Social commerce has grown dramatically over the last few years, but it’s particularly strong in China. Much of its success and growth in this country can be linked to the popular Chinese messaging app, WeChat, that encourages the activity.

If you haven’t used social commerce yet, let alone know what it is, by definition it’s the process of selling products directly via social platforms such as Facebook, Instagram, Twitter, or, if you’re in China most probably WeChat. What’s more, it also seeks to engage online shoppers by offering expert product advice and support.

Social commerce recognizes that social media is inherently social. So, you can use groups, forums, and communities to research products and compare notes about online shopping experiences. Related to this is "conversational commerce," as coined by Uber's Chris Messina. In 2015, Messina predicted that messaging apps, like Facebook Messenger and WhatsApp, would facilitate online sales in a more convenient, conversational manner. This enables consumers to interact with brands in real time.

Although it’s still relatively early days for social commerce (and conversational commerce), here are some of the most interesting statistics about its current adoption and other social shopping trends that will help transform economies across the world.

Key Social Commerce Statistics You Should Know in 2023:

- 1. Global Social Commerce Sales Estimated to Reach $1.298 Billion in 2023

- 2. Each Day Users Spend 2+ Hours on Social Media

- 3. About a Quarter Mainly Use Social Media for Shopping

- 4. China Is the Social Shopping Leader

- 5. Social Commerce Is Also Popular in Asia-Pacific Regions

- 6. eCommerce Still Twice as Popular in the UK and US

- 7. The Number of US Social Buyers to Increase to $68.91 million in 2023

- 8. Social Commerce Adoption in Other Parts of America Also Promising

- 9. WeChat Drives the Growth in China

- 10. Pinduoduo Has 750+ Million Monthly Active Users

- 11. Facebook Is the Most Popular Platform in the US

- 12. YouTube Is the Most Trusted Social Network for Shopping

- 13. The Average Sale per Buyer Is $500+

- 14. Nearly a Third Use Social Media for Holiday Shopping

- 15. Deals and Discounts Main Driving Force

- 16. Good Reviews Remain Supreme in Customer Acquisition.

- 17. It’s Most Popular Among Gen Zers

- Frequently Asked Questions

17 Social Commerce Stats

1. Global Social Commerce Sales Estimated to Reach $1.298 Billion in 2023

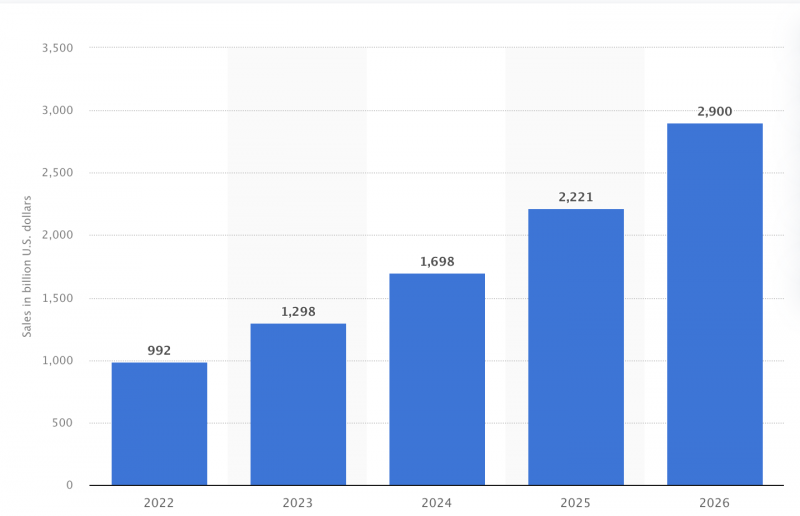

According to online data shared by Statista, it’s estimated that in 2023 sales via social media platforms across the world will add up to $1.298 billion. Its popularity is showing no signs of dying down and further predictions anticipate that it will reach nearly $3 trillion by 2026.

Source: statista.com

2. Each Day Users Spend 2+ Hours on Social Media

According to the Digital 2022 Global Overview Report, the average daily time spent using social media is 2 hours and 27 minutes. To put this into perspective, more than a third of the time that internet users aged 16 to 64 spend online are spent on social media. And, it’s not just on the same platform. According to the report, each month 7.5 social media platforms are visited.

