Fast-paced trends, a connected global market, and growing consumer confidence make the fashion industry one of the most unpredictable and exciting in the world. Many elements come into play in the state of fashion, from the changing of the seasons, the state of the economy, the most popular influencers, the newest tech, and new consumer sentiments. All these have been changing the way retailers and consumers interact with fashion.

As one of the biggest players in the eCommerce market, the future of fashion is bright with growth and possibilities. It’s such a fluid industry, being both a necessity and a luxury, with easy accessibility through digital innovations yet now more personalized than ever.

Keep reading to stay updated with the latest in fashion, from big-picture statistics to emerging trends changing the game one outfit at a time.

- Fashion eCommerce Trends to look out for in 2024

- Key Fashion eCommerce Facts and Stats to Keep in Mind

- Fashion ECommerce Consumer Behavior

- Social Commerce Investment

- Technology and Innovation in Fashion ECommerce

- Sustainability and Ethics in Fashion ECommerce

- Top Performing Fashion ECommerce Brands

- Fashion ECommerce Sales Channels and Conversion

- Final Thoughts

- Frequently Asked Questions

Fashion eCommerce Trends to look out for in 2024

- AI-Driven Personalization in Social Media: Brands are increasingly turning to AI to craft highly personalized shopping experiences, from tailored product recommendations to bespoke marketing strategies. Read more about this in our AI Marketing Report.

- Sustainability as a Core Value: Eco-friendly products and green operations are no longer just trends - they're becoming fundamental principles for brands.

- Omnichannel Strategies: Successfully blending online and offline shopping experiences is crucial for meeting customers wherever they choose to engage.

- Social Commerce: Direct customer engagement through social platforms is not only driving sales but also building stronger brand loyalty. TikTok Shop is overshadowing others in this area, more on this in our TikTok Marketing Report.

- Flexible Payment Options: Expanding payment choices is enhancing purchasing flexibility and reducing cart abandonment rates.

These trends underscore the growing importance of personalization, sustainability, and a seamless customer experience as key drivers in fashion eCommerce for 2024. Are you ready to keep up?

Key Fashion eCommerce Facts and Stats to Keep in Mind

Below are facts and figures that will shape the eCommerce fashion market in 2024. With these statistics and strategies, you can get an updated view of where the industry is now and where it’s headed.

Fashion eCommerce is one of the world's leading eCommerce industries

Fashion is cyclical in nature and fashion eCommerce companies must be versatile to keep up with all the changes. It's a dense, dynamic, and demanding sector, with new entrants emerging regularly. That's hardly surprising given that the fashion industry (which includes apparel, accessories, and footwear) is projected to reach $905.62 billion in 2024. With a compound annual growth rate (CAGR) of 10.6%, it’s predicted to reach a value of $1356.74 billion by 2028.

The two key variables driving this growth are penetration rates (defined as the percentage of active, paying customers) and online retail share. Analysts expect that the number of active online shoppers in 2024 will reach 2.71 billion people.

Vertical growth is seen in all major fashion eCommerce subcategories

The compound annual growth rates (CAGR) for fashion, as well as each subcategory, are on the upswing.

-

Apparel (women’s, men’s, children’s)

Reduced digital entry barriers for all clothing retailers enable them to promote, sell, and deliver goods seamlessly in any part of the world. As a result, both global revenue and revenue per user are expected to grow.

The global apparel market is currently worth $1.79 trillion in 2024 with a CAGR of 2.81% between 2024 to 2028, making up 1.6% of the world’s GDP. In the US, the average household spends $162 per month on apparel, and data shows that in general, people buy 60% more clothes than they did decades ago.

-

Shoes (sneakers, athletic, leather, textile, and others)

As a part of eCommerce fashion, the shoe sector also saw a rise in market value. From an estimated value of $438.62 billion in 2023, it’s now anticipated to grow at a CAGR of 4.3% from 2024 to 2030. By 2030, its revenue forecast is thought to be at $588.22 billion, driven by multiple factors like rising disposable incomes, and the number of brands launching limited-edition, premium, and/or luxury footwear.

