As we saw in our Ultimate Guide to Advertising on Walmart, Walmart is huge, particularly in the United States. Over 4,700 stores operate in the USA and 5,300 more do so in 23 other countries. They also recognize the power of eCommerce nowadays and have a notable online presence with Walmart Connect.

Since 2021, Walmart’s Demand-Side Platform (DSP) has been a significant contributor to the retailer’s online success. Walmart built its DSP in partnership with one of the leading independent demand-side platforms, The Trade Desk.

- Walmart’s Vision for its Demand-Side Platform

- What is a Demand-Side Platform?

- Is Walmart’s Demand-Side Platform (DSP) The Trade Desk DSP with a Different Name?

- Highlights of Walmart’s Demand-Side Platform and Connect

- Benefits of Walmart’s Demand-Side Platform

- How Does Walmart’s DSP Compare to Amazon’s Offering?

- Bringing Your Brand to Walmart?

- Wrapping Things Up

- Frequently Asked Questions

Walmart’s Vision for its Demand-Side Platform

When Walmart first announced its new Demand-Side Platform in August 2021, it expressed a focus on three key strategic areas:

- Growing its offerings across its digital properties to provide more holistic ad campaigns.

- Introducing new Omni capabilities to help brands reach customers in their stores.

- Expanding its offsite media opportunities at scale by introducing a new demand-side platform, Walmart DSP.

What is a Demand-Side Platform?

When most people think about online ads, they tend to think of big-name players like Google Ads or Facebook Ads. However, there are many other options for brands wishing to advertise on the Internet. One of the more common methods is to work with one of the many demand-side Platforms, commonly known as DSPs.

Although the name may suggest something complicated, DSPs are simply platforms and tools that enable advertisers to purchase ads using automation – that includes the previously mentioned Google Ads and its Facebook equivalent. The DSPs are provided on behalf of publishers (websites or apps), who have space available for brands to advertise.

Each DSP uses automation to decide which ad is uploaded to each user of the app or website. Some DSPs work with multiple publishers, while others are directly owned by publishers, like Walmart and Amazon, and focus on their own app/website (although as we see below, Walmart’s DSP offers additional channels to advertisers wanting to diversify where they position their ads).

In general terms, advertisers upload creative to the demand-side platform of their choice. They then use the platform’s technology to set up targeting for their ads, typically on some form of a dashboard. The DSP then uses automation to compare the advertisers’ requirements with the available ad spots of the relevant publisher(s), and when they find matches, the DSP automatically runs a bidding system in real-time for the spots.

The highest relevant bidder will typically win the advertising slot, although many DSPs use a mix of criteria, not just bidding price, to decide which ad appears. All this bidding and decision-making occurs in microseconds behind the scenes, and the average app user or website visitor has no idea how the ads served to them are selected.

Demand-side platforms work alongside Supply-side Platforms (SSP) and the Ad Exchange in the programmatic advertising space. Demand-side platforms allow ad agencies and other marketers to offer automated, efficient processes. Supply-side platforms look at the other half of the equation – they are a tool for website and app owners who have spare places on their websites/apps that could take advertising.

The Ad Exchange is where DSPs and SSPs connect. It is where the behind-the-scenes activity occurs, where automation ensures those bidding to place ads via a DSP can find advertising slots that are managed on an SSP.

Is Walmart’s Demand-Side Platform (DSP) The Trade Desk DSP with a Different Name?

Although Walmart’s Demand-Side Platform uses The Trade Desk’s technology, it isn’t merely a rebadge of their platform. It is a separate, walled-off version of The Trade Desk. Walmart has populated it with exclusive data and inventory, and it connects to a different cloud than the standard Trade Desk DSP (which uses Amazon Web Services).

Walmart’s Demand-Side Platform uses a self-service model, enabling advertisers to directly buy on-site search and sponsored product ads on walmart.com. Walmart has released an API that makes inventory available through Teikametrics, Flywheel Digital, Skai, and Pacvue.

