Despite Snapchat reporting an operating loss for a third consecutive year in 2023, its engagement statistics and innovation are noteworthy. Features like its AI-powered chatbot, AR lenses, stickers, and direct messaging make it a popular platform among younger social media users.

While Snapchatters use the app for shorter periods compared to its competitors, they’re genuinely happy while using it. It manages to create a happy user experience, which can leave social media strategists, brands, and investors equally happy as the following financial metrics and engagement data show.

Snapchat Revenue Statistics

1. Revenue for Q2 2024 increased by 16%

Snapchat’s global revenues for Q2 2024 stood at $1.237 billion, a 16% increase from the same period in 2023. The revenue for the three months ended June 30, 2023 added up to just over $1 billion, according to an official Snapchat press release.

2. Revenue increased with nearly 21%

While Snapchat enjoyed a year-on-year (YoY) increase of 20.85% between Q1 2023 and Q1 2024, it’s still lagging behind other top social media companies. Meta platforms boast a YoY increase of 27.26% for this period, while Pinterest is only slightly ahead of Snapchat with 22.72%.

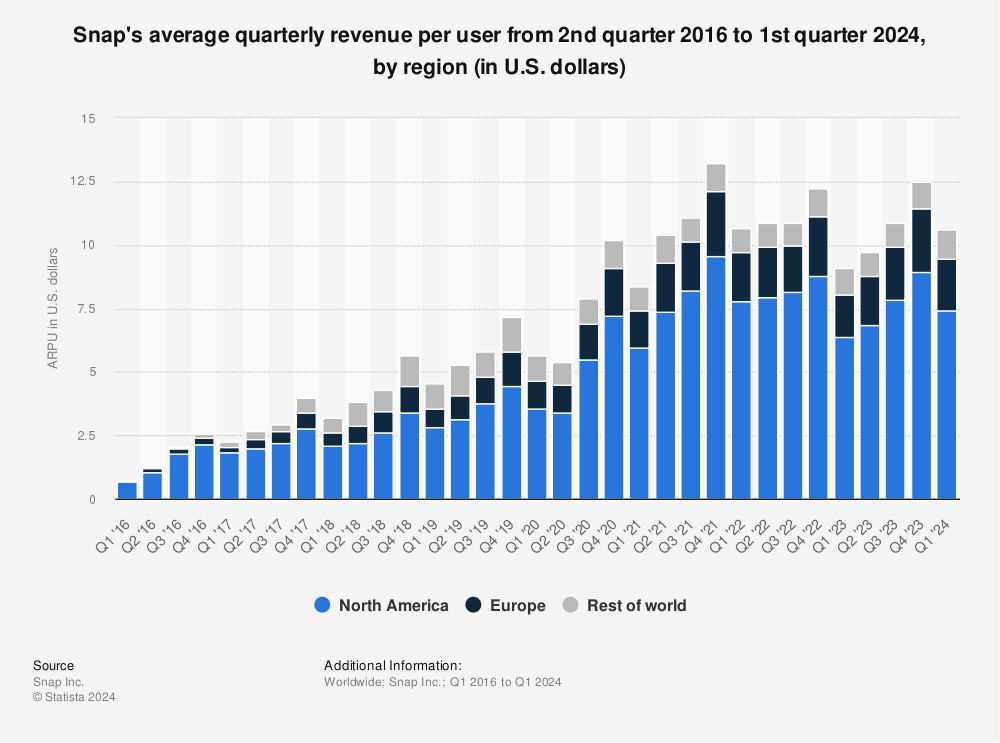

3. The global average revenue per user is nearly $3

As of Q2 2024, the average revenue per user was $2.86. While it’s not the highest it has ever been, it’s still a huge increase from a few years ago.

Back in Q1 2016, the average revenue per user (ARPU) was just $0.32. This grew steadily for most of that year, reaching $1.05 per user in Q4 2016.

The ARPU has fluctuated each quarter since then (recognizing some seasonality of revenue generation), but the overall trend has been upward. It first broke the $2.00 mark in Q4 2018, with an ARPU of $2.09.

4. North America generates the highest average revenue per user

The average revenue per user (ARPU) is the highest in North America ($7.67). Snapchat's ARPU in Europe was $2.36 while the worldwide ARPU was $1.02 for Q2 2024.

5. Snapchat+ has 14+ million subscribers

As of Q24 2024, Snapchat+, its paid subscription model, boasted 14 million subscribers.

It was launched only in June 2022 as a way to create extra revenue streams in addition to advertising. Its subscriber growth started to gain significant steam in April 2023 when it had 3 million subscribers.

Snapchat+ offers pre-release and experimental features like:

- Special icons and badges

- Customization

- Improved Stories

Subscribers can, for example, add AI-generated pets viewable next to Bitmojis in chats. Similar to WhatsApp, Snapchatters can now also edit unviewed messages within five minutes after sending them.

Subscription pricing is based on device and country, but you’re looking at about $3.99 per month. It’s one of the cheapest subscription plans with Meta Verified, Twitter Blue, and Reddit Premium all charging more per month.

Snapchat Marketing and Advertising Statistics

As you may already know, Snapchat is much less popular for marketing than other platforms like Instagram and Facebook. But it is experiencing some improvement in this aspect with more marketers leveraging the platform for their marketing campaigns. It does offer some interesting advertising features such as sponsored lenses.

1. It has a potential ad audience of nearly 680 million

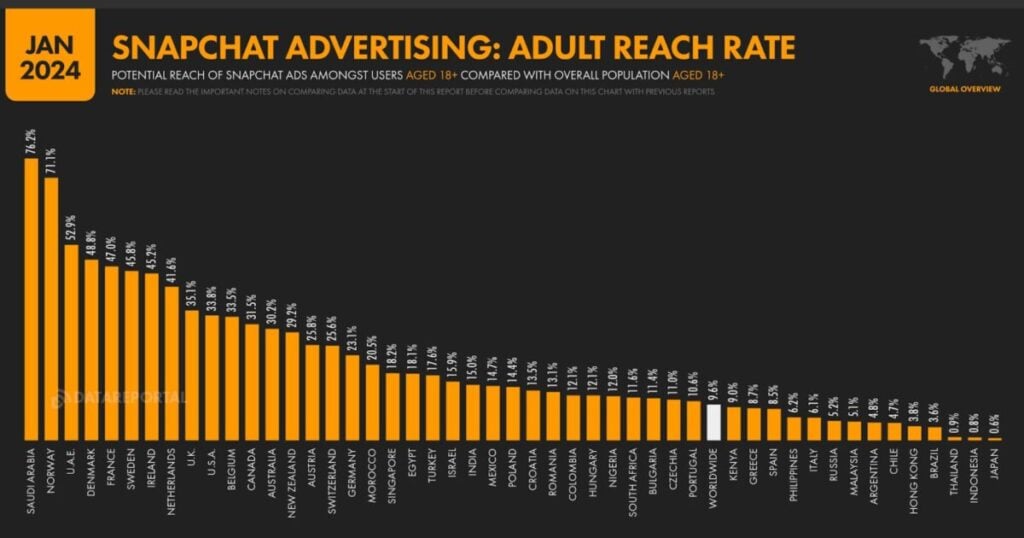

Meltwater and We Are Social's Digital 2024 Global Overview Report examines the advertising audience of each social network, including Snapchat. They observe that the potential audience that can be reached with adverts on Snapchat is 677.7 million, which is 8.4% of the total population aged 18+.