-

Bags and accessories

The segment of bags and accessories will also see double-digit growth but at a faster rate. The fashion accessory market will expand at a CAGR of 12.3% between 2024 and 2029, with Asia-Pacific being the fastest-growing region and North America as the largest. Even with the lowest actual figures at $185.6 billion in 2024, these predictions make bags and accessories one of the most robust eCommerce fashion segments.

-

Luxury items (jewelry and watches)

The global jewelry sector is projected to generate $368.9 billion in 2024 and is expected to grow with a CAGR of 3.22% from 2024 to 2028. About 15.4% of total revenue is said to come from eCommerce sites, showing the rising potential of online selling platforms. Across the globe, the US is the top contributor to the luxury market. In 2024, rising consumer confidence and a growing preference for high-end fashion in the US led to a market value of $77 million.

Asia has the biggest market share for online fashion shopping

Geographically, China holds the largest market share in fashion eCommerce, with a $427 million market share. The United States closely follows with $364 of market dominance. Rounding out the top five are the United Kingdom with $70 million, Germany with $69 million, and Japan with $65 million in market shares, respectively.

By 2030, the estimated total sales for online fashion in Asia are expected to reach approximately $985 billion with a CAGR of 9.5% from 2023 to 2030. eCommerce transactions account for about 21% of total fashion retail sales globally. In other regions, like Europe, Oceania, or the Americas as a whole, online outlets account for about 30% of overall fashion retail sales.

Fashion ECommerce Consumer Behavior

Most fashion eCommerce shoppers are women

Not only are there more female shoppers, but they buy more often and make purchase decisions much faster. Women across the world spend almost $35 trillion on consumer goods, including fashion. They also buy more often than men seven times a year vs. men who average a purchase only five times.

When it comes to checking out their basket, women reach a decision 7% faster than men. This goes to show how responsive women are to eCommerce, and are even more likely to give in to impulse online purchases.

The most common online impulse purchases are clothes and shoes

Women worldwide are buying more or less of the same things: 57% admit they’ve impulse-bought either clothes and/or shoes. As for where they’re buying, 20% of women are likely to head straight to their favorite brands’ retailer sites or websites to buy clothes, while others look to online marketplaces. 15% of women surveyed shop for clothes online at Amazon, while 10% use other platforms like eBay or Alibaba.

More shoppers are converting to online shopping

Now that anyone with a smartphone and an internet connection can shop online, fewer people are shopping in physical stores. 20.1% of retail purchases are expected to take place online in 2024, and this rate is projected to go up to 23% in 2027. It’s also significant to note that 81% of these eCommerce transactions are happening on mobile, showing the importance and preference towards mobile-friendly eCommerce platforms.

Social Commerce Investment

Various online fashion brands integrate social media into their eCommerce marketing strategies. This is expected considering the average person spends 143 minutes on social media every day.

But social media platforms are becoming more than just places to see what's new in fashion; they are also growing to include shopping in-app. This makes it easier for retail retailers to reach customers who are ready to buy.

Sales of social commerce are expected to triple by 2025, but brands must invest in their social commerce strategy to make an impact. Consumers are no longer satisfied with traditional, static fashion ads. About 46% of consumers want to see product videos before buying, and 66% of them actually do.

They need to be educated about a product or brand before they are convinced to buy. About 87% of customers say that social media helps them decide what to buy, and 26% head to social networks to seek advice when buying an item of clothing.

Because shoppers can visualize the item in a real person, platforms like TikTok and Instagram are credited with driving sales for major fashion brands. In fact, 70% of Instagram users use the platform to look for and learn more about their next purchase. It's even better if the recommendation comes from a social media influencer they already know and trust.

Beyond social commerce, multichannel eCommerce incorporates off-site native selling to create direct buying routes in areas where the brand's target market spends its time. Think of Facebook Shops, Product Pins on Pinterest, or Instagram Shopping. More and more social platforms are launching and developing their own commerce features.

Fashion is a best-seller on social media

In 2023, fashion and apparel were at the top of the list of most-purchased products on social media. Highly visual platforms like Instagram, Facebook, and TikTok have made it easier than ever to convert users. Not only do they leverage aesthetic and photo/video formats, but added features like shoppable posts, live shopping, and direct checkout across platforms allow sales to happen without leaving the feed. In 2024, an estimated 110.4 million people will shop via social channels.