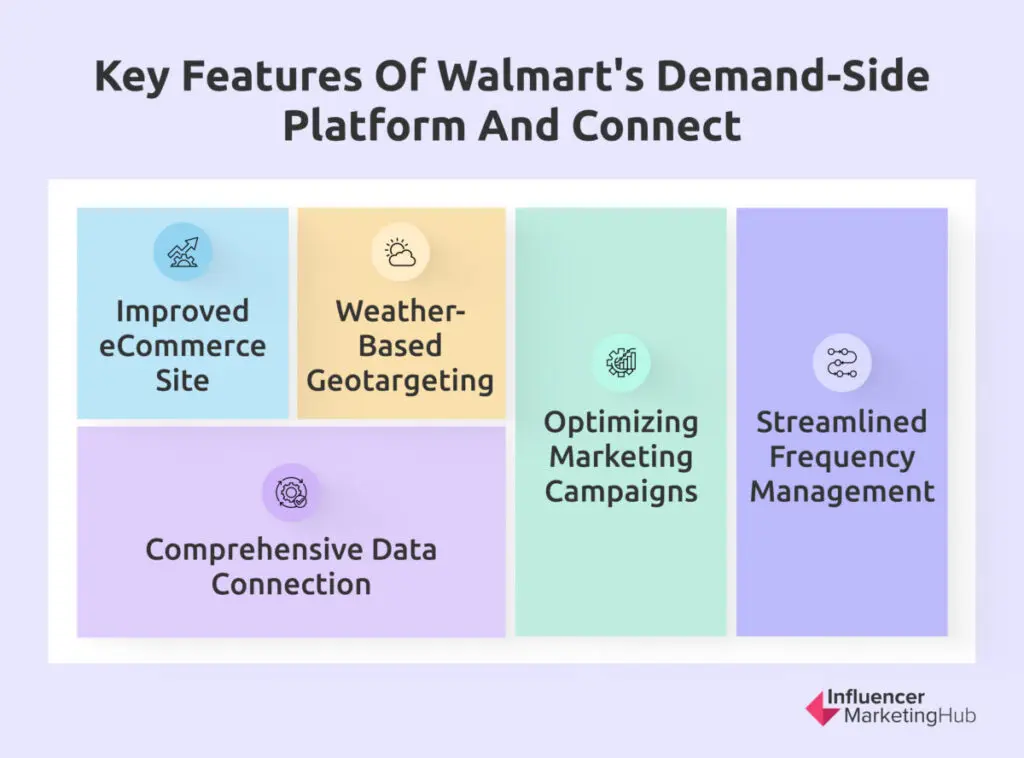

Highlights of Walmart’s Demand-Side Platform and Connect

The current Walmart eCommerce site is much improved on its predecessor. Customers can add exclusive first-party segments from Walmart that recognize their buying preferences. The platform generates online and offline conversion data, making it much easier for attribution and optimization.

Another useful feature of the platform is its ability to geotarget based on weather predictions. Walmart sellers can target their promotions to include products suitable for the local weather conditions; no worries about serving ads to consumers for umbrellas in drought-prone areas or sun cream to those in towns covered by snow.

Walmart’s DSP connects both online and in-store transaction data. This gives a fuller picture of those ads that most attracted customers and converted best. As a result, brands can use this data to perfect future marketing campaigns, ensuring that they position most of their advertising budget on high-performing channels.

Walmart’s DSP offers advertisers the ability to easily manage frequency caps across all campaign touchpoints, i.e., the number of times that an ad will appear before a particular person, no matter which apps they use or websites they visit. Advertisers can set a limit for the number of times one ad is presented to somebody across Walmart Connect and all The Trade Desk channels.

Benefits of Walmart’s Demand-Side Platform

By creating a demand-side platform, Walmart greatly opened up its eCommerce site to external advertisers. While smaller brands may think of Walmart as a colossal competitor, the scale of its operation means that many advertisers can reach a substantially larger audience than they otherwise could with their ads. Their Walmart advertising helps expand their organic reach.