3. About a Quarter Mainly Use Social Media for Shopping

When internet users aged 16 to 64 were asked what their main reasons for using social media were, nearly 28% indicated that it was to find inspiration for things to do or buy. Just over 26% revealed that it was to find products that they could buy. Even if they’re not using it for shopping, it’s proving to be an effective channel for brands with 23% answering that they mainly use it to see the content posted by their favorite brands.

4. China Is the Social Shopping Leader

When it comes to social commerce, China is at the forefront (and by a long shot). As of 2022, 84% of Chinese consumers have done shopping on social media channels.

To put this into perspective, about 36% of US internet users are social buyers. This means that more or less 90 million US consumers have bought on at least one platform. In the United Kingdom, the picture looks pretty much the same with a third of surveyed consumers having shopped via a social network at least once.

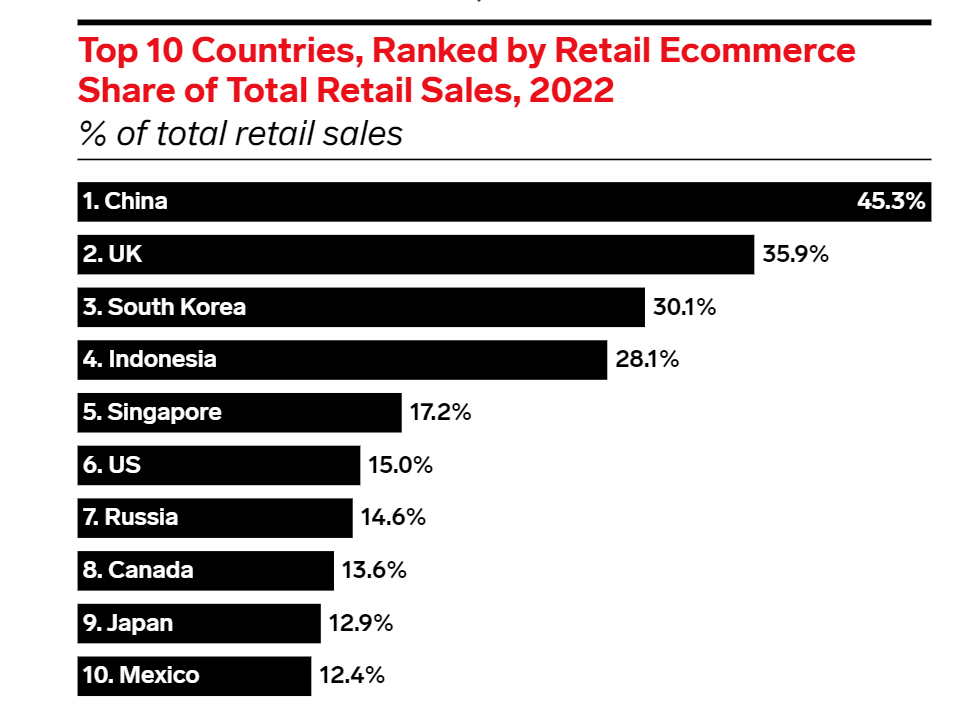

China's eCommerce makes up 45.3% of the country's retail sales, or three times larger than the size of the American eCommerce market (16.1%) as of June 2022, according to eMarketer. And, it’s showing no signs of slowing down any time soon…

ResearchAndMarkets.com forecasts that China's social commerce industry could hit $2 trillion by 2028 from its 2022 value of $363 billion. The market research firm said the sector’s value would grow at a compound annual growth rate of 33.7% between 2022 and 2028.

5. Social Commerce Is Also Popular in Asia-Pacific Regions

If you extend your scope a bit further, you’ll also find that social commerce is a popular activity in the Asia-Pacific (APAC) region, specifically in Thailand. A survey completed in 2022 among online shoppers from this region found that a whopping 88% of respondents from Thailand have shopped via social media. The actual conversion rate is also high with 62% having completed their transactions.