TikTok is a rising platform for eCommerce

There’s no doubt that TikTok has revolutionized online trends, even pushing the shift from desktop to mobile even further and creating a greater audience preference for short-form content and innovative ads. But there’s more to it than content: the platform drives sales, too.

Within the US alone, TikTok has a user reach of 44.8%, and annual TikTok consumer spending is at $3.84 billion, showing the power of a platform that leads trends and comes with a great deal of influence. Gen Zs on TikTok between the ages of 18 to 24 are 3.2x more likely to purchase on TikTok Shop. For brands who want to stay relevant and reach a younger audience, that adds a new platform to keep up with.

No more “one size fits all” as shoppers look for more diverse body types

The preference for inclusive sizing continues to grow, with 72% of plus-size consumers searching for more diversity in fashion and advertising. Plus-Size Fashion accounts for 17% of the total US Women’s Apparel Market, and the global Plus-Size Clothing Market is projected to reach $55.75 billion by 2027.

Within the fashion industry, this has led to expanding size ranges on eCommerce platforms, and even size inclusivity efforts by top brands like Vogue.

Technology and Innovation in Fashion ECommerce

By 2024, livestream shopping could generate $129.6 billion globally

Livestream shopping combines eCommerce sites' enormous traffic with retail visits' greater conversion rates. As a result, it has grown exponentially since the pandemic. This growth shows no signs of slowing down—in fact, Facebook and Instagram live streams are seeing conversion rates of up to 30% with lower product return rates.

Globally, it’s Asia that’s taking the lead in adoption and revenue. China has the largest share of the market, with 72% of Chinese consumers having purchased something during a live selling event.

Taobao, the Chinese platform owned by eCommerce giant Alibaba, is the unrivaled market leader in live shopping. As livestream shopping gets global traction, other social platforms like Facebook, Instagram, and TikTok, as well as eCommerce giants like Amazon, have begun to adopt it.

Livestream shopping is a sector that is fast expanding among Gen-Z and millennial shoppers. The top product category in livestream shopping is apparel and fashion, accounting for 36% of the market. Gen Z shoppers are also champions of social commerce.

A report by The Influencer Marketing Factory noted that in a survey of livestream purchasing transactions by age group, Gen Z took the lead, with 47% of buyers in both the US and the UK having made a livestream purchase.

Artificial Intelligence in Fashion

In 2024, artificial intelligence (AI) will be a game-changer for fashion brands, particularly in eCommerce and marketing.

A McKinsey report estimates that generative AI can earn the fashion industry anywhere between $150 to $275 billion in the next 5 years. There’s definitely a lot of potential with its capabilities. AI can be used to help with fashion design, 3D imaging, development, and production, and even generate virtual models for campaigns and runways. Another aspect driving growth is AI's ability to personalize product recommendations through customer behavior analysis, which boosts sales and enhances customer experience.

The ability of AI-powered search engines to understand natural language queries and provide precise search results makes shopping easier for customers. Tools like Dressipi use AI to offer tailored clothing recommendations based on customer preferences, reducing returns and increasing satisfaction.

Moreover, AI-developed virtual assistants are transforming customer service by answering product queries and offering personalized advice. Brands like Zara, Nike, and Nordstrom have already embraced AI, demonstrating its potential to create a more engaging, personalized customer experience.

By the end of 2027, the worldwide market for AI in fashion is expected to reach $4.4 billion.

Hyper-personalization Is the New Standard

Making things easy for customers is a tactic that never fails. The capacity to avoid or minimize service disruptions and make touchpoints seamless continues to satisfy consumers wherever they are in their buying journey. Retailers must ensure that their tech platforms can meet current needs while also being scalable for future demands.

Today, it's all about hyper-personalization, in which the brand evaluates the customer's preferences, activities, and past purchases to decide how to provide them with the most value in the future.

A great example of this trend is Stitch Fix, which debuted in 2016 and uses artificial intelligence and machine learning to figure out which exact products to send to each of its subscribers. The direct-to-consumer brand's valuation has soared to over $0.46 billion as of August 2024.