Allied with this, Walmart is a household name, and brands advertising on their DSP can create an impression of permanence and “properness”, and not just some small fly-by-night operation.

According to Walmart, their DSP offers the opportunity for marketers and advertisers to connect with the right customers at the right time. They can reach specific audiences with increased precision by leveraging Walmart’s past purchases and predictive audience segments, as well as brand-level shopping behavior data from across the entire Walmart ecosystem.

Many brands take advantage of Walmart’s platform to introduce their new products to a sizable audience. Although the majority of Walmart’s brick-and-mortar stores are located in the USA, their eCommerce operation is global, meaning you can present your product to a worldwide audience.

The connection with The Trade Desk creates additional channels for advertisers too. You can extend your campaign to target that group’s various channels, through display ads, streaming video, mobile, and audio ads, and Connected TV (CTV) ads.

The Trade Desk also brings a massive knowledge base and understanding of how the online marketplace works, that they are sharing with Walmart. This means that Walmart can offer advertisers advanced security and protection services, a dedicated marketplace quality team, exclusion and inclusion lists, sensitive site blocking, etc.

One of the greatest benefits of Walmart’s demand-side platform, from an advertiser’s point of view, is that it is the only way they can access Walmart’s advertising inventory, like Walmart.com and in-store ad placements.

Walmart can access the data of 150 million weekly shoppers, far more than anybody aside from Amazon.

How Does Walmart’s DSP Compare to Amazon’s Offering?

When Walmart revamped its Walmart Connect offering, based on The Trade Desk’s DSP technology, it clearly did so with an eye on arch-rival Amazon’s websites and apps (or at least the back end of their systems). Amazon already had a powerful demand-side platform, so it was obvious to Walmart that they would need something competitive for them to perform nearly as well online as they have traditionally done so on Main Street.

They knew they already possessed a comprehensive database of consumer data, and they already held a commanding position in the advertising business. You might consider Walmart a legacy company, a leader in the traditional world of advertising and marketing. However, Walmart’s management wasn’t prepared to sit back and ignore the oncoming rush of online sales.

Although Amazon is very much the face of the “new world” of online retailing, it was quick to recognize its marketing strengths and weaknesses. It knew it was collecting a massive quantity of customer and sales data that it could see ways to monetize, as long as that didn’t negatively impact the customer experience in the process.

In addition, it wasn’t long before Amazon developed into the world’s biggest product search engine. As a result, in 2012 Amazon launched Amazon Media Group (AMG), Amazon Marketing Services (AMS), and Amazon Advertising Platform (AAP). These groups began to offer PPC services to advertisers that year.

Amazon merged its media, marketing, and advertising branches, into “Amazon Advertising” in 2018 and Amazon Advertising Platform (AAP) became Amazon DSP.

As we’ve seen, Walmart Connect launched its DSP service as a direct competitor to Amazon in November 2021, working alongside an existing DSP market leader, The Trade Desk. This gave the company sufficient time to learn from Amazon. As with Amazon, Walmart had a massive quantity of data, albeit initially mainly store-based rather than from online sales. They are now adding to this database daily, both from their online sales and traditional store-based activities.

Perhaps the most significant factor hindering small brands and advertisers from using Amazon’s DSP is that Amazon only makes it available to those willing to spend at least $50,000 on a campaign (for the managed-service option). Other Amazon advertisers find themselves restricted to primarily Sponsored Product, Sponsored Brand, and Sponsored Display ads, along with a few other specialist types.

Walmart also offers both self-serve and managed campaigns for advertising on the Walmart Marketplace. They only require a $25,000 commitment if you want a managed campaign. However, you must commit to a minimum monthly spend of $1000 for a self-serve campaign.

Bringing Your Brand to Walmart?