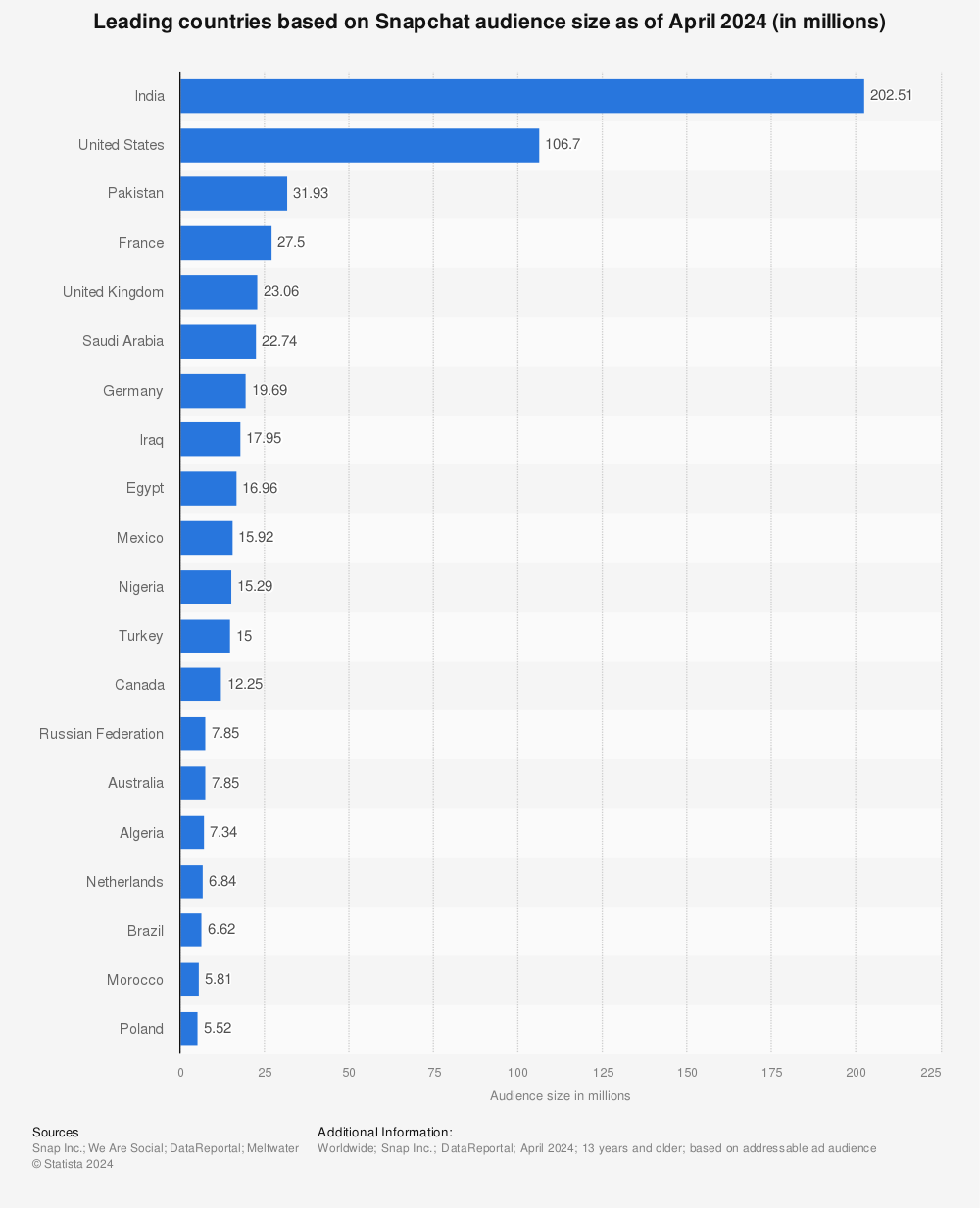

2. India has the biggest ad audience

India has the largest Snapchat audience with 202.51 million users based on Statista's April 2024 data. The U.S. was in second place at 106.7 million.

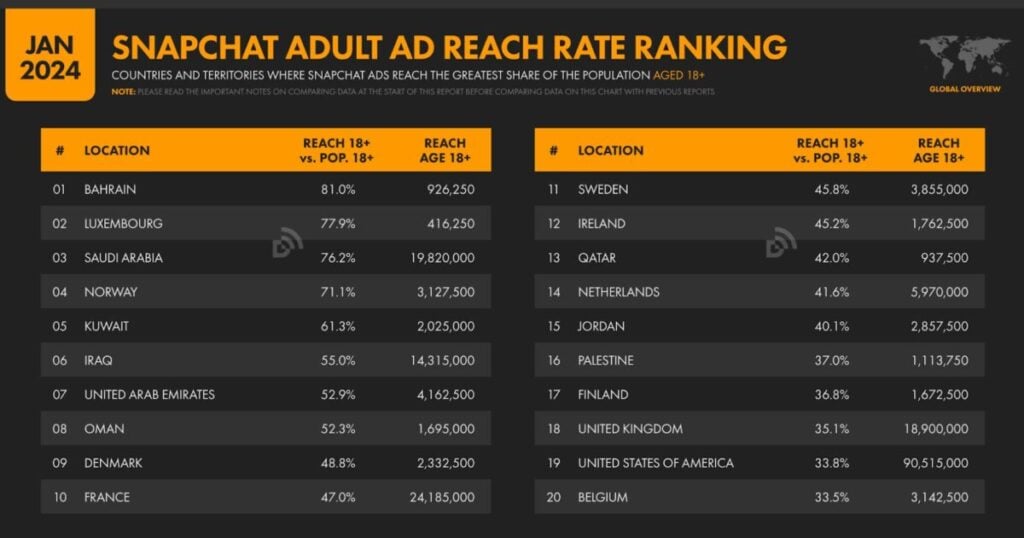

That said, while India has the biggest audience, Snapchat Ads reach the biggest share of the population in Bahrain. Here, ads on the platform can reach 81% of the population.

To put this into perspective, in the U.S. ads reach only about a third of the adult population. India has a reach of merely 15%, even though it’s the country with the most users. However, both the U.S. and India are still well over the global average of 9.6%.

We Are Social

3. Global ad revenue expected to exceed $4 billion in 2024

According to EMARKETER’s March 2024 predictions, Snapchat’s advertising revenues worldwide will add up to $4.04 billion in 2024. If it reaches this number, it will work out to a YoY increase of 10.5%. Considering that the platform’s ad revenues decreased in 2023 by 3.5%, this growth rate is a significant improvement.

The U.S. will account for more than half of the total ad revenue in 2024, accounting for $2.079 billion.