Virtual fitting rooms and size recommendations powered by AI

AI, augmented reality, and virtual reality join forces to make virtual try-ons a reality. Now, you can fit any piece of clothing and see how it looks on your body through this new smart-fitting tech. By providing personal measurements or using sizes from another brand as a reference, the technology can find the best size for every customer.

Like a real fitting room, the platform will display how the product would look on a person’s body type or size. New products, styles, and sizes are now accessible—all from your mobile device. The tech can even go a step further with personalized fashion recommendations, whether for style or sizing.

This data is taken from previous purchases, set preferences, and measurements. This is a significant development that answers the demand of more than 70% of customers who expect brands to tailor their shopping experience and anticipate their needs.

AI empowers customers to purchase any item of clothing confidently through their phones. The virtual fitting room market is expected to reach $6.5 million by 2025, with a CAGR of 13.75%. Fashion eCommerce brands who aren’t leveraging AR have a little catching up to do if they want a competitive edge against other eCommerce brands as well as physical stores.

Tech opens doors for next-level experiences through eCommerce platforms.

Brands use interactive and experiential elements on eCommerce platforms.

Today’s technology allows brands to get more playful and experimental than ever, opening new doors in the virtual world. Fashion brands make big impressions through interactive and experiential elements, such as virtual fashion shows and 3D models. These work with a combination of VR and AR, giving viewers a 360 and front-row view of their latest collections.

Luxury brands like Tommy Hilfiger and Dior have launched immersive and visually stunning shows that were not only fully digital but also fully shoppable. These were hosted as live-streamed events with a convenient link to purchase, marking a seamless conversion to sales.

The Metaverse's Promise

Metaverse was the buzzword in 2022, and many fashion brands are using Roblox to create immersive experiences for their clients and attract Gen Z audiences. Non-fungible tokens (NFTs) are a type of commodity that can be used both in and out of the metaverse. They are unique digital tokens that can only be owned by one person and are typically paid for with virtual money like crypto.

Under Armour has already tested NFTs in the retail sector. When Stephen Curry became the NBA's leading three-point shooter, the fitness brand collaborated with him to recreate the star athlete's sneakers. In addition to the real shoes, the company released digital NFTs. Users who own the NFT shoes can virtually stroll through Decentraland, The Sandbox, and Gala Games wearing the Curry sneakers.

There are currently 600 million active Metaverse users worldwide, with a greater majority of them aged below 18 years old. More than half of today’s innovators believe in the Metaverse’s growth, though it’s quite a long game. It may take until 2040 before the metaverse unlocks its immersive potential and becomes fully integrated into daily life.

Sustainability and Ethics in Fashion ECommerce

Sustainability is the Future

The fashion industry is often criticized, particularly for the practices it employs to manufacture, produce, and discard inventories. Considering these widespread criticisms, as well as consumers' increasing commitment to fighting climate change, a study shows that 42% of global customers opt to buy eco-friendly and sustainable items.

While green consumerism had already been on the rise before the pandemic, the last couple of years have further accelerated the trend. The pandemic heightened awareness about environmental and social accountability, and a growing number of customers and investors are now demanding transparency. As a result, thrifting and secondhand commerce have become more popular. Rather than acquiring brand-new items, shoppers can save both money and the environment by leasing, trading, and recycling fashion items.

Sustainable and ethical fashion matters most to Gen Zs and Millennials

72% of consumers in the US are aware of sustainability and environmental issues surrounding the fashion industry, but it’s the younger generations who are most vocal about it.

In terms of age groups, 58% of Millennials and Gen Z are aware that their clothes contribute to climate change (vs. 43% of the market). Meanwhile, 63% of Millennials and Gen Zs believe they can reduce their carbon footprint (vs. 55% overall) and 61% of them would call themselves sustainably focused or eco-conscious, as opposed to 51% overall.