Before 2016, the Walmart Marketplace had fewer than 10,000 third-party sellers. However, the latest data show this number grew to over 150,000. During the pandemic, Walmart was adding 5,000 new sellers per month.

Walmart has three types of sellers on its platform:

- First-party sellers (1P) – selling products to Walmart at wholesale rates, that Walmart then sells in its stores and/or online.

- Third-party sellers (3P) – selling products via the Walmart Marketplace, in much the same way as Amazon Sellers operate on that platform. They set prices, control inventory, and ship to customers unless they choose to use Walmart Fulfillment Services (WFS).

- Dropship vendors (DSV) – selling products to Walmart at wholesale prices, with Walmart using its name to sell them to customers. Walmart pays shipping costs, but sellers ship the products to the customer or the store for pickup.

To advertise on Walmart (or any other of the added channels thanks to The Trade Desk connection), you must submit an ad application to Walmart Marketplace. However, don’t consider advertising on Walmart until you are making sales. Walmart looks closely at your existing performance on the platform before they accept your advertising application. Walmart holds a compulsory webinar all advertisers must attend, covering essential details about how the platform works.

Wrapping Things Up

In early 2020, Google announced that they were removing third-party cookies from its Chrome browser, initially planning to phase them out completely by 2024. They have subsequently delayed this a year until 2024, but it has still caused a flurry of activity and panic in advertising agencies and marketing agencies across the world.

Brands are having to transition into a world without third-party cookies. If they haven’t already done so they need to start working on viable alternatives. Walmart’s Demand-Side Platform is one way that brands can discover essential conversion rates and other data without the need for traditional website Cookies. Interestingly, Walmart’s technology partner, The Trade Desk, is testing a Unified ID 2.0 to replace third-party cookies. It uses pixel tags to track information, much like LiveRamp’s Authenticated Traffic Solutions. Before long, we may well find Walmart using this unified ID too.

Frequently Asked Questions

What is Walmart’s Demand-Side Platform (DSP)?

Walmart DSP is an advertising platform that allows eligible advertisers to target Walmart shoppers offsite through various digital channels, including audio, video, mobile, and connected TV (CTV) advertising. It leverages Walmart's extensive first-party data to enhance audience targeting and campaign performance.

How does Walmart DSP work?

Walmart DSP automates the ad buying process, enabling advertisers to bid in real-time auctions across multiple exchanges. It allows brands to extend their reach beyond Walmart.com by utilizing Walmart's shopper data to target audiences on various platforms.

What types of advertising can be done through Walmart DSP?

Advertisers can run display ads, video ads, mobile ads, audio ads, and CTV ads through Walmart DSP. This multi-channel approach helps brands engage with customers across different media formats.

What are the benefits of using Walmart DSP?

Key benefits include access to Walmart's vast first-party data for precise audience targeting, enhanced campaign performance through advanced technology from The Trade Desk, and the ability to measure both online and in-store sales attributed to advertising spend.

How does Walmart DSP compare to Amazon DSP?

While both platforms enable advertisers to reach audiences across various channels, Walmart DSP differentiates itself by combining The Trade Desk's technology with Walmart's unique first-party data, providing a more tailored advertising solution for brands.

What audience targeting options are available in Walmart DSP?

Advertisers can create custom audiences, lookalike audiences, and re-target users who have previously engaged with their products. Walmart DSP allows for precise targeting based on past purchase behavior and predictive analytics.

Are frequency caps available in Walmart DSP?

Yes, advertisers can set frequency caps to control how often their ads are shown to the same users, helping to reduce ad fatigue and optimize advertising spend.

What reporting options does Walmart DSP provide?

Walmart DSP offers comprehensive reporting on campaign performance, including metrics like return on ad spend (ROAS) and sales lift reports, allowing advertisers to assess the effectiveness of their campaigns both online and offline.

How does Walmart DSP ensure privacy and data security?

Walmart DSP adheres to strict privacy standards and employs advanced security measures to protect consumer data, ensuring that advertising practices are transparent and compliant with regulations.