on TikTok—people like @nicktalksmoney, @pricelesstay, and @yourrichbff. These influencers are more than just finance gurus; they’re the cool kids at the financial table, making investing, saving, and budgeting sound like a conversation at your favorite café. By partnering with these TikTok stars, FinTron got to tap into their established trust and credibility with a younger, finance-hungry audience.

-

Engaging Content: The influencers didn’t just talk about the app—they showed it in action. With their easy-to-follow tutorials and relatable advice, the influencers created educational content that felt less like a sales pitch and more like an invite into their financial world. Watching a TikTok video about budgeting might not sound riveting at first, but when it’s delivered with the personality and insight of someone like @yourrichbff (a Wall Street pro and NYT Bestseller), it’s hard to scroll past.

-

Hashtag Campaigns That Stick: With over 6 million total hashtag reach and a dedicated hashtag that trended throughout the campaign, FinTron was able to create a space where users didn’t just watch—they participated. Viewers shared their own experiences and advice, generating buzz and extending the campaign’s lifespan far beyond the influencer posts.

@fintroninvest Looking for an all-in-one finance app? Look no further! FinTron’s got you covered. From Financial Literacy Lessons to Automated Investments, earn points while investing in your future. #FinTron #money #Finance #budgeting #savingmoney #investing # learning #personalfinance #financialliteracy #cash #points #rewards #goals ♬ original sound - FinTron

Campaign Impact

-

Massive Reach: The campaign wasn’t just seen—it was felt. With 5.6 million TikTok views and 289k likes, FinTron’s app became a part of the financial conversation, one TikTok at a time. The total combined followers of all the influencers involved? 12.6 million. That’s an audience bigger than some countries.

-

Engagement Through the Roof: With 2,377 shares, the campaign not only sparked interest but encouraged users to pass the information along to their networks, making it a true viral success. In the world of finance, where content can often be dry, FinTron proved that learning how to manage your money can actually be exciting.

The Takeaway

In a sea of personal finance apps, standing out is no easy feat. But FinTron cracked the code by leveraging the power of TikTok influencers who made personal finance feel both relevant and fun. By tapping into the TikTok universe, where short-form videos reign supreme, FinTron not only increased app downloads but also created a buzz that had people talking—and sharing.

6. Security Bank: Amplifying Savings with Influencer Power

When Security Bank set out to promote its high-interest savings account, they didn’t just rely on the traditional financial jargon and stiff brochures. Instead, they turned to the influence of social media, tapping into the powerhouse of YouTube, Instagram, and TikTok to generate buzz and excitement around their offering.

By partnering with the right influencers through Narrators, they transformed what could have been a dry savings pitch into a campaign that had people not just paying attention but engaging.

Strategic Approach

-

Multi-Channel Power Play: Security Bank didn’t just stick to one platform—this was an all-out influencer takeover. By collaborating with 21 influencers across YouTube, Instagram, and TikTok, they were able to target different segments of the audience. Whether it was the deep dive on YouTube or the quick TikTok scroll, each platform brought a unique advantage to the table, ensuring that the campaign reached its target audience wherever they were.

-

Influencer Diversity: The beauty of this strategy was the diversity of influencers involved. By working with a range of personalities who resonated with different demographics, Security Bank was able to not only increase reach but also make their high-interest savings account feel accessible and relevant to a wider group. After all, nothing says "trustworthy" quite like hearing about a financial product from a face you already know and follow.

-

Engagement at its Core: The goal was clear—create widespread awareness and drive engagement. And boy, did it work. These influencers didn’t just talk about the product; they made their followers think, ask questions, and take action.

Campaign Impact

-

Reach and Engagement: 121K engagements isn’t just a number—it’s a testament to how well the campaign resonated with audiences. With 21 influencers bringing their credibility to the table, the high-interest savings account became more than a product; it became a conversation. The total follower count of 600K speaks volumes about the potential scale Security Bank tapped into by diversifying platforms and influencer types.

-

Widespread Awareness: Security Bank successfully achieved its primary objective—creating a buzz around their offering and making sure people took notice. Whether it was through a casual Instagram story, an in-depth YouTube video, or a fun TikTok post, the message was clear: this savings account isn’t just another product—it’s the smart way to save.

@securitybankph With just PHP10,000 you can open a savings account with Security Bank's Money Builder Savings Account for your emergency fund, a savings account that continuously rewards you as your money grows 💚💙 Open an account online via www.securitybank.com/tkMB-NicoleOh #BetterBanking #SecurityBank #MoneyBuilder #savingmoney #financetiktok #banksph #highinterestrates #passiveincome ♬ original sound - Security Bank PH

The Takeaway:

If you want to make a financial product stand out, make it fun—and get influencers on your side. Security Bank’s multi-platform strategy demonstrated that with the right influencers, even a product like a high-interest savings account can spark a real conversation. So, the next time you think your offering is too “boring” to market, just remember: with the right strategy, you can turn savings into a trend.

Personal Finance Tools: Innovating Engagement and Trust in the Digital Age

Across these campaigns, successful strategies included multi-channel influencer engagement, making finance feel accessible, and sparking interactive conversations. Brands that embraced diverse influencers, integrated audience participation, and used viral trends saw standout results.

The personal finance sector continues to evolve with increased focus on digital engagement and trust-building. Brands should experiment with interactive content and cross-platform campaigns to stay relevant in this growing space. The future is digital, social, and engaging.

Frequently Asked Questions

What is influencer marketing in personal finance?

Influencer marketing in personal finance involves partnering with influencers—individuals with a significant online following—to promote financial tools and services, such as budgeting apps or investment platforms, to their audience.

How do influencers impact personal finance tools?

Influencers can build trust and credibility, making financial tools more relatable and accessible to their followers. Their endorsements can simplify complex financial concepts and encourage adoption of these tools.

Why should financial brands use influencer marketing?

Influencer marketing helps financial brands reach a targeted audience, build trust, and educate consumers on financial products. It can also simplify complex financial concepts and increase engagement with potential users.

What types of influencers are best for promoting finance tools?

Micro and nano-influencers, who have smaller but highly engaged audiences, are often more effective for promoting finance tools. They tend to have higher engagement rates and can provide more personalized recommendations.

How can I measure the success of an influencer campaign?

Success can be measured through key performance indicators (KPIs) such as engagement rates, click-through rates, conversion rates, and return on investment (ROI). Tracking these metrics helps assess the effectiveness of the campaign.

What are the legal considerations when working with influencers?

It's important to ensure that influencers comply with regulations, such as disclosing sponsored content as per FTC guidelines. Financial product promotions are often regulated by external agencies, including government organizations like the FDIC, FTC, and SEC.

How do I choose the right influencer for my campaign?

Select influencers whose audience demographics align with your target market. Consider their content style, engagement rates, and authenticity. Tools like influencer marketing platforms can assist in identifying suitable influencers.

What content formats work best for promoting finance tools?

Educational content, such as tutorials, reviews, and personal finance tips, tends to resonate well. Short-form videos on platforms like TikTok and Instagram Reels are particularly effective for engaging audiences.