Brands are respected and preferred for eco-friendly practices

More than half of consumers are interested in shopping sustainable fashion, and they often depend on brands to let them know what makes their clothes sustainable. Brands that are open and transparent about environmentally sound practices are often preferred. There are many ways brands can apply these practices, such as:

- Fair and ethical supply chain information

- Eco-friendly products

- Recyclable packaging

- Use of organic or vegan raw materials

- Repurposed or recycled materials/items

- Sales that benefit an environmental cause

- Production/operation efforts that lead to lower carbon emissions

High demand for quality and sustainable products

Cheap, fast fashion no longer sells. These days, brands and consumers both prioritize quality, durability, and timeless style. Carefully crafted products made to stand the test of time and created with consideration to their environmental impact are what sell. This sets a new standard for fashion eCommerce in 2024.

The growing market for repairs

If something’s broken, the more popular practice now is to fix it instead of replacing it. This is true for both high-end and affordable fashion brands.

For instance, Bottega Veneta now offers a lifetime warranty on their handbags, while Louis Vuitton has repair services for theirs. Meanwhile, Zara, Uniqlo, Patagonia, and Arc’teryx are just some brands that have repair centers for their customers. The rise in repairs grows side-by-side with sustainability, as repairs are a cost-effective way to keep a piece for longer.

The Time for Resale and ReCommerce

Second-hand or "pre-loved" fashion items have become a global craze. In 2023, the global fashion resale market grew 15x faster than traditional retail and is estimated to reach $73 billion by 2028. The secondhand apparel industry has grown eight times faster than the entire apparel sector, predominantly driven by North American shoppers.

According to Retail Dive, reCommerce businesses will account for 18% of the apparel market by 2031, and over 75% of retail executives either currently offer or are willing to sell secondhand items.

Dôen, a luxury fashion brand in California, launched a resale business called Hand Me Dôen. Customers will be able to bring in pre-owned Dôen items to trade for store credit. Once the resold product becomes available, Dôen will have flash sales throughout the year.

As for reCommerce, 65% of consumers have recently used resale and reCommerce services. ThredUp, Poshmark, and eBay were among the first to pioneer the reCommerce trend, but it is no longer limited to third-party retailers. Major brands such as Patagonia and Levi's are embracing reCommerce initiatives.

When it comes to consumer motivation, 60% of consumers believe that shopping secondhand gives them more bang for their buck. However, the reselling boom is also influenced by sustainability: letting go of clothes sustainably and environmental concerns ranked third and fourth respectively among the top reasons for getting into resale.

Top Performing Fashion ECommerce Brands

China’s VIP Shop has the highest market cap among eCommerce fashion companies worldwide

VIP Shop is currently the leading fashion eCommerce company in the world, with a market cap of about $9.3 billion. Zalando, headquartered in Berlin, ranks second, with a share value of around $7 billion. The Hut Group from the United Kingdom came in third with $1.3 billion in revenue.

The following companies round out the top ten:

- Revolve (US): $1.2 billion

- About You (Germany): $863 million

- ASOS (UK): $578 million

- boohoo.com (UK): $521 million

- Stitch Fix (US): $438 million

- The RealReal (US): $222 million

- Global Fashion Group (Luxembourg): $146 million

As of August 2024, SHEIN.com is the world's leading fashion and apparel site

Shein.com is the most visited fashion and apparel site in the world with 190.86 million monthly visits. It's a direct-to-consumer business and has more customers in the West than any other Chinese company. Its biggest market is America, which accounts for 35 to 40% of the company's gross merchandise value.

Shein's success has relied primarily on social media. The brand has over 32.5 million Facebook fans and 33 million Instagram followers. Shein Haul, in which influencers unpack their Shein parcels, try on outfits, and describe how they feel on camera, has become a viral hit, with a collective 4.5 billion views on TikTok.

Inditex (Zara) remains the largest fast-fashion retailer in the world

With a market cap of $134 billion, Zara holds 9.1% of Spain’s apparel market as of 2023. Many commend its production and distribution model, which changed the game for fast fashion.

Brands that adapt consumer behavior and trends come out on top

Consistent high-quality collections, distinct brand aesthetics, and online and offline synergy have made these brands shine. Here are some of the most valuable brands in 2024:

- Nike: $33.2 billion

- Louis Vuitton: $23.4 billion

- Gucci: $18.1 billion

- Chanel: $15.3 billion

- Adidas: $14.6 billion

- Hermes: $13.5 billion

- Zara: $13 billion

- H&M: $12.7 billion

Fashion ECommerce Sales Channels and Conversion

Despite skyrocketing inflation and supply chain difficulties in retail eCommerce, the facts and figures presented above illustrate a myriad of growth opportunities for fashion eCommerce brands. Here are some current and upcoming trends that retailers should include in their long-term sales strategy.