6. eCommerce Still Twice as Popular in the UK and US

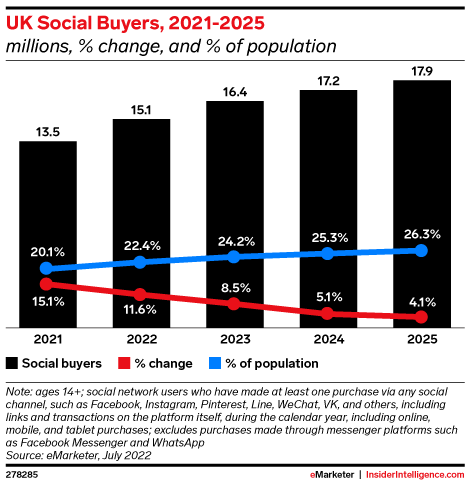

Insider Intelligence expects the UK's social buyers to make up less than 25% of the nation's consumer market in 2023, even if over 80% now shop online. Meanwhile, consumer research platform Attest said in its “UK Direct-to-Consumer Report 2022” that results of online searches will trigger most buying decisions (22%), followed by social media (10.4%) and email marketing (8.5%).

However, starting one's online shopping journey on social platforms is becoming popular among younger consumers. FIS Global reported that 70% of millennials and 78% of Gen Zers in the UK buy directly on social channels.

In the US, social commerce still only accounts for a fraction of online retail sales. The social commerce share of online retail sales in the U.S. stands at 4.4% as of 2022, with social buyers making up 32% of all online consumers in America. It’s expected that about 5% of the total eCommerce retail sales will be via social channels by 2025.

On the other hand, social commerce already accounted for 11.7% of total Chinese retail eCommerce sales in 2020. This figure has risen to 52% in 2022. Influencer Intelligence predicts that 60.9% of Chinese social commerce sales in 2023 will come from livestreaming alone (about $281.21 billion).

7. The Number of US Social Buyers to Increase to $68.91 million in 2023

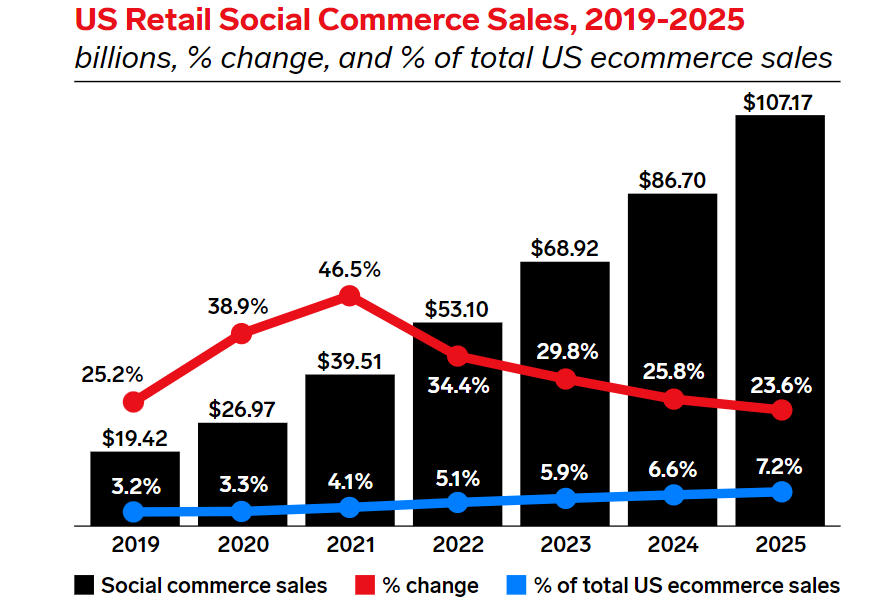

While China still leads the way, it’s anticipated that social commerce will continue to grow in the US. It’s expected that by 2025 the United States will have about 108 million social buyers. Social commerce sales may soar to $107.17 billion by the same year, according to eMarketer.

The value of America’s social commerce sales rose to $68.91 millions in 2023, making up 5.9% of all online sales. This figure was an improvement from the $39.51 million recorded in 2021.

8. Social Commerce Adoption in Other Parts of America Also Promising

In other parts of North and South America, social commerce adoption is also on the increase. A study completed in 2022 revealed that about two thirds of online consumers in Mexico have bought something via social media. What’s more, most of the remaining 33% who haven’t used it yet showed interest in trying it out in the near future.

In Brazil, the picture is more or less similar with 62% indicating that they’ve used social commerce. Though, fewer of those who haven’t tried it yet showed interest in exploring it in the future.

However, in Canada, social commerce adoption is lagging behind. Although according to the 2022 Canadian Ecommerce Trends Report by Bolt Logistics, 47% of the nation's social media users bought something from social platforms that same year.