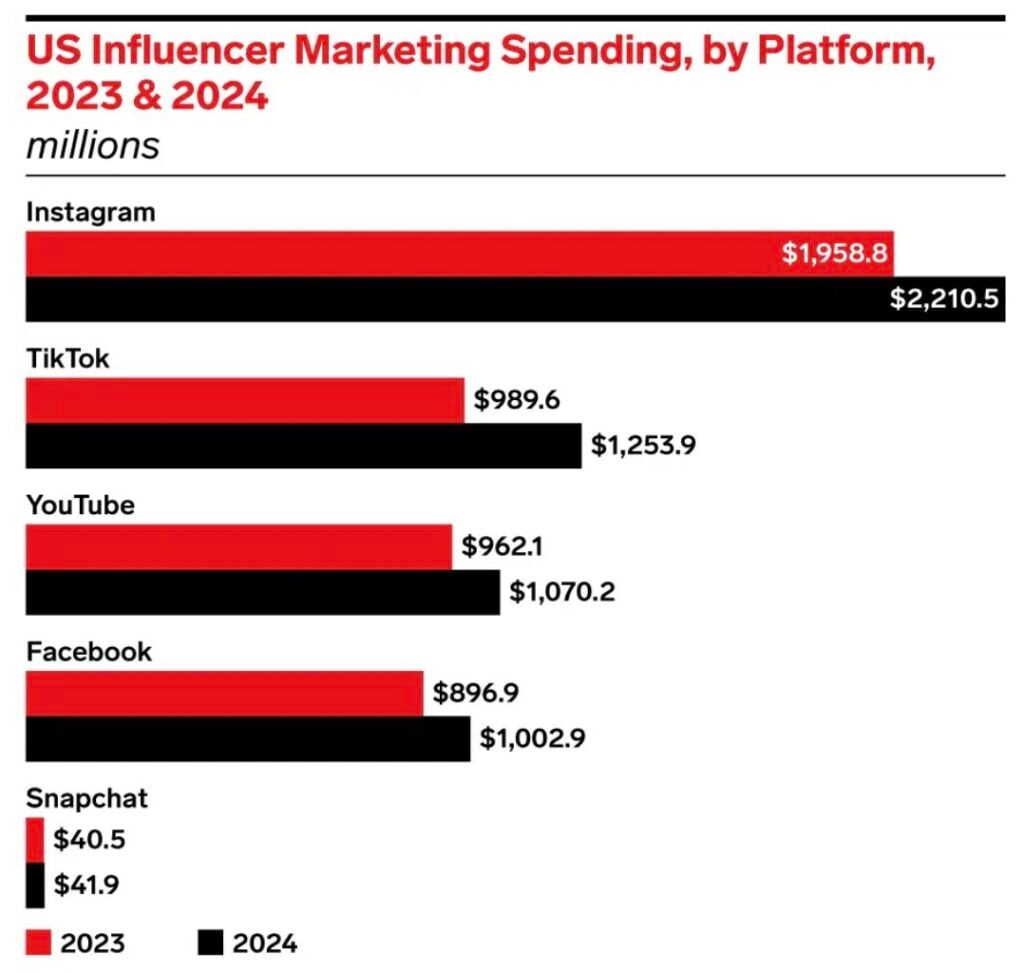

4. Only 23.1% will use Snapchat for influencer marketing

Less than a quarter of influencer marketers (23.1%) will use Snapchat in 2024 for influencer marketing, according to EMARKETER’s March 2024 forecast.

This can be attributed to the fact that only 8% believe that Snapchat Spotlights is the platform that delivers the best return on investment (ROI) for short-form video, as per our The State of Influencer Marketing 2024: Benchmark Report. On the other hand, over half of respondents believe in TikTok’s ROI potential, which is also the most common channel used by influencer marketing brands according to our report.

That said, brands are spending slightly more money on influencer marketing on Snapchat in 2024. EMARKETER’s forecast predicts that spending on the platform will increase from $40.5 million in 2023 to $41.9 in 2024.

Snapchat User Statistics

1. It has over 430 million daily active users

First, let's take a look at just how popular this app is, based on the number of users. As of the second quarter of 2024, the app had 432 million daily active users.

This is an increase of about 9% from the Q2 numbers of 2023 when there were 397 million daily active users.

Snapchat first became popular in 2014, growing consistently until it received a noticeable boost in support in 2016. Growth continued, although at a slower rate over 2017. There was a slight drop in user count during 2018. Growth picked up again in 2020 and since then it has shown no signs of slowing down.

In addition to its daily user base, Snapchat now sees around 850 million monthly active users as of early 2025. This positions it among the most-used social platforms worldwide, ahead of competitors like X (formerly Twitter) and Pinterest, and signals that Snapchat continues to hold significant global relevance despite shifting trends in the social media landscape.

This wider monthly audience reflects the app’s evolution beyond messaging, with features like Spotlight, Discover, and its growing library of augmented reality tools attracting users who don’t necessarily log in every day but still engage regularly.

2. Most users live in the APAC region

According to EMARKETER, 303.9 million Snapchat users live in the Asia-Pacific (APAC) region. Only about 13.4% of all Snapchat users are based in the United States

As of the beginning of 2024, Snapchat ads reached about 30% of the Australian adult population, making it the country in the APAC region with the highest ad reach.

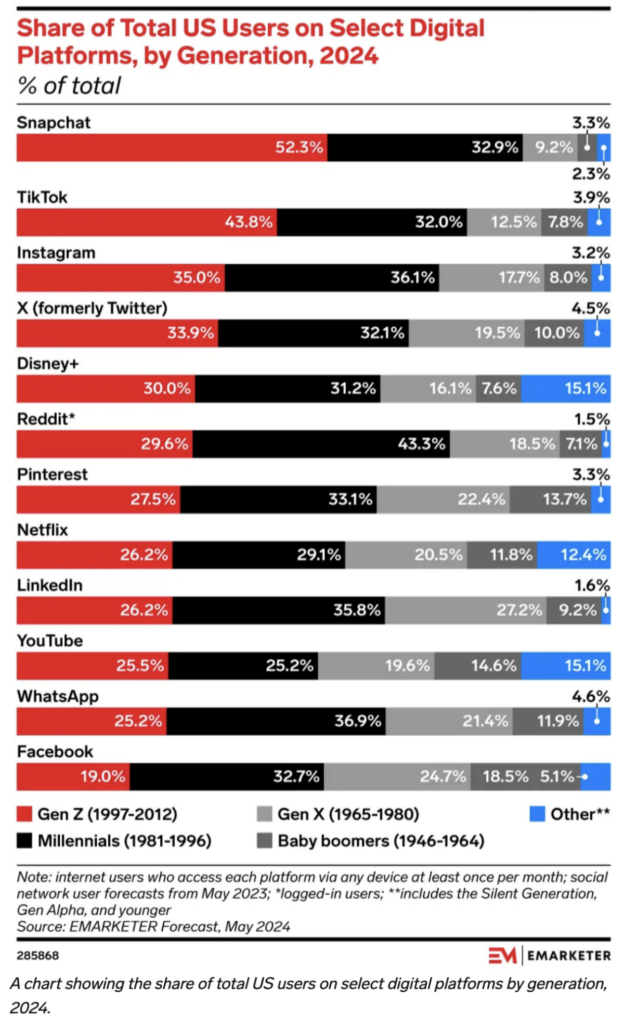

3. It has the highest share of Gen Z users

Snapchat seems to be more popular among a younger crowd, according to EMARKETER. Over half (52.3%) of Gen Z internet users in the U.S. access the platform. Of all the main social media platforms, it has the biggest share of Gen Z users.

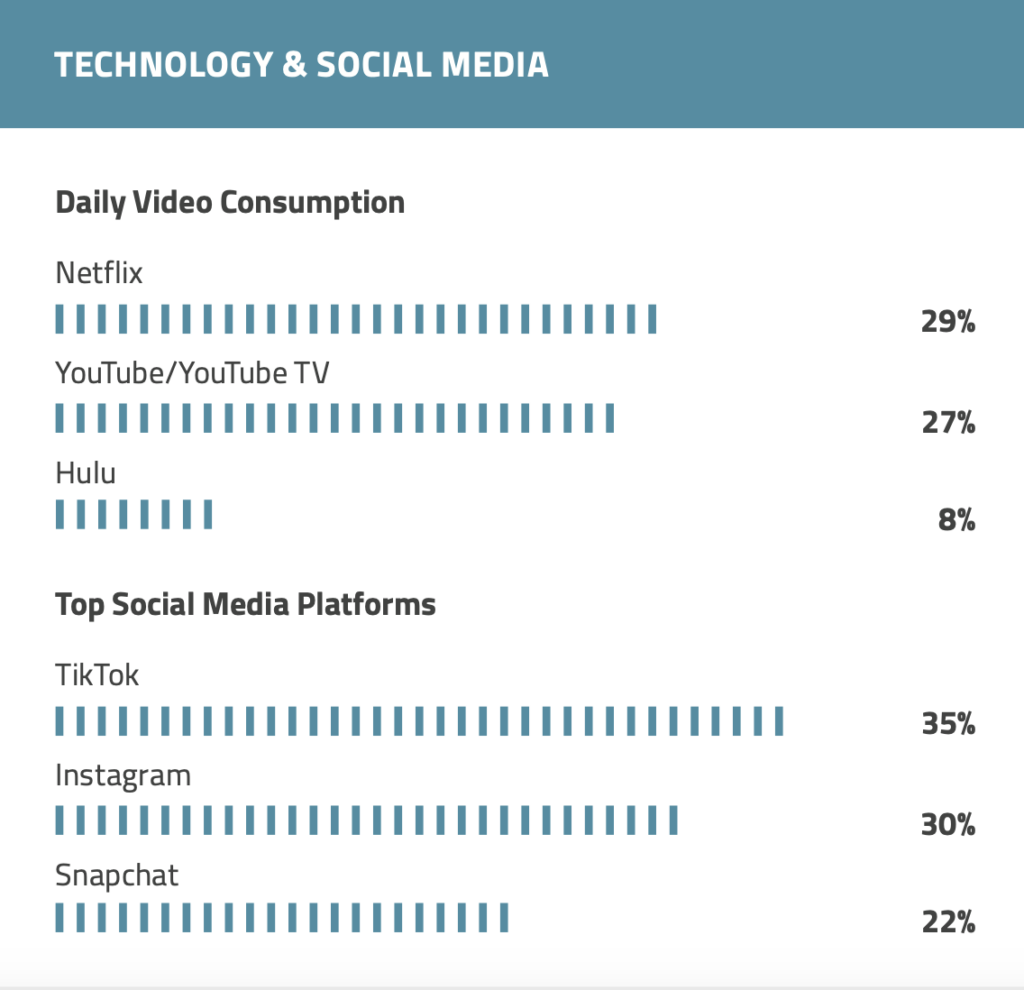

According to Piper Sandler’s 47th Semi-Annual Taking Stock With Teens® Survey, Spring 2024, Snapchat also continues to be among the top three favorite apps among teens in America. That said, its popularity has declined with only 22% of teens reporting it as their favorite app, dropping from last year’s number two spot to third position this year.