Average Conversion Rates in Fashion eCommerce

The clothing sector typically experiences an average conversion rate of 0.8% to 2.3%, though this largely depends on the kind of product. In a different survey, results showed a higher average of 1.9% conversion rate on desktop, with the potential to reach up to 6.1%.

Overcoming sizing issues is both an online and offline effort

As much as 56% of online returns are caused by products not matching their description online. This is one of the main pain points for fashion eCommerce but can be addressed effectively through omnichannel commerce. New tech doesn’t always mean leaving behind the traditional shopping experience. In fact, it’s more important to have online and offline sales channels that are in sync.

Meanwhile, 59% of consumers say they’re likely to browse items online and buy them in-store, while 54% prefer looking at a product in-store first and then purchasing it online. This makes it important to provide a seamless experience on both sides and to invest in both digital and physical retail.

Discounted Rates and Flash Sales

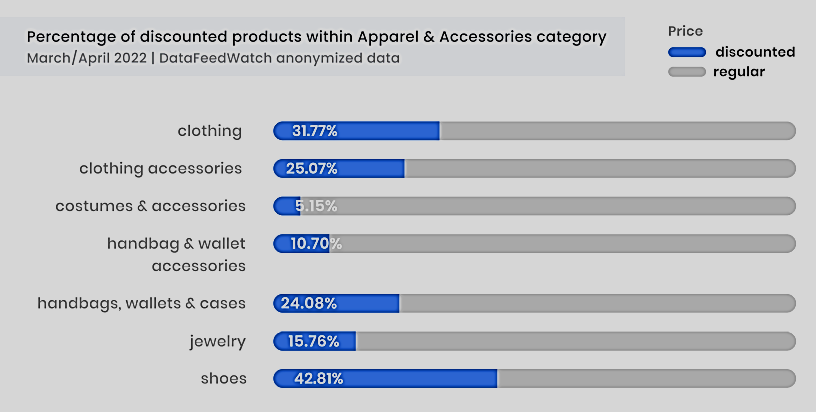

With around 22% of product catalogs offered at reduced pricing in 2024, the fashion industry is at the forefront of discount implementation. Consumers prioritize cost-consciousness as well, with an average planning to purchase 7% less apparel at full price this year.

Shoes had the highest average proportion of discounted items in the apparel and accessories sector, with 42.81% of advertised products reduced. Apart from shoes, clothes (31.77%), handbags, and wallet accessories (24.08%) were often put on sale by online fashion retailers.

On the other hand, flash sales, when paired with discounted merchandise, are no longer seen as a lowbrow way of disposing of out-of-season items. Instead, they're regarded as an eCommerce fashion high perk, particularly when paired with exclusivity and loyalty rewards. Clothes, accessories, and shoes are the most lucrative flash sales during Black Friday and Cyber Monday.

Omnichannel retail is revolutionizing the fashion eCommerce industry

The concept of omnichannel retail is revolutionizing the fashion eCommerce landscape. Unlike multichannel retail, which primarily focuses on unifying digital experiences, omnichannel retail seamlessly integrates the online and offline worlds.

This is achieved by maintaining a unified view of customer data across three primary points of purchase: proprietary retail locations, eCommerce stores, and wholesale partnerships or marketplaces.

Several eCommerce fashion brands, including Happy Socks, Untuckit, and Rhone, have already demonstrated their prowess in managing their own retail spaces.

An omnichannel strategy does more than just design a unified customer journey. It empowers fashion eCommerce brands to deliver an exceptional customer experience. This approach provides answers to critical business questions such as: What products do customers currently own and love? What items do their friends or family own and talk about? How can in-person and in-store interactions be enhanced?