It’s projected that it will enjoy a compound annual growth rate (CAGR) of about 20% for the next six years to reach just over $20 million by 2028.

9. WeChat Drives the Growth in China

Much of the boost in social media commerce in China can be attributed to the development of WeChat Mini Program stores. In a nutshell, WeChat Mini Programs were launched in 2017 and are a type of sub-application within Tencent’s WeChat, China’s most popular messaging app.

WeChat Mini Programs is an ecosystem of cloud-based apps embedded within WeChat and offer advanced features like eCommerce, task management, and coupons.

And many major eCommerce retailers and brands have created Mini Programs to sell their products. In 2022, WeChat recorded 450 million active WeChat Mini Program users daily. 67% of users access these programs over four times per day.

While WeChat is huge in China, it doesn’t hold the same popularity across the world. After WhatsApp, Instagram, and Facebook, WeChat is the world’s favorite social media platform, according to the Digital 2022 Global Overview Report. In terms of global active users, though, it’s in fifth position with 1.2 billion users.

10. Pinduoduo Has 750+ Million Monthly Active Users

One successful store with a WeChat Mini Program store is Pinduoduo. They’re even more "social" than just a store on a social app. They use a group buying model which means that the more friends somebody brings in, the higher the discount they will receive.

In short, Pinduoduo is the largest agriculture-focused technology platform in China and its platform connects farmers and distributors with consumers directly through its interactive shopping experience.

Over the years, Pinduoduo has experienced tremendous growth, in large part due to its social commerce business model. Its market share and user base have grown noticeably since 2018. In less than 10 years since it started, it has grown to become China’s second biggest online marketplace in terms of monthly visits, recording about 263 million monthly visits. Pinduoduo earned $4.99 billion in revenues for Q3 2022, up 65% year-on-year.

11. Facebook Is the Most Popular Platform in the US

In 2020, Facebook launched Facebook Shops with the goal of helping small- and medium-sized businesses to create online storefronts. It’s been a huge success and, during a Clubhouse discussion, Mark Zuckerberg revealed that 250 million people interact with it per month. A 2022 Hootsuite report showed that one million Facebook users buy from Shops monthly. Some brands said their sales through Facebook Shop exceeded the sales from their websites by 66%.

What’s more, a survey completed in the middle of 2022 has identified Facebook as the leading social network for shopping in the US. While social commerce is more popular among younger audiences, digital shoppers across all age groups have listed Facebook as their top channel. Almost one out of every five US digital shoppers have stated that they’ve used Facebook for shopping, compared to Instagram that was used by 12% and YouTube by 9%. In terms of time, Facebook users spend nearly 20 hours per month using the Facebook app.

In 2022, it’s estimated that about 63.5 million US shoppers made a purchase via the platform. It’s expected that it will remain the top social commerce platform for the next few years at least and online data shared by Statista predicts that by 2025 it will have nearly 70 million shoppers, while Instagram will have about 47 million.

Pinterest and TikTok are also expected to attract more social buyers by 2025. At the beginning of 2022, when TikTok shoppers were asked about their shopping habits on the platform, nearly 60% revealed that they used it for shopping inspiration. In a blog post released in Q3 2022, TikTok said that 48% of subscribers they surveyed expressed interest in placing an order on the platform in the next three months.

12. YouTube Is the Most Trusted Social Network for Shopping

In the United States, YouTube is the social network that consumers trust most for product research and purchases. A survey completed in 2022 revealed that 61% of US consumers found it trustworthy for social commerce. In second spot was Facebook along with Instagram.

13. The Average Sale per Buyer Is $500+

In the United States, the average retail social commerce sale per shopper is expected to be over $640 in 2023. What’s even more impressive is that online data suggests that it will nearly double in just two years to about $937.

14. Nearly a Third Use Social Media for Holiday Shopping

Statista said that 34% of respondents to a 2022 survey answered that they would use social media to look for or buy items they need for the holiday season.

It’s especially popular for finding inspiration with 70% of US consumers admitting that they used at least one social media network for gift ideas. For 2022, the Deloitte Holiday Retail Survey showed that 60% of Gen Z and 56% of millennial shoppers will use social media for their holiday shopping.

15. Deals and Discounts Main Driving Force

The main factor that motivated shoppers to shop more via social media was deals and discounts. This counted for online shoppers from all over the world. Nearly 40% of online shoppers surveyed identified this as their biggest motivator.