4. The number of UK users increased again after a drop

Snapchat users in the UK dipped from 21.1 million in 2021 to 20.65 million in 2022 but the number of users increased again in 2023 and 2024 to reach 23.67 million. The country also remains one of the app’s top markets. The UK is in fifth place behind France according to Statista’s ranking of countries with the highest number of Snapchat users.

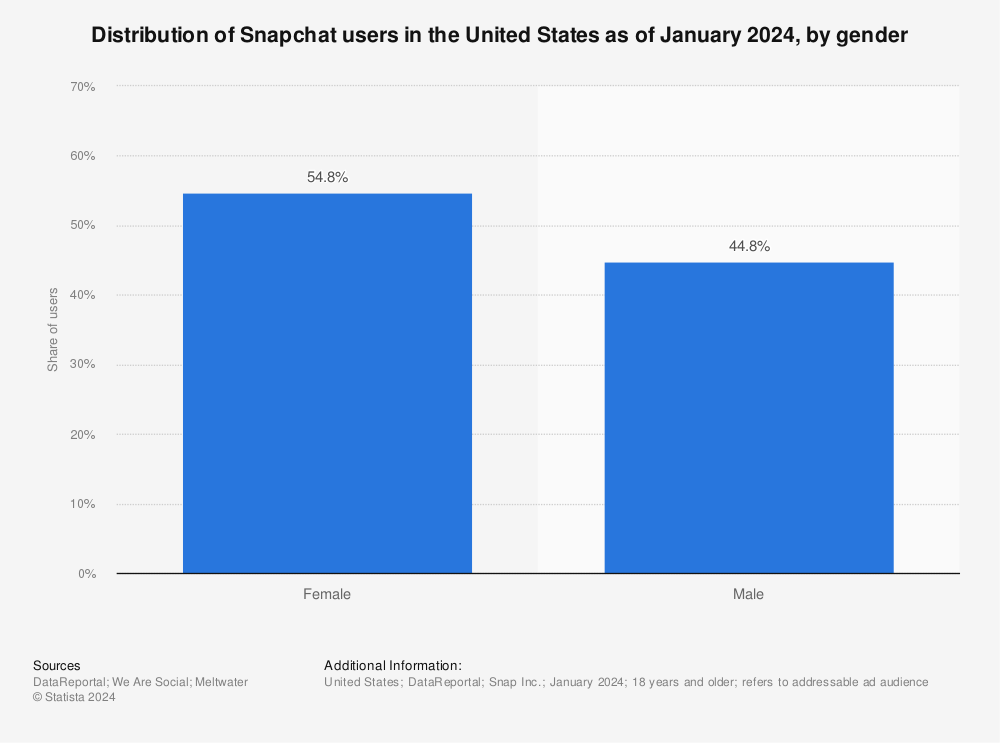

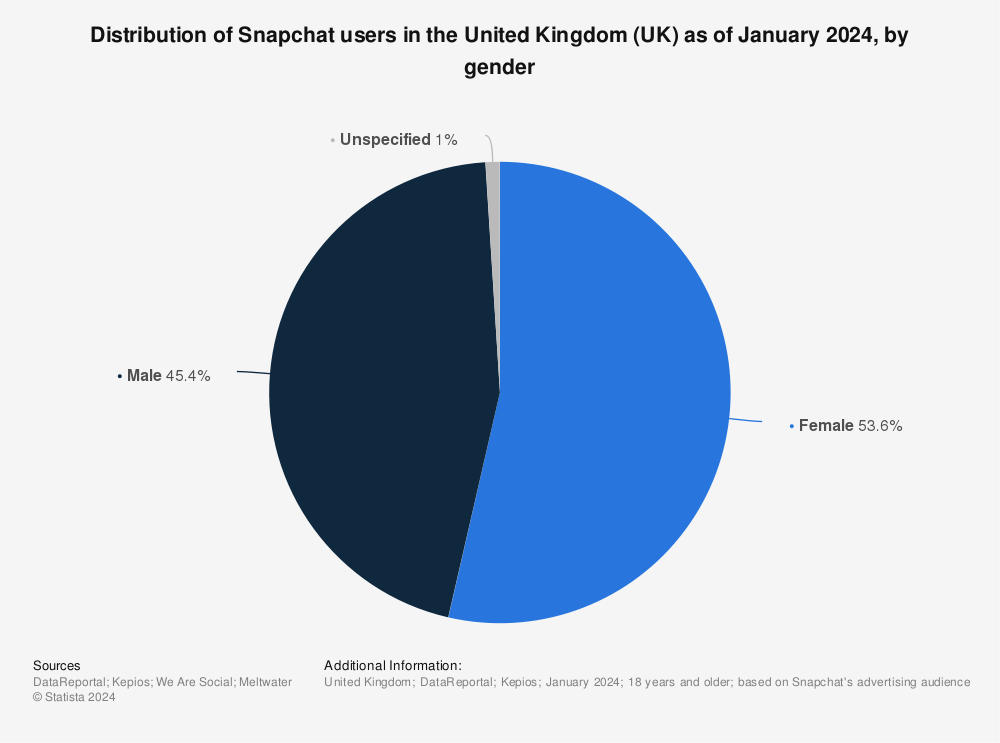

5. Slightly more male users worldwide

There is practically no difference in the distribution of Snapchat users by gender. About 49.1% of the app's users worldwide are female while about 50% are male.

Though, in the U.S. and the UK the picture looks different. Here, 54.8% of Snapchatters are women—about the same percentage in the U.K. (53.6%).

Snapchat Usage Statistics: How People Use the Platform

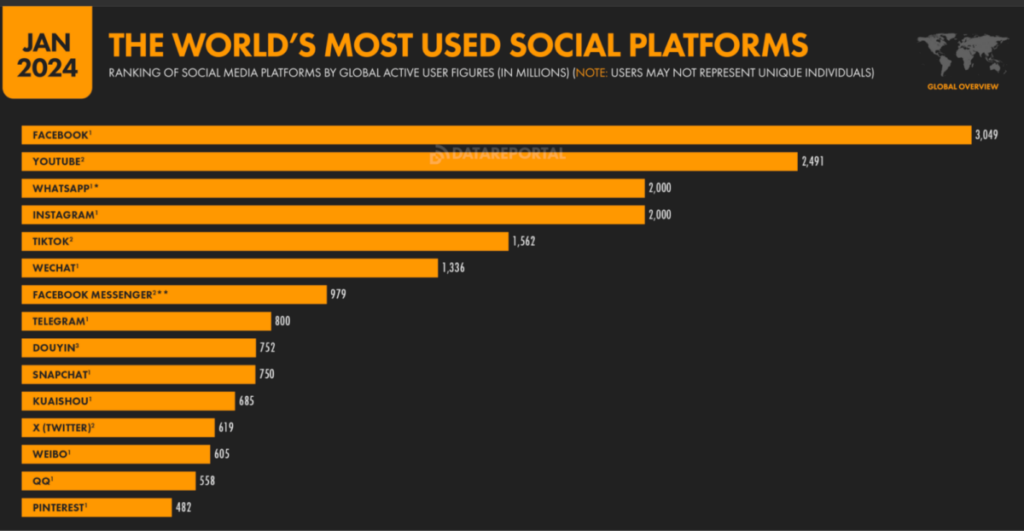

1. It’s one of the top 10 most-used social platforms

Based on the number of global active users, Snapchat is the world’s 10th most-used social platform. Of all the mainstream platforms, it’s only used more often than X and Pinterest.