Flexibility and buyer confidence care of Buy-Now-Pay-Later options

Buy-now-pay-later market and platforms are valued at nearly $11 billion, and it’s expected to reach more than $59 billion by 2030. These payment schemes let customers purchase clothes immediately and pay with interest-free spread payments over time. Payment options like these help build confident buyers who are more empowered than ever and are more open to purchasing high-end and luxury products.

In fact, data shows that 13% of customers will abandon their carts if they feel that payment options at checkout are lacking. The absence of multiple payment options may be keeping potential customers away. For retailers, this emphasizes the need to expand payment options to digital wallet payments, one-click checkout options, and pay-later schemes.

Final Thoughts

Fashion eCommerce is flourishing and diversifying at an astonishing rate, and as technology progresses, this speed will only intensify. This is exciting news for the industry since traditional fashion shops can now extend their reach outside of brick-and-mortar shops to eCommerce sites to reach customers all over the world. Fashion influencers, agencies and PR agencies are likewise prevalent. Using the above facts and figures and keeping an eye on new trends, fashion retailers can put themselves in the best position to be successful in 2024.

Frequently Asked Questions

How large is the fashion eCommerce market?

Fashion eCommerce is one of the largest industries in the world, projected to reach $905.62 billion in 2024. With a CAGR of 10.6%, it’s anticipated to reach a whopping $1356.74 billion by 2028.

What are the best-selling products in fashion eCommerce?

Here are the best-selling products in fashion, according to market value:

- Apparel: $1.79 trillion

- Shoes: $438.62 billion

- Luxury items: $368.9 billion

- Bags and accessories: $185.6 billion

What trends are shaping fashion eCommerce in 2024?

Social media, artificial intelligence, and sustainability are key trends influencing the state of fashion eCommerce in 2024:

- Social media has transformed into a seamless shopping platform as well, giving way to social commerce, user-generated content, and live streaming.

- Meanwhile, AI encourages brands to venture into the virtual world with virtual fitting rooms, personalized algorithms and recommendations, virtual fashion shows, and more.

- Lastly, sustainability creates demand for more environmentally friendly fashion brands and contributes to the rise in repair and resales.

Which online platform is best for fashion eCommerce?

The best platform ultimately depends on your brand, but among the most popular are social media (Instagram, Facebook, TikTok), owned websites, and online marketplaces (Amazon, eBay, Alibaba, etc.).

How can eCommerce platforms effectively integrate new trends?

Staying up to date with the latest statistics, facts, and trends is the first step to integrating them into your eCommerce platform. Then, you can come up with an eCommerce or influencer strategy that lets you take part in the conversation with your consumers and lead them toward conversion.

What drives the shift towards sustainability and personalization in fashion eCommerce?

Ethical consumerism has influenced the public preference towards sustainability and eco-friendly practices in fashion. Meanwhile, technological advancements provide personalization as AI allows for more targeted and customized content, ads, and recommendations.

How can fashion eCommerce platforms implement sustainability practices?

There are many opportunities for eCommerce platforms to add sustainability to their story, from sourcing to production. On a production level, being transparent about your supply chain, production process, raw materials, or final products can be a good start. Alternatively, you can also offer biodegradable or eco-friendly products, or drive sales by partnering with an eco-friendly cause. Finally, consider packaging and low-carbon delivery options.

How can fashion brands effectively use social commerce?

Fashion brands can benefit from letting consumers take the lead on social media. Partnering with influencers, incentivizing and rewarding user-generated content, and offering consistent online support help build a brand’s presence online. At the same time, investing in shoppable posts and platform-specific features makes the path to purchase seamless for consumers.

Who is the largest eCommerce fashion?

The largest fashion eCommerce brands are:

- VIP Shop (China): $9.3 billion

- Zalando (Berlin): $7 billion

- Revolve (US): $1.2 billion

- About You (Germany): $863 million

- ASOS (UK): $578 million

- boohoo.com (UK): $521 million

- Stitch Fix (US): $438 million

- The RealReal (US): $222 million

How does omnichannel commerce affect fashion eCommerce?

The integration of omnichannel sales efforts with fashion eCommerce is more important than ever, as consumers expect a seamless shopping experience from online to offline. For brands to show up where their customers are, there must be a unified omnichannel journey that considers and connects both digital and physical shopping experiences.