Convenience was listed as the second biggest driver with 31% identifying ease of use as the reason why they embraced social commerce. Exclusivity was also one of the leading driving forces with 27% listing exclusive deals as their primary driver.

16. Good Reviews Remain Supreme in Customer Acquisition.

Social buyers across generations continue to put a premium on positive reviews when buying on social platforms. In "The Future of Social Commerce Report 2023 & Beyond," brand advocacy platform Duel showed that social shoppers across all generations (54% among Gen Zers, 65% among millennials, 55% among Gen Xers, and 47% among baby boomers) ranked poor reviews as the top reason for deciding not to proceed with a purchase in a particular channel. Lack of trust in the brand was the second factor among millennial (51%) and Gen Z (52%) social consumers.

Meanwhile, customer reviews were also the top consideration among millennial buyers (56%) when asked what might influence them to buy an item from a specific platform. Gen Z, Gen X, and baby boomer shoppers answered that being shown products of interest will be the prime factor that will convince them to buy from a social media channel.

17. It’s Most Popular Among Gen Zers

It probably doesn’t come as a huge surprise that in the United States social commerce is most popular among Gen Z consumers.

In 2022, more than 25% of online consumers aged 18 to 34 did their shopping on Facebook and Instagram, which are America's top social commerce players based on eMarketer data.

The picture looks more or less the same in the United Kingdom. According to data shared by Statista, at the beginning of 2022, more than half of Gen Zers and millennials in the UK have visited a brand’s social media store at least once.

If you break it down further according to gender, data shows that social commerce is more popular among Gen Z women than Gen Z men. About 43% of Gen Z women have bought a product via social networks, compared to only 37% of men in this age group. This trend was also true when it came to discovering new brands via social channels or visiting a brand’s store on social media.

Even if Gen Z shoppers don’t end up buying something through social media, it’s still a useful source for shopping. A survey completed in 2022 has revealed that nearly a third of US shoppers in their early 20s begin the purchasing process through social media platforms by, for example, searching for info about the product.

Wrapping Things Up

If your brand is not embracing social commerce yet, what are you waiting for? Surely, it’s not for more consumers to catch up as virtually everyone is planning to give it a go.

While eCommerce sales are still responsible for the biggest share, it’s a good idea to explore social commerce as well. This way, if the scale should tip in favor of social commerce in the near future, you’ll be ready.

You don't want to be one of those brick-and-mortar stores that had to scramble to put together some kind of online store last minute. These stats suggest that eCommerce is going to follow a similar path. Increasingly more customers will want to visit your “social media store” instead of your “online store”.

Frequently Asked Questions

What is social commerce?

Social commerce happens when you use social network platforms such as Facebook, Twitter, Instagram and, perhaps even, WeChat (a popular Chinese messaging app) to buy and sell services and goods. It aims to engage online shoppers by offering expert product advice and support. It has grown a lot over the last couple of years and is particularly strong in China where the retail social commerce sales added up to $186.04 billion. In the US, retail social commerce sales were only $19.42 billion.

What is Pinduoduo?

Pinduoduo is a successful store with a WeChat Mini Program store. What makes them unique is that they use a group buying model. The more friends you bring in, the more discount Pinduoduo will give you. The store has experienced significant growth to become the third biggest e-commerce player in China.

How much time do people spend on average on social networking?

In total, the average person spent 144 minutes per day on social networking. This was an increase of an hour per day (62.5%) in seven years. That being said, the time spent differs significantly from country to county. Though, surprisingly, people from poorer parts of the world like Africa and South America spent the most time on social networking (averaging more than three hours per day).

On which social network do people spend the most time?

According to studies, on average, people spend the most time on Facebook. SimilarWeb studies show that the time an average person spends on Facebook per day is 58 minutes. This is followed by Instagram with people spending an average of 53 minutes per day on this platform. YouTube is in third place with users averaging 40 minutes per day.

What are the most important social channels for B2B research?

According to a work survey completed by We Are Social / GlobalWebIndex, YouTube and Facebook are used the most by B2B decision makers when researching new services or products to buy. Other important social media networks for B2B research are WhatsApp, Instagram and LinkedIn. While B2B decision makers still prefer to contact suppliers via email, 23.3% prefer to reach out to them by means of social media.