We Are Social

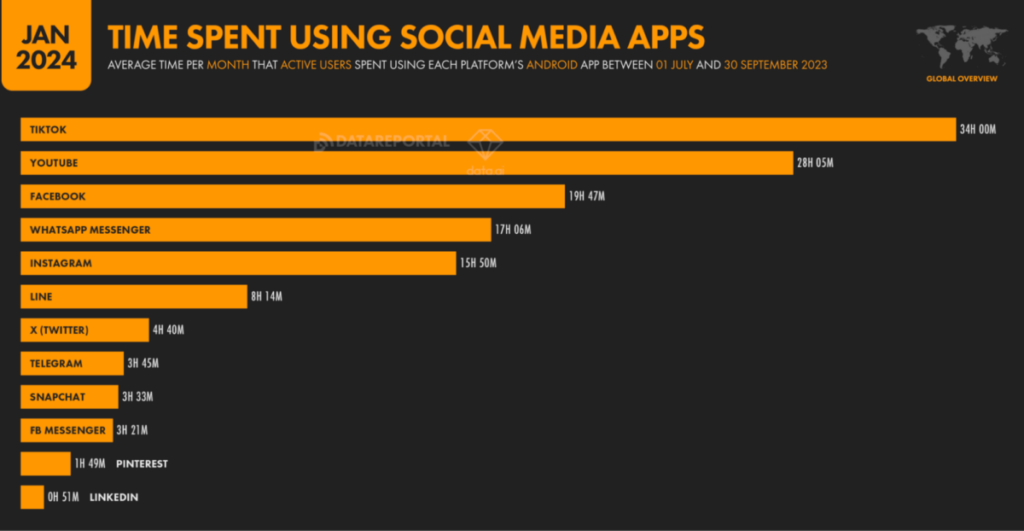

2. Average time spent per month is over 3 hours

Active Snapchat users spend on average 3 hours and 33 minutes per month using the app. While it’s used less often than Facebook Messenger, based on these numbers users spend more time using the Snapchat app than the Messenger app but only by 12 minutes.

We Are Social

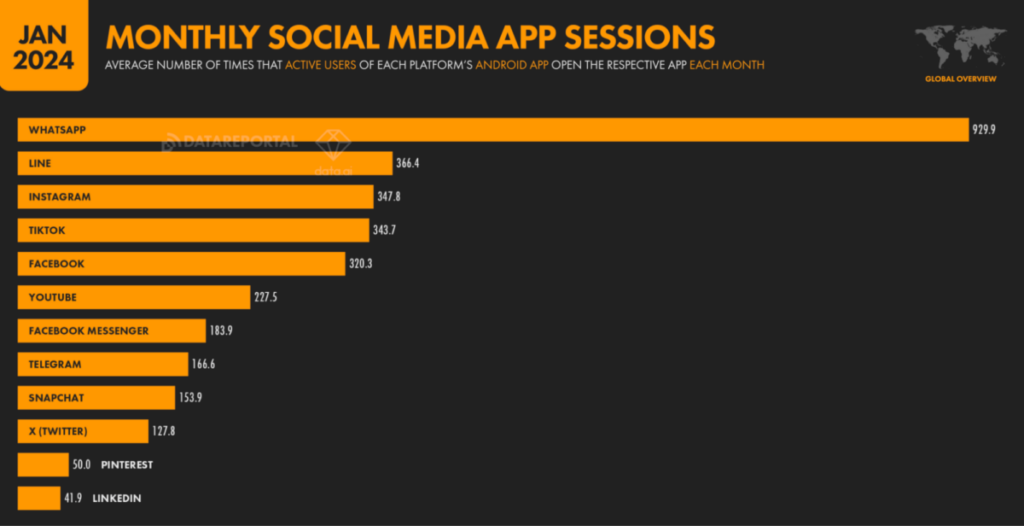

While they don’t spend as much time using the app per month compared to other platforms, they do open it multiple times. The monthly app sessions add up to 153.9 times per month which would mean that they check the app about 5 times per day.

We Are Social

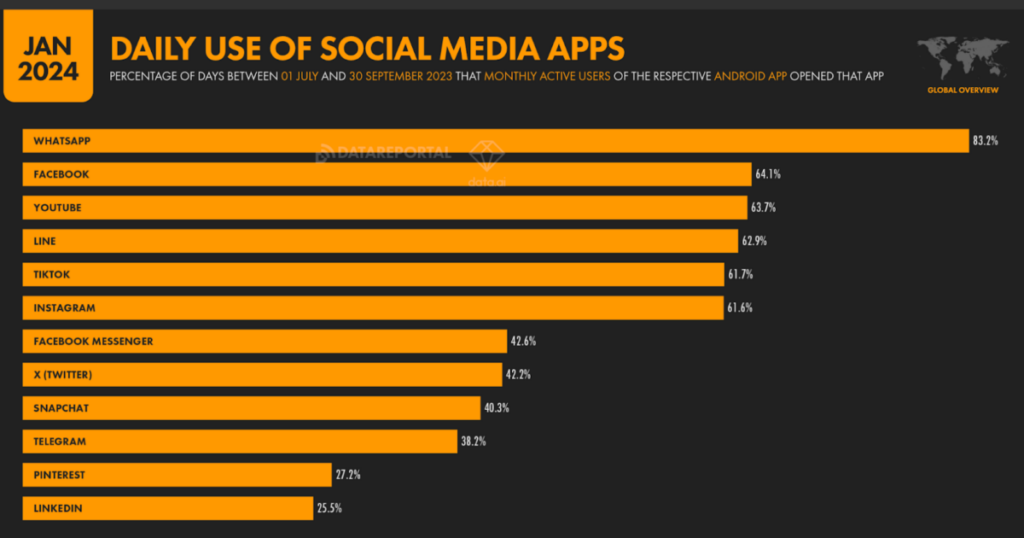

3. 40% use it daily

When it comes to usage, Snapchat gets about two-thirds of the attention that platforms like Facebook, YouTube, Instagram, and TikTok enjoy. Only 40.3% of monthly active users open the Snapchat app daily, compared to other above-mentioned platforms that were opened by 60+% of users each day.

We Are Social

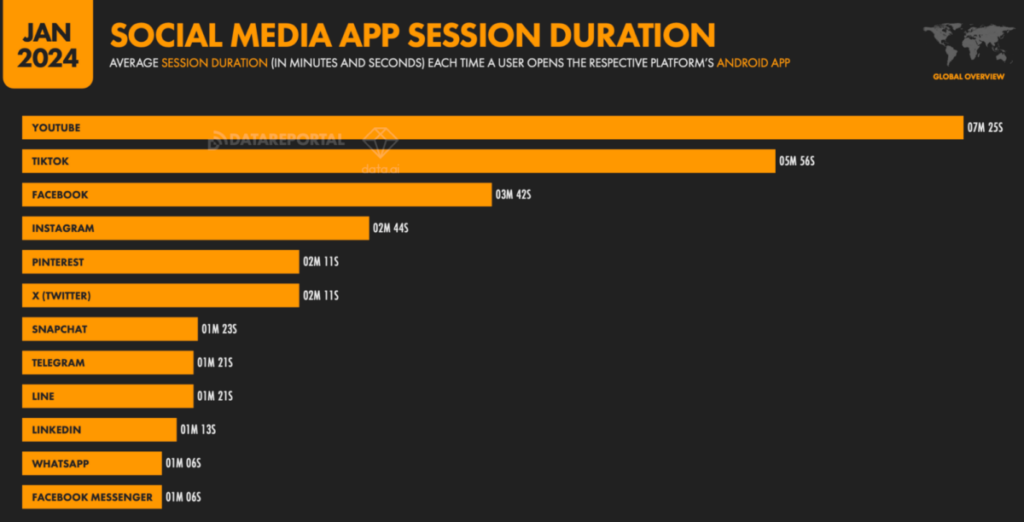

4. The app session duration is about 1 minute

The average Snapchat session duration is 1 minute and 23 seconds. On the other hand, users spend between four and six minutes longer per session on video-sharing platforms like YouTube and TikTok.

We Are Social

5. US adults spend about 8 minutes on average on Snapchat

While app sessions are short, the fact that Snapchat users typically open the app several times a day means that the total time spent per day on the app is slightly more. EMARKETER’s June 2024 forecast suggests that for US adults this will add up to about eight minutes per day on average.

This is in line with the findings of Meltwater and We Are Social. If users open the app about five times per day for 1 minute and 23 seconds, it means that they spend about 7 minutes per day using the platform.

However, considering that it’s much more popular among younger generations, it’s key to break down the time spent per age group. EMARKETER filters their forecasts further and anticipates that US adults between 18 and 24 will spend three times longer per day, averaging at nearly 30 minutes. Those in their late 20s and early 30s will spend about 15 minutes.

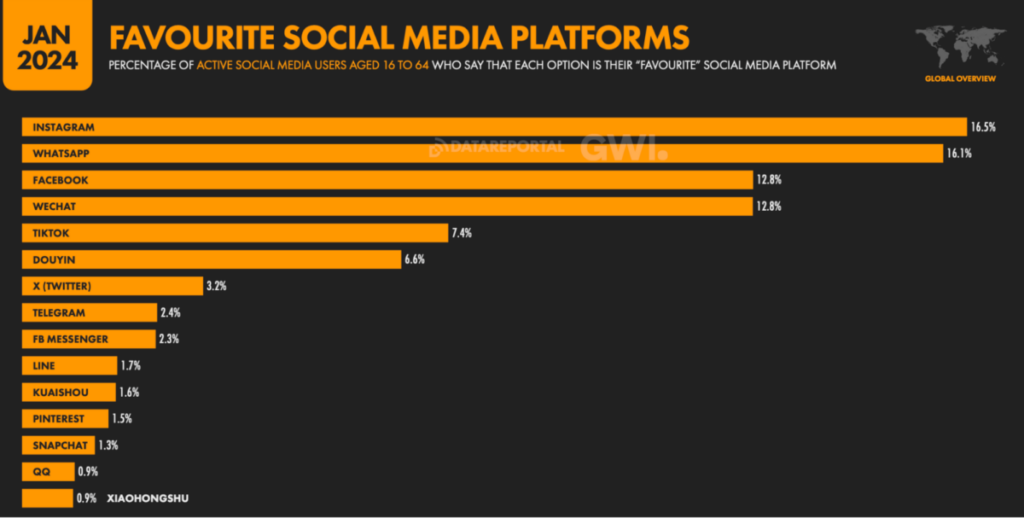

6. Only 1.3% list it as their favorite app

While Snapchat is used by one out of four each day, only 1.3% of active social media users aged 16 to 64 list it as their favorite app. On the other hand, more than 16% feel that Instagram and WhatsApp qualify as their favorites.

We Are Social

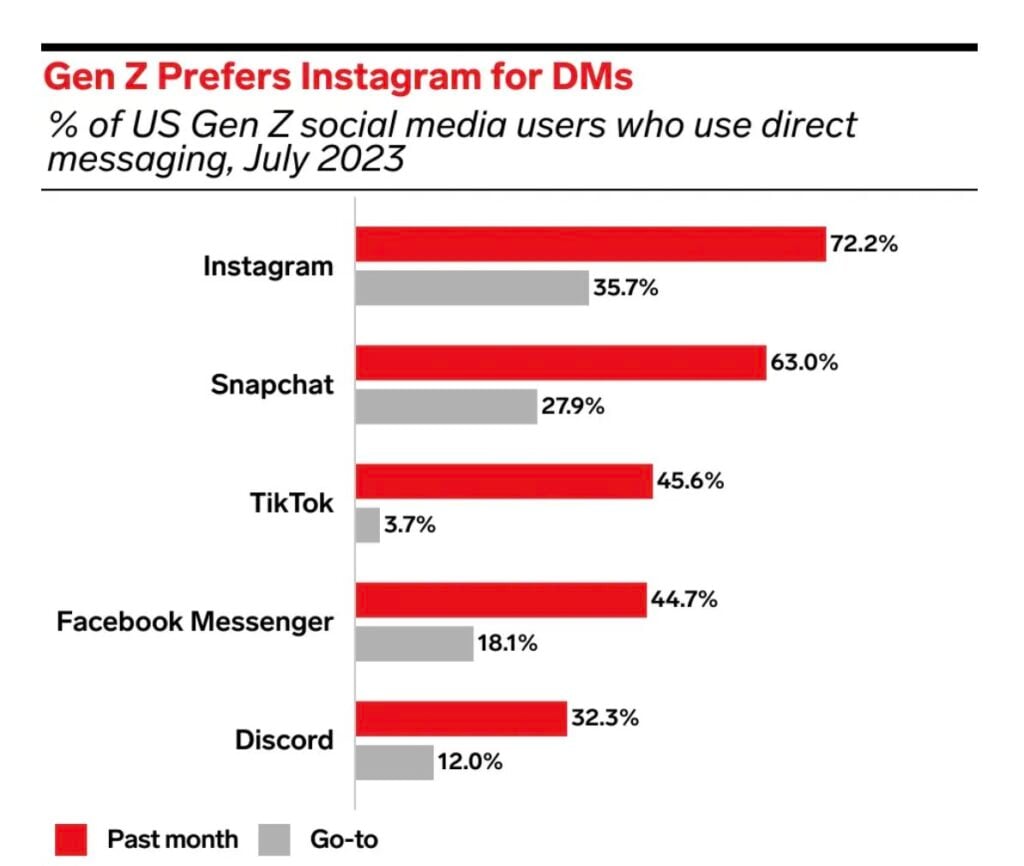

7. It’s 27.9% of Gen Zers go-to for direct messaging

During a survey completed in 2023, 27.9% of monthly social media users aged between 15 and 26 answered that Snapchat is their go-to social media platform for direct messaging. Only Instagram was more popular, with 35.7% listing it as their preferred platform.

EMARKETER explains that this presents a challenge to advertisers. While DMs are a powerful way for brands can connect with their target audiences, it’s more difficult to track engagement generated by messages.

EMARKETER

Snapchat for Business Statistics

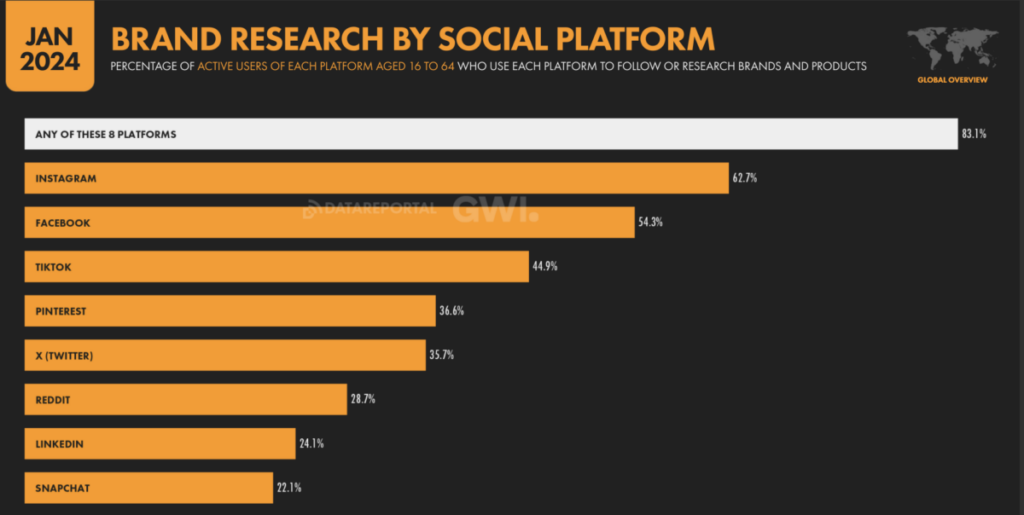

1. About a quarter use it for brand and product research

Brand research is a popular social media activity with nearly half of social media users aged 16 to 64 turning to platforms to learn more about brands. Plus, if they’re considering buying from a specific brand, that percentage jumps to over 70%.

Though, compared to the other popular social media platforms, Snapchat is used the least often for brand research. Only 22.1% of active social media users aged 16 to 64 use it to follow or research brands and products.

We Are Social

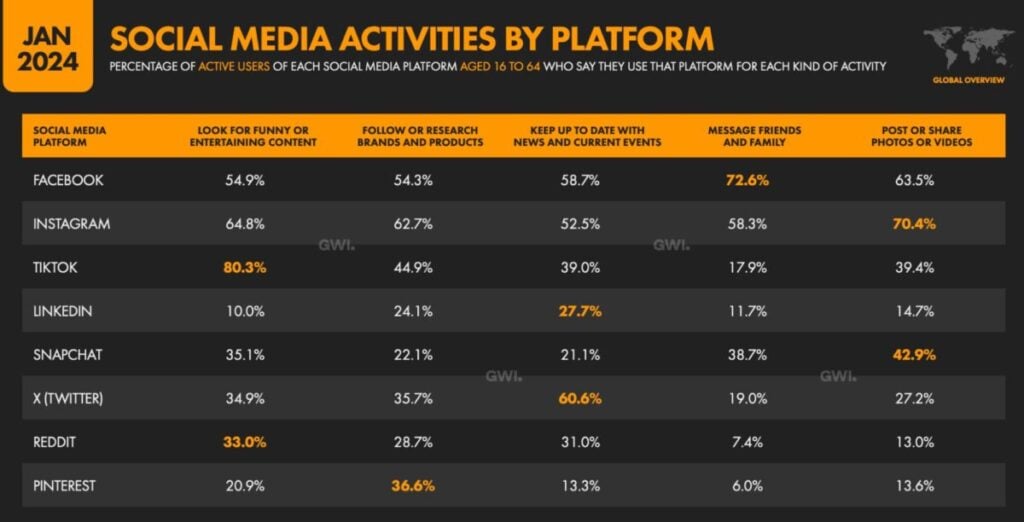

2. It’s mostly used to post/share content

So, if it’s not used for brand research, what gets Snapchatters chatting? According to the Digital 2024 Global Overview Report, it’s mostly used to post or share photos or videos. Just over 40% of active users aged 16 to 64 use it for this.

As for the type of content that resonates more with users, humorous content, like Snapchat sticker memes, will get you more than a laugh. About a third (35.1%) use it to look for funny or entertaining content.

We Are Social

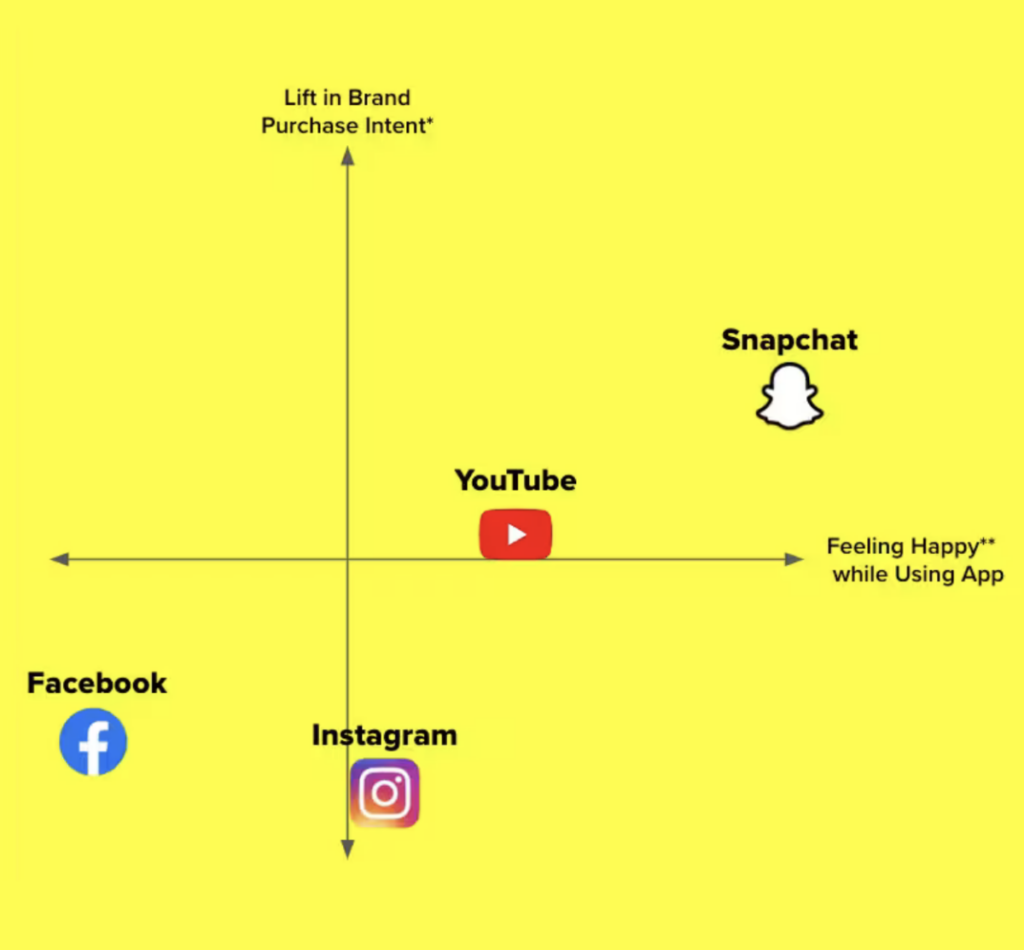

3. It can improve brand recommendations by 450%

While Snapchat isn’t users’ go-to platform for brand research, it doesn’t stop them from recommending brands. According to the platform’s own data, brand recommendations are 4.5 times higher than other platforms.

Not only are users more inclined to recommend brands, but also more likely to go out and buy the product. Compared to YouTube, Facebook, and Instagram, brand purchase intent is 1.7 times higher.

Snapchat

4. Brands on Snapchat are viewed more relatable

User happiness aside, another possible reason why brands can get more recommendations on Snapchat is because they’re viewed as 1.6 times more relatable. What’s more, they’re perceived as nearly 5 times less dated than brands on other social apps.

5. Snapchat ads can generate 1.6 times better engagement

Research completed by Alter Agents, a full-service market research consultancy, revealed that happiness on Snapchat is much higher compared to other social platforms. Snapchat adds that this “positive halo effect” benefits their ad experience. According to their numbers, ads on their platform can generate 1.6 times better engagement.

As for the sentiment, it’s very positive. Ads on the platform are perceived as 1.2 times more positive and 1.3 times more playful.

Snapchat Trends and Innovations

1. Snapchat My AI the third-most liked AI-powered tool in the US

Launched at the end of February 2023, Snapchat My AI, an AI-powered chatbot, ended its first year as the third-favorite AI-powered tool in the United States with 36% of respondents listing it as the tool they preferred. ChatGPT was the leading tool with 59% listing it as their top pick, followed by Google Gemini with 44%.

In terms of awareness, Snapchat also claimed third spot. About four out of 10 (42%) of respondents were aware of Snapchat My AI. Meta AI was the most well-known tool in the U.S. with more than half knowing about the tool, followed by ChatGPT with 49%.

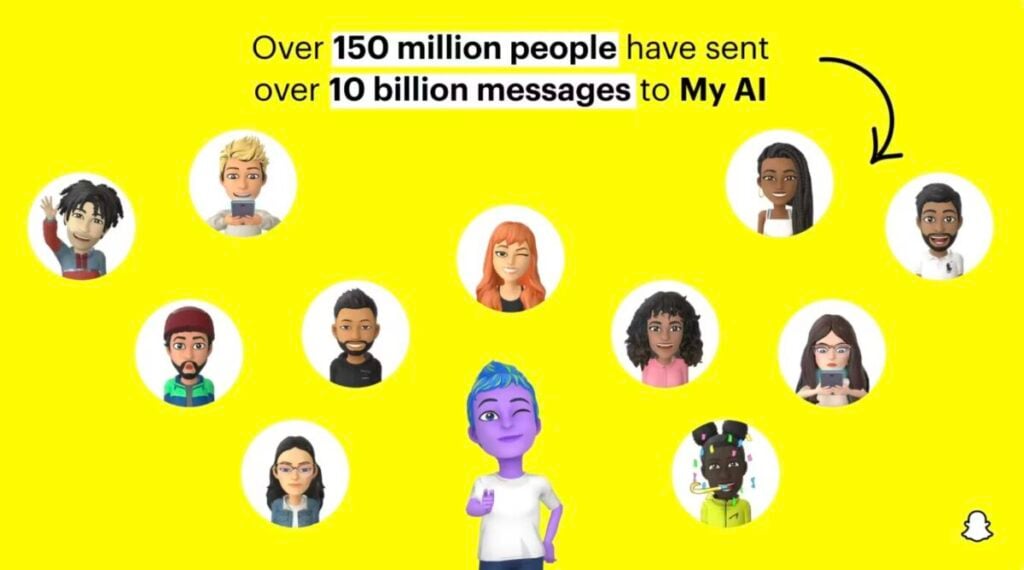

2. Over 10 billion messages have been sent to My AI

In terms of the number of messages sent, My AI is also one of the biggest consumer chatbots. In the first few months more than 10 billion messages were sent, according to Snapchat Newsroom.

Some of the most popular uses cases and conversation topics include:

- Beauty advice

- Fitness

- Art and design inspiration

- Clothing and apparel

- Pets

- Cars

- Sports news (specifically soccer)

- Celebrity and entertainment news

3. Its Gen AI lens Scribble World was viewed over 1 billion times

In 2024, Snapchat continued to invest in its Generative AI models and automation to create ML and AI Lenses. One of its most popular lenses is Scribble World which has been viewed more than 1 billion times.

4. Snapchat campaigns that include AR can drive 5x more active attention

Snapchat partnered with OMD, the world’s largest media agency network, and Amplified Intelligence, a leader in the research and measurement of human attention, to measure how augmented reality (AR) lenses can delight audiences. To do this, they used live analysis of in-the-moment human attention on the platform’s AR lenses.

The results revealed that campaigns that include these AR lenses can generate an average active attention of 12.6 seconds. This is five times longer compared to other social media platforms.

What’s more, it can also have a positive impact on sales. After only one exposure, the short-term likelihood to buy is increased by 53% while long-term likelihood is improved by 31%.

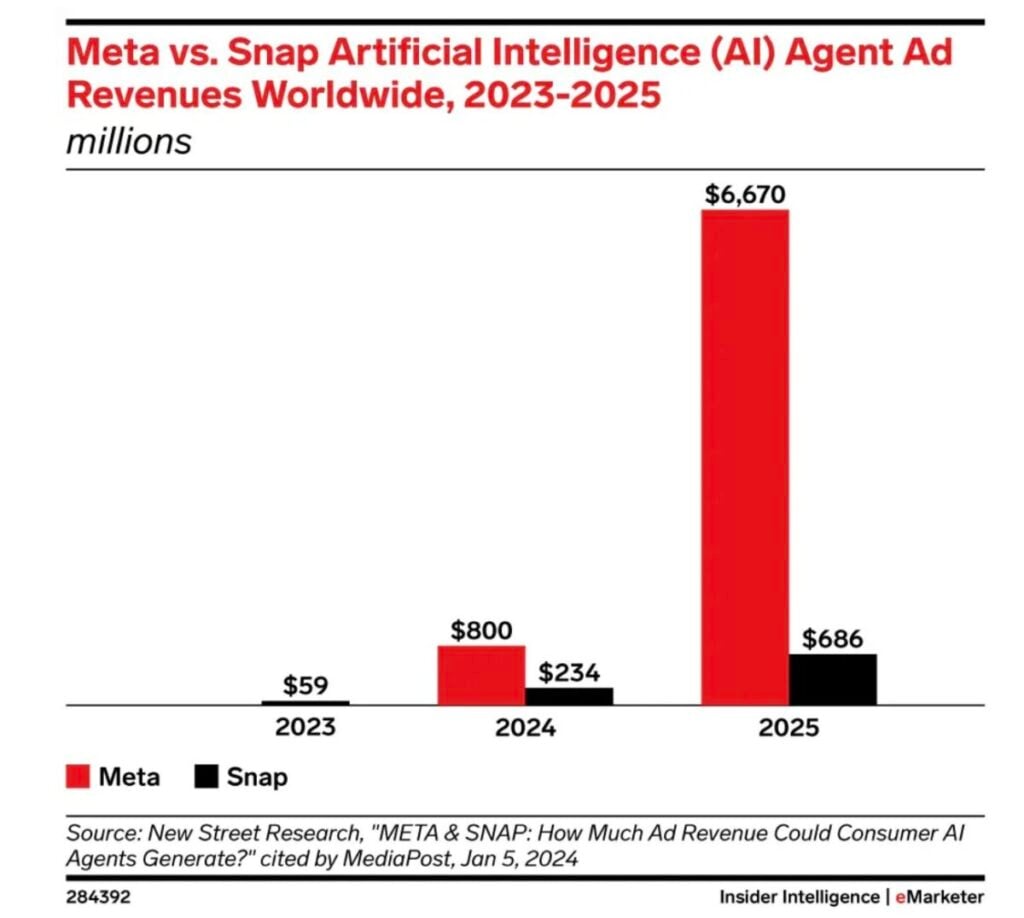

5. Snap’s AI agent ad revenues will add up to $686 million in 2025

While Snapchat is one of the leaders when it comes to incorporating AI, its ad revenue is still lagging behind significantly. EMARKETER reveals that according to New Street Research, its AI agent ad revenues will add up to $686 million by 2025.

While it’s nearly three times more than 2024’s predicted worldwide revenue, Meta’s AI agent ad revenues are expected to reach $6,670 million by 2025.

EMARKETER

Snapchat is a messaging app that relies on visual communication formats like images and videos. It was developed in 2011 by students at Stanford University. Snapchat is most popular among younger users in the U.S.: Globally, about 49.1% of Snapchat users are female, while around 50% are male. In the U.S., 54.8% of users are women. Snapchat sees significantly less daily use compared to Facebook, YouTube, TikTok and Instagram. More than 60% of monthly active users open these apps on a daily basis, compared to only 40.3% who open Snapchat on a daily basis. Snapchat+ is a subscription-based service launched in June 2022 for $3.99 per month. It offers exclusive and experimental features, including additional icons, backgrounds, custom notification sounds, and a My Story Timer. Compared to Meta Platforms which include Facebook, Instagram, Facebook Messenger and WhatsApp, Snapchat’s revenue is much lower. In 2023, Meta Platforms generated $133 billion, while Snapchat’s annual revenue added up to about $4.6 billion. Snapchat’s recent revenue growth can be linked to: Snapchat’s main source of income is its ads. It also makes money via its subscription model. Snapchat’s primary focus is on creating AI-powered lenses. It has recently announced an upgraded version of Lens Studio allowing creators and developers to create AR features for Snapchat and other apps and sites. High research and development (R&D) as well as selling, general, and administrative expenses (SG&A) can be blamed for Snapchat’s continued losses. Its high level of share-based compensation also plays a factor.Frequently Asked Questions

What is Snapchat and when was it developed?

Who are the primary users of Snapchat in the US?

What are the gender demographics of Snapchat users globally?

How does Snapchat usage compare to other social media platforms?

What is Snapchat+ and what does it offer?

How does Snapchat's revenue compare to other social media platforms?

What has contributed to Snapchat's recent revenue growth?

How does Snapchat make money?

How is Snapchat investing in augmented reality (AR) technology?

What are the main reasons for Snapchat's continued losses despite revenue